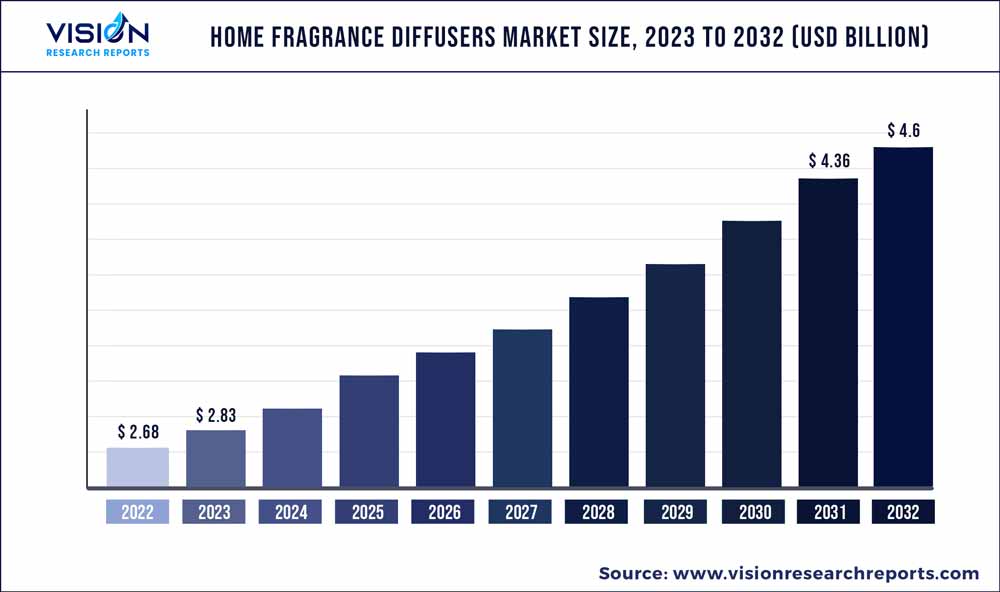

The global home fragrance diffusers market was surpassed at USD 2.68 billion in 2022 and is expected to hit around USD 4.6 billion by 2032, growing at a CAGR of 5.55% from 2023 to 2032. The home fragrance diffusers market in the United States was accounted for USD 701.2 million in 2022.

Key Pointers

Report Scope of the Home Fragrance Diffusers Market

| Report Coverage | Details |

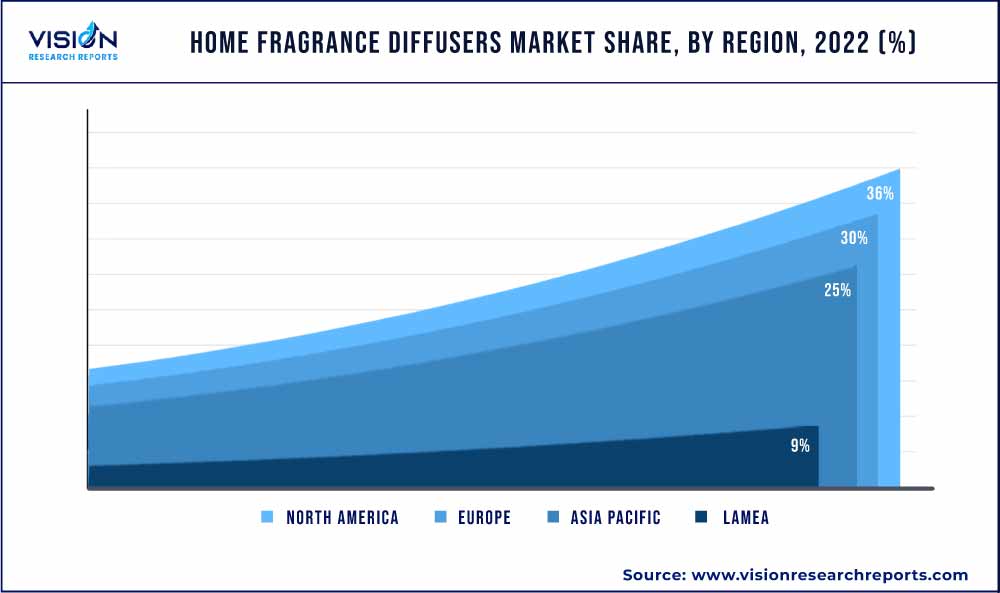

| Revenue Share of North America in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 7.03% |

| Revenue Forecast by 2032 | USD 4.6 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Diptyque Paris; Jo Malone London; Nest Fragrances LLC; Capri Blue LLC; Paddywax LLC; Aromatique Inc.; Agraria San Francisco; The Yankee Candle Company, Inc.; Bath & Body Works, LLC; and Scentsy, Inc. |

The growth of the global market is mainly driven by a strong desire among consumers to create pleasant and welcoming living spaces, and home fragrance diffusers provide a convenient and effective solution for achieving this. By infusing fragrances into their homes, individuals can enhance the overall ambiance and create a relaxing and soothing atmosphere. Another significant factor is the increasing interest in aromatherapy and the recognized therapeutic benefits of scents. Home fragrance diffusers enable individuals to experience the benefits of aromatherapy within the comfort of their own homes.

