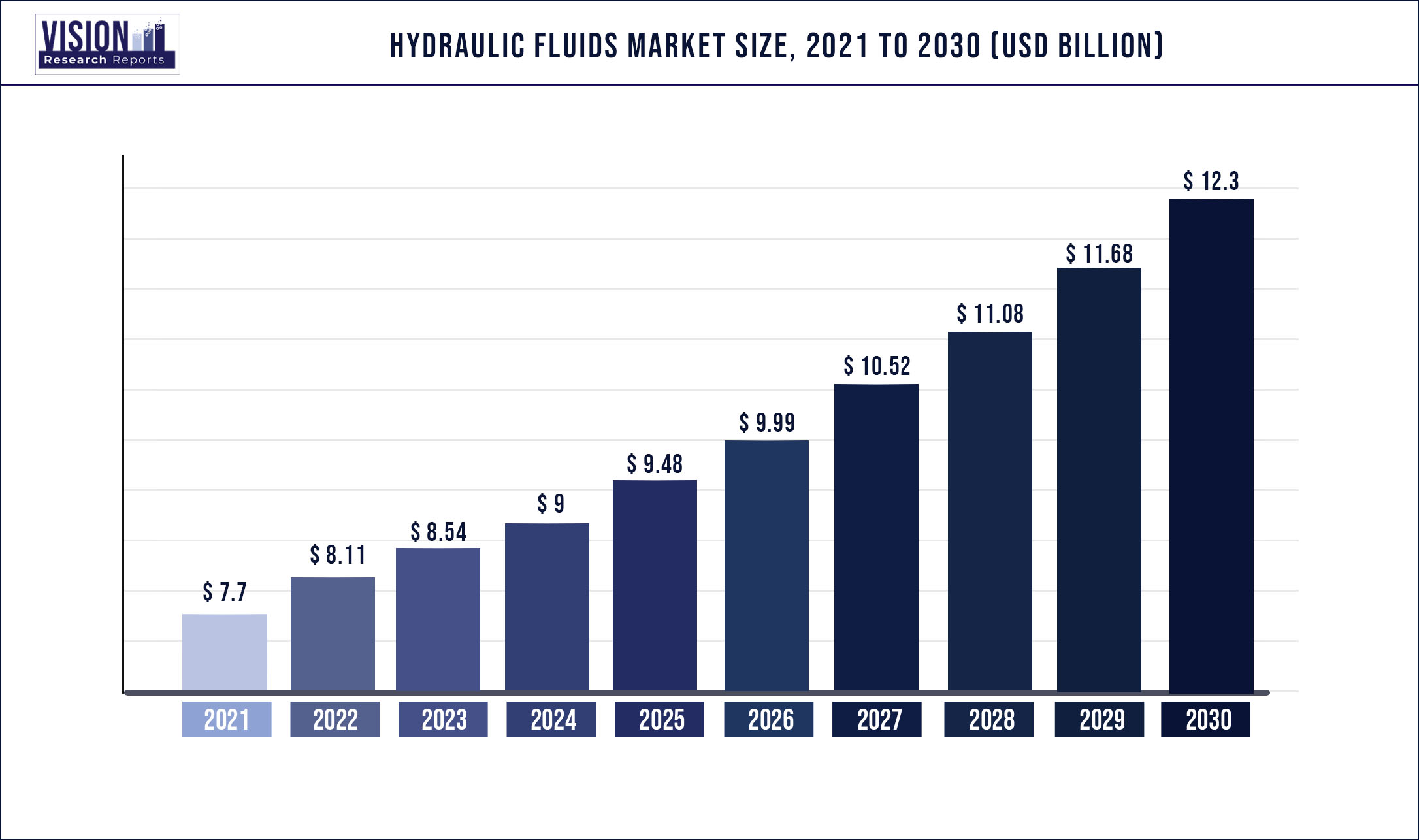

The global hydraulic fluids market was valued at USD 7.7 billion in 2021 and it is predicted to surpass around USD 12.3 billion by 2030 with a CAGR of 5.34% from 2022 to 2030.

Report Highlights

In recent years, industrialization has been on a rise, particularly in emerging economies such as India, China, and Brazil, among others. The share of the manufacturing industry in the GDP is increasing significantly for these countries. Various policies by governments all over the world are being targeted toward the growth of industrial sectors.

The digital revolution, combined with artificial intelligence, has opened numerous new opportunities for fluid power. It will take time to turn into high-power electromechanical solutions. The industry must leverage the inherent capabilities of fluid power technology and expand its reach through technological advancements. In terms of energy efficiency, fluid power technology has huge potential. The focus will soon shift to the development of high-speed switching valves, high-efficiency hydraulic fluids, and more efficient pumps and motors. In 2020, the market was severely affected by the global pandemic. Prices were dropped due to the lack of demand for lubricants and oils from end-user industries such as construction, automotive, marine, and aerospace, among others.

