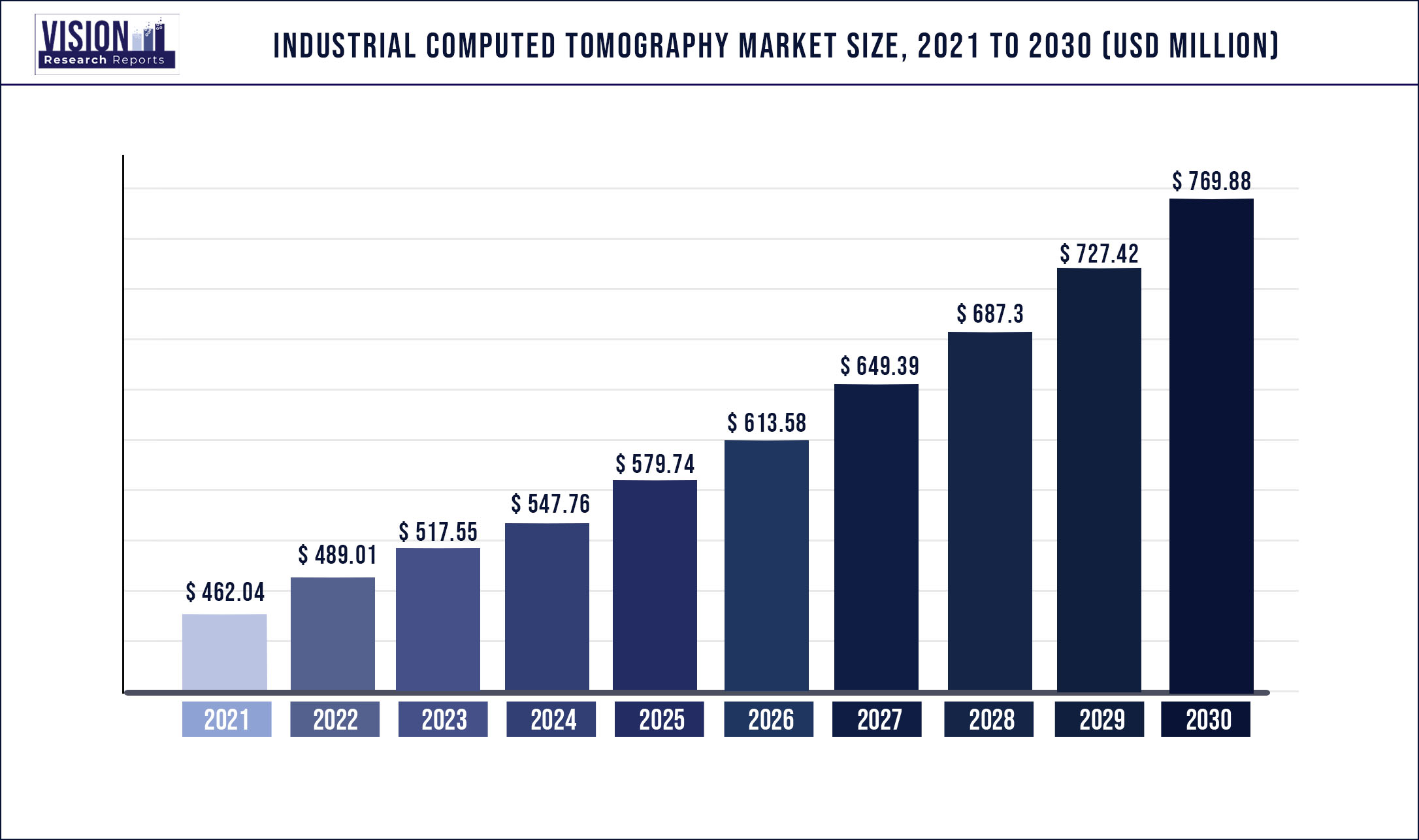

The global industrial computed tomography market was estimated at USD 462.04 million in 2022 and it is expected to surpass around USD 769.88 million by 2030, poised to grow at a CAGR of 5.84% from 2022 to 2030.

Report Highlights

The increasing use of CT scanners in industries, such as automotive, electronics, oil & gas, and aerospace among several others, is anticipated to boost the market growth over the forecast period. Moreover, a rise in the demand for advanced electronics is expected to support market growth.

Industrial computed tomography systems are increasingly being used for inspecting and testing the internal and external structure & design of various complex parts and components without destructing/disassembling the product. Additive manufacturing technology is increasingly being used for the production of multiple complex parts and structures. Therefore, to inspect the product’s conformity with the original CAD designs, industrial CT scanners are used to determine the structure, dimensions, design, and tolerance of these products without altering their structure/form.

The benefits offered by industrial CT scanners, including manufacturing cost reduction, improved product design, and performance, as well as reduced product failure instances, are also expected to boost their adoption amongst the manufacturers. Moreover, these scanners provide high-quality inspection images that ease the inspection process and provide detailed information about the product under examination. Furthermore, assembly analysis is increasingly being done using the industrial computed tomography systems in the automotive industry that does not require the assembled systems to be disassembled for inspection. These benefits are expected to drive market growth over the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 462.04 million |

| Revenue Forecast by 2030 | USD 769.88 million |

| Growth rate from 2022 to 2030 | CAGR of 5.84% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Offering, application, vertical, and region |

| Companies Covered |

Nikon Metrology NV; OMRON Corp.; Baker Hughes Company; YXLON International; ZEISS Group; VJ Group; Rigaku Corp.; Shimadzu Corp.; North Star Imaging, Inc |

Offering Insights

The equipment segment accounted for the highest revenue share of more than 59.2% in 2021, contributing to more than 59.2% of the global market revenue in 2021. Previously, companies preferred to buy CT scanners, including the line and cone beam scanners, due to confidentiality issues with the product design process, which is the primary reason for the high share of the equipment segment in the market. However, the high cost of equipment restricts several small- and medium-scale organizations from investing in product purchases, thereby lowering the growth of the equipment segment over the forecast period.

