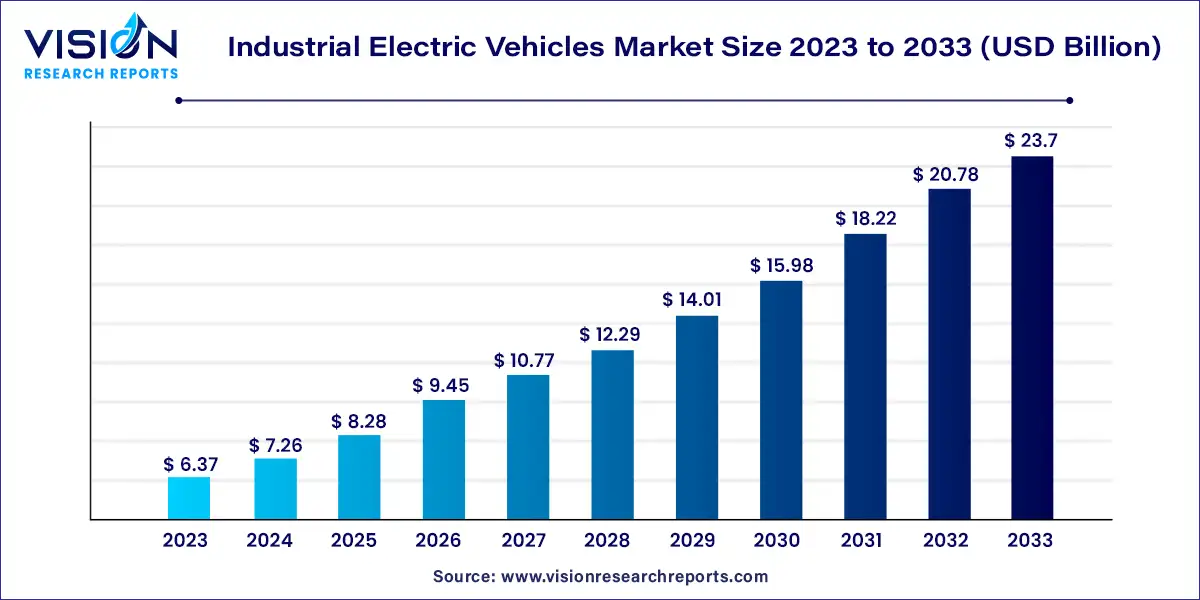

The global industrial electric vehicles market size was estimated at around USD 6.37 billion in 2023 and it is projected to hit around USD 23.7 billion by 2033, growing at a CAGR of 14.04% from 2024 to 2033.

The industrial electric vehicles (IEV) market is experiencing a transformative phase, driven by the growing emphasis on sustainability and the need for energy-efficient transportation solutions in industrial sectors. Unlike conventional vehicles relying on fossil fuels, industrial electric vehicles utilize electric powertrains, reducing greenhouse gas emissions and contributing to a cleaner environment.

The industrial electric vehicles (IEV) market is experiencing robust growth due to several key factors. Stringent environmental regulations and the global emphasis on reducing carbon emissions have accelerated the adoption of IEVs, driving market expansion. Additionally, advancements in battery technology, leading to increased energy storage capacities and improved efficiency, have enhanced the practicality of electric vehicles in industrial applications. Rising fuel costs and the need for operational cost savings further incentivize businesses to transition to electric fleets. Moreover, supportive government policies and incentives, coupled with a growing awareness of environmental sustainability, are encouraging businesses to invest in IEVs, fostering market growth. The convergence of these factors creates a favorable environment for the widespread adoption of Industrial Electric Vehicles, positioning the market for sustained expansion in the coming years.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.04% |

| Market Revenue by 2033 | USD 23.7 billion |

| Revenue Share of Europe in 2023 | 31% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The autonomous mobile robots (AMR) segment held the largest revenue share of 55% in 2023. AMRs, equipped with advanced sensors and artificial intelligence, navigate autonomously within industrial facilities, optimizing workflows and minimizing human intervention. These robots are versatile, capable of handling various tasks, from transporting raw materials to packing finished products, making them indispensable in modern manufacturing environments.

The automated guided forklift segment is predicted to show significant growth during the forecast period. Automated Guided Carts, a form of autonomous vehicles, follow predetermined paths or tracks within industrial facilities. These carts are equipped with sensors and guidance systems, ensuring precise movement and navigation. AGCs are widely utilized in industries where repetitive material transportation tasks are prevalent. Their ability to follow predefined routes with accuracy and reliability enhances the efficiency of material handling processes, leading to improved productivity and reduced operational costs.

Europe dominated the market with the largest market share of 31% in 2023. In Europe, a similar trend is observed, with a robust emphasis on environmental conservation and sustainable practices. The European Union's ambitious carbon reduction targets and supportive initiatives have accelerated the adoption of Industrial Electric Vehicles across various industries. Additionally, the presence of well-established automotive manufacturers and a growing awareness of the benefits of electric vehicles contribute significantly to the market's growth in the region.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Asia-Pacific stands as a dynamic and rapidly growing market for Industrial Electric Vehicles, driven by factors such as urbanization, industrialization, and the need for efficient transportation solutions. Countries like China, Japan, and South Korea are at the forefront of electric vehicle technology development. The increasing demand for electric vehicles in emerging economies, coupled with government incentives and investments in charging infrastructure, has propelled the Asia-Pacific region into a key player in the global Industrial Electric Vehicles market.

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Electric Vehicles Market

5.1. COVID-19 Landscape: Industrial Electric Vehicles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Electric Vehicles Market, By Product

8.1.Industrial Electric Vehicles Market, by Product Type, 2024-2033

8.1.1. Automated Guided Carts

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Automated Tow Tractor

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Autonomous Mobile Robots (AMR)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Automated Guided Forklift

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Industrial Electric Vehicles Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Swisslog Holding AG

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Dematic

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Daifuku Co., Ltd.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Bastian Solutions, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Toyota Industries Corporation

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Hyster-Yale Materials Handling, Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Balyo

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. John Bean Technologies Corporation (JBT)

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Seegrid Corporation

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Kuka AG

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others