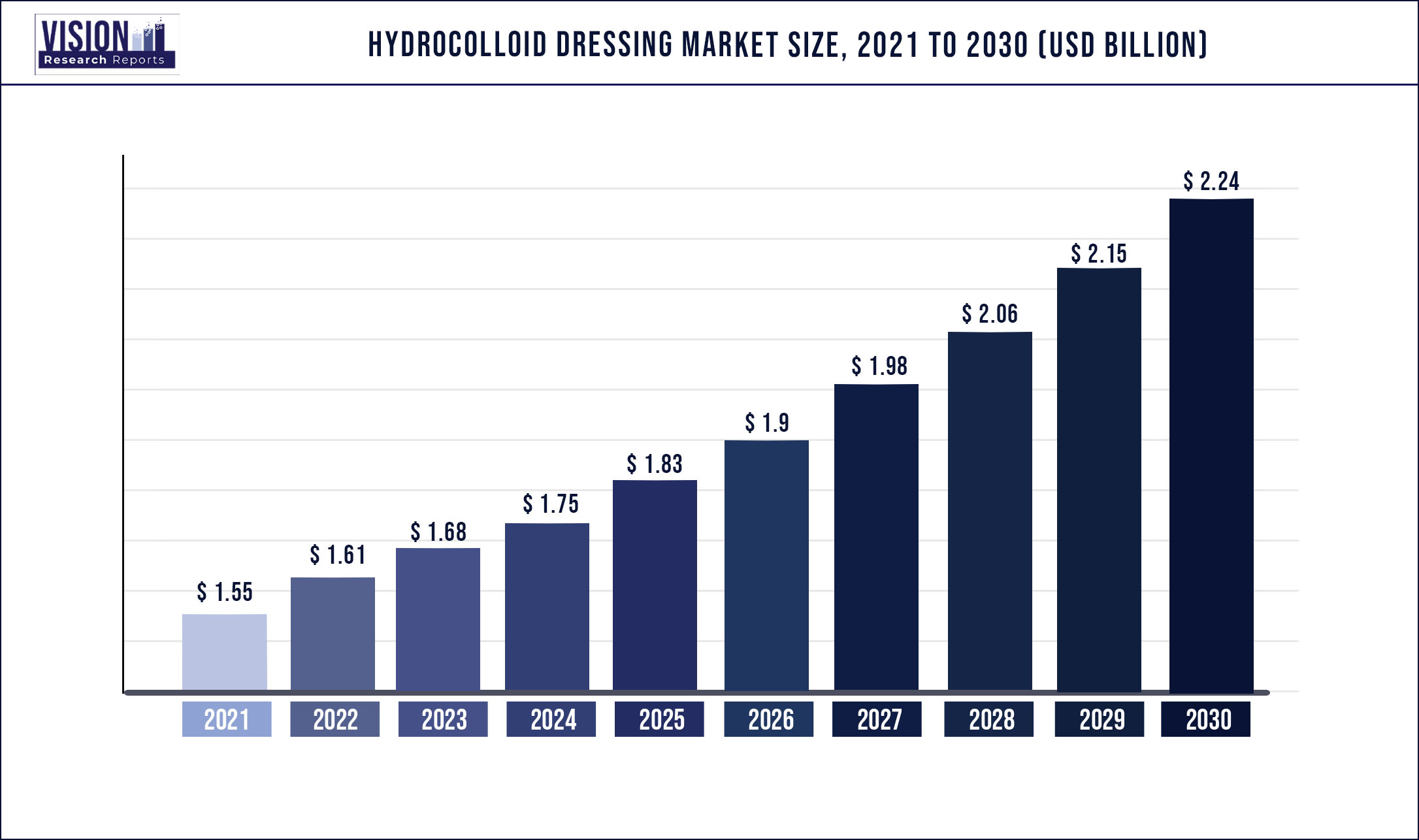

The global hydrocolloid dressing market was valued at USD 1.55 billion in 2021 and it is predicted to surpass around USD 2.24 billion by 2030 with a CAGR of 4.18% from 2022 to 2030.

Report Highlights

Increasing prevalence of chronic and acute wounds, rapidly aging population, rising number of diabetic patients, and surge in research and development activities are among the major factors driving the market growth. The rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, among the general population is likely to increase the number of patients getting treatment and fuel the adoption of hydrocolloid dressings.

Furthermore, the rising prevalence of acute wounds, such as surgical wounds and burns, is further expected to drive the demand for hydrocolloid wound dressings throughout the projected period. Surgical wounds, for example, are a major problem in general healthcare, according to the Wound Healing Society (WHS). Despite all attempts, Surgical Site Infections (SSI) cause death in 75% of patients globally. As a result, the increased incidence of infections has imposed a significant cost burden on the healthcare business. This is likely to contribute to the launch of advanced products, thus fostering market growth. Clinical uses for several hydrocolloid materials have been proposed in recent years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.55 billion |

| Revenue Forecast by 2030 | USD 2.24 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.18% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, end-use, region |

| Companies Covered | Smith & Nephew; 3M; Coloplast Corp.; Convatec Inc.; Paul Hartmann AG; B. Braun Melsungen AG; Cardinal Health; Covalon Technologies Ltd.; Dermarite Industries, LLC; Medline Industries, Inc. |

Application Insights

The acute wounds segment is expected to grow at the fastest CAGR of 5.23% during the forecast period. The surgical & traumatic wounds segment held the largest share in 2021. The rising number of SSIs is one of the major driving factors for segment growth. Surgical wounds majorly occur due to SSIs. As per a study conducted by Wounds International, the incidence rate of SSI in general surgery was found to be 11.7%, which led to the re-admission of 19.2% of patients during the study period. Furthermore, the rising incidence of trauma is contributing to the segment growth. For instance, as per a study by ResearchGatein 2020, around 6.6% of mortality occursdue to trauma every year.

