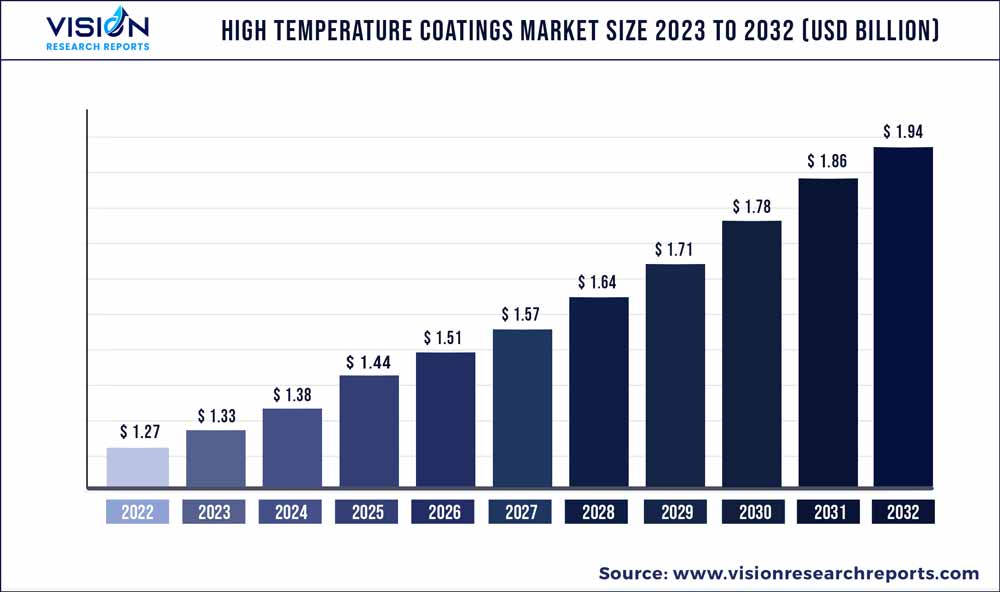

The global high temperature coatings market size was estimated at USD 1.31 billion in 2023 and it is expected to surpass around USD 2 billion by 2033, poised to grow at a CAGR of 4.34% from 2024 to 2033.

The high temperature coatings market has emerged as a vital sector within the coatings industry, addressing the escalating demand for materials capable of withstanding extreme thermal conditions. High temperature coatings are specially formulated to endure elevated temperatures, making them indispensable in numerous industrial applications where exposure to heat is inevitable. This sector has experienced significant growth owing to the continuous technological advancements, expanding industrialization, and the need for enhanced protection against extreme heat and corrosion.

The high temperature coatings market is experiencing significant growth due to several key factors. One of the primary drivers is the expanding industrial sector, leading to a higher demand for materials capable of withstanding extreme thermal conditions. Technological advancements and innovative formulations have also played a crucial role by introducing coatings with superior heat resistance properties, meeting the stringent requirements of various industries. Additionally, stringent regulatory standards promoting eco-friendly coatings and the rising focus on energy efficiency have spurred the development and adoption of high temperature coatings. The increasing demand from sectors such as automotive and aerospace, coupled with the need for reliable heat management solutions, further propels the market's growth.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.34% |

