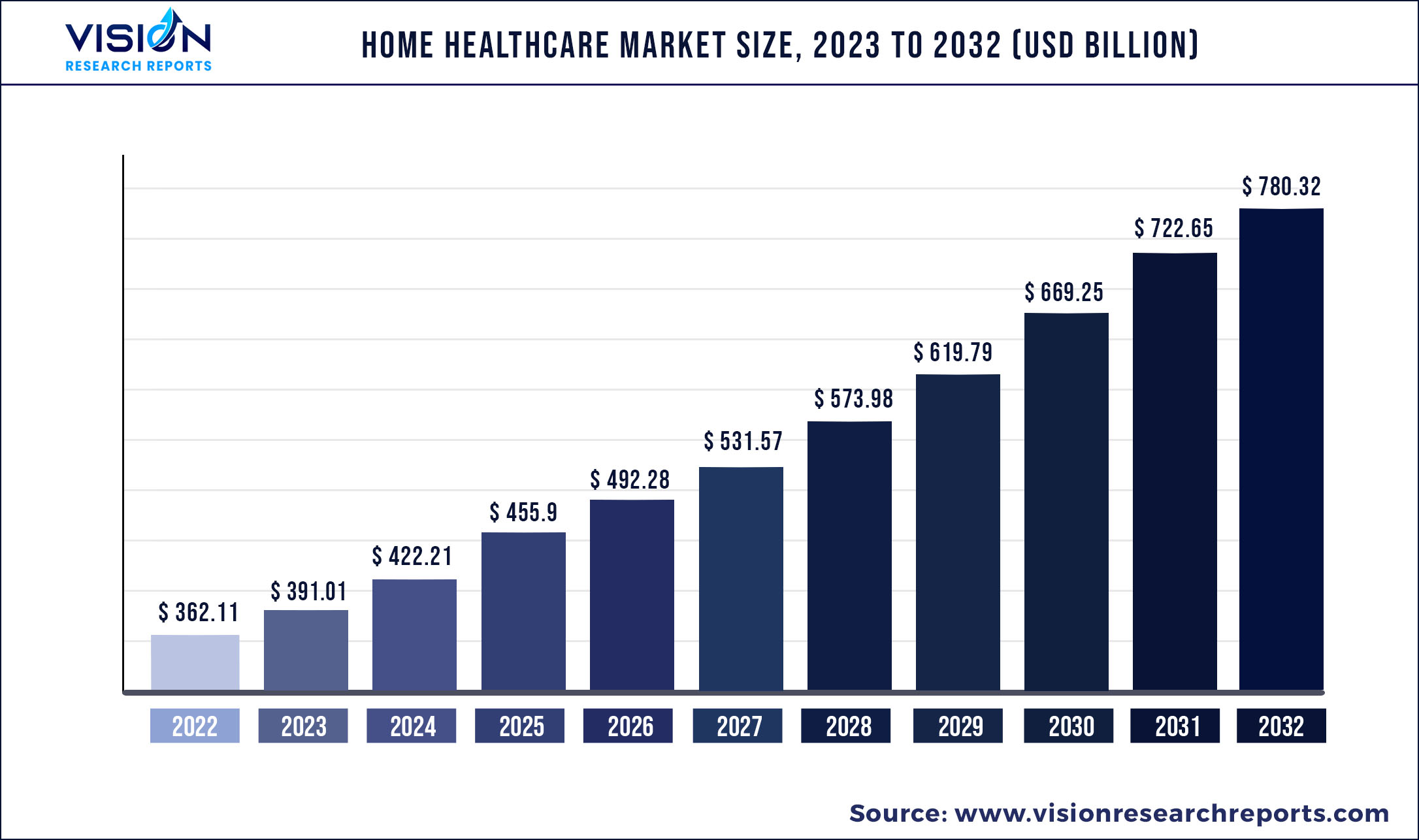

The global home healthcare market size was estimated at around USD 362.11 billion in 2022 and it is projected to hit around USD 780.32 billion by 2032, growing at a CAGR of 7.98% from 2023 to 2032.

Key Pointers

Report Scope of the Home Healthcare Market

| Report Coverage | Details |

| Market Size in 2022 | USD 362.11 billion |

| Revenue Forecast by 2032 | USD 780.32 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.98% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

The growing geriatric population and rising incidence of target diseases such as dementia and Alzheimer’s as well as orthopedic diseases are factors expected to fuel market growth. Increasing treatment cost is one of the prime concerns for governments and health organizations, and hence they are striving to curb healthcare costs. Home healthcare is a cost-efficient alternative to an expensive hospital stay.

For instance, as per a report by The Commonwealth Fund, “hospital at home” programs enable patients to receive acute care at home with fewer complications and over 30% reduction in the cost of care. This helps ensure patient comfort and is projected to serve as a high impact rendering driver of the market. Advancements in medicine have led to a shift from communicable to noncommunicable diseases in developing countries. Sedentary lifestyle and high consumption of alcohol are factors responsible for increase in the prevalence of lifestyle diseases. Growing incidence of target diseases requiring long-term care, such as Alzheimer’s disease and dementia, is expected to drive the market during the forecast period.

Furthermore, awareness about home care services and devices for such conditions is increasing. Availability of portable devices such as heart rate monitors, respiratory aids, and blood glucose monitors has improved the efficiency and effectiveness of home care for lifestyle diseases. Value-based healthcare is another major factor contributing to the market. In most of the developed and developing nations, the central government is offering either partial or complete coverage for the in-home services. In the U.S., Medicare reimbursements are highly favorable in providing value-based healthcare for improved patient outcomes at a low cost. Thus, in-home care has become a modality of choice for treatment.

The advent of advanced home healthcare services in the country has enabled the delivery of high-quality healthcare in the comfort of one’s home. Moreover, patients can save 10% to 25% from their overall medical treatment costs by opting for home healthcare services. Modern-age networking has provided physicians with access to patient data from remote locations and the ability to provide immediate consultation.

Key Companies & Market Share Insights

The market is highly fragmented due to the presence of a large number of multinational as well as local market players. Moreover, the consolidation activities undertaken by multinational companies are estimated to increase competition amongst new and local market players. The leading players are constantly looking to increase their share in the market. For instance, Nightingales Home Health Services (India) recently launched its operations in Chennai. Portea Medical is offering at-home COVID-19 testing services to expand its service offerings. Currently, service providers are focused on geographical expansions over increasing service offerings. Moreover, the market is largely unregulated, which may lead to unfair competition and hostile takeovers. Some of the prominent players in the home healthcare market include:

Home Healthcare Market Segmentations:

By Component

By Indication

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Healthcare Market

5.1. COVID-19 Landscape: Home Healthcare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Healthcare Market, By Component

8.1. Home Healthcare Market, by Component, 2023-2032

8.1.1. Equipment

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Home Healthcare Market, By Indication

9.1. Home Healthcare Market, by Indication, 2023-2032

9.1.1. Cardiovascular Disorders & Hypertension

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Diabetes

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Respiratory Diseases

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Pregnancy

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Mobility Disorders

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Cancer

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Wound Care

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Other Indications

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Home Healthcare Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Component (2020-2032)

10.1.2. Market Revenue and Forecast, by Indication (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Component (2020-2032)

10.2.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Component (2020-2032)

10.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Component (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Component (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Indication (2020-2032)

Chapter 11. Company Profiles

11.1. McKesson Medical-Surgical Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Fresenius Medical Care

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Medline Industries, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Medtronic PLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. 3M Healthcare

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Baxter International Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. B. Braun Melsungen AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Arkray, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. F. Hoffmann-La Roche AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Becton, Dickinson And Company

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others