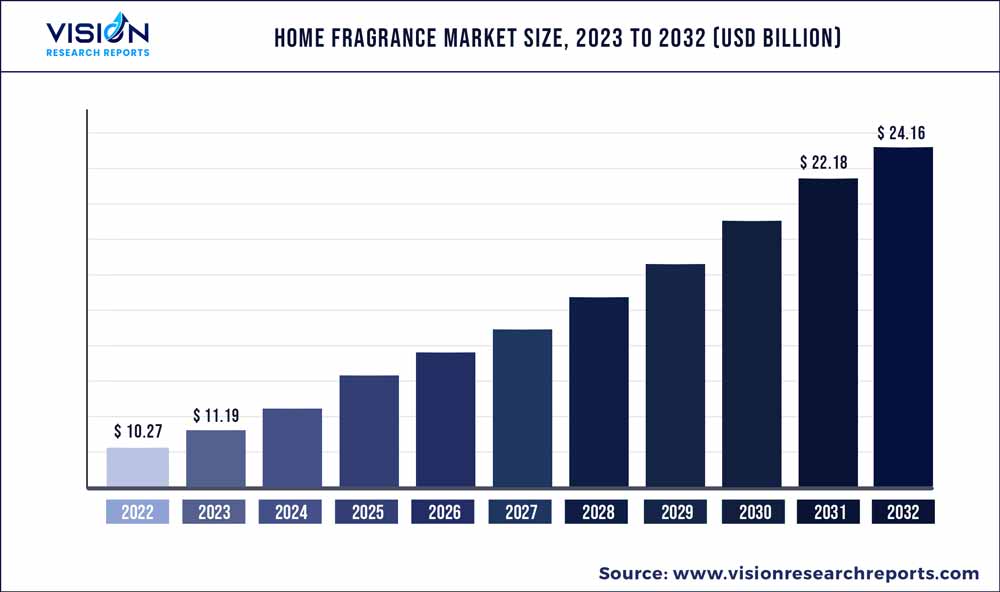

The global home fragrance market size was estimated at around USD 10.27 billion in 2022 and it is projected to hit around USD 24.16 billion by 2032, growing at a CAGR of 8.93% from 2023 to 2032. The home fragrance market in the United States was accounted for USD 2.6 billion in 2022.

Key Pointers

Report Scope of the Home Fragrance Market

| Report Coverage | Details |

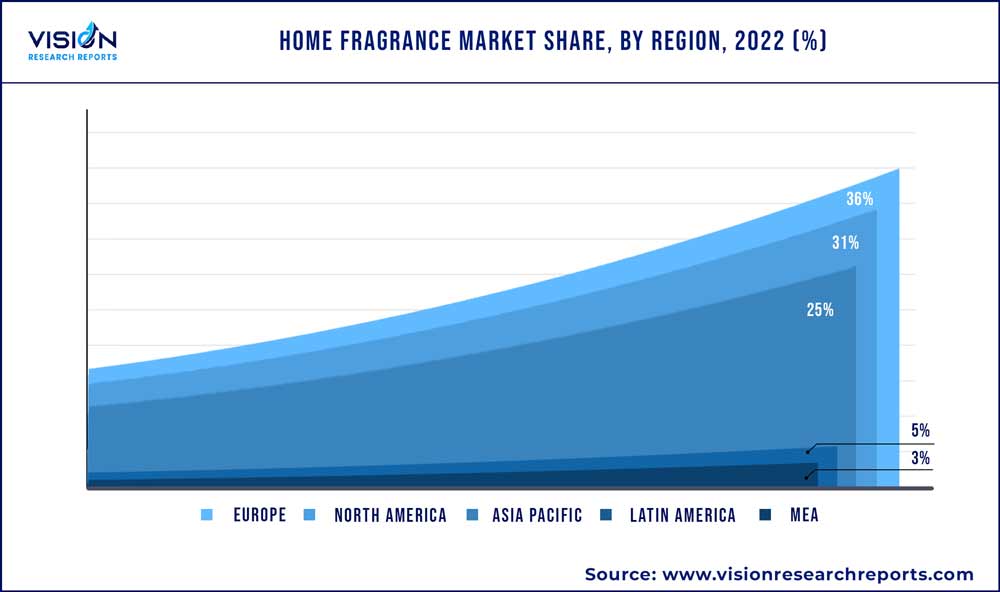

| Revenue Share of Europe in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 10.34% |