In recent years, a huge fluctuation in the prices of base oil and hydraulic fluids has been experienced by the industries. In 2021, the prices of the market skyrocketed owing to the sudden demand for the product after the revival of the end-user industries. In 2022, the Russia-Ukraine war has resulted in the further increase of the base oil and hydraulic fluids prices.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.7 billion |

| Revenue Forecast by 2030 | USD 12.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.34% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Base oil, end-use, region |

| Companies Covered |

Shell plc; Exxon Mobil Corporation; Chevron Corporation; BP p.l.c.; TotalEnergies; PetroChina Company Limited; China Petrochemical Corporation (SINOPEC); FUCHS; Valvoline; NYCO; Idemitsu Kosan Co., Ltd.; Dow, Eastman Chemical Company; LUKOIL; Gazprommeft - Lubricants Ltd. |

Base Oil Insights

The mineral oil segment led the market for hydraulic fluids and accounted for 48.96% of the global revenue in 2021. Mineral oil is the most common base oil used for hydraulic fluid production and is categorized into three groups: Group I, Group II, and Group III. The mineral oil which is solvent-refined classifies within Group I. Group I base mineral oil is the most common base stock for modern hydraulic fluids. Other base stocks such as silicone oils or propylene glycol, can be required for certain purposes. Hydraulic fluids are given special qualities by adding additives. Anti-erosion additives, corrosion inhibitors, anti-foaming agents, and friction reducers are some common additives. Oils in Group II and Group III are hydrocracked type mineral oils, they have a higher viscosity than Group I. The industry would see a shift from Group I to II over the next few years as more factories that produce Group I oil convert to Group II or shut down.

The synthetic oil segment is expected to witness a CAGR of 6.09% over the forecast period in terms of revenue. Synthetic hydraulic oil was created to compensate for the drawbacks of mineral hydraulic oil. They have better performance than mineral hydraulic fluids because they are formed of chemically manufactured base oils. This type of oil is fire-resistant and therefore appropriate for high-temperature uses as it has outstanding lubrication properties and high viscosity index. The most common benefit of synthetic fluids is that they remain longer in service. In March 2022, BASF SE, a globally renowned company announced to increase its synthetic ester base stock’s production capacity at its Jinshan, China, facility. The investment is in response to the growing demand for high-performance lubricants in the Asia Pacific.

End-use Insights

The construction segment dominated the market for hydraulic fluids and accounted for 25.56% of the global revenue in 2021. According to the Society of Tribologists and Lubrication Engineers (STLE), Hydraulic construction equipment makes up 76% of the hydraulic equipment market. Some of the popular construction hydraulic equipment that uses hydraulic fluids are excavators, backhoes, bulldozers, trenchers, loaders, dump trucks, graders, etc. Maintaining operational flow and end-activity amid often uncontrollable construction situations can be difficult. According to Valvoline, lubricants represent between 1 and 3% of the construction equipment’s maintenance budget. To achieve rigorous deadlines without jeopardizing the bottom line and profitability, construction machinery must stay reliable and available.

Lubrication is an important part of the maintenance process. Although it may only account for a tiny fraction of the budget, lubrication can have a significant impact on performance goals and project success. According to Oxford Economics, the global construction market would rise by USD 4.5 trillion between 2020 and 2030, reaching USD 15.2 trillion in 2030, with USD 8.9 trillion in emerging nations. Sub-Saharan Africa is predicted to have the fastest construction increase, followed by rising Asia. The U.S., India, China, and Indonesia account for 58.3 percent of worldwide construction growth. Short-term recovery is expected to be driven by residential development, whereas medium-term recovery will be driven by infrastructure spending.

The automotive segment is expected to witness a CAGR of 6.11% over the forecast period in terms of revenue. The demand for hydraulic fluids in the automotive industry is expected to rise over the forecast period owing to the increasing off-highway vehicle production and sales. Moreover, technological advancement in vehicle braking and suspension systems and the increasing adoption of electronics in automobiles is further expected to increase the growth of the market.

Regional Insights

Asia Pacific dominated the market for hydraulic fluids and accounted for a revenue share of 36.44% in 2021. Major markets in the Asia Pacific are China, Japan, India, and Australia. Rising investments in manufacturing and construction, growth in the SME sector, and the emergence of new domestic and international players are some of the factors driving the demand for industrial lubricants in the region. Moreover, rising sales of passengers and commercial vehicles in the region and increased demand for synthetic lubricants are also supporting the growth of the market.

In Europe, the market for hydraulic fluids accounted for a revenue share of 24.33% in 2021. The major hydraulic fluid companies present in the region are Shell plc, BP p.l.c., TotalEnergies, and LUKOIL. Europe is one of the key regions for the construction and automotive industry. Demand for hydraulic fluids is expected high in the region over the forecast period. In 2020, the European Union imported prepared liquids for hydraulic transmission and hydraulic fluids for brakes that did not contain or contained less than 70% by weight of petroleum oils or bituminous mineral oils. The transaction was valued at USD 88,641.30 thousand.

In Canada, the market for hydraulic fluids is expected to witness a CAGR of 5.27% over the forecast period. As per the COMTRADE database (by the United Nations) on international trade, the exports of prepared liquids for hydraulic transmission and hydraulic brake fluids in Canada were reported at USD 32.33 Million in 2021. Canada is one of the largest importers of commodities in the world, with most of the imports coming from the U.S.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hydraulic Fluids Market

5.1. COVID-19 Landscape: Hydraulic Fluids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hydraulic Fluids Market, By Base Oil

8.1. Hydraulic Fluids Market, by Base Oil, 2022-2030

8.1.1. Mineral Oil

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Synthetic Oil

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Bio-based Oil

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Hydraulic Fluids Market, By End-use

9.1. Hydraulic Fluids Market, by End-use, 2022-2030

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Metal & Mining

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Oil & Gas

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Agriculture

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Automotive

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Aerospace & Defense

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Hydraulic Fluids Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Base Oil (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Shell plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Exxon Mobil Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Chevron Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BP p.l.c.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. TotalEnergies

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PetroChina Company Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. China Petrochemical Corporation (SINOPEC)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. FUCHS

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Valvoline

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. NYCO

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others