The COVID-19 pandemic initially presented challenges for the fragrance diffuser industry due to disruptions in supply chains and changes in consumer behavior. As lockdown measures eased and economies began to recover, the home fragrance diffusers market started showing signs of rebounding. Consumers' continued interest in creating pleasant home environments and the gradual reopening of retail outlets contributed to the industry's recovery. With people spending more time at home due to lockdowns and restrictions, there has been a heightened emphasis on creating pleasant and inviting living spaces. This has led to a greater demand for home fragrance diffusers as consumers seek to enhance their home ambiance and create a comforting atmosphere.

According to the statistics published by PYMNTS.com, home fragrance products including candles, diffusers, and other scented items witnessed a 13% hike in demand in 2020. The pandemic has brought a heightened awareness of the importance of self-care and mental well-being. Fragrance diffusers, particularly those offering aromatherapy benefits, have gained popularity as individuals seek ways to relax, reduce stress, and improve their overall well-being.

In the fragrance diffuser industry, product innovation plays a crucial role in attracting customers and staying ahead of the competition. One prominent trend in product innovation is the incorporation of smart technology into fragrance diffusers. These smart diffusers offer enhanced functionality and convenience for users. An example of a product that showcases this trend is the "Godrej aer smart-matic" by a well-known brand, Godrej Consumer Products Limited. This diffuser is equipped with Bluetooth connectivity and can be controlled remotely through a smartphone application. Users have the flexibility to adjust fragrance intensity, set timers, and even customize scent combinations according to their preferences. The diffuser also offers compatibility with Android and iOS smartphones.

In the home fragrance diffuser industry, there is a noticeable trend towards organic products that align with the growing consumer preference for natural and sustainable options. The organic product trend in fragrance diffusers resonates with environmentally conscious consumers who prioritize sustainable and eco-friendly choices. By opting for organic options, consumers can enjoy the benefits of fragrance without compromising their health or contributing to environmental harm. Manufacturers that embrace this trend can attract a growing segment of consumers seeking natural and organic alternatives, ultimately driving the demand for organic fragrance diffusers in the market.

Type Insights

The reed diffusers captured the largest market share of around 31% in 2022. The demand for reed diffusers is increasing due to their convenience, safety, decorative appeal, low-maintenance nature, and a wide variety of fragrances available. Reed diffusers provide a long-lasting and subtle scent experience without the need for open flames, making them suitable for various settings. They also serve as visually appealing home decor items. With minimal maintenance required, reed diffusers offer a hassle-free fragrance solution. Their popularity among consumers reflects the desire for a convenient, safe, and aesthetically pleasing way to enjoy fragrance in homes and offices.

In response to growing environmental concerns, manufacturers are focusing on using eco-friendly and sustainable materials for reed diffusers. This includes recyclable and biodegradable components, as well as natural fragrance oils derived from renewable sources. For instance, in May 2022, NAYRA India launched eco-friendly reed diffusers for residential purposes. NAYRA diffuser is a premium product crafted with high-quality fragrance and features a unique handmade flower that undergoes color transformation, creating a captivating visual experience. It effectively revitalizes the air and creates a calming ambiance with its soothing fragrance. Such product innovations catering to ever-changing consumer trends are expected to boost market growth in the coming years.

The heat diffusers are expected to witness strong consumer adoption in the coming years and will expand with a CAGR of 6.73% over the forecast period of 2023 to 2032. The demand for heat diffusers is on the rise due to their convenience and efficiency in dispersing fragrance. Unlike other types of diffusers, heat diffusers utilize heat from sources like candles or electric heating elements to release fragrance without the need for water or electricity. They provide a consistent and long-lasting scent experience, making them appealing to those who prefer a subtle and lingering fragrance presence.