| Revenue Forecast by 2032 | USD 24.16 billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.93% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Reckitt Benckiser Group PLC; The Procter & Gamble Company; Seda France; S. C. Johnson & Son, Inc.; Newell Brands Inc.; Voluspa; Scent Air; NEST Fragrances; The Estée Lauder Companies Inc.; Bougie & Senteur; Bath & Body Works LLC |

The market growth is attributed to growing interest in home decor and ambiance, and the popularity of aromatherapy. Moreover, consumers' rising ability to spend discretionary money is boosting their propensity to buy diverse scent goods. The development of new, visually beautiful goods, their personalization, and their use of natural substances like oils are what are driving the home fragrances industry across the globe. The pandemic has also led to increased hygiene concerns among consumers, which has affected the packaging and delivery of home fragrance products. Companies are implementing new safety protocols, such as contactless delivery and increased sanitation measures, to address these concerns and reassure customers.

onsumers are increasingly concerned about the impact of their purchasing decisions on the environment. As a result, there is a growing demand for natural and eco-friendly home fragrance products. Companies are responding by creating products made from natural ingredients and using sustainable packaging. For instance, in March 2023, Grove Collaborative Holdings, Inc., a top manufacturer of environmentally friendly consumer goods, launched of its new Grove Co. Fresh Horizons Limited Edition Collection with Drew Barrymore.

Essential oils are becoming more popular in the home fragrance industry as consumers seek out natural and holistic products. Many people believe that essential oils have therapeutic properties and can help to promote relaxation and wellness. Moreover, consumers are looking for unique and innovative fragrances in home fragrance products. As a result, companies are developing new and interesting scent combinations to differentiate their products in the market. For example, some companies are blending unexpected scents like coffee and leather to create a unique and appealing fragrance profile.

Technology integration is a growing trend in the home fragrance industry, with companies developing products that are compatible with smart home technology. For example, some companies are developing scent diffusers that can be controlled through a smartphone app, allowing consumers to adjust the scent intensity and schedule fragrance delivery. For instance, March 2020, Air Wick launched a new scented oil diffuser that use Bluetooth and can be operated with an iPhone.

The business has also been boosted by the increased awareness of house fragrances spread through different media like YouTube, television commercials, and others. For instance, Godrej Aer, an Indian company that provides car, home and bathroom perfumes, introduced a new TVC campaign in 2022 called "If Bathrooms Could Talk" for its Godrej Aer Power Pocket collection of bathroom fragrances. Innovative graphics and animation methods were used to create the TVC, which Creativeland Asia conceptualised, making it aesthetically appealing to draw consumers' attention.

Product Insights

In terms of revenue, the sprays segment led the market and accounted for a 35% share of the global revenue in 2022. Home fragrance systems have been a popular choice among consumers for many years. They are easy to use and can quickly freshen up a room with a burst of fragrance. The demand for home fragrance sprays has remained steady over time, with some fluctuations due to changing consumer preferences and market trends.

The scented candles segment is anticipated to expand at a CAGR of 9.82% from 2023 to 2032. Scented candles offer a wide variety of fragrance options, catering to different consumer preferences. There are floral scents, fruity scents, spicy scents, and many others, allowing consumers to find a scent that they enjoy and that suits their personal taste. Moreover, the increasing popularity of the scented candles as a gift item, especially during the holiday season. They are often given as hostess gifts, housewarming gifts, or as a small token of appreciation. This has contributed to the overall demand for scented candles.

