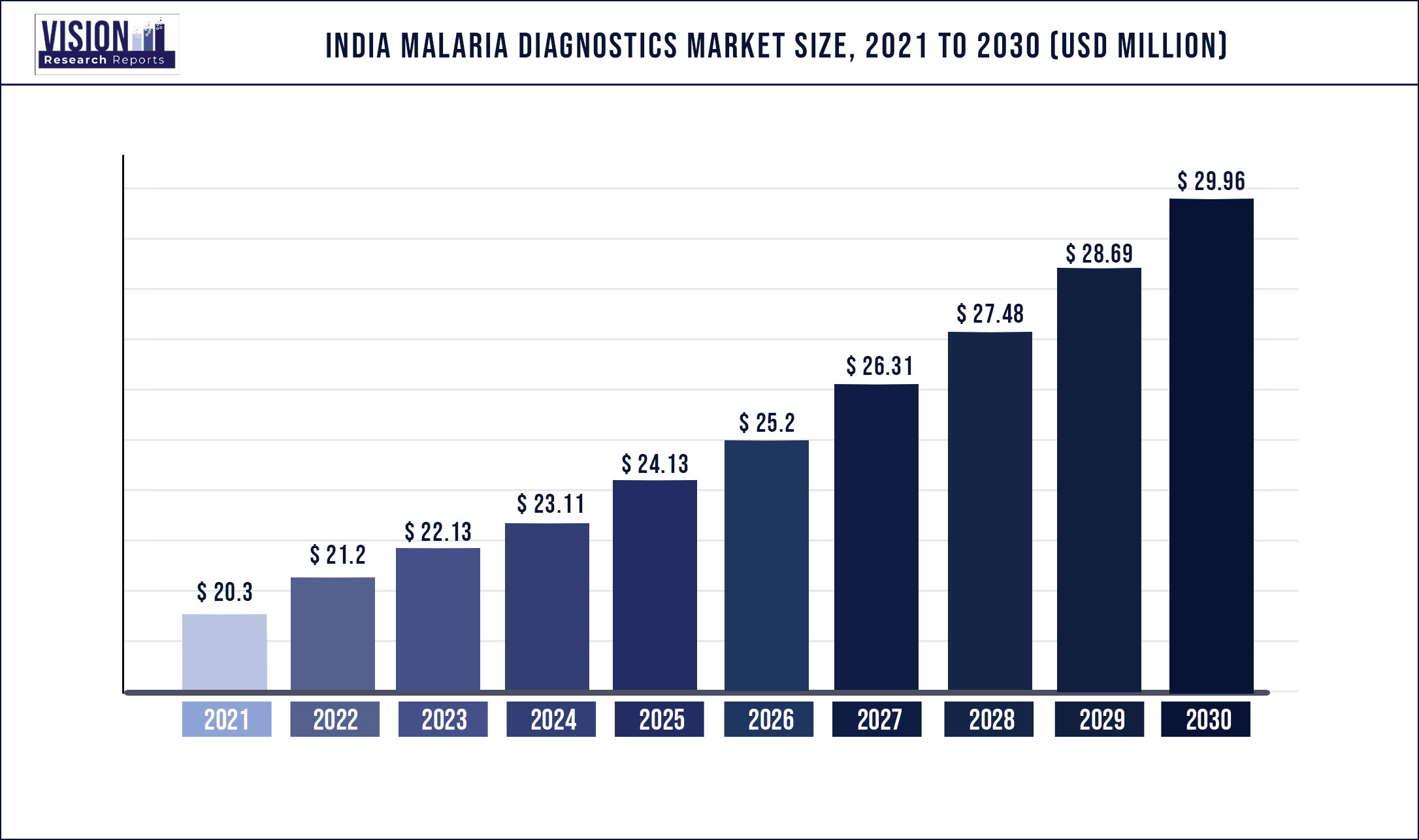

The India malaria diagnostics market was valued at USD 20.3 million in 2021 and it is predicted to surpass around USD 29.96 million by 2030 with a CAGR of 4.42% from 2022 to 2030

Key drivers of the market include rising demand for malaria diagnostics, introduction of novel diagnostic techniques, and increasing prevalence of the disease in the nation.

