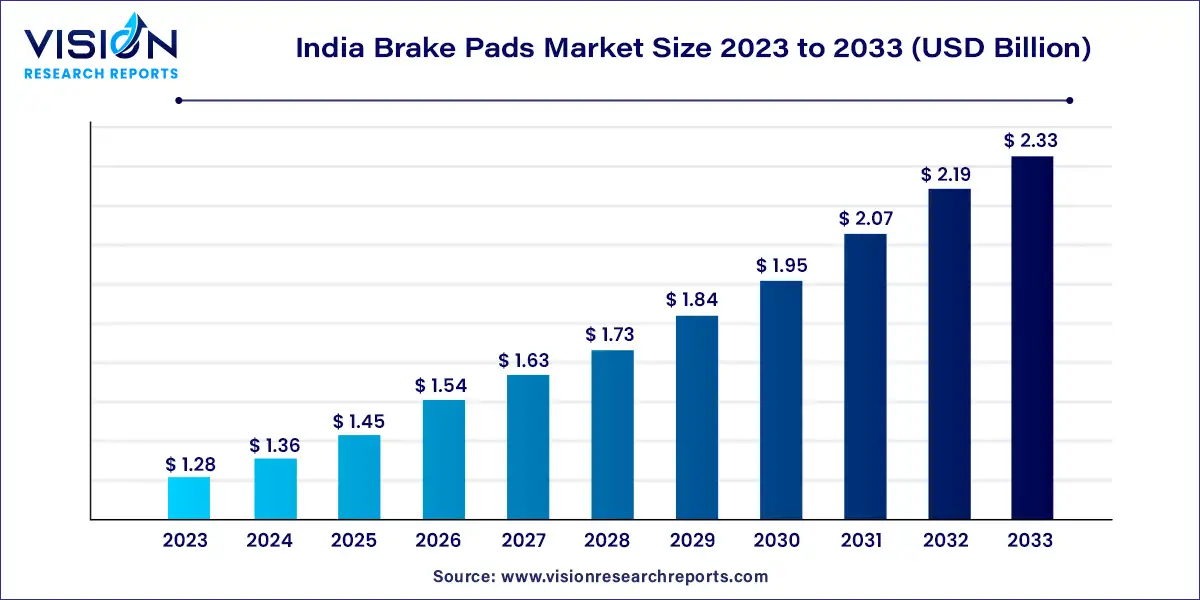

The India brake pads market was surpassed at USD 1.28 billion in 2023 and is expected to hit around USD 2.33 billion by 2033, growing at a CAGR of 6.13% from 2024 to 2033.

The India brake pads market is a critical component of the automotive industry, playing a pivotal role in vehicle safety and performance. As India's automotive sector continues to expand and evolve, driven by factors such as urbanization, infrastructure development, and increasing disposable income, the demand for high-quality brake pads remains robust. This overview delves into the dynamics shaping the India Brake Pads market, including key trends, market drivers, challenges, and opportunities.

The growth of the India brake pads market is fueled by several key factors. Firstly, the rapid expansion of the automotive industry in India, driven by increasing vehicle sales and infrastructure development, creates a substantial demand for brake pads. As vehicle ownership rises, particularly in urban areas, the need for replacement brake pads grows, stimulating market growth. Additionally, stringent vehicle safety regulations mandated by regulatory bodies such as the Automotive Research Association of India (ARAI) and the Bureau of Indian Standards (BIS) incentivize the adoption of high-quality brake pads, further driving market expansion. Moreover, the shift towards premium and high-performance brake pads, coupled with growing consumer awareness of the importance of vehicle safety, contributes to market growth as consumers seek reliable braking systems to enhance safety and performance. These factors collectively propel the India Brake Pads market forward, offering manufacturers and retailers significant opportunities for expansion and innovation in meeting the evolving needs of the automotive industry and safety standards.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.28 billion |

| Revenue Forecast by 2033 | USD 2.33 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.13% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The two-wheeler segment accounts for the largest market share of more than 67% in 2023. The development of advanced braking system in high-performing bikes such as sports and racing bikes, rising integration of traction control system, electronic stability control system and rear lift off protection are major factors driving segmental growth. The growing demand for advanced friction and lightweight materials in two-wheeler is another factor driving segmental growth.

The three-wheeler segment is expected to witness the fastest growth during the forecast period. The rising demand for affordable public transportation and the growing traction of electric three-wheelers across the country is creating the demand for brake pads in the three-wheeler segment. The government’s PLI scheme to support the manufacturing of electric three-wheelers, is expected to drive the growth of electric three-wheelers and growth has cascading effects on the sales of brake pads in the market.

