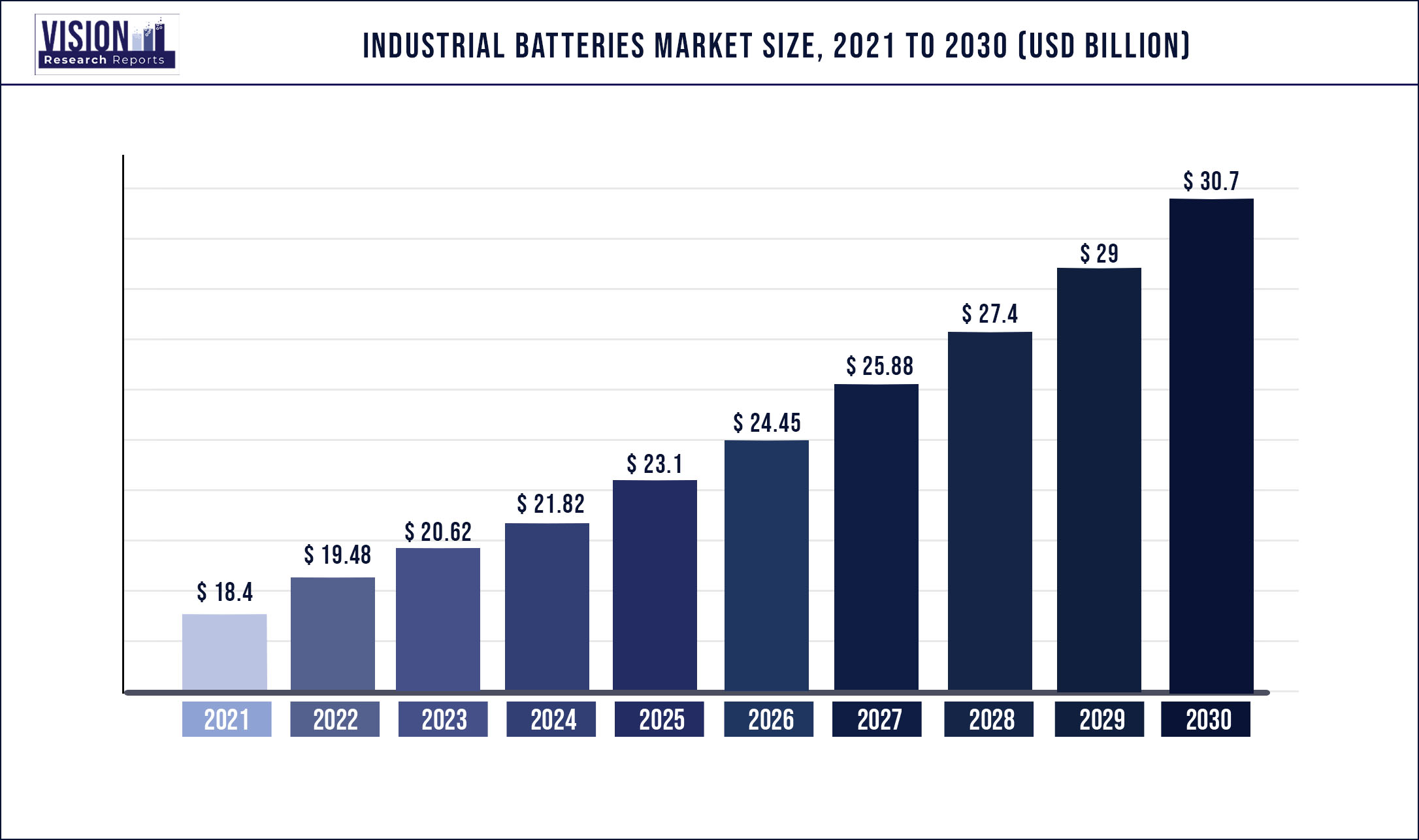

The global industrial batteries market was surpassed at USD 18.4 billion in 2021 and is expected to hit around USD 30.7 billion by 2030, growing at a CAGR of 5.85% from 2022 to 2030

High demand for back-up power batteries in grid-level energy storage application for solar and wind power projects will boost the market growth during the forecast period. Moreover, increasing usage of these batteries in various applications, such as UPS and motive power, is anticipated to drive the market. Industrial batteries offer benefits, such as reduction in manufacturing cost, high durability, lower maintenance costs, and low discharge rate capability, which is expected to increase their demand further.

