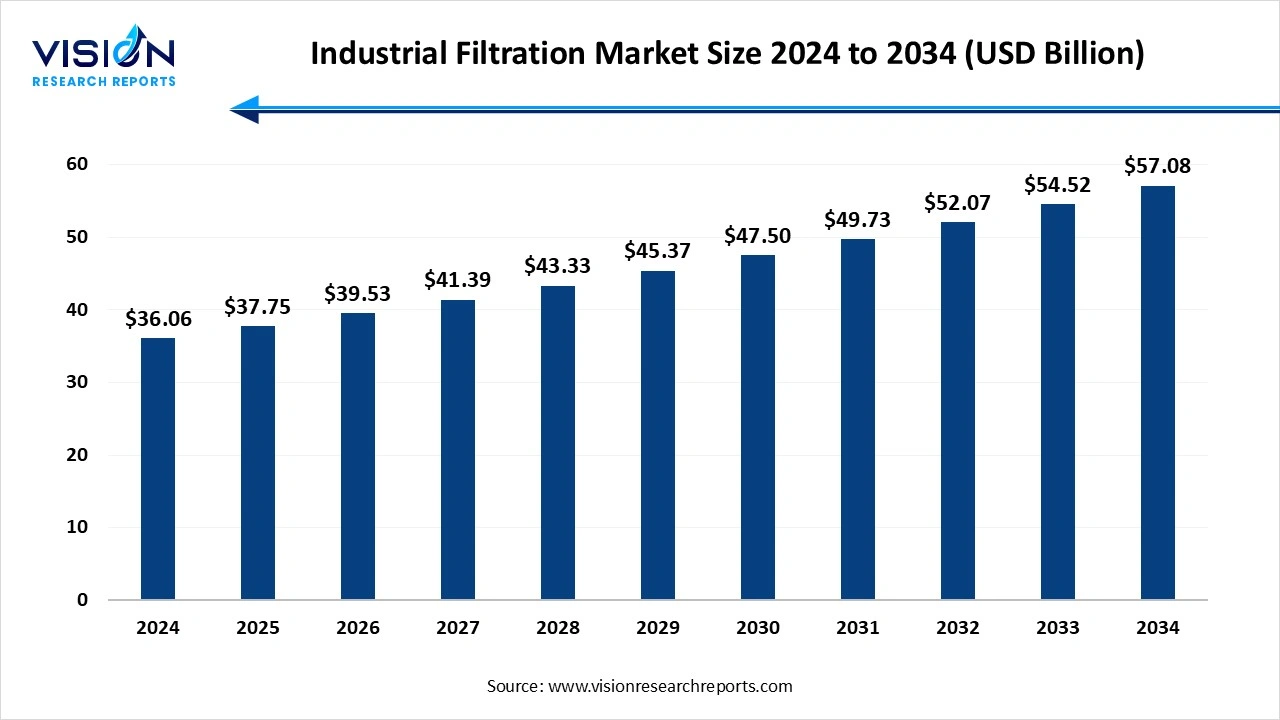

The global industrial filtration market size was valued at around USD 36.06 billion in 2024 and it is projected to hit around USD 57.08 billion by 2034, growing at a CAGR of 4.70% from 2025 to 2034.

The industrial filtration market plays a crucial role across a wide range of industries by ensuring the removal of contaminants from air, gases, liquids, and solids. This market has witnessed substantial growth in recent years due to increasing awareness regarding workplace safety, environmental regulations, and the demand for high-quality output in manufacturing processes. Filtration systems are widely used in industries such as oil and gas, pharmaceuticals, chemicals, power generation, food and beverages, and water treatment, where clean and controlled environments are essential for efficiency and compliance.

The industrial filtration market is experiencing robust growth driven primarily by stringent environmental regulations and growing awareness of workplace health and safety standards. Governments and regulatory bodies across the globe are enforcing stricter emission and discharge norms for industries, compelling manufacturers to adopt advanced filtration systems to comply with these requirements. Additionally, the growing concern over air and water pollution, especially in rapidly industrializing regions such as Asia Pacific, has accelerated the implementation of filtration technologies in sectors like chemicals, oil & gas, power generation, and food processing.

