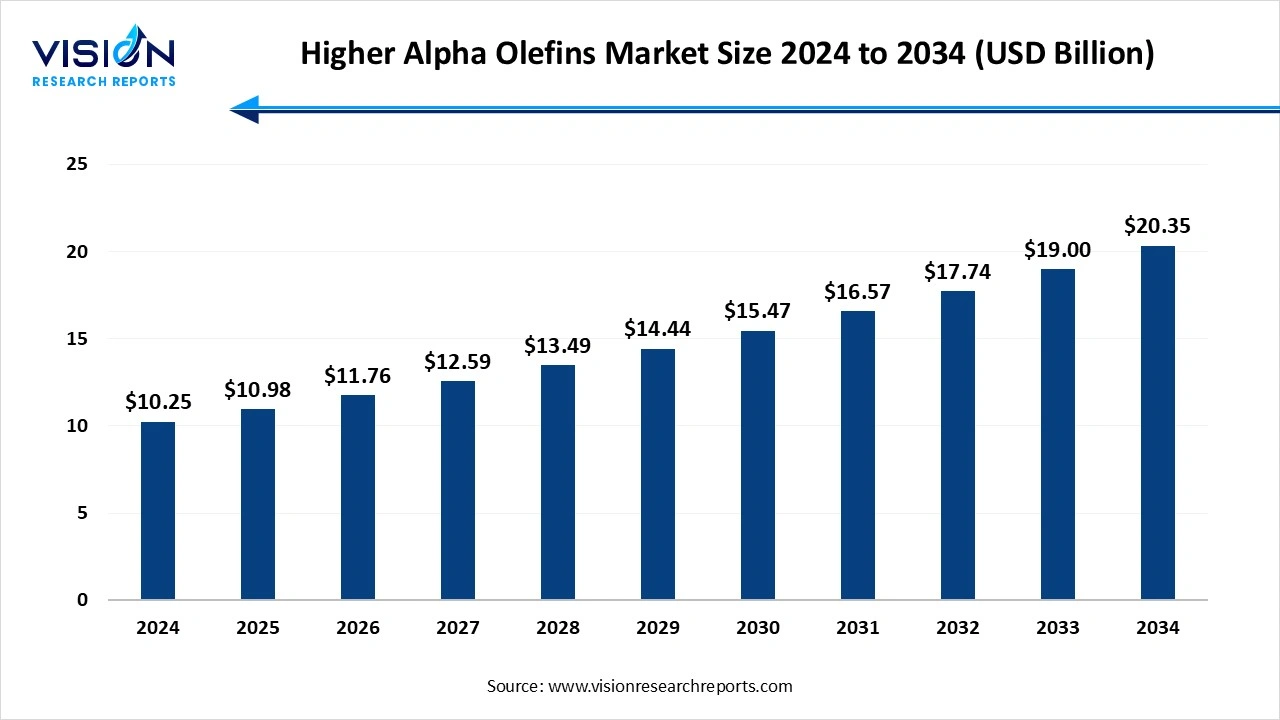

The global higher alpha olefins market size was estimated at around USD 10.25 billion in 2024 and it is projected to hit around USD 20.35 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

The global higher alpha olefins (HAOs) market is witnessing steady growth, driven by their extensive use in the production of polyethylene, synthetic lubricants, plasticizers, and surfactants. These olefins, characterized by their terminal double bonds, offer enhanced reactivity and versatility, making them valuable intermediates in various chemical processes. With the rising demand for polyethylene in packaging and construction applications, the consumption of HAOs has grown substantially, especially in emerging economies experiencing rapid industrialization.

The growth of the higher alpha olefins (HAOs) market is primarily fueled by the increasing demand for polyethylene, particularly linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which use HAOs as co-monomers. These polymers are widely utilized in applications such as flexible packaging, films, containers, and pipes, which continue to experience high demand due to urbanization, e-commerce expansion, and infrastructural development.

Another significant growth driver is the expanding use of HAOs in synthetic lubricants, surfactants, and oilfield chemicals. Their chemical properties make them ideal for producing high-performance lubricants with improved thermal stability and low volatility, especially in industrial and automotive applications. Additionally, as the oil and gas industry increasingly turns to enhanced oil recovery (EOR) techniques, the demand for surfactants derived from HAOs is expected to rise.

