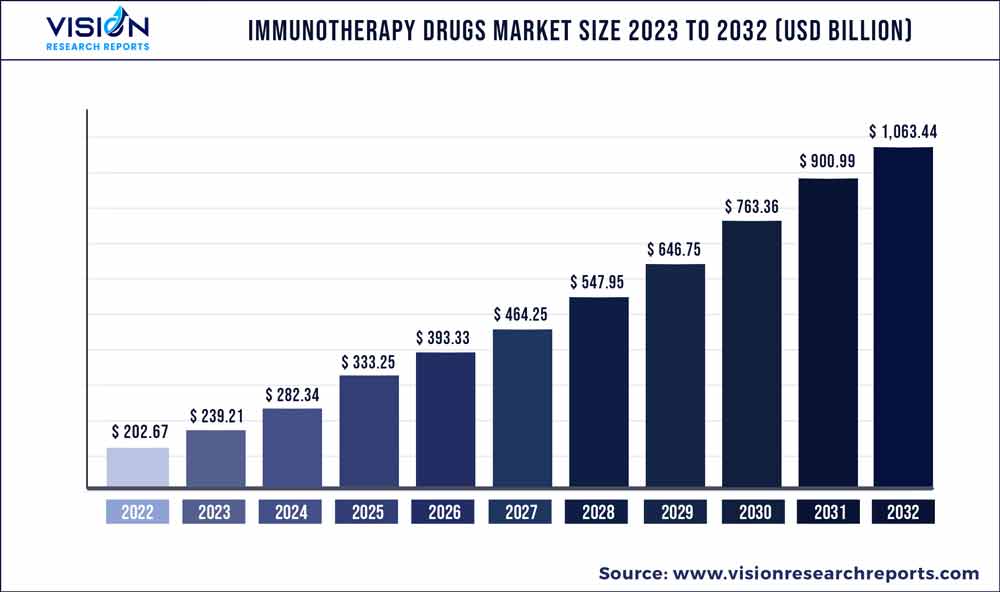

The global immunotherapy drugs market size was estimated at around USD 202.67 billion in 2022 and it is projected to hit around USD 1,063.44 billion by 2032, growing at a CAGR of 18.03% from 2023 to 2032.

Report Highlights

The key factors contributing to the lucrative growth of the industry include increased awareness about chronic diseases including cancer, autoimmune diseases, inflammatory diseases, and infectious diseases, coupled with supportive government policies for drug approval. The rising adoption of targeted therapies for chronic disease treatment is expected to increase inclination toward immunotherapy drugs, thereby driving the industry during the forecast period.

For instance, in May 2022, AstraZeneca and Daiichi Sankyo’s Enhertu (trastuzumab) received U.S. approval for treating HER2-positive breast cancer. Other targeted immunotherapy drugs include Kadcyla (trastuzumab emtansine) and Tecentriq (atezolizumab). In June 2022, F. Hoffmann-La Roche Ltd. received EU approval for Tecentriq as an adjuvant treatment for NSCLC. In addition, developing healthcare infrastructure in low- and middle-income countries coupled with increased research & development by key players is anticipated to contribute to the industry growth. For instance, in December 2021, Novartis AG collaborated with BeiGene, Ltd. for ociperlimab (BGB-A1217), therefore expanding its R&D activities in immune-oncology.

In August 2022, Pfizer, Inc. shared positive results from phase 2b/3 clinical trial of ritlecitinib for treating alopecia areata. Moreover, the rise in the incidence of cancer cases worldwide is expected to drive the demand for immunotherapy drugs. As per Globocan reports, an estimated 19.3 million new oncology cases were diagnosed in 2020. Moreover, according to the European Society of Medical Oncology, cancer incidence in Europe is anticipated to rise by 21% between 2020 and 2040. Thus, approvals of various immunotherapy drugs for cancer treatment are predicted to increase industry growth.