Distribution Channel Insights

The sales of home fragrance through supermarkets and hypermarkets distribution channels made the largest revenue contribution of around 41% in 2022. Supermarkets and hypermarkets play a significant role in the home fragrance industry by offering a diverse range of products at competitive prices, providing convenience and accessibility to consumers, and promoting and raising awareness of home fragrance products. In the forecast term, these reasons are likely to boost the segment.

The online distribution channel is projected to expand at a CAGR of 10.33% from 2023 to 2032. This distribution channels offer consumers a convenient and easy way to shop for home fragrance products. With the increase in online shopping and the convenience it provides, it is expected that online distribution channels will continue to play a significant role in the home fragrance industry. Furthermore, Bath & Body Works offers a wide variety of home fragrance products, including candles, room sprays, and diffusers, on its e-commerce website. The website provides a seamless shopping experience, with easy navigation, product descriptions, and customer reviews.

Regional Insights

Europe made the largest revenue contribution of around 36% to the global market in 2022. Consumers in Europe are becoming more health-conscious and are looking for products that can provide a sense of well-being. The UK home fragrance market valued at USD 634.1 million in 2022 owing to rising demand for the natural and ecofriendly home fragrance. Home fragrance products that contain natural ingredients such as essential oils are seen as a healthier alternative to synthetic fragrances. Germany home fragrance market size was valued at USD 474.3 million in 2022. The increasing urbanization in the Germany has led to an increase in small living spaces, such as apartments and condos, where home fragrance products are used to create a pleasant and relaxing atmosphere.

Asia Pacific is expected to expand at a CAGR of 10.34% from 2023 to 2032. The regional market has been fueled by the rapid rise of emerging economies such as India, China, and Australia. Moreover, in many countries of the Asia-Pacific region, home fragrance products are deeply rooted in culture and tradition. For example, incense sticks and scented oils are commonly used in religious ceremonies and rituals. Additionally, in terms of revenue, China home fragrance market accounted for USD 776.2 million market size in Asia Pacific home fragrance market, in 2022.

India home fragrance market contributed USD 320.7 million in 2022 on account of the increased consumer sophistication, brand awareness, rising disposable income, rising demand from middle-class consumers, and low-cost fragrance in the form of scented candles, sprays, essential oils, and other items. Moreover, Australia home fragrance market valued USD 195.3 million in 2022 owing to increasing demand for fresh, customized and visually beautiful home fragrance products, and products made with natural substances like oils.

The North America region accounted for a market share of around 31% of the global revenue in 2022. Growing popularity of aromatherapy in North America, with consumers using home fragrance products to promote relaxation, reduce stress, and improve overall well-being is further anticipated to boost the demand for the product. The U.S. home fragrance market valued USD 2,568.4 million in 2022 and held the largest share of North America home fragrance market in 2022. The dominance is majorly attributed to the significant growth of unique and personalized fragrances in the country.

For instance, in April 2023, Three new exclusive scents, "Free To Be," "Sunroof's Open," and "Free Spirit," were introduced by Friday Collective, a Newell Brands brand, as part of its collection at Target. The bold lifestyle brand offers a selection of scented candles that, via their brilliant colors and daring aroma combinations, express optimism and joy. These candles may be used to set the tone, raise energy levels, or even just refresh a person's mood.

Home Fragrance Market Segmentations:

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Fragrance Market

5.1. COVID-19 Landscape: Home Fragrance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Fragrance Market, By Product

8.1. Home Fragrance Market, by Product, 2023-2032

8.1.1. Scented Candles

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Sprays

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Essential Oils

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Incense Sticks

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Home Fragrance Market, By Distribution Channel

9.1. Home Fragrance Market, by Distribution Channel, 2023-2032

9.1.1. Supermarkets & Hypermarkets

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Specialty Store

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Convenience Stores

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Online

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Home Fragrance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Reckitt Benckiser Group PLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. The Procter & Gamble Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Seda France

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. S. C. Johnson & Son, Inc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Newell Brands Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Voluspa

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Scent Air

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. NEST Fragrances

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. The Estée Lauder Companies Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bougie & Senteur

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others