Moreover, the burns segment is anticipated to witness the fastest growth rate over the forecast period owing to the rising incidence of burn injuries. Around 50.0% of people worldwide are exposed to fire-related traumas and among them, 90.0% of the cases occur in low- to moderate-income countries. As per the Joye Law Firm, on average, there are 450,000 burn injuries throughout the U.S. annually that require medical treatment, and about 3,500 people are fatally injured in a fire or burn accident. Thereby, the rising prevalence of traumatic wounds, SSI and burn injuries are among the key factors anticipated to propel segment growth over the forecast period.

The chronic wounds segment held the largest revenue share in 2021 and is anticipated to witness a considerable growth rate over the forecast period. The increasing incidence of diabetes and diabetic foot ulcers is a major factor driving the segment growth. For instance, according to ScienceDirect, diabetic foot ulcers may affect more than 25% of the diabetic population and may lead to amputation of the foot in 20% of patients. Moreover, according to the American Diabetes Association, in 2018, an estimated 34.2 million people, i.e., 10.5% of the total U.S. population, had diabetes.

Nearly 1.6 million U.S. residents had type 1 diabetes, which includes about 187,000 adolescents and children. According to a similar source, approximately 1.5 million people in the U.S. are diagnosed with diabetes each year. The use of hydrocolloid wound dressings helps such ulcers to heal as they provide a moist wound environment that supports healing and autolytic debridement. Thus, with an increase in the number of patients suffering from diabetesand a rise in the prevalence of diabetic foot ulcers, the segment is expected to grow during the forecast period.

End-use Insights

The hospitals segment held the largest share of more than 45.09% of the global revenue in 2021 due to a growing patient flow in hospitals suffering from chronic and acute wounds. For instance, as per a research article published by Smith & Nephew, in a typical hospital setting, between 25% and 40% of beds are occupied by patients with wounds. Moreover, the increasing number of surgical procedures is further driving the segment growth. For instance, as per the latest statistics published by a research article in NCB, around 310 million key surgeries are performed annually across the globe, with about 40 to 50 million in the U.S. and 20 million in Europe.

Hydrocolloid dressings are commonly used for surgical incisions, thereby its adoption is likely to increase with the rising volume of surgeries. The aforementioned factors are projected to boost the segment growth during the forecast period. The home healthcare segment is anticipated to grow at the fastest CAGR during the forecast period due to patients’ increasing preference for home care settings for personalized wound care. Most of the surgeries require a prolonged recovery period, leading to frequent changing of dressings. Moreover, the geriatric population suffering from wounds prefer home care over hospital stay.

Conditions, such as diabetic foot ulcers, venous leg ulcers, and surgical wounds, typically necessitate extended hospital stays, which can be difficult for senior patients. Furthermore, due to the rising healthcare expenses, a growing number of individuals with chronic conditions prefer to obtain treatment at home. This trend is expected to boost the demand for hydrocolloid dressings, as they are used to treat, diagnose, and monitor a variety of chronic and acute wounds. Hence, such factors are anticipated to boost the segment growth over the forecast period.

Regional Insights

North America held the largest revenue share of 45.5% in 2021 and is expected to witness a steady CAGR over the forecast period. The region’s dominance is due to the rising prevalence of chronic wounds, higher treatment costs, and availability of appropriate reimbursement programs in the U.S. and Canada. According to an article published in October 2021 by Mary Ann Liebert, Inc., the prevalence of venous leg ulcers among the adult population in the U.S. was roughly 1.69% in 2020. It was also estimated that the yearly economic burden for venous leg ulcers in the U.S. was roughly USD 14.90 billion. Due to the large patient pool suffering from chronic wounds, there is a rising need for and acceptance of advanced wound care products, such as hydrocolloid dressings.

This is responsible for this region’s market domination. Asia Pacific is estimated to witness the highest CAGR over the forecast period. The market is steadily increasing, offering several opportunities for the introduction of new products. Furthermore, medical tourism in this region is increasing, which is increasing the number of surgeries performed. In addition, the increasing focus of major players in the emerging Asian countries and government support are further driving the market in this region. However, the lack of awareness and price sensitivity have significantly hampered the expansion of the advanced wound care management market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hydrocolloid Dressing Market

5.1. COVID-19 Landscape: Hydrocolloid Dressing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hydrocolloid Dressing Market, By Application

8.1. Hydrocolloid Dressing Market, by Application, 2022-2030

8.1.1. Acute Wounds

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Chronic Wounds

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Hydrocolloid Dressing Market, By End-use

9.1. Hydrocolloid Dressing Market, by End-use, 2022-2030

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Specialty Clinics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Home Healthcare

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Hydrocolloid Dressing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Smith & Nephew

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. 3M

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Coloplast Corp

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Convatec Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Paul Hartmann AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. B. Braun Melsungen AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Cardinal Health

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Covalon Technologies Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Dermarite Industries, LLC.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Medline Industries, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others