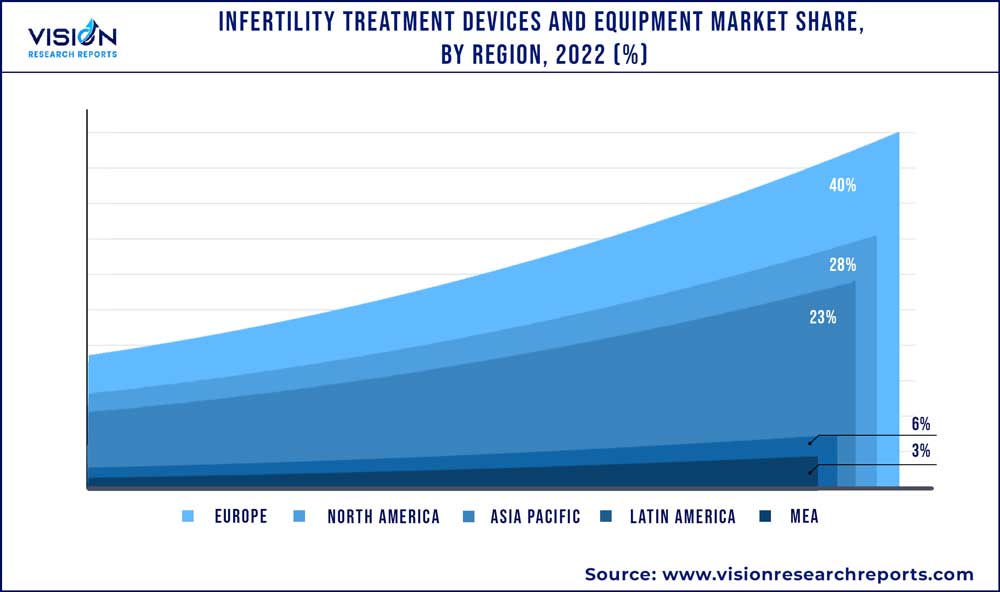

The global infertility treatment devices and equipment market was valued at USD 0.28 billion in 2022 and it is predicted to surpass around USD 0.77 billion by 2032 with a CAGR of 10.58% from 2023 to 2032. The infertility treatment devices and equipment market in the United States was accounted for USD 55.1 million in 2022.

Key Pointers

Report Scope of the Infertility Treatment Devices And Equipment Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 40% |

| Revenue Forecast by 2032 | USD 0.77 billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.58% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Cooper Companies Inc.; Cook Medical; Vitrolife; DxNow; Eppendorf AG; AB Scientific Ltd; Hamilton Thorne, Inc; IVFtech ApS; Rocket Medical Plc; Art Biotech Pvt. Ltd.; LabIVF Asia Pte Ltd; Esco Micro Pte Ltd. |

Over the last few years, infertility rates have been increasing across the globe. The use of Assisted Reproductive Technology (ART) by infertile couples is increasing by 5-10% per year. The CDC and the WHO monitor high infertility prevalence around the world. Currently, 46% of the global population lives in countries with low levels of fertility. Another 46% of the population lives in countries with intermediate fertility and the remaining 8% population lives in countries with high fertility. According to the UN , the global fertility rate is expected to decline to 2.4 by 2030 and 2.2 by 2050.

The rate of infertility is increasing around the world due to the rising prevalence of conditions such as erectile dysfunction and Polycystic Ovary Syndrome (PCOS). Significant changes in lifestyle and increasing preference of working women for conceiving at a later age may result in complications. Infertility in men is a result of various factors such as stress, alcohol consumption, changing lifestyle, and reduced sperm count & motility.

A constant increase in the incidence of infertility in both sexes is driving the market for infertility treatment devices and equipment. Fertility in women generally starts decreasing after the age of 30. The rate of infertility is especially higher in the late 30s and early 40s. Women aged over 35 are classified as having advanced reproductive age and are advised to opt for early investigations and treatments.

According to WHO, around 10% of women are directly or indirectly affected by infertility. Infertility affects around 12% of couples of reproductive ages, as one in every four couples suffers from infertility in developing countries. The WHO monitors the incidence of infertility across the globe in line with “WHO Reproductive Health Indicators: Guidelines for Their Generation, Interpretation and Analysis for Global Monitoring.”