The services segment is anticipated to register the fastest CAGR of over 8.78% from 2022 to 2030. The capital-intensive nature of the industrial CT scanners has paved the way for the high growth of the services segment in the market. Companies are increasingly outsourcing the CT services to third-party service providers due to the low cost, which helps them significantly reduce their capital investment.

Application Insights

The flaw detection & inspection segment accounted for the highest revenue share of more than 27.2% in 2021. The increasing need for inspection of the products to detect any flaw, crack, damage or variation from the designed product has been the key driver for the high share of this segment. The use of industrial CT systems for product inspections helps the manufacturer considerably reduce production/manufacturing costs. In addition, industrial CT scanners can quickly test and analyze minor defects that are not efficiently and effectively traceable using traditional inspection methods. The flaw detection & inspection segment is also anticipated to register the fastest CAGR during the forecast period.

The fastest growth is credited to the growing use of 3D printing technology and the increasing complexity of the products/parts. Furthermore, CT scanners are also used for several other purposes, including failure analysis, assembly analysis, dimensioning & tolerance analysis. The assembly analysis segment is expected to register a significant growth rate over the forecast period. Assembly analysis is increasingly being used in industries, such as automotive, aerospace, and electronics, which require the inspection and analysis of the assembled products to gain insights on the placement and condition of smaller/minor internal components without disassembling or destructing the product.

Vertical Insights

The automotive segment held the largest revenue share of more than 35.5% in 2021. The industrial CT systems are used in the automotive industry at various stages of the production process that include pre-production inspection, production inspection, parts sorting, as well as failure investigation. The scanners generate precise metrology data that enables the user to validate the conformity of the parts with the original CAD designs, which, in turn, helps in improving the overall product quality. In addition, dimensioning analysis is also conducted at various intervals during the production process, along with the tolerance analysis of the produced parts. Furthermore, several automotive companies are making significant investments in developing and utilizing advanced CT technology for automotive applications. For instance, in July 2018, BMW Group announced that the company is using an advanced CT system for prototype development, analysis, and production applications. Therefore, the unmatched utility and application of CT scanners in the automotive industry are boosting the segment growth.

The other verticals that use industrial computed tomography systems include oil & gas, aerospace & defense, and electronics. The electronics segment is anticipated to register the fastest CAGR of more than 8.8% from 2022 to 2030. CT scanning, as a non-destructive testing method for inspection, is increasingly being used in the electronics industry to investigate internal parts & assemblies, molded circuits, and verify the optimal functioning of the electronic components. In addition, the increasing demand for electronic devices and the resultant rise in their manufacturing coupled with the growing focus on quality control are anticipated to drive the segment during the forecasted period.

Regional Insights

North America dominated the global market in 2021 and accounted for the highest revenue share of more than 32.2%. The region will expand further at a significant CAGR over the forecast years. The increasing number of investments in the adoption of new & advanced technologies by key industry players is expected to drive the regional market growth. The region’s prospering automotive and electronics industries and strong presence of prominent market players, such as Baker Hughes Co., Nikon Metrology NV, and Yxlon International GmbH, are also anticipated to bolster the market growth over the coming years.

Asia Pacific is anticipated to be the fastest-growing regional market from 2022 to 2030. This growth can be attributed to the rising adoption of industrial CT systems for testing and inspection purposes among various industries, such as electronics, automotive, aerospace & defense. The region is considered to be the hub for automotive and electronics manufacturing companies. Furthermore, the Asia Pacific region is also marked by the highest amount of oil & gas production across the globe. For instance, in 2019, the oil & gas production in the region totaled over 3600 million tonnes of oil equivalent (Mtoe). Therefore, the rising manufacturing and production activities in the region are contributing to the market expansion.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Computed Tomography Market

5.1. COVID-19 Landscape: Industrial Computed Tomography Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Computed Tomography Market, By Offering

8.1. Industrial Computed Tomography Market, by Offering, 2022-2030

8.1.1 Equipment

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Industrial Computed Tomography Market, By Application

9.1. Industrial Computed Tomography Market, by Application, 2022-2030

9.1.1. Flaw Detection & Inspection

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Failure Analysis

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Assembly Analysis

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Dimensioning & Tolerancing Analysis

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Industrial Computed Tomography Market, By Vertical

10.1. Industrial Computed Tomography Market, by Vertical, 2022-2030

10.1.1. Oil & Gas

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Aerospace and Defense

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Automotive

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Electronics

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Industrial Computed Tomography Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Offering (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Offering (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Offering (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Offering (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Offering (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Offering (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Offering (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Offering (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Offering (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Offering (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Vertical (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Offering (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Vertical (2017-2030)

Chapter 12. Company Profiles

12.1. Nikon Metrology NV

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. OMRON Corp.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baker Hughes Company

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. YXLON International

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ZEISS Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. VJ Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Rigaku Corp.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Shimadzu Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Werth, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. North Star Imaging, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others