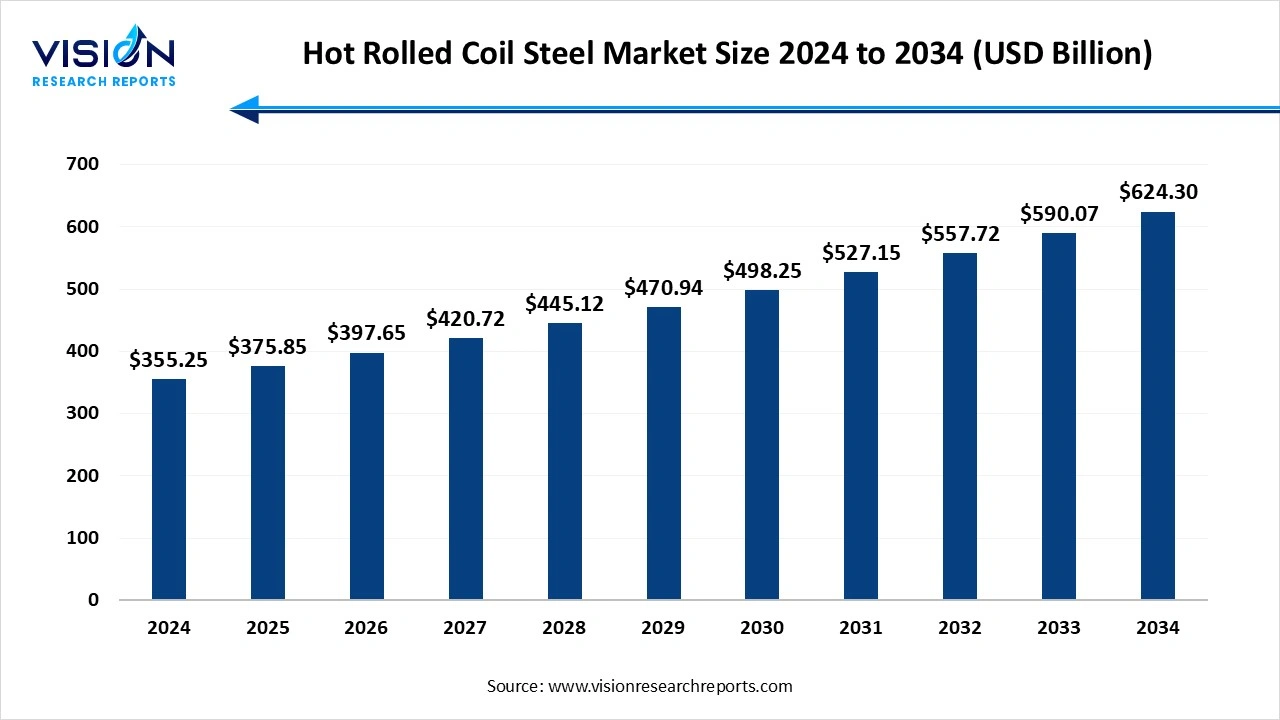

The global hot rolled coil steel market size was estimated at around USD 355.25 billion in 2024 and it is projected to hit around USD 624.30 billion by 2034, growing at a CAGR of 5.80% from 2025 to 2034.

The global hot rolled coil (HRC) steel market is experiencing steady growth, driven by rising demand across key end-use sectors such as construction, automotive, machinery, and energy. HRC steel, known for its strength, formability, and cost-efficiency, is increasingly used in infrastructure development and industrial manufacturing. Asia-Pacific remains the dominant regional market, with China and India leading in production and consumption. Meanwhile, North America and Europe are witnessing moderate growth, supported by industrial recovery and infrastructure investments. Market dynamics are influenced by raw material prices, trade regulations, and evolving environmental standards, with sustainability and decarbonization emerging as critical trends shaping the industry's future.

One of the primary growth drivers of the hot rolled coil steel market is the robust expansion of the construction and infrastructure sectors worldwide. Rapid urbanization, particularly in emerging economies such as China, India, and Southeast Asian countries, has significantly boosted the demand for HRC steel in applications like structural components, bridges, and transportation networks. Government-led infrastructure projects and increased investments in housing, energy, and transportation further contribute to sustained demand.

