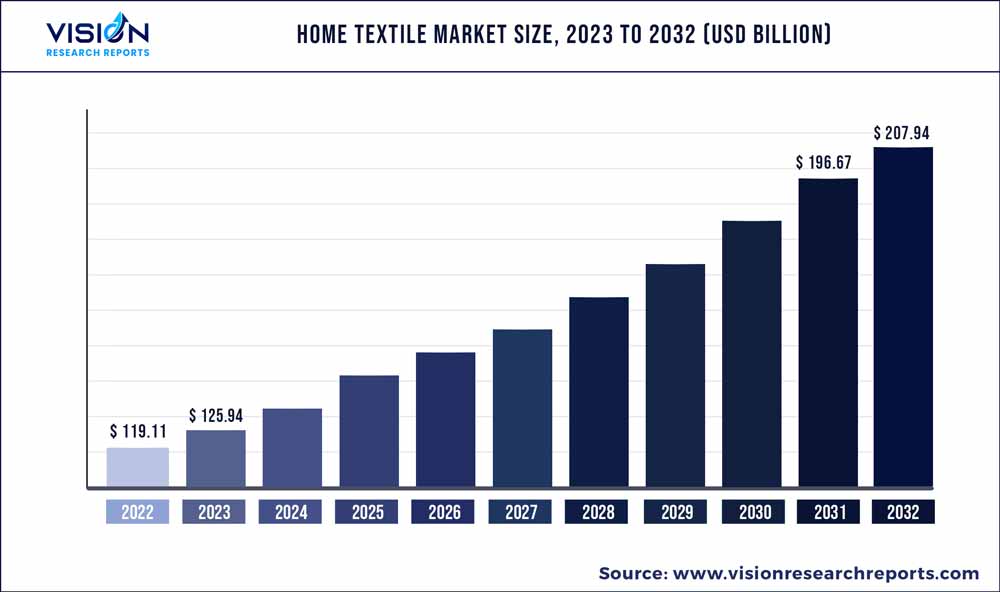

The global home textile market was valued at USD 119.11 billion in 2022 and it is predicted to surpass around USD 207.94 billion by 2032 with a CAGR of 5.73% from 2023 to 2032. The home textile market in the United States was accounted for USD 18.3 billion in 2022.

Key Pointers

Report Scope of the Home Textile Market

| Report Coverage | Details |

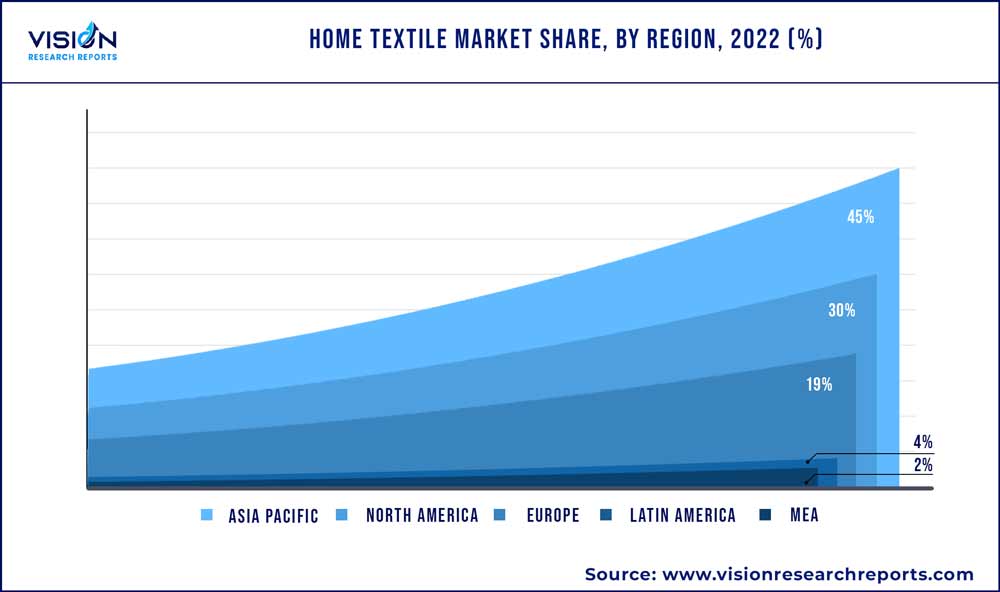

| Revenue Share of Asia Pacific in 2022 | 45% |

| CAGR of Europe from 2023 to 2032 | 7.43% |

| Revenue Forecast by 2032 | USD 207.94 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Welspun Group; Springs Global; New Sega Home Textiles; Ralph Lauren Corporation; Shenzhen Fuanna; Trident Group; Marvic Textiles; Shanghai Hometex, Honsun; Hunan Mendale Hometextile Company Ltd.; LLC Honsun Home Textile |

Home textiles have become more than a basic necessity in modern homes across the globe. They are increasingly being viewed as an extended part of a homeowner’s personality, tastes, and preferences. Product manufacturers have been constantly innovating in terms of designs, styles, quality, patterns, and applications to attract more consumers. Spending on interior design and house decoration has expanded as a result of the expanding real estate industry and rising standards of living. This is also anticipated to be one of the major drivers of market expansion throughout the foreseeable future.