Scope of The Report

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 18.03% |

| Market Revenue by 2032 | USD 1,063.44 billion |

| Revenue Share of North America in 2022 | 44.98% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

| Companies Covered | Amgen, Inc.; Novartis AG; AbbVie, Inc.; Pfizer, Inc.; F. Hoffmann-La Roche Ltd.; Johnson & Johnson Services, Inc.; AstraZeneca; GSK; Sanofi; Bayer AG |

Indication Insights

On the basis of drug types, the industry has been further categorized into cancer, autoimmune diseases, infectious diseases, and others. The cancer segment accounted for the largest revenue share of more than 91.25% in 2022 owing to the increased prevalence of cancer, coupled with a rise in the launch of cancer immunotherapies. As per Globocan 2020, breast cancer and lung cancer are the two most predominant cancers with a prevalence of approximately 11.7% and 11.4%. Moreover, in April 2021, the FDA approved Opdivo (nivolumab) in combination with chemotherapy for patients with gastric cancer.

On the other hand, the autoimmune diseases segment is anticipated to register the fastest growth rate during the forecast period. The growth of this segment can be attributed to the increasing cases of autoimmune diseases across the globe and regional approvals of immunotherapy drugs. As per NCBI research, the estimated global prevalence of rheumatoid arthritis is around 0.46% of the global population. Moreover, GSK’s Benlysta (belimumab) received China’s National Medical Products Administration approval for the treatment of active lupus nephritis in February 2022.

Drug Type Insights

On the basis of drug types, the industry has been further divided into monoclonal antibodies, immunomodulators, and vaccines. The monoclonal antibodies segment accounted for the largest share of more than 76.58% in 2022 owing to increased R&D in therapeutic monoclonal antibodies coupled with supportive government initiatives. For instance, in May 2022, the U.S. FDA accepted the supplemental Biologics License Application for priority review of Dupixent (dupilumab) indicated for treating prurigo nodularis. The vaccines segment is expected to register the fastest CAGR during the forecast period.

The growth of this segment is attributed to strategic collaborations among key players and an increase in clinical trials for vaccine development. For instance, in January 2022, Pfizer Inc. and BioNTech SE entered a strategic collaboration to develop an mRNA-based vaccine to prevent shingles. Under this agreement, BioNTech’s mRNA platform technology and Pfizer’s antigen technology will be utilized. In addition, in March 2022, the National Institute of Health launched a Phase 1 trial of three investigational HIV mRNA-based vaccines.

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of more than 44.98% of the overall revenue. The launch and regulatory approval of new immunotherapy drugs and favorable reimbursement policies are projected to aid in the region’s growth. For instance, Keytruda, Merck’s anti-PD-1 therapy, was approved by the FDA in October 2021, in combination with chemotherapy for cervical cancer treatment. Moreover, in August 2021, Opdivo (nivolumab) manufactured by Bristol Myers Squibb Co. received FDA approval for the treatment of urothelial carcinoma.

The Centers for Medicare & Medicaid Services provides reimbursement for hospital inpatient treatment with chimeric antigen receptor T-cell therapy. Japan is expected to witness a significant CAGR during the forecast period. The increasing prevalence of cancer in Japan, rising geriatric population, increasing investments in medical research, and well-developed healthcare infrastructure, are some of the major factors boosting the region’s growth. According to the GLOBOCAN report, in 2020, around 27,10,728 people were suffering from cancer in Japan, with about 10,28,658 newly diagnosed cancer cases. Thus, the demand for advanced immunotherapies is expected to be high in this region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Immunotherapy Drugs Market

5.1. COVID-19 Landscape: Immunotherapy Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Immunotherapy Drugs Market, By Drug Type

8.1. Immunotherapy Drugs Market, by Drug Type, 2023-2032

8.1.1. Monoclonal Antibodies

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Immunomodulators

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Vaccines

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Immunotherapy Drugs Market, By Indication

9.1. Immunotherapy Drugs Market, by Indication, 2023-2032

9.1.1. Cancer

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Autoimmune Diseases

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Infectious Diseases

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Immunotherapy Drugs Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Indication (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Indication (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Drug Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Indication (2020-2032)

Chapter 11. Company Profiles

11.1. Amgen, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Novartis AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. AbbVie, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Pfizer, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. F. Hoffmann-La Roche Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Johnson & Johnson Services, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. AstraZeneca

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. GSK

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Sanofi

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bayer AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others