Increasing initiatives undertaken by the government is anticipated to propel market growth during the forecast period. The government of India has been committed to achieving malaria free recognition by 2027. Highest prevalence of the disease is typically seen across states such as Arunachal Pradesh, Jharkhand, Maharashtra, Tripura, Madhya Pradesh, Dadar & Nagar Haveli, Meghalaya, Mizoram, and Odisha.

The Micro Strategic Plan for Malaria Elimination in the State of Punjab, India (2018-2020) was developed by the National Vector Borne Disease Control Program and the State Government of Punjab in collaboration with WHO Country Office of India and National Vector Borne Disease Control Program, Delhi. In alignment with the National Strategic Plan for Malaria Elimination (2017-2022), the Government of Punjab launched a state-specific Strategic Action Plan (SAP) to eliminate the disease. The goal of this SAP is to achieve zero malaria transmission by 2020 and ensure prevention of reintroduction of the disease after 2020. Some of the objectives of SAP in Punjab are, reduction of disease incidence to zero indigenous cases to achieve malaria free status in the state, reduction in the number of active disease foci to zero level, and maintaining zero deaths caused by malaria. Thus, rise in such initiatives by the government to curb the disease is anticipated to fuel market growth.

Rising demand for diagnostic tools in malaria-endemic countries such as India, is one of the major factors accelerating market growth. According to the World Malaria Report published by WHO, India contributed to around 4% of the total cases and 48% of Plasmodium vivax infections globally. According to a research study published by the National Center for Biotechnology Information (NCBI), almost 70% of malaria cases were reported by five states, namely, Chhattisgarh, Madhya Pradesh, Odisha, Jharkhand, and Maharashtra. Hilly and tribal areas of the country such as Meghalaya, Nagaland, and Mizoram also exhibit high prevalence of the disease. These facts are indicative of the chronic burden of the disease in endemic countries, making it an urgent health priority in these regions.

Increasing initiatives undertaken by market players to reduce disease prevalence is also one of the major factors driving the market. For instance, Abbott Laboratories and a non-profit group called “Malaria No More” are providing the Odisha government with one million RDTs. In addition, Abbott Laboratories is contributing USD 750,000 to the non-profit group, facilitating the government of Odisha’s Vector Borne Disease Control Program. Such initiatives are expected to facilitate the development of new and advanced diagnostic technologies and product launches.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 20.3 million |

| Revenue Forecast by 2030 | USD 29.96 million |

| Growth rate from 2022 to 2030 | CAGR of 4.42% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, end-use |

| Companies Covered | Abbott Laboratories; Siemens Healthineers; Bio-Rad Laboratories; Beckman Coulter, Inc.; Access Bio, Inc.; Premier Medical Corporation Pvt. Ltd.; Olympus Corporation; Nikon Corporation; J. Mitra & Co. Pvt. Ltd.; Tulip Diagnostics Ltd.; Microgene Diagnostic Systems Pvt. Ltd. |

Technology Insights

Based on technology, the India malaria diagnostics market is segmented into rapid diagnostic tests, microscopy, and molecular diagnostic tests. The molecular diagnostics segment is expected to witness the fastest growth owing to accurate diagnosis offered by these tests. Molecular diagnostic tests include real-time PCR or quantitative PCR (qPCR) and Polymerase Chain Reaction (PCR). The usage of real-time PCR using DNA extracted from the blood samples have been used for the detection of low parasite count. However, the market share of these tests is less due to the lack of skilled workforce and specialized laboratories in India.