The coronavirus pandemic significantly impacted the global economy. The offline retail suffered a massive hit, whereas, the online sales of home bedding products surged. With changing routines and added levels of stress and anxiety, people were struggling to get enough quality sleep. This pattern could be a reflection of people searching for self-care solutions at a time when anxiety around COVID-19 resulted in a plethora of sleep issues. Thus, there was an increased expenditure on comfort and bedding, an outcome that was not adequately anticipated by manufacturers in the industry.

The market for home textiles & furnishing fabrics is extremely wide and varied in terms of prices, designs, as well as colors. While affluent consumers have refined international taste in terms of quality and design, with no price constraints, mid and economy-segment consumers opt for huge volumes of reasonably priced products. With growing awareness regarding the environment, safety, hygiene, and functionality, the demand for better-quality stain-resistant and flame-retardant home textiles is increasing.

Home textile products that blend well with the walls and the color of the house to complement modern furniture as well as lights and colors of the rooms to elevate the overall look of the house have always been a prime expectation of people. Most manufacturers have gained popularity for a similar reason as they provide complete sets of fashionable and luxurious home textile products.

Product Insights

The bedroom linen home textiles market dominated the market with a share of around 46% in 2022. In traditional blankets, soft-twist yarns are used in the filling while higher-twist yarns are used in the warp. Wool, acrylic, polyester, or a mix of these fibers may be used in the yarns. Nylon-based blends are also often used. The fabric is highly napped to create a thick, tight, fuzzy surface. Thermal blankets are knitted with an open lightweight construction or woven in a variation of the plain weave, such as a honeycomb design.

The bathroom linen home textiles market is projected to register a CAGR of 6.23% from 2023 to 2032. The adoption of hand towels in the bathroom linen segment is largely inspired by Western countries as well as influenced by the hospitality sector. Hand towels are currently widely adopted in urban households, as well as significant portions of rural households as well. The segment is expected to expand at a faster rate as a result of the expansion of end-use industries like hospitality and housing.

Material Insights

The polyester home textiles segment dominated the market with a share of around 38% in 2022. This material is durable and long-lasting, making it a popular choice for items such as bedding, curtains, and upholstery. It is also relatively easy to care for, as it is resistant to wrinkles and shrinking, and can be machine-washed and dried.

The cotton home textile segment is projected to register a CAGR of 6.52% from 2023 to 2032. Himatsingka has introduced a new line of Calvin Klein bedding that is composed of a combination of 35% recycled cotton scraps and 65% lyocell fibers. In the meantime, Pem America has unveiled its Upcycle line of bedding, throws, and shower and bathroom curtains made from recycled materials. Additionally, licensed goods sold in Canada under the London Fog and Crayola brands are available in recycled packaging.

Distribution Channel Insights

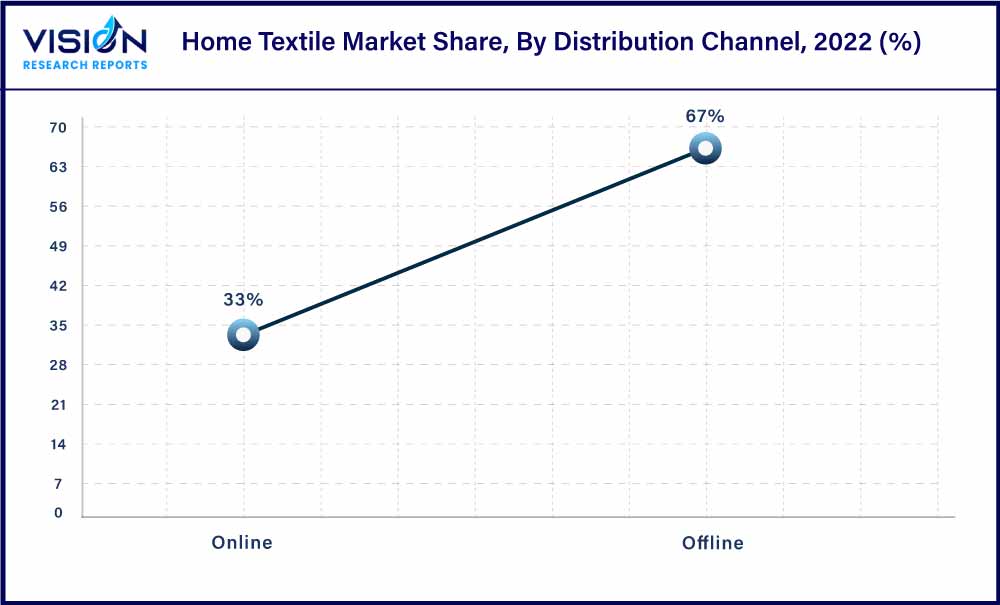

Sales of home textiles through offline distribution channels, covering supermarkets/hypermarkets, specialty stores, and other channels, dominated the market with a share of 67% in 2021. Growing urbanization, coupled with the expansion of supermarkets and hypermarkets to further extend their reach to maximum consumers, is expected to drive the global market through offline distribution channels across the globe over the forecast period. Moreover, major manufacturers in the market are inclined to sell their products via offline channels, positively impacting the growth of the distribution channel market.

