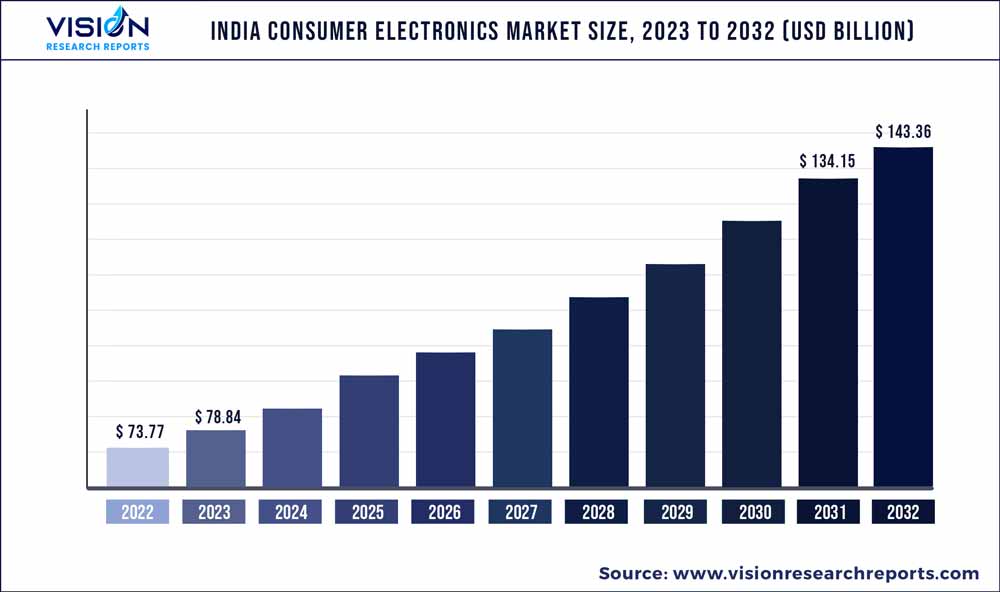

The India consumer electronics market size was estimated at around USD 73.77 billion in 2022 and it is projected to hit around USD 143.36 billion by 2032, growing at a CAGR of 6.87% from 2023 to 2032.

Key Pointers

Report Scope of the India Consumer Electronics Market

| Report Coverage | Details |

| Market Size in 2022 | USD 73.77 billion |

| Revenue Forecast by 2032 | USD 143.36 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.87% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Samsung Electronics Co., Ltd., LG Electronics, Inc., Godrej Appliances, Sony Corporation, Mitsubishi Electric Corporation, Vijay Sales, Panasonic Corporation, Haier Consumer Electronics Group, Bajaj Electricals Ltd., Hitachi Ltd., Toshiba Corporation, Whirlpool Corporation |

India provides a worldwide opportunity for short to medium-term growth in consumer electronics spending. Minimal penetration rates, as against other upcoming markets, portray a better prospect to sell to first-time buying households, along with replacement devices to the middle class.

Due to the COVID-19 pandemic, the demand for consumer electronics has been significantly impacted. Manufacturing plant shutdown and supply chain disruptions resulted in substantial component shortages. Increased counterfeiting, shipping delays, customer behavior, and environmental concerns had a significant impact on the market growth. Due to the pandemic, manufacturers of consumer electronics have witnessed component shipment delays of at least five weeks from suppliers.

Growth in the Indian market for consumer electronics can be attributed to an increase in demand from households, changing lifestyles of individuals, easier access to credit, and rising disposable incomes. Intentional reduction by the Government in the import bill, coupled with government and corporate spending, is anticipated to complement the positive demand in this market. The India consumer electronics sector has attracted several strong investments in the form of merger & acquisition policies practiced by key participants of the global market and other FDI inflows.

As per the Make in India initiative, Electronic Development Fund Policy has been approved, with the intention of rationalizing a transposed duty structure. Additionally, the Modified Special Incentive Package Scheme (M-SIPS) has been introduced to provide a CAPEX subsidy of nearly 15 - 20%. Consumer electronics manufacturers are set to elevate investments in production, distribution, and R&D in the next few years. With the rising presence of organized retail, the market has witnessed the emergence of modern, durable retail chains, which include e-retailers such as E Zone, Reliance Digital, and Tata Croma.

High production in the Indian electronics market can be attributed to paced-up demand for advanced computers, mobile phones, TVs, and defense-related electronics. The situation in this market mandates manufacturers to keep themselves updated with the latest technology since it is eye-catching to typical consumers, and technological features play an apex role while selling to higher-income classes. The consumer electronics sector has acquired the largest share in the total production of electronic goods in India.

Under the Union Budget for the financial year 2017, the government exempted certain components, parts, and subparts for the production of set-top boxes for TV and internet and broadband modems. The introduction of artificial intelligence (AI) is set to project a bright future for consumers and industrial electronics in India.

India is likely to emerge as a potential future manufacturing hub for the region, provided the government shows adequate support and focus towards this sector. Specific factors anticipated to push manufacturing in India are inclusive of a reduction in borrowing costs, export incentives, reduction of customs duties on raw materials and components, and improvement in the ease of doing business.

Product Insights

The smartphone segment held the largest revenue share of over 31% in 2022. Increased disposable income, the development of telecom infrastructure, the appearance of budget-friendly smartphones, and a rising number of product launches are all contributing to the smartphone market's rise in India. In addition, the desire for high-speed data connectivity for integrated IoT (Internet of Things) applications like energy management and smart home devices is expected to drive 5G smartphone adoption.

The refrigerators segment is projected to grow from 2023 to 2032. Rapid urbanization, coupled with the increasing disposable income in the country, has contributed to a rise in demand for refrigerators. Due to the versatile and advanced refrigerators available in the market, Indian consumers are replacing their existing and old refrigerators with new ones. In addition to this scenario, refrigerator-selling retailers are adopting competitive strategies such as teaming up with financial institutes to provide easy financing options to sell their products. Such trends are expected to favor the market growth over the forecast period.

The Indian refrigeration industry is characterized by increasing supply, novel product launches, and regulatory support from the government. Companies adopt competitive pricing techniques to gain market share. The increasing penetration of refrigerators in rural areas is a key industry scenario.

India Consumer Electronics Market Segmentations:

By Product

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on India Consumer Electronics Market

5.1. COVID-19 Landscape: India Consumer Electronics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. India Consumer Electronics Market, By Product

8.1.India Consumer Electronics Market, by Product Type, 2023-2032

8.1.1. Smartphones

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. TV

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Refrigerators

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Washing Machines

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Digital Cameras

8.1.5.1.Market Revenue and Forecast (2020-2032)

8.1.6. Air Conditioner

8.1.6.1.Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1.Market Revenue and Forecast (2020-2032)

Chapter 9. India Consumer Electronics Market, Regional Estimates and Trend Forecast

9.1. India

9.1.1. Market Revenue and Forecast, by Product (2020-2032)

Chapter 10.Company Profiles

10.1. Samsung Electronics Co., Ltd.

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. LG Electronics, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Godrej Appliances

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Sony Corporation

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Mitsubishi Electric Corporation

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Vijay Sales

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Panasonic Corporation

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Haier Consumer Electronics Group

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Bajaj Electricals Ltd.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Hitachi Ltd.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others