Distribution Channel Insights

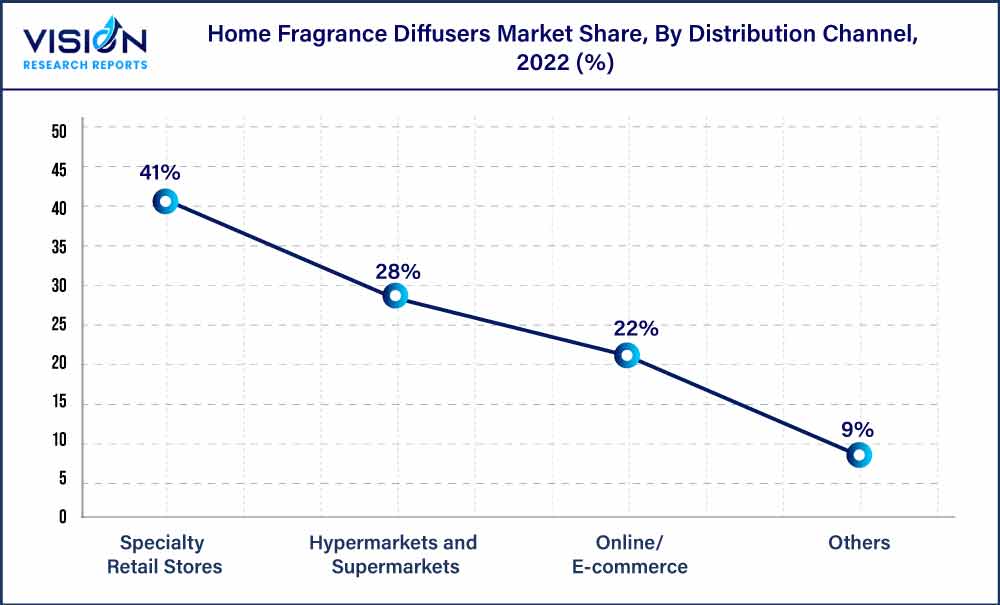

The specialty retail stores segment dominated the global market with a revenue share of around 41% in 2022. Specialty retail stores include perfume and fragrance boutiques, natural and organic home fragrance shops, custom fragrance studios, aromatherapy stores, etc. These stores offer a variety of products in a wide range of options, including candles, reed diffusers, room sprays, and wax melts. Fragrance specialty stores, aromatherapy shops, and other stores provide a platform to showcase and offer a diverse selection of these products, allowing customers to explore different scents and choose what suits their preferences.

The online/e-commerce channel segment is expected to expand at a CAGR of 7.05% from 2023 to 2032. Online shopping provides convenience to customers, allowing them to browse and purchase fragrance diffusers from the comfort of their homes. They can easily explore a wide range of products, compare prices, and read customer reviews before making a purchase decision. Online retail platforms have a global reach, enabling fragrance diffuser manufacturers and sellers to target a broader customer base beyond their local markets. This allows for increased brand visibility and the opportunity to reach customers who may not have access to physical stores selling home fragrance diffusers.

The combination of convenience, wider reach, product information, competitive pricing, promotions, seamless shopping experience, and the impact of the COVID-19 pandemic has fueled the growth of the online retail sales channel for fragrance diffusers. Companies in the industry are increasingly focusing on optimizing their online presence and e-commerce capabilities to capitalize on this growing trend.

Regional Insights

North America captured the largest market share over 36% in 2022. The fragrance diffuser industry in North America is witnessing steady growth driven by various factors. The U.S. home fragrance industry stood at USD 702.9 million in 2022 and is expected to showcase strong growth in the coming years. The home fragrance diffuser industry in North America is witnessing increasing consumer demand driven by several factors. There is a growing preference for creating an inviting atmosphere at home, driving the popularity of home fragrance products like diffusers. Aromatherapy is also on the rise, with diffusers playing a pivotal role in this trend. Consumers seek long-lasting fragrances that enhance their well-being.

The online retail sales has experienced significant growth, offering consumers convenience and a wide range of product choices. Furthermore, the industry caters to premium and luxury segments, with consumers willing to invest in high-quality, unique, and elegantly designed diffusers. Overall, the North American fragrance diffuser industry is poised for continued growth in response to these market trends.

The Asia Pacific is expected to expand at a CAGR of 7.03% over the forecast period. The fragrance diffuser industry in the Asia Pacific region is experiencing significant growth and presents numerous opportunities for market players. The rising disposable income and improving standards of living in countries like China, India, and Japan are driving the demand for home fragrance products, including diffusers. There is a growing awareness and appreciation for the benefits of aromatherapy, contributing to the increased adoption of fragrance diffusers in households.

The Indian home fragrance diffusers industry was valued at USD 106.8 million in 2022. Key product manufacturers operating in India are taking major business expansion initiatives and are targeting consumers willing to invest in high-quality and unique diffusers, while more affordable options cater to a broader customer base. For instance, in December 2022, Cycle Pure Agarbathies' lifestyle and wellness brand, IRIS Home Fragrances, introduced the Glitter range for the Christmas season. The collection features exotic fragrances like Gold Musk and Romance, available in candles, tapers, and reed diffusers. The Glitter range adds a touch of sparkle and charm to Christmas celebrations, perfectly complementing the festive decor. With radiant and warm fragrances infused with musk undertones, these products create a cozy and captivating ambiance.

By Type

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Fragrance Diffusers Market

5.1. COVID-19 Landscape: Home Fragrance Diffusers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Fragrance Diffusers Market, By Type

8.1. Home Fragrance Diffusers Market, by Type, 2023-2032

8.1.1. Reed Diffusers

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Ultrasonic Diffusers

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Nebulizing Diffusers

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Heat Diffusers

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Evaporative Diffusers

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Home Fragrance Diffusers Market, By Distribution Channel

9.1. Home Fragrance Diffusers Market, by Distribution Channel, 2023-2032

9.1.1. Hypermarkets and Supermarkets

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Specialty Retail Stores

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Online/E-commerce

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Home Fragrance Diffusers Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Diptyque Paris

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Jo Malone London

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nest Fragrances LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Capri Blue LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Paddywax LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Aromatique Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Agraria San Francisco

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. The Yankee Candle Company, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Bath & Body Works, LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Scentsy, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others