One of the key trends in the higher alpha olefins (HAOs) market is the increasing adoption of metallocene catalysts in polyethylene production. These catalysts allow for more precise control over polymer structure, improving the strength, clarity, and flexibility of the final product. As a result, manufacturers are increasingly using HAOs in LLDPE and HDPE formulations tailored for high-performance packaging films, automotive components, and consumer goods. This technological shift is driving demand for specific alpha olefins like 1-hexene and 1-octene, which deliver better performance in engineered polymers.

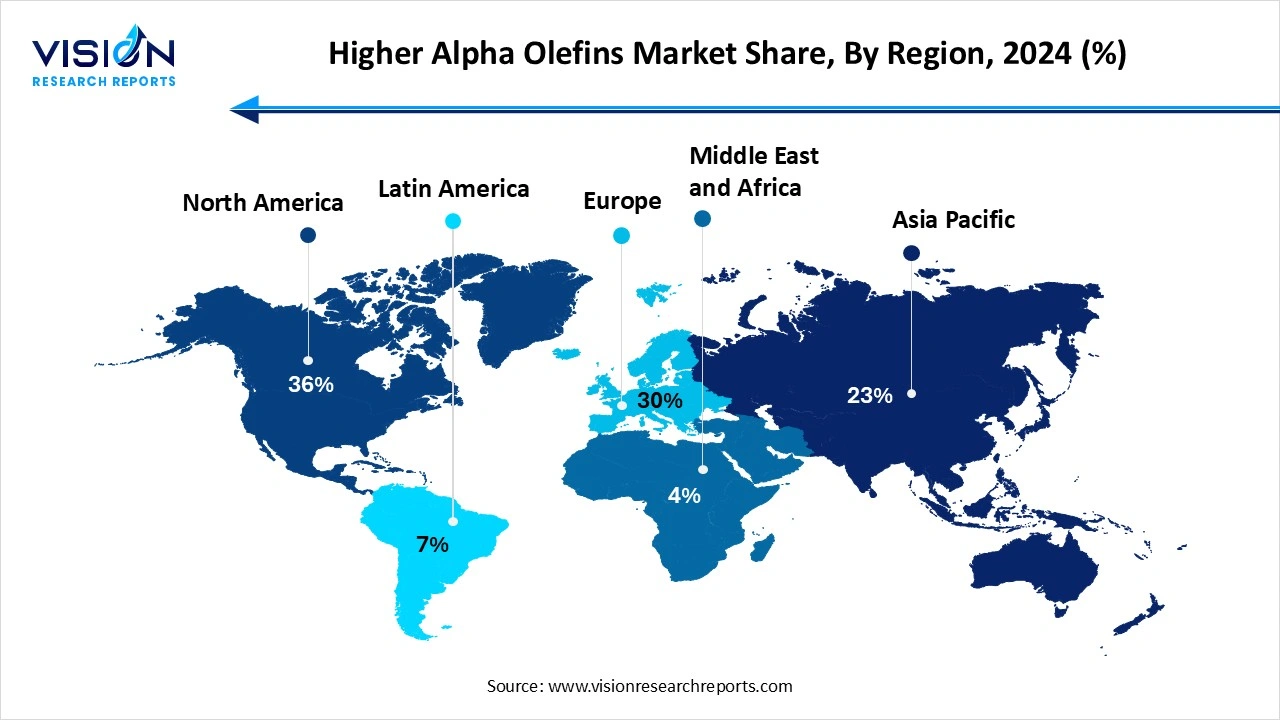

Another notable trend is the geographic diversification of production and consumption. While North America continues to be a leading producer due to its access to low-cost ethylene from shale gas, Asia-Pacific is emerging as a dominant consumer, fueled by rapid industrialization, population growth, and expanding manufacturing sectors. Multinational chemical companies are either expanding their footprint in Asia or forming strategic partnerships with local players to capture a larger share of this growing market.

The higher alpha olefins (HAOs) market faces several significant challenges that can impact its long-term growth. One major concern is the volatility in raw material prices, especially ethylene, which is derived from crude oil and natural gas. Fluctuations in global oil and gas markets, geopolitical tensions, and supply chain disruptions can lead to inconsistent production costs, affecting the profitability and stability of HAOs manufacturers.

Environmental and regulatory pressures also present considerable challenges for the HAOs market. The growing emphasis on reducing carbon emissions and implementing circular economy principles has increased scrutiny on petrochemical-based products. Producers are under pressure to adopt cleaner technologies and comply with evolving environmental regulations, which may require costly upgrades and innovation.