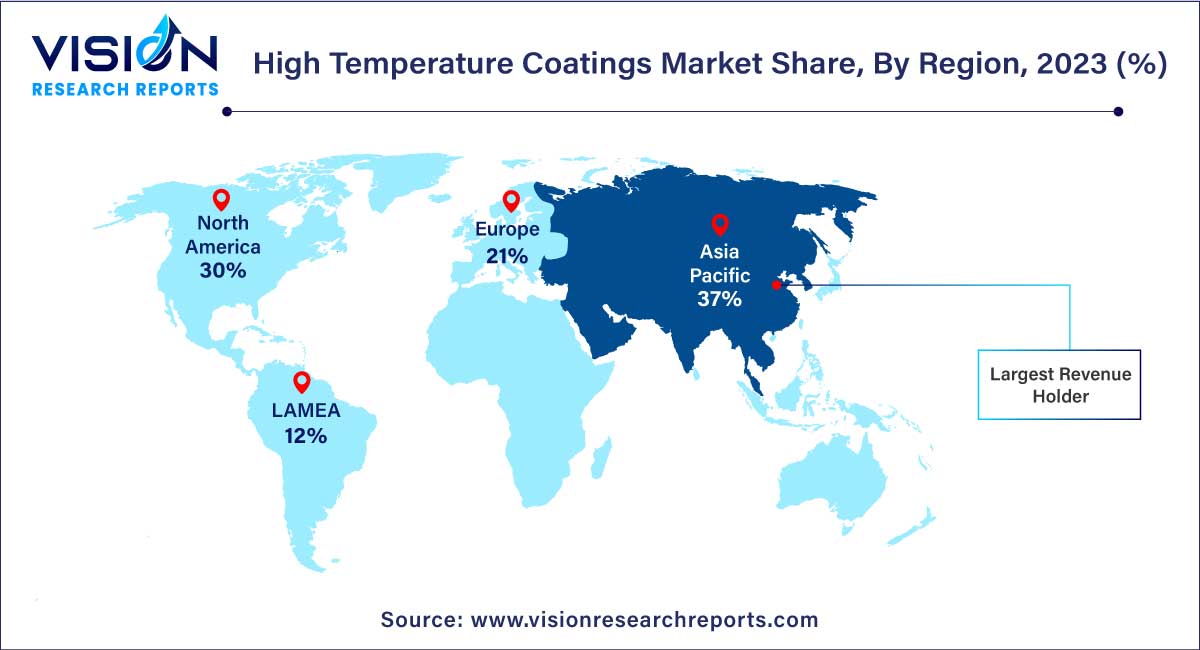

| Revenue Share of Asia Pacific in 2023 | 37% |

| CAGR of North America from 2024 to 2033 | 4.18% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The acrylic segment accounted for the largest revenue share of 24% in 2023. Acrylic-based high temperature coatings are known for their excellent adhesion properties and resistance to weathering, making them suitable for applications where exposure to extreme heat and environmental elements is common. These coatings offer exceptional thermal stability, ensuring that surfaces remain protected even under high temperatures. Industries such as automotive, aerospace, and industrial manufacturing rely on acrylic-based high temperature coatings to enhance the longevity and performance of their components.

The epoxy segment is expected to grow at the fastest CAGR of 4.95% during the forecast period. Epoxy resin-based high temperature coatings are widely recognized for their superior mechanical strength and chemical resistance. Epoxy coatings form a robust and protective layer on substrates, effectively shielding them from heat, corrosion, and abrasion. This makes epoxy-based coatings ideal for applications in harsh industrial environments, including petrochemical plants, pipelines, and chemical processing facilities. Epoxy resins provide excellent heat resistance, making them a preferred choice for components exposed to elevated temperatures.

The dispersion/water based segment held the largest revenue share of 76% in 2023. Dispersion/water-based high temperature coatings have gained significant traction due to their environmentally friendly properties. These coatings are formulated with water as the primary solvent, reducing the emission of volatile organic compounds (VOCs) into the atmosphere. Industries operating under stringent environmental regulations prefer water-based coatings for their low environmental impact. Additionally, dispersion technology allows for the even distribution of heat-resistant pigments and additives, ensuring uniform coverage and excellent adhesion on various substrates.

The powder based segment is anticipated to grow at the fastest CAGR of 5.66% over the forecast period. Powder-based high temperature coatings, on the other hand, have become synonymous with durability and resistance. These coatings are applied as a dry powder and then cured at high temperatures, forming a tough and heat-resistant finish. Powder coatings offer exceptional adhesion, corrosion resistance, and thermal stability, making them ideal for applications in extreme environments. Industries such as aerospace, automotive components, and industrial equipment rely on powder-based high temperature coatings to protect critical parts from heat, wear, and corrosion.

The energy & power segment generated the maximum market share of 17% in 2023. Within the energy & power sector, high temperature coatings are indispensable for power plants, boilers, turbines, and exhaust systems. These coatings protect crucial components from extreme heat and corrosion, ensuring the efficiency and longevity of power generation equipment. With the increasing global demand for energy, power plants are under constant pressure to operate at high temperatures, making high temperature coatings essential for maintaining the reliability and performance of these facilities.

The metal processing segment is expected to grow at the fastest CAGR of 4.84% over the forecast period. In the metal processing industry, high temperature coatings are extensively used in applications involving furnaces, ovens, heat exchangers, and metal molds. These coatings provide a protective barrier against heat, oxidation, and wear, ensuring the integrity of metal processing equipment. Furnaces and ovens, in particular, rely on high temperature coatings to maintain high operating temperatures while preventing heat loss. By applying these coatings, manufacturers can optimize energy efficiency and reduce production costs.

Asia Pacific dominated the market with largest revenue share of 37% in 2023. Asia-Pacific stands as a prominent market for high temperature coatings, primarily due to rapid industrialization and infrastructural development in countries like China and India. The automotive and construction sectors in this region are significant consumers of high temperature coatings. With the increasing urbanization and a rising number of manufacturing facilities, the demand for these coatings has surged.

North America region is expected to grow at the fastest CAGR of 4.18% during the forecast period. In North America, the market is driven by the presence of a robust aerospace and automotive industry. Stringent regulations regarding emissions and environmental concerns have led to a high demand for eco-friendly high temperature coatings, encouraging research and development in this region. Additionally, the increasing focus on renewable energy sources, such as solar power, has contributed to the market growth, as high temperature coatings are essential for solar energy applications.

By Resin

By Technology

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Resin Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High Temperature Coatings Market

5.1. COVID-19 Landscape: High Temperature Coatings Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High Temperature Coatings Market, By Resin

8.1. High Temperature Coatings Market, by Resin, 2024-2033

8.1.1 Epoxy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Silicone

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Polyethersulfone

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Polyester

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Acrylic

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Alkyd

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global High Temperature Coatings Market, By Technology

9.1. High Temperature Coatings Market, by Technology, 2024-2033

9.1.1. Solvent Based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Dispersion/Water Based

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Powder Based

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global High Temperature Coatings Market, By Application

10.1. High Temperature Coatings Market, by Application, 2024-2033

10.1.1. Energy & Power

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Metal Processing

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cookware

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Stoves and Grills

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Marine

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Automotive

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Coil Coating

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Aerospace

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Building & Construction

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Others

10.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global High Temperature Coatings Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Resin (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Resin (2021-2033)

11.2.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Resin (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Resin (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Resin (2021-2033)

11.3.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Resin (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Resin (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Resin (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Resin (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Resin (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Resin (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. BASF SE.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Akzo Nobel N.V.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. The Sherwin-Williams Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. PPG Industries, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Valspar.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Carboline Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Axalta Coating Systems, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Jotun

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Aremco.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Belzona International Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others