Moreover, high adoption of Assisted Reproductive Technology (ART) is a significant driver for the infertility treatment devices & equipment market. The increasing awareness & acceptance of ART has led to a surge in demand for these procedures. According to a report by the Centers for Disease Control and Prevention (CDC), the use of ART has doubled in the past decade in the U.S. alone.

ART procedures, such as In Vitro Fertilization (IVF), Intracytoplasmic Sperm Injection (ICSI), and others, have become more accessible and affordable for couples who are struggling with infertility. These procedures have high success rates and are an attractive option for those who are unable to conceive naturally. For instance, according to the latest data from the Society for Assisted Reproductive Technology (SART), 301,523 ART cycles were performed in the U.S. in 2020, resulting in 73,602 live births.

The COVID-19 pandemic slowed the global economy owing to a high infection rate. The Brigham and Women's Hospital community has overcome various COVID-19 pandemic obstacles to become more resilient than ever. The Center for Infertility and Reproductive Surgery is adopting a careful approach to safely reintegrating its fertility patients, as the number of COVID-19 patients rapidly falls.

In response to the COVID-19 pandemic, scientific and professional fertility societies worldwide, such as the International Federation for Fertility Societies (IFFS), American Society of Reproductive Medicine (ASRM), European Society for Human Reproduction and Embryology (ESHRE), and the Canadian Fertility and Andrology Society (CFAS), issued specific guidelines for intended couples who were undergoing or willing to undergo fertility treatments.

Type Insights

Sperm separation devices dominated the market with 18% of the revenue share in 2022. Sperm separation devices are used in assisted reproductive treatments such as In Vitro Fertilization (IVF) and artificial insemination. In addition, the shelf life of these devices is lower than that of other capital equipment, such as incubators. Hence, these devices need to be replaced in a few years to maintain optimum productivity.

Sperm separation devices have the capability of isolating highly motile sperms with high DNA integrity from the semen sample. Microfluidic technology isolates healthy sperms, creating gradients. The sperm separation procedure eliminates the sperms with malformations, larger heads, or bent necks. The healthiest and strongest sperms get through the sperm separation arrays and are then collected at the end of the procedure.

Time-lapse imaging systems are used for safe and continuous embryo monitoring throughout the incubation period. These imaging systems have a built-in microscope that captures and analyses embryo development in high resolution, without disturbing the growth environment of the culture in the incubator.

With the help of time-lapse imaging systems, the best embryos can be selected by embryologists for the final transfer, based on the embryo development patterns visible in time-lapse images & videos. Time-lapse imaging systems prevent embryos from getting disturbed in the culture during their assessment. Hence, manual handling is eliminated, minimizing the risk of accidents, and improving cultural conditions.

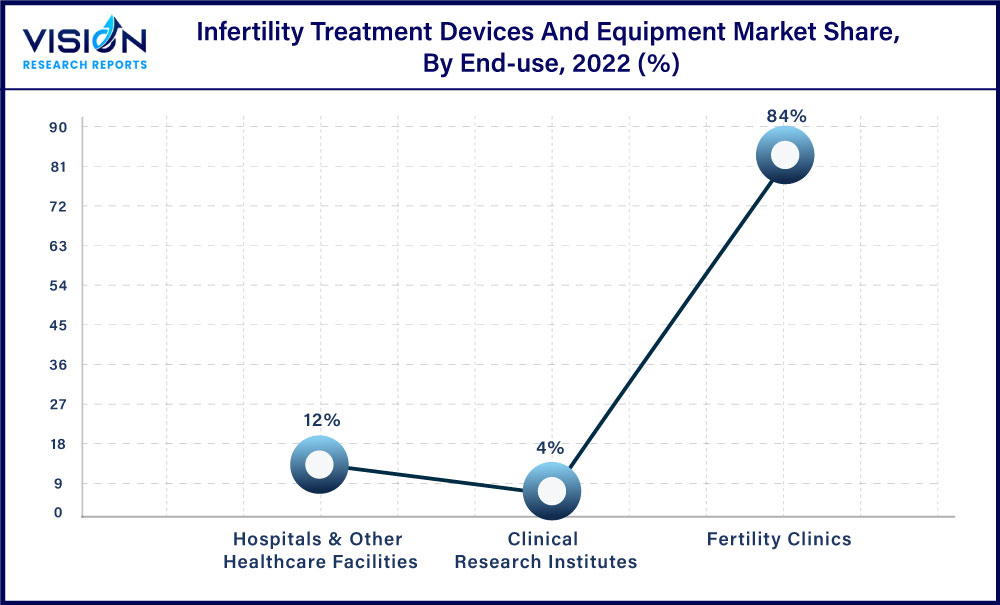

End-use Insights

Fertility clinics accounted for the dominant revenue share of 84% in 2022. All types of infertility treatment procedures are performed at licensed fertility clinics. The treatment procedures involve consultation, which includes the determination of the causes of infertility, before initiating the procedures. In addition, fertility specialists can prescribe medications for fertility to increase the chances of conception.

