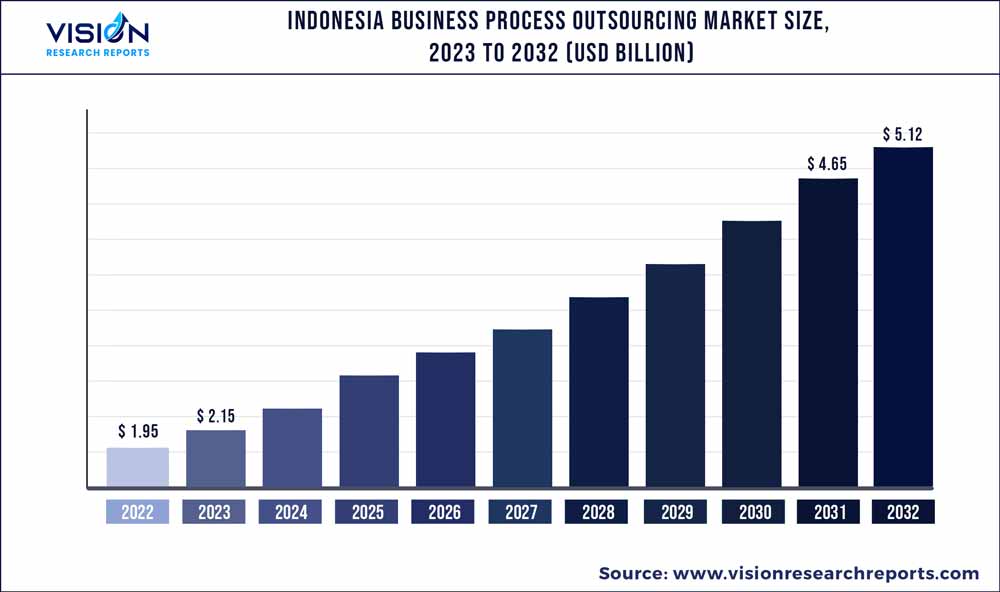

The Indonesia business process outsourcing market was valued at USD 1.95 billion in 2022 and it is predicted to surpass around USD 5.12 billion by 2032 with a CAGR of 10.14% from 2023 to 2032.

Key Pointers

Report Scope of the Indonesia Business Process Outsourcing Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.95 billion |

| Revenue Forecast by 2032 | USD 5.12 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.14% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Concentrix Corporation; Conduent, Inc.; ExlService Holdings, Inc.; Foundever; Genpact; KPSG; Majorel; Relia, Inc.; Teleperformance; TELUS; Transcom; Transcosmos Inc.; TTEC Holdings, Inc.; VADS BERHAD; WNS (Holdings) Ltd. |

The Indonesia business process outsourcing (BPO) industry is anticipated to be driven by the growing adoption of cloud computing outsourcing services across different verticals such as BFSI, HR, and IT & telecommunications. In recent years, the retail industry has undergone significant transformation. The inclusion of various technologies such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), and big data analytics remains a major positive for the future growth of the market. Further, these BPO services are witnessing high demand owing to their various benefits, such as enhanced service quality, flexibility, and reduced costs, supporting the proliferation of the market.

The Indonesia business process outsourcing industry has grown significantly over the years and is now a vital component of Indonesia’s economy. The major BPO offerings include highly specialized tasks such as web development, research, and other IT-related customer services to its potential clients. Many companies, both large and small, rely on outsourcing to remain competitive and stay ahead of the competition, creating a positive outlook for the market. The trends supporting the growth of these services include the use of omnichannel solutions, the rise of social media management, the integration of AI solutions, the preference for remote work, strategic business partnerships, adoption by SMEs, and the usage of progressive web applications.

The advancement of cloud technologies has been another major driver for the growth of BPO, owing to its advantages such as scalability, lower cost, reliability, and agility. Moreover, various companies in the market have been coming up with cloud delivery of BPO services to improve their brand representation, further fueling the adoption of BPO services. For instance, in March 2022, PERSONIV joined NetSuite Business Process Outsourcing Partner Program. By joining this program, PERSONIV was able to deliver Finance & Accounting Outsourcing (FAO) Services to clients operating in industries such as logistics, financial services, transportation, retail, and restaurant.

The Indonesian business process outsourcing market features the entry of several players offering cloud-based BPO services, some of which are among the top companies in the world. For instance, in September 2021, NTT DATA Indonesia introduced the availability of its Global Insurance Digital Platform (GIDP), a cloud-based digital platform and partner ecosystem, which offers partnership, consulting, third-party administration, and Business Process as a Service (BPaaS), among others. GIDP would make it easier for businesses to accelerate their process digitization initiatives, quickly launch new products, reduce operational costs, mitigate risks, proactively use data, enhance decision-making based on robust data, and remain competitive. GIDP also enabled seamless connectivity via event-based APIs and was built on industry knowledge, security, BPO, compliance, and automation, supporting the market.

Instead of call center software programs, businesses invest in real-time client involvement, which is expected to allow them to gather first-hand product insights and offer new products or solutions for handling upcoming problems. The business process outsourcing service providers perceive this transformation in customer management as a significant potential. It has been observed that BPOs invest in the resources and skills necessary to offer a wide range of social media management services, such as business analytics, social media monitoring, and customer response auctioning, supporting market growth. Since customer service personnel and social media teams can handle customer complaints more effectively and rapidly, several BPO service providers are investing in specialized social media service teams.

