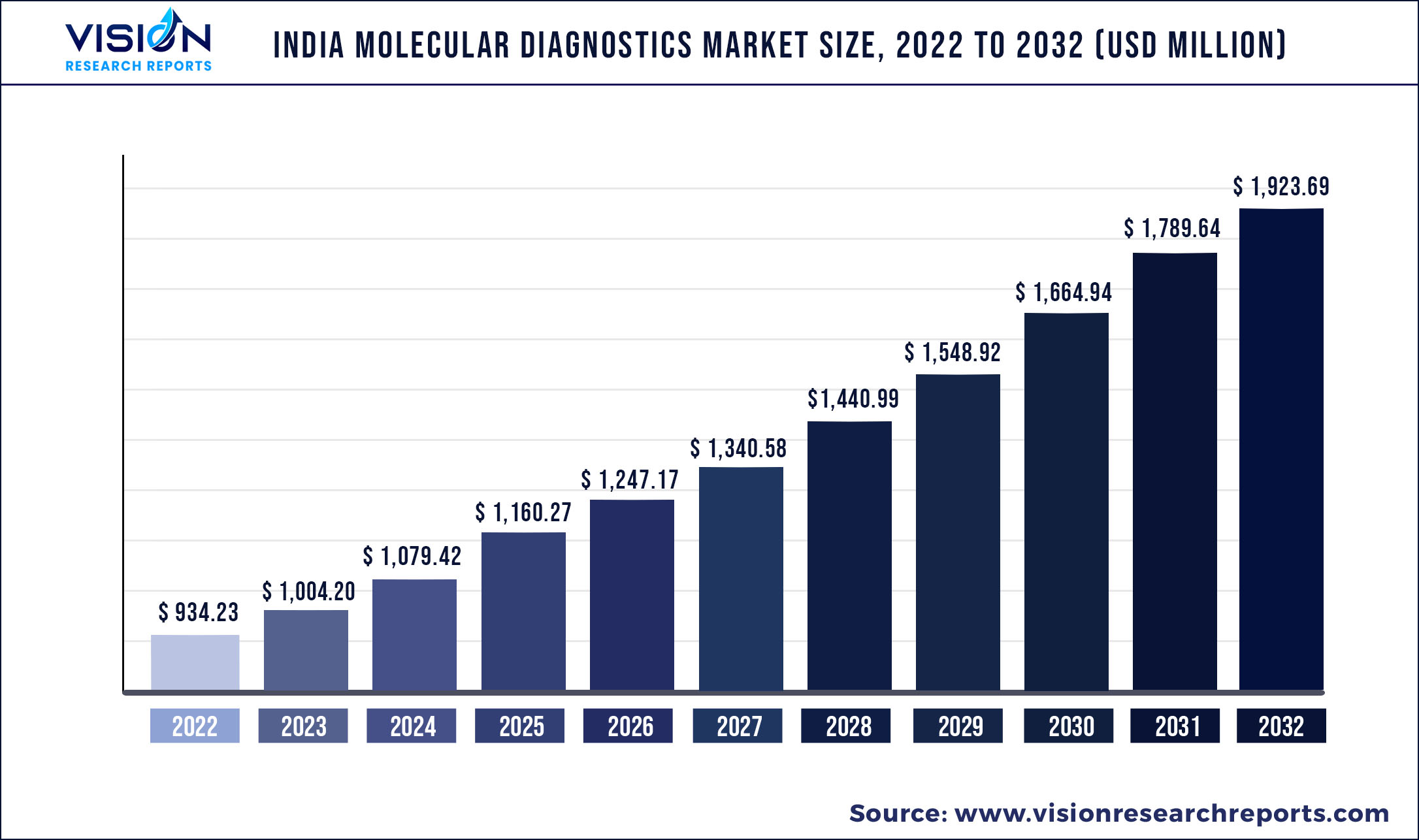

The India molecular diagnostics market was valued at USD 934.23 million in 2022 and it is predicted to surpass around USD 1,923.69 million by 2032 with a CAGR of 7.49% from 2023 to 2032.

Key Players

The central laboratories segment held the dominant revenue share of over 88.11% in 2022 and is anticipated to maintain its leading share in the forthcoming years.

The rising target disease burden, growing geriatric population, and introduction of technologically advanced products are the major factors driving the growth. Furthermore, the region reports an increase in the demand for POC facilities which is driving the industry’s growth. However, high prices of molecular diagnostic tests and poor reimbursement policies in the country are anticipated to restrain the market growth.

The geriatric population is rapidly increasing in India. As per the Government of India National Statistical Office, India’s geriatric population (aged 60 and above) is projected to rise by 41% over the next decade. It is expected to reach 194 million in 2031 from 138 million in 2021. Among the states, Kerala has the highest elderly population, with around 16.5% geriatric population, followed by Tamil Nadu, Himachal Pradesh, Bihar, Uttar Pradesh, and Assam.

Aging has become a substantial risk factor for numerous diseases, including obesity and diabetes, which, in turn, significantly increases the risk of infectious diseases. For example, the geriatric population is more likely to suffer from infectious diseases such as COVID-19 due to decreased immune function, multimorbidity, and physiological changes associated with aging. According to the WHO, until April 2020, around 95% of the deaths were reported among patients 60 years or above. Furthermore, more than 50% of deaths occurred in patients aged 80 years or older. Therefore, the growing aging population is driving the demand for diagnostics and factoring in the market’s growth.

Rapid technological advancements-leading to accurate results, portability, and cost-effectiveness-are expected to be a high-impact rendering driver for India’s molecular diagnostics market. Companies are upgrading their products by implementing new techniques to gain specific and accurate results. Companies such as Sigma Aldrich Corporation and QIAGEN are developing a new range of molecular diagnostic techniques, such as Transcription-Mediated Amplification (TMA) and Loop-Mediated Isothermal Amplification (LAMP), for the diagnosis of tumors. The growing use of multiplex PCR technologies and real-time PCR equipment; e.g., EpiTect Methyl II PCR by QIAGEN for the detection of DNA methylation, is also likely to boost the market during the forecast period.

Key Players

Market Segmentation

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others