Another critical factor propelling market growth is technological advancement in steel production and increasing global trade of steel products. Improved production efficiencies, cost-effective manufacturing, and innovations in steel processing have made HRC more accessible and versatile across industries.

Asia Pacific emerged as both the largest and fastest-growing market for hot-rolled coil steel, representing more than 63% of global demand in 2024. China’s position as the world’s largest steel producer gives it substantial influence over global pricing and supply trends. India, meanwhile, is rapidly expanding its infrastructure and manufacturing base, further bolstering regional demand. Southeast Asian countries are also emerging as significant contributors, supported by growing construction activity and industrial investments.

The hot rolled coil steel industry in Europe is projected to experience steady growth between 2025 and 2034, fueled largely by the revival of major sectors like construction, automotive manufacturing, and renewable energy. With ongoing emphasis on modernizing infrastructure including the development of green and smart cities the demand for HRC steel in structural applications is expected to increase significantly. Additionally, the automotive industry’s shift towards electric vehicles is driving higher consumption of steel for lightweight, durable components, further supporting market expansion.

the segment with a size of 3 mm or less contributed the largest market share of 32% in 2024. The global hot rolled coil (HRC) steel market for products with a thickness of less than or equal to 3mm is witnessing notable growth, primarily driven by its wide application across various industrial sectors. Thin-gauge hot rolled coils are commonly used in automotive body panels, lightweight structural components, appliances, and precision fabrication. Their excellent formability, weldability, and cost-efficiency make them an ideal choice for manufacturers aiming to reduce weight without compromising strength. As industries increasingly focus on fuel efficiency, lightweight design, and material optimization, demand for thinner hot rolled steel coils continues to rise.

Technological advancements in rolling mills have enabled manufacturers to produce high-quality thin-gauge coils with improved surface finish and mechanical properties. This has expanded their use in sectors such as electrical enclosures, tubing, and construction cladding. Emerging economies are contributing significantly to market expansion as infrastructure development and industrialization drive the need for thinner steel solutions.

The construction and infrastructure sectors have played a major role in driving the global hot rolled coil steel market, contributing to more than 43% of the total market share  in 2024. HRC steel is extensively utilized in the construction of buildings, bridges, highways, and industrial structures due to its strength, durability, and cost-efficiency. As urban development intensifies across emerging economies and developed nations prioritize infrastructure modernization, the use of HRC steel continues to grow. Its excellent weldability and formability make it an ideal material for structural frames, columns, and reinforcements, supporting both residential and commercial construction.

In the steel industry itself, hot rolled coils serve as a foundational input for numerous downstream steel products. These include pipes, tubes, structural beams, and plates used across multiple industries such as oil and gas, shipbuilding, and heavy machinery. The internal consumption of HRC steel within the steel industry supports the production of value-added products that feed into other critical sectors. Technological advancements and the shift toward environmentally friendly production methods are also enhancing the performance and sustainability of HRC steel.

By Thickness

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hot Rolled Coil Steel Market

5.1. COVID-19 Landscape: Hot Rolled Coil Steel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Hot Rolled Coil Steel Market, By Thickness

8.1. Hot Rolled Coil Steel Market, by Thickness

8.1.1. Less than or equal to 3mm

8.1.1.1. Market Revenue and Forecast

8.1.2. Greater than 3mm

8.1.2.1. Market Revenue and Forecast

Chapter 9. Hot Rolled Coil Steel Market, By End-use

9.1. Hot Rolled Coil Steel Market, by End-use

9.1.1. Construction & Infrastructure

9.1.1.1. Market Revenue and Forecast

9.1.2. Oil & Gas / Energy

9.1.2.1. Market Revenue and Forecast

9.1.3. Automotive

9.1.3.1. Market Revenue and Forecast

9.1.4. Industrial Equipment

9.1.4.1. Market Revenue and Forecast

9.1.5. Shipbuilding & Marine

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Hot Rolled Coil Steel Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Thickness

10.1.2. Market Revenue and Forecast, by End-use

Chapter 11. Company Profiles

11.1. ArcelorMittal

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Nippon Steel Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. POSCO

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Tata Steel

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. JFE Steel Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Baosteel Group (China Baowu Steel Group)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nucor Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. United States Steel Corporation (U.S. Steel)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Hyundai Steel Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. JSW Steel

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others