Service Type Insights

The customer services segment accounted for the largest market share of 33% in 2022. The BPO sector uses "customer satisfaction" as a marketing tool for its goods and services. Consumer service in BPOs refers to businesses that are focused on responding in real-time to customer inquiries received via chat, social media, email, phone, and other channels. The growth of the customer service segment can be attributed to customer service BPO accessing specialized expertise, gains flexibility, and reducing costs, among others. Moreover, the presence of top companies in the Indonesian business process outsourcing industry offering customer service solutions has paved the way for the segment's growth over the forecast period. Some of the major ones include Foundever, Majorel; VADS BERHAD; and Concentrix Corporation.

The finance & accounting segment is anticipated to grow at a CAGR of 10.52% during the forecast period. The growing adoption of outsourcing solutions across the finance & accounting sector to tackle the problems in business operations and enhance the financial performance across areas of North America, Europe, and Asia Pacific is driving the market growth of the finance & accounting segment in the market. Moreover, the country is home to many companies offering finance & accounting services type which has also contributed to the growth of the segment in the country. Some major companies in the Indonesia business process outsourcing industry offering finance & accounting solution include Genpact; Telus; and WNS (Holdings) Ltd., among others, creating a favorable environment for the market.

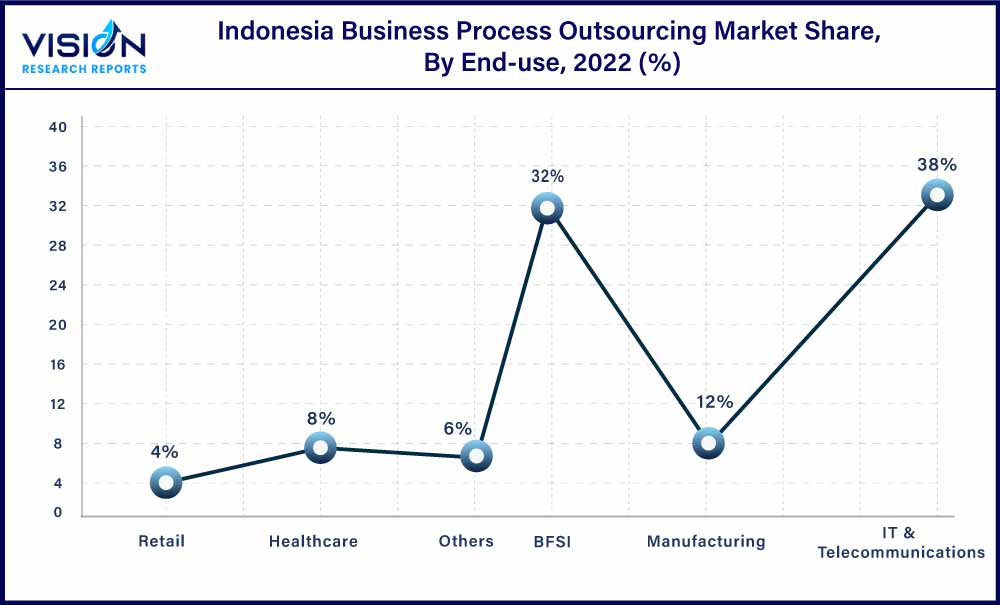

End-use Insights

The IT & telecommunications segment accounted for a market share of 38% in 2022. Business process outsourcing is used by various IT & telecommunications firms to develop and enhance their product & service offerings. In-house hiring is costly and requires several resources for training, upkeep, office space, payroll, and IT infrastructure. BPO can provide better services with reduced costs to the clients through outsourcing as it saves expenses and resources in the setup process.

The BFSI segment is expected to grow at the highest CAGR of 10.93% during the forecast period. The BFSI industry has been expanding at a high growth rate with its fair share of concerns, which involves proliferating cyber-attacks, delivering superior customer experience, and increasing competition, creating robust opportunities in the market. Financial organizations in Indonesia can benefit from service providers' expertise in managing non-core activities by outsourcing business processes. The ideal partner also helps introduce the best business practices and maximize the association's benefits, resulting in the high adoption of Indonesian business process outsourcing solutions among BFSI institutions, resulting in increased segment growth.

Indonesia Business Process Outsourcing Market Segmentations:

By Service Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Indonesia Business Process Outsourcing Market

5.1. COVID-19 Landscape: Indonesia Business Process Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Indonesia Business Process Outsourcing Market, By Service Type

8.1. Indonesia Business Process Outsourcing Market, by Service Type, 2023-2032

8.1.1. Finance & Accounting

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Human Resource

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. KPO

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Procurement & Supply Chain

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Customer Services

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others (Legal & tax, Logistics, and Training)

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Indonesia Business Process Outsourcing Market, By End-use

9.1. Indonesia Business Process Outsourcing Market, by End-use, 2023-2032

9.1.1. BFSI

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Healthcare

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Manufacturing

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. IT & Telecommunications

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Retail

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others (Construction & Utilities, Travel & Transportation, and Government & Education)

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Indonesia Business Process Outsourcing Market, Regional Estimates and Trend Forecast

10.1. Indonesia

10.1.1. Market Revenue and Forecast, by Service Type (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Concentrix Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Conduent, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ExlService Holdings, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Foundever

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Genpact

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. KPSG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Majorel

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Relia, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Teleperformance

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. TELUS

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others