Another major growth factor is the rising demand for energy-efficient and cost-effective manufacturing processes. Industries are increasingly prioritizing filtration systems that not only ensure cleaner production environments but also contribute to operational efficiency by reducing equipment wear and downtime. Technological advancements in filtration materials such as nanofibers, smart filters, and self-cleaning systems are enhancing performance and longevity, making them more attractive to end-users.

The industrial filtration market is witnessing several key trends that are shaping its growth and evolution. One significant trend is the increasing integration of smart technologies into filtration systems. IoT-enabled filters, sensors, and automated monitoring systems are gaining traction, allowing real-time data collection on filter performance, pressure drops, and contamination levels. This advancement supports predictive maintenance, reduces downtime, and optimizes overall operational efficiency. As industries move toward Industry 4.0, the demand for intelligent and connected filtration solutions continues to rise, particularly in sectors like manufacturing, oil & gas, and pharmaceuticals.

Another notable trend is the growing emphasis on sustainability and environmentally friendly filtration solutions. Companies are investing in reusable, energy-efficient, and recyclable filter materials to align with global sustainability goals. Innovations such as nanofiber filters, membrane filtration, and bio-based filter media are being adopted to reduce environmental impact while maintaining high filtration efficiency.

The industrial filtration market faces several key challenges that can hinder its growth and operational efficiency. One of the primary challenges is the high initial investment and maintenance costs associated with advanced filtration systems. Many small and medium-sized enterprises (SMEs) struggle to adopt these technologies due to budget constraints, especially when filters require frequent replacements or involve complex installation and operational procedures.

Another significant challenge is the variability in industrial waste and operating conditions across different sectors. Each industry may produce unique types of contaminants ranging from fine particulates to corrosive gases which demand specialized filtration solutions. Developing customized filters that meet industry-specific standards while maintaining cost-effectiveness remains a complex task for manufacturers.