Online is estimated to grow with the fastest CAGR of 6.44% over the forecast period. Major online channels include company portals and e-commerce websites. The online segment is expected to witness significant growth in the coming years due to the increasing number of online shoppers who prefer various e-commerce platforms. In addition, the availability of a wide range of products from domestic as well as international players on online platforms is expected to boost consumer preference for e-commerce platforms.

Regional Insights

Asia Pacific dominated the global market with a share of over 45% in 2022. The Export Promotion Bureau (EPB) of Bangladesh has reported that the country's exports of home textiles generated revenue of $268.52 million during the first two months of the current fiscal year (FY23), which represents an impressive 53.39% increase compared to the same period of FY22 when the revenue was $175.06 million. Bangladesh home textile remains the second highest source of export income for Bangladesh, after readymade garments, both in the last fiscal year and the beginning of FY23.

China home textile market size was valued at USD 16.54 billion in 2022. According to a home textile manufacturer Sunvim Group Co. Ltd., the sales of home textiles were in demand even during the Covid-19 pandemic. Favorable economic conditions, including reduced inflation, increased savings, optimistic growth projections, and decreased supply chain constraints in China, have resulted in significant growth in both demand and supply in this particular market.

The ASEAN home textile industry was valued at USD 7.19 billion in 2022. ASEAN countries’ diverse cultural heritage has influenced home textile trends, with an appreciation for textiles and patterns inspired by different ethnicities. Traditional motifs and craftsmanship techniques from countries like Malaysia, Brunei Cambodia, Laos, Myanmar, and Thailand have been incorporated into contemporary home textile designs.

EXPOs provide a platform for home textile manufacturers, suppliers, and designers to display their products to a wide audience, including potential buyers, retailers, and industry professionals. Exhibiting at an expo allows companies to showcase their latest designs, innovative materials, and manufacturing techniques, thereby generating interest and awareness about their offerings. A few of the most popular expos related to home textiles are Heimtextil, Maison & Objet, Intertextile Shanghai Home Textiles, Interior Lifestyle Tokyo, and more. Additionally, HOMETEX 2023 is an ongoing fair set up in Istanbul, Turkey where major home textile players from Europe, North America, and the Middle East & Africa will be participating, creating more opportunities for the importers and exporters, manufacturers, retailers, wholesalers, chain stores, designers, interior architects.

The European home textile market is expected to register a CAGR of 7.43% from 2023 to 2032. Germany home textiles industry was valued at USD 8.21 billion in 2022. The country is also the largest importer and exporter of home textiles in Europe. In 2022, made-ups such as kitchen linens topped the list of home textile imports in Germany, with a total value of $1.794 billion, representing 27.89% of the country's total imports in this category. Increased imports can help stimulate competition in the domestic market, encouraging local manufacturers to improve their product offerings and pricing to remain competitive.

The UK home textile industry was valued at USD 6.62 billion in 2022. This is mainly driven by the increasing adoption of sustainable home textile products. Haines Collection, a UK-based home textile designer started an online platform in 2020 for the resale of unwanted wallpapers, lights, textiles, and accessories.

North American home textile industry is expected to grow at a CAGR of 5.15% from 2023 to 2032. A shift towards sustainable and environmentally-friendly products, and this has impacted the home textiles industry as well. Consumers are increasingly seeking out eco-friendly and organic products, such as bedding, towels, and curtains made from sustainable materials, which are manufactured in an environmentally responsible manner. Welspun Group; Ralph Lauren; New Sega Home Textiles; Standard Textiles; and companies under the H&M Group are actively contributing to the promotion of sustainable home textiles in the U.S. home textiles industry.

Home Textile Market Segmentations:

By Product

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Textile Market

5.1. COVID-19 Landscape: Home Textile Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Textile Market, By Product

8.1. Home Textile Market, by Product, 2023-2032

8.1.1 Bedroom Linen

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Bathroom Linen

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Carpets and Floor Coverings

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Kitchen Linen

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Curtains and Drapes

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Home Textile Market, By Product

9.1. Home Textile Market, by Product, 2023-2032

9.1.1. Polyester

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cotton

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Silk

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Wool

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others (hemp, jute, etc.)

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Home Textile Market, By Distribution Channel

10.1. Home Textile Market, by Distribution Channel, 2023-2032

10.1.1. Offline

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Online

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Home Textile Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Welspun Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Welspun Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. New Sega Home Textiles

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ralph Lauren Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Shenzhen Fuanna

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Trident Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Marvic Textiles

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Shanghai Hometex, Honsun

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Hunan Mendale Hometextile Company Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. LLC Honsun Home Textile

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others