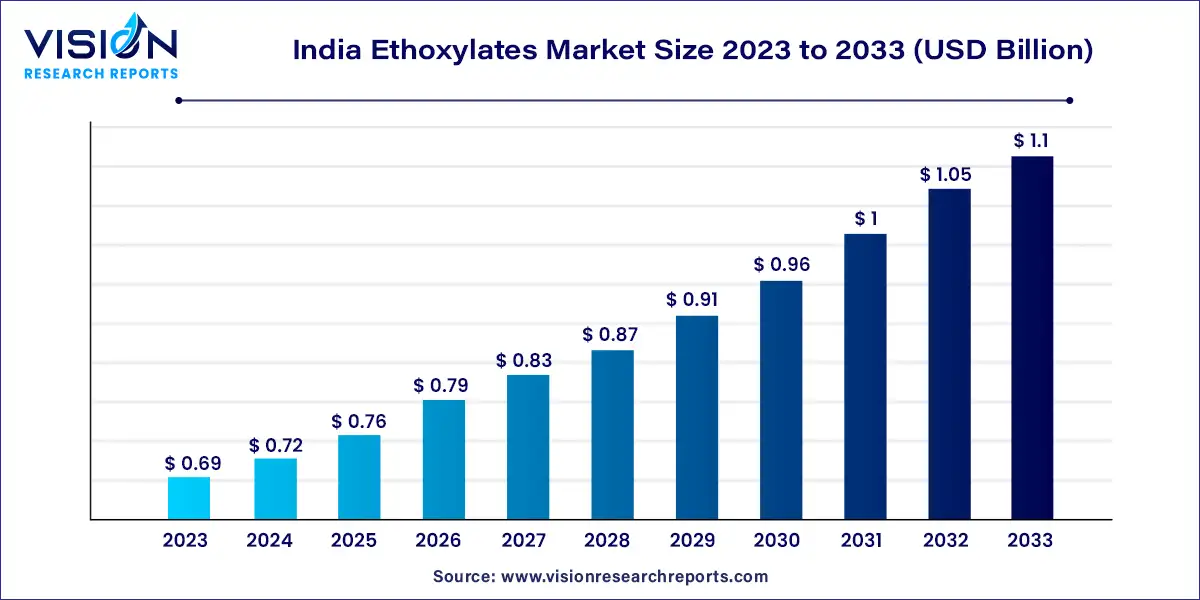

The India ethoxylates market size was estimated at USD 0.69 billion in 2023 and it is expected to surpass around USD 1.1 billion by 2033, poised to grow at a CAGR of 4.74% from 2024 to 2033.

The India Ethoxylates market is witnessing significant growth driven by various factors such as industrial expansion, growing consumer demand, and advancements in technology. Ethoxylates, a key class of surfactants, find widespread applications across diverse industries including agriculture, textiles, personal care, and pharmaceuticals.

The growth of the India Ethoxylates market is driven by an increasing industrial activities across sectors such as agriculture, textiles, personal care, and pharmaceuticals drive the demand for ethoxylates as versatile surfactants. Moreover, the growing population and rising disposable incomes contribute to heightened consumer spending on products containing ethoxylates, further boosting market growth. Additionally, advancements in technology enable the development of innovative ethoxylate formulations with enhanced performance and sustainability, aligning with evolving consumer preferences and regulatory standards. Furthermore, government initiatives promoting industrial growth and investments in infrastructure development create a conducive environment for market expansion. Overall, these growth factors collectively propel the India Ethoxylates market towards a path of sustained growth and development.

| Report Coverage | Details |

| Market Size in 2023 | USD 0.69 billion |

| Revenue Forecast by 2033 | USD 1.1 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.74% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of type by end-use, the fatty alcohol ethoxylates segment dominated the market in 2023 with a revenue share of 57%. This growth is attributed to the fact that they are known for their excellent surface-active emulsifying, wetting, dispersing, and solubilizing properties. They are widely used in personal care products, as well as in household cleaning, agricultural, and industrial applications thus, driving their demand in the market.

Fatty alcohol ethoxylates are produced by reacting ethylene oxide with fatty alcohols. These alcohols are typically derived from natural sources such as coconut oil or palm oil. They can vary in chain length. Common examples of fatty alcohol ethoxylates are lauryl alcohol (C12), stearyl alcohol (C18), and cetyl alcohol (C16). Moreover, the number of ethylene oxide units added during ethoxylation determines the degree of ethoxylation and impacts the properties of the resulting ethoxylate.

Fatty Acid Ethoxylates is anticipated to witness the fastest CAGR of 5.95% over the forecast period. This is attributed to the fact that they are highly ethoxylated, and have superior solubility and dispersing properties that facilitate their use in personal care products. Moreover, in household cleaning products, fatty acid ethoxylates help in the removal of dirt, grease, and stains by reducing the surface tension of liquids and improving their ability to penetrate and disperse soils.

In terms of function, the cleaning agent segment dominated the market in 2023 with a revenue share of 46%. This is attributed to their excellent ability to dissolve grease and dirt. They are a type of non-ionic surfactant, which implies they have no charge. This makes them well-suited for use in cleaning products as they do not react with other chemicals found in the environment.

In addition to laundry detergents, ethoxylates are also used in other cleaning products such as all-purpose cleaners, floor cleaners, and dishwashing detergents. These products benefit from ethoxylates’ ability to break up dirt and grease, making them more effective at cleaning. Thus, the growing demand for cleaning products is anticipated to propel the growth of the product market over the forecast period.

Emulsifying agent segment is anticipated to witness a notable CAGR over the forecast period. Emulsifying agents are substances that help to create stable emulsions by mixing two immiscible liquids, such as oil and water. Ethoxylates work as excellent emulsifying agents because of their unique chemical properties. When added to water, they can form micelles tiny spheres with a non-polar core and a water-soluble outer shell.

These micelles surround oil droplets and allow them to mix with water, creating a stable emulsion. They are commonly used in detergents, cosmetics, and textiles to emulsify creams, lotions, and chemicals. In addition to their emulsifying properties, the product can act as solubilizers. For example, they can be used to dissolve fragrances into cosmetic products and solubilize essential oils in cleaning products.

By End-use

By Function

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Ethoxylates Market

5.1. COVID-19 Landscape: India Ethoxylates Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Ethoxylates Market, By End-use

8.1. India Ethoxylates Market, by End-use, 2024-2033

8.1.1. Fatty Alcohol Ethoxylates

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Fatty Acid Ethoxylates

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Fatty Amine Ethoxylate

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Castor Oil Ethoxylates

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Ethyl/Methyl Ester Ethoxylates

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Glyceride Ethoxylates

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Other Types

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. India Ethoxylates Market, By Function

9.1. India Ethoxylates Market, by Function, 2024-2033

9.1.1. Cleaning Agent

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Emulsifying Agent

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Wetting Agent

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Lubricating Agent

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Other Functions

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. India Ethoxylates Market, Regional Estimates and Trend Forecast

10.1. India

10.1.1. Market Revenue and Forecast, by End-use (2021-2033)

10.1.2. Market Revenue and Forecast, by Function (2021-2033)

Chapter 11. Company Profiles

11.1. APL

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Clariant IGL Specialty Chemicals Private Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Core Chemicals Pvt. Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Esteem Industries Pvt. Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Godrej Industries Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Matangi Industries

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MOHINI AUXI CHEM PVT. LTD

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Fibrol Non-Ionics Pvt. Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rimpro-India

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Saibaba Surfactants PVT LTD.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others