The microscopy method is also expected to grow owing to the rise in the use of microscopy techniques for the diagnosis of the disease. This technique is one of the most reliable and traditional methods used for disease diagnosis. Malarial parasites such as P. malaria, P. vivax, P. falciparum, and P. ovale can be identified using this technique. Also, parasite density can be quantified to design treatment plans accordingly.

Rapid diagnostic tests are another method that is used for the detection of specific malaria antigens from the blood sample. This test makes use of a test card, wherein the blood sample is applied along with specific reagents. The appearance of specific bands in the test card, within 15 to 20 minutes, indicates the presence of infection with either of the human malarial parasites. These RDTs are capable of detecting P. falciparum, P. malariae, P. ovale, and P. vivax species of human malaria. Malarial RDTs are typically used where microscopy examination is not feasible, especially in remote areas with limited access to healthcare infrastructure and high-quality microscopy services.

End-use Insights

Based on end-use, the market is segmented into hospitals and clinics, diagnostic laboratories, blood banks, and academic and research institutes. The hospitals and clinics segment accounted for the largest market share in 2021 as the majority of the population relies on these long-term facilities for diagnosis, treatment, and management of diseases. In urban India, the easy availability of diagnostic devices, awareness, and experienced healthcare professionals facilitates the easy and effective treatment of malaria. In these areas, malaria is generally prevalent during and post monsoons between July and October. In urban areas, the disease outbreak is highly prevalent due to prolonged rainfall and climatic changes that facilitate the easy growth of Anopheles mosquitoes. Most of the urban regions in India seek treatment in privatized healthcare settings as they are well equipped with advanced diagnostic techniques and provide timely treatment. Thus, the hospitals and clinics segment is anticipated to witness significant growth during the forecast period.

The blood bank segment is expected to witness steady growth during the forecast period. For infectious diseases such as malaria, influenza, and dengue, typically, blood donors are inquired regarding recent visits to endemic regions. In most cases, rapid diagnostic tests are used as primary screening tests, and serological tests are done post confirmatory results. Blood samples from the donor are analyzed and other disease illnesses are determined before blood transfusions. A rise in the number of surgical procedures has been reported in India, which can be attributed to the increase in the incidence of severe chronic diseases and accidents. This has created a significant demand for blood donations in the nation, facilitating increased demand for malarial diagnostic devices.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Malaria Diagnostics Market

5.1. COVID-19 Landscape: India Malaria Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global India Malaria Diagnostics Market, By Technology

8.1. India Malaria Diagnostics Market, by Technology, 2022-2030

8.1.1. Microscopy

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Rapid Diagnostic Tests (RDT)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Molecular Diagnostic Tests

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global India Malaria Diagnostics Market, By End-use

9.1. India Malaria Diagnostics Market, by End-use, 2022-2030

9.1.1. Hospitals & Clinics

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Diagnostic Laboratories

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Blood Banks

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Academic and Research Institutes

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global India Malaria Diagnostics Market, Regional Estimates and Trend Forecast

10.1. India

10.1.1. Market Revenue and Forecast, by Technology (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Abbott Laboratories

11.1.1. Company Overview

11.1.2. Technology Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens Healthineers

11.2.1. Company Overview

11.2.2. Technology Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bio-Rad Laboratories

11.3.1. Company Overview

11.3.2. Technology Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Beckman Coulter, Inc.

11.4.1. Company Overview

11.4.2. Technology Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Access Bio, Inc.

11.5.1. Company Overview

11.5.2. Technology Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Premier Medical Corporation Pvt. Ltd.

11.6.1. Company Overview

11.6.2. Technology Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Olympus Corporation

11.7.1. Company Overview

11.7.2. Technology Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Nikon Corporation

11.8.1. Company Overview

11.8.2. Technology Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. J. Mitra & Co. Pvt. Ltd.

11.9.1. Company Overview

11.9.2. Technology Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Tulip Diagnostics Ltd.

11.10.1. Company Overview

11.10.2. Technology Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others