Easy availability of batteries of different specifications and sizes will also augment the market growth. Lead acid batteries are relatively cheaper than other batteries and are can be manufactured using lesser technology equipment, which in turn will drive market their demand in the near future. Increasing investments by major manufacturers coupled with the growing number of renewable energy projects with battery storage capability are likely to drive the market. However, volatility in raw material prices will pose a restraint for the market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 18.4 billion |

| Revenue Forecast by 2030 | USD 30.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.85% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Battery type, end-use, region |

| Companies Covered | Johnson Controls, Inc.; Exide Technologies, Inc.; Enersys, Inc.; Saft Groupe S.A.; GS Yuasa Corp.; Northstar Battery Company LLC; C&D Technologies, Inc.; Robert Bosch GmbH; East Penn Manufacturing Co. |

Battery Type Insights

Lead-acid battery accounted for the largest share of over 49% in 2021 and is estimated to be the dominant segment in the forecast period. Lead-acid batteries find application in Uninterruptible Power Supply (UPS) systems as they provide high power density and enhanced life expectancy. A UPS system is an electrical equipment that provides power supply when the main power or input power sources fail. The high electric manageability of lead-acid batteries is expected to fuel the segment growth over the forecast period.

They are also used in motive industry applications including forklifts on account of their low cost, reliability, and well-established supply chain. Rapid industrialization and a growing number of manufacturing units are expected to propel the segment growth in the future. Expansion of warehouse space, growing e-commerce sector, and high demand for forklift truck replacement along with growing investments by players in emerging economies are also expected to augment segment growth over the next eight years.

Lithium-based product segment is estimated to register the highest CAGR during the forecast period. Lithium-ion batteries are utilized in numerous industrial applications, such as UPS systems, industrial automation systems, and grid-level storage systems. The demand for renewable sources of energy is increasing owing to the depletion of fossil fuel and environmental pollution caused by non-renewable sources. Renewable sources, such as wind and solar, produce variable power and need to be converted into storable forms. Energy Storage Systems (ESS) aid in storing these renewable energy sources for further usage. Thus, increasing usage of ESS is expected to boost the demand for lithium-ion-based batteries over the forecast period.

End-use Insights

Motive power emerged as the largest segment in 2021 accounting for over 35.2% of the global share. The segment will retain its leading position throughout the forecast period due to the wide scope of product application in motive industry applications including forklifts.

Rapid industrialization and a growing number of manufacturing units are expected to propel the segment growth further. In addition, the expansion of warehouse spaces, growing e-commerce sector, and rising demand for forklift truck replacement will support the segment growth over the next eight years.

The grid-level energy storage segment is projected to register the fastest CAGR of over 9% during the forecast period. The growth of the global energy storage systems market is estimated to amplify the consumption of industrial batteries over the next couple of years. Grid energy storage systems are expected to compete with traditional or conventional power generation, transmission & distribution systems.

As the growth of this industry gains momentum, new types of business models are expected to be invented and adopted by manufacturers to implement and operate storage assets. This is estimated to further impact the operational ability thus allowing grids to work in a more reliable and cost-effective manner by employing industrial batteries.

Regional Insights

Asia Pacific was the leading regional market in 2021 and accounted for over 36.4% of the global share. It is also estimated to be the fastest-growing regional market over the forecast period owing to a strong industrial base and rise in civil infrastructure activities, especially in China, India, Australia, and several Southeast Asian. Various initiatives by the Indian government are encouraging industrial establishments in the country, which is anticipated to drive the demand for industrial batteries over the forecast period.

Developing economies in the region have witnessed strong growth in industrial and commercial sectors including IT, telecom, and others, resulting in high demand for industrial batteries for back-up power in these facilities.

North America is projected to be the second-largest regional market wherein the U.S. is the major contributor. This is attributed to the strong presence of key manufactures, such as Exide, Johnson Controls, and Odyssey, in U.S. Robust manufacturing base and rapid growth of the automotive industry in the U.S. will augment the demand for industrial vehicles, such as a battery-operated forklift, which will drive the demand for industrial batteries over the upcoming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Batteries Market

5.1. COVID-19 Landscape: Industrial Batteries Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Batteries Market, By Battery Type

8.1. Industrial Batteries Market, by Battery Type, 2022-2030

8.1.1. Lead-Acid

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Lithium-Based

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Industrial Batteries Market, By End-use

9.1. Industrial Batteries Market, by End-use, 2022-2030

9.1.1. Motive Power

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Telecom & Data Communication

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Uninterruptible Power Supply (UPS)/Backup

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.3. Grid-Level Energy Storage

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Industrial Batteries Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Battery Type (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Johnson Controls, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Exide Technologies, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Enersys, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Saft Groupe S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. GS Yuasa Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Northstar Battery Company LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. C&D Technologies, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Robert Bosch GmbH

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. East Penn Manufacturing Co.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others