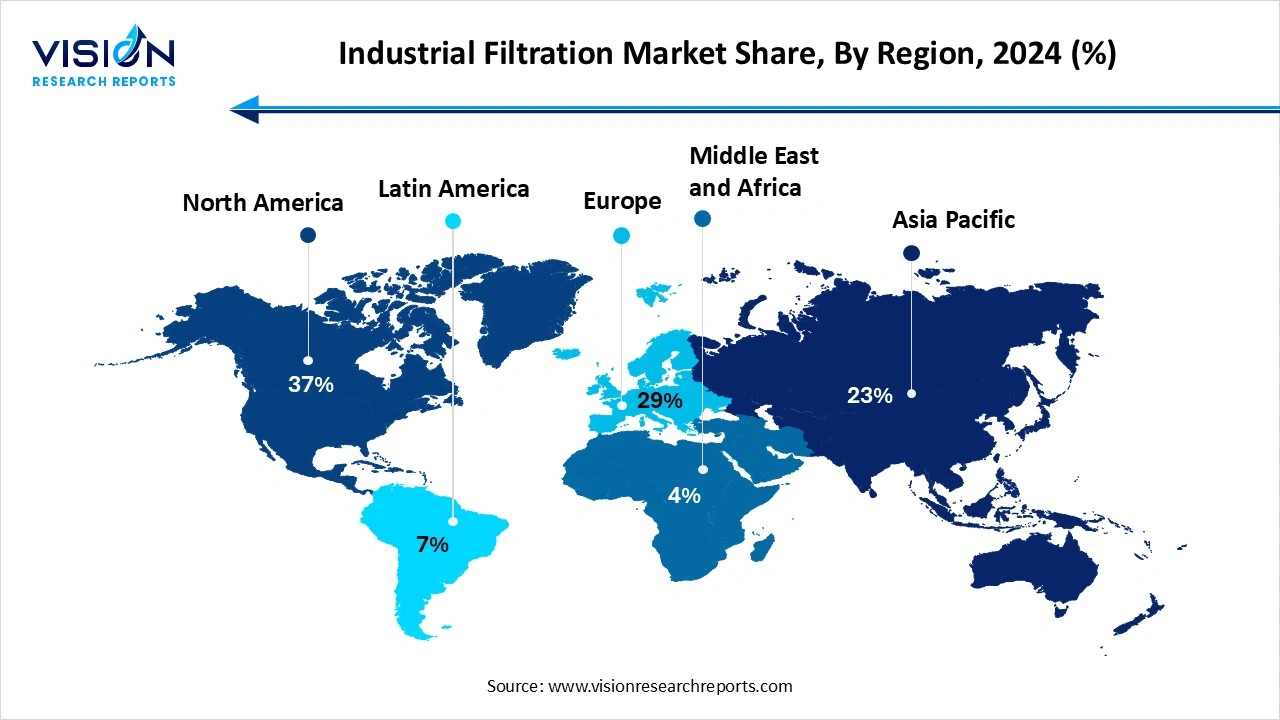

North America held the leading market share, surpassing 37% in 2024. The United States, in particular, leads the regional market due to the strong presence of manufacturing sectors like pharmaceuticals, chemicals, and food processing. Companies in this region are increasingly investing in advanced filtration technologies to comply with regulatory standards, enhance energy efficiency, and support sustainable practices.

The Asia Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization, urbanization, and the expansion of key industries in countries like China, India, and Japan. The growing demand for clean water, safe working environments, and improved process efficiency has significantly boosted the adoption of filtration technologies in the region. Increasing government initiatives toward environmental conservation and infrastructure development further strengthen the market outlook in Asia Pacific.

The Asia Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization, urbanization, and the expansion of key industries in countries like China, India, and Japan. The growing demand for clean water, safe working environments, and improved process efficiency has significantly boosted the adoption of filtration technologies in the region. Increasing government initiatives toward environmental conservation and infrastructure development further strengthen the market outlook in Asia Pacific.

The chemicals and petrochemicals segment held a substantial share of the industrial filtration market in 2024. These industries deal with complex processes involving hazardous substances, aggressive chemicals, and volatile compounds that necessitate robust filtration to ensure operational safety and product quality. Filtration systems are essential for removing solid particulates, separating phases, and protecting sensitive equipment from contamination and corrosion. With growing environmental regulations and an increased focus on emission control and waste management, chemical and petrochemical manufacturers are investing heavily in advanced filtration technologies, such as membrane filters, bag filters, and cartridge systems, to maintain compliance and enhance process efficiency.

The pharmaceutical manufacturing segment is anticipated to register the fastest growth rate throughout the forecast period. Filtration systems play a pivotal role in ensuring sterile manufacturing conditions by removing particulates, microorganisms, and other contaminants from air, water, and liquid formulations. From raw material filtration to final product polishing and sterile air supply in cleanrooms, filtration solutions are embedded at every stage of pharmaceutical processing. The adoption of advanced technologies such as HEPA filters, depth filters, and nanofiber membranes is rising as pharmaceutical companies aim to meet GMP (Good Manufacturing Practice) standards and reduce the risk of contamination.

The liquid filtration segment captured a notable market share exceeding 58% in 2024. Industries such as chemicals, oil and gas, food and beverages, and pharmaceuticals heavily rely on liquid filtration systems to ensure the purity of water, process fluids, and end products. Technologies like membrane filters, depth filters, and cartridge filters are commonly used depending on the specific requirements of the application.

The air filtration segment is projected to witness the highest growth in the industrial filtration market over the forecast period. In manufacturing environments, air filtration systems are vital for capturing dust, aerosols, fumes, and other airborne contaminants that can compromise cleanroom conditions or damage sensitive machinery. High-efficiency particulate air (HEPA) filters, electrostatic precipitators, and baghouse filters are among the most commonly used technologies in air filtration.

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Filtration Market

5.1. COVID-19 Landscape: Industrial Filtration r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Industrial Filtration Market, By Type

8.1. Industrial Filtration Market, by Type, 2024-2033

8.1.1. Air Filtration

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Liquid Filtration

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Industrial Filtration Market, By feb

9.1. Industrial Filtration Market, by feb, 2024-2033

9.1.1. Food & Beverages

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Power Generation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Semiconductors & Electronics

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Chemicals & Petrochemicals

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Pharmaceutical Manufacturing

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Metals & Mining

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Paper & Paints

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by feb (2021-2033)

Chapter 11. Company Profiles

11.1. Parker Hannifin Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Donaldson Company, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eaton Corporation plc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. 3M Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Ahlstrom-Munksjö Oyj

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Camfil Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MANN+HUMMEL Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Lydall, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Filtration Group Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Cummins Filtration (a division of Cummins Inc.)

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others