Moreover, fertility clinics offer couples counseling and treatment plans based on the severity and causes of their infertility. ART centers need to comply with certain regulatory guidelines for operations. As per the statistics of CDC’s Fertility Clinic Success Rates Report 2020, there were 326,468 ART cycles performed at 449 clinics in the U.S. during the year, resulting in 75,023 live births and 79,942 live-born infants. In October 2022, Alife launched a new AI software to aid fertility clinics in optimizing & supporting decision-making during critical stages of IVF procedures.

In addition, some multispecialty hospitals offer ARTs, such as artificial insemination, IVF, and surrogacy. An increase in convenience and availability of various treatments in a single setting is contributing to the growing preference for hospitals by consumers. ART procedures offered by hospitals are generally expensive and require highly skilled staff. Hence, significant investments are required by hospitals to recruit dedicated staff for infertility treatments.

Regional Insights

Europe accounted for the largest market share of 40% in 2022. In Europe, the fertility rate has constantly been declining over the years. According to Eurostat: Demographic Statistics, in 2022, the fertility rate in Europe was 1.49 births per woman, compared to 2.7 in 1950. In addition, the number of couples reporting infertility has been increasing by 8-9% each year, making infertility a public health concern.

Moreover, the increasing number of market players and the launch of new products in this region are factors expected to boost the competitive rivalry among players. In September 2021, Rebecca Weiss, a German design graduate, received the James Dyson Award for a male contraceptive product known as COSO, that uses ultrasound waves to halt sperm regeneration for a short period of time. The device is designed to be a reversible contraceptive solution.

The demand for ART treatments is expected to grow exponentially in Asia Pacific, owing to the rise in fertility tourism, an increase in the number of international players focusing on entering the market in economically developing countries, and changing regulatory landscape. The Asia Pacific Initiative on Reproduction consists of a task force of clinicians and scientists involved in the monitoring and management of fertility and ART. It promotes awareness regarding ART & infertility and enhances infertility-related services in the region.

Increasing infertility rates and rising awareness about treatment options are expected to boost market growth in this region. The social stigma associated with ARTs is slowly decreasing in Asia Pacific. Japan, China, and India are the notable markets in this region. As per statistics from The World Bank Group, in 2021, the birth rate in the Asia Pacific fell to a population replacement level of 4.6 children per woman. The decline in the birth rate and the increase in the geriatric population are among the major factors expected to propel market growth in Asia Pacific during the forecast period.

Infertility Treatment Devices And Equipment Market Segmentations:

By Type

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Infertility Treatment Devices And Equipment Market

5.1. COVID-19 Landscape: Infertility Treatment Devices And Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Infertility Treatment Devices And Equipment Market, By January

8.1. Infertility Treatment Devices And Equipment Market, by January, 2023-2032

8.1.1. Ovum Aspiration Pumps

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Sperm Separation Device

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Sperm Analyzer Systems

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Micromanipulators Systems

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Incubators

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Cryosystems

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Imaging System

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Microscopes

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Others

8.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Infertility Treatment Devices And Equipment Market, By End-use

9.1. Infertility Treatment Devices And Equipment Market, by End-use, 2023-2032

9.1.1. Fertility Clinics

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Hospitals & Other Healthcare Facilities

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Clinical Research Institutes

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Infertility Treatment Devices And Equipment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by January (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by January (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by January (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by January (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by January (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by January (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by January (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by January (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by January (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by January (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by January (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by January (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by January (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by January (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by January (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by January (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by January (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by January (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by January (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by January (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by January (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. The Cooper Companies Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cook Medical

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Vitrolife

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DxNow

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Eppendorf AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. AB Scientific Ltd

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hamilton Thorne, Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. IVFtech ApS

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rocket Medical Plc

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Art Biotech Pvt. Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others