The front brake pads segment accounts for the largest market share of more than 76% in 2023. The front brake pads are the most used brakes throughout a vehicle's life cycle. When the brakes are applied to any vehicle, the front brake operates, and friction is generated between the disc and the brake pads, which results in vehicle stoppage. The continuous braking operation results in high wear and tear of braking material, thereby resulting in higher maintenance and replacement of existing brake pads. Therefore, to address such issues, brake pad manufacturers are working on improving the material quality and making them more eco-friendly. Hence, continuous innovation in brake pads with organic material, coupled with rising sales of passenger and commercial vehicles is contributing to the high growth of the segment.

The rear brake pads segment is expected to witness significant growth during the forecast period. The rear brake pads are designed to improve the stability of the vehicle. The rear brake pads handle lesser brake force but are pivotal when the emergency brakes are applied as they prevent skidding, spinouts, and rollovers, the brake also prevents the vehicles such as two wheelers from being unbalanced during braking due to the state of inertia. Therefore, innovation in brake pad material and increasing development in high performance vehicles such as sports bike and luxury cars are increasing the functionality of rear brake pads, thereby driving the segmental growth.

The OEM segment accounts for the largest market share of more than 57% in 2023. Factors such as partnerships with automotive OEMs to supply brake pads for vehicles and substantial investment in research and development for creating brake pads with organic material is expected to drive the market growth. The segment is further experiencing growth owing to the competitive market environment prompting OEM to implement organic and in-organic growth strategies to maintain their market dominance.

The aftermarket segment is expected to witness significant growth during the forecast period. The segmental growth of the aftermarket is attributed to multiple domestic suppliers and international brake pads suppliers taking initiatives to launch products for aftermarket use and to enhance their market presence in the Indian market. For instance, in April 2023, ZF Aftermarket, a division of ZF Friedrichshafen AG‘s expanded their aftermarket product portfolio with the launch of three TRW products including brake pads, brake disks, and shock absorbers. The TRW brake pads are designed and extensively tested ensure braking system safety to ensure longer life span of the brake pads.

The ceramic material segment accounts for the largest market share of more than 51% in 2023. The segmental growth is attributed to factors such as increasing stability and the ability to function efficiently in different temperature variations. Ceramic brake pad material includes fine particles of copper fibers which helps in increasing heat conductivity. Moreover, ceramic brake pads offer noiseless operation during break peddling and have a lower cost of operation making them a preferred choice for two-wheelers and passenger vehicles. Their deterioration rate is much slower; as a result, despite the high costs of manufacturing, ceramic brake pads are preferred over their other counterparts.

Non-asbestos Organic (NAO) segmenthas is expected to witness significant growth during the forecast period. NAO brake pads are constructed of organic materials such as high-temperature resins, glass, rubber, fiber, and Kevlar. NAO have a softer consistency than copper brake pads, thus, NAO brake pads create less noise. The growing traction toward the use of eco-friendly material for manufacturing brake pads and technological development in the type of material used is expected to drive market growth.

By Vehicle Type

By Position Type

By Sales Channel

By Material

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Brake Pads Market

5.1. COVID-19 Landscape: India Brake Pads Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Brake Pads Market, By Vehicle Type

8.1. India Brake Pads Market, by Vehicle Type, 2024-2033

8.1.1. Two-wheeler

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Three-wheeler

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Passenger Vehicle

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Commercial Vehicle

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. India Brake Pads Market, By Vehicle Type

9.1. India Brake Pads Market, by Vehicle Type, 2024-2033

9.1.1. Front

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Rear

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. India Brake Pads Market, By Sales Channel

10.1. India Brake Pads Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. India Brake Pads Market, By Material

11.1. India Brake Pads Market, by Material, 2024-2033

11.1.1. Semi-metallic

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Non-asbestos Organic (NAO)

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Low-metallic NAO

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Ceramic

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. India Brake Pads Market, Regional Estimates and Trend Forecast

12.1. India

12.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.4. Market Revenue and Forecast, by Material (2021-2033)

Chapter 13. Company Profiles

13.1. Brakes India Private Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Rane Holdings Limited

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Endurance Technologies Limited

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ASK Automotive Pvt. Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Brembo Brake India Pvt. Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Makino Auto Industries Pvt. Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Masu Brake Pads Pvt.Ltd

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Allied Nippon Ltd

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Sagestics BRAKES

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Ceratech Friction Composites

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others