North America held the largest share of the higher alpha olefins market, accounting for 36% of the total revenue in 2024. This dominance was primarily driven by the United States, supported by its well-established petrochemical infrastructure and robust regulatory environment. This regional strength is further reinforced by consistent demand from packaging, automotive, and construction sectors that rely on polyethylene and synthetic lubricants made using HAOs.

Asia-Pacific is emerging as one of the fastest-growing markets for HAOs, driven by rapid industrialization, expanding manufacturing bases, and rising demand for consumer goods, packaging materials, and detergents. Countries like China, India, and South Korea are witnessing substantial investments in polymer production and downstream processing, which in turn is fueling the consumption of alpha olefins. The region is also becoming a strategic target for global players aiming to tap into new growth opportunities by establishing joint ventures and increasing local production capabilities to meet rising domestic demand.

Asia-Pacific is emerging as one of the fastest-growing markets for HAOs, driven by rapid industrialization, expanding manufacturing bases, and rising demand for consumer goods, packaging materials, and detergents. Countries like China, India, and South Korea are witnessing substantial investments in polymer production and downstream processing, which in turn is fueling the consumption of alpha olefins. The region is also becoming a strategic target for global players aiming to tap into new growth opportunities by establishing joint ventures and increasing local production capabilities to meet rising domestic demand.

The C6-C8 higher alpha olefins segment emerged as the market leader, capturing the highest revenue share of 49% in 2024. These compounds enhance the strength, flexibility, and clarity of LLDPE and HDPE, making them ideal for a range of applications, including food packaging, agricultural films, and household containers. Their performance benefits, combined with growing consumption of plastics in packaging and consumer goods, continue to drive growth in this segment.

The C16 segment is projected to register the highest compound annual growth rate (CAGR) over the forecast period. These long-chain olefins offer superior lubrication properties, thermal stability, and biodegradability, making them suitable for high-performance automotive and industrial lubricant formulations. The rising focus on fuel-efficient and low-emission engines is contributing to the growing preference for synthetic lubricants, which in turn supports the demand for C16 alpha olefins.

The polyethylene comonomers segment dominated the market, capturing the highest revenue share of 52% in 2024. HAOs such as 1-butene, 1-hexene, and 1-octene are widely used as co-monomers in the production of linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). These polymers are essential for manufacturing flexible packaging, films, containers, and industrial components due to their excellent mechanical strength, impact resistance, and transparency. The continued growth of the packaging industry, coupled with increasing demand for durable and lightweight materials in construction and automotive applications, is significantly driving the consumption of HAOs in this segment.

Detergents and surfactants represent another vital application area for higher alpha olefins, particularly the mid- to long-chain variants. These olefins are key raw materials in the production of linear alkylbenzene (LAB), a precursor for biodegradable surfactants used in household and industrial cleaning products. The shift toward environmentally friendly and high-performance detergents has spurred the use of HAOs in this sector. Furthermore, growing hygiene awareness, rising urban populations, and increasing disposable incomes especially in developing regions are driving consumption of detergent products, thereby supporting the demand for olefin-based surfactants.

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Higher Alpha Olefins Market

5.1. COVID-19 Landscape: Higher Alpha Olefins Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Higher Alpha Olefins Market, By Type

8.1. Higher Alpha Olefins Market, by Type

8.1.1. C6-C8

8.1.1.1. Market Revenue and Forecast

8.1.2. C10-C14

8.1.2.1. Market Revenue and Forecast

8.1.3. C16

8.1.3.1. Market Revenue and Forecast

Chapter 9. Higher Alpha Olefins Market, By Application

9.1. Higher Alpha Olefins Market, by Application

9.1.1. Polyethylene Comonomers

9.1.1.1. Market Revenue and Forecast

9.1.2. Lubricants & Synthetic Oils

9.1.2.1. Market Revenue and Forecast

9.1.3. Detergents & Surfactants

9.1.3.1. Market Revenue and Forecast

9.1.4. Other Applications

9.1.4.1. Market Revenue and Forecast

Chapter 10. Higher Alpha Olefins Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Shell plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Chevron Phillips Chemical Company LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. INEOS Group Holdings S.A.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sasol Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ExxonMobil Chemical Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Qatar Chemical Company Ltd. (Q-Chem)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Evonik Industries AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Idemitsu Kosan Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Linde plc

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Ascend Performance Materials LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others