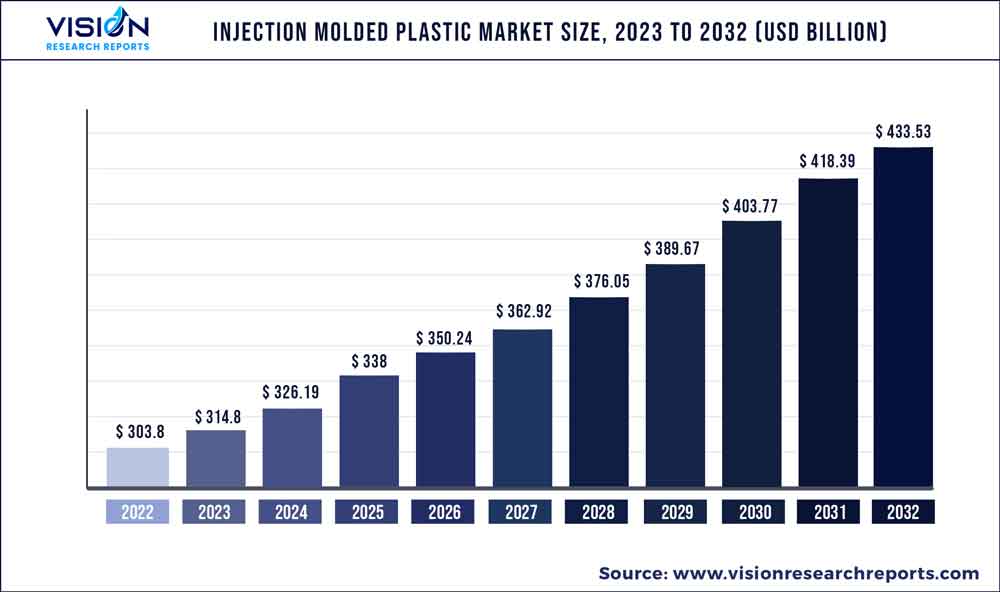

The global injection molded plastic market was valued at USD 303.8 billion in 2022 and it is predicted to surpass around USD 433.53 billion by 2032 with a CAGR of 3.62% from 2023 to 2032. By raw material segment, the injection molded plastic market in the United States was estimated at USD 48.8 billion in 2022.

Key Pointers

Report Scope of the Injection Molded Plastic Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 39.42% |

| Total Demand of Europe to Reach by 2032 | USD 103.54 billion |

| Revenue Forecast by 2032 | USD 433.53 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.62% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ExxonMobil Corporation; BASF SE; DuPont de Nemours, Inc.; Dow, Inc.; Huntsman International LLC.; Eastman Chemical Company; INEOS Group; LyondellBasell Industries Holdings B.V.; SABIC; Magna International, Inc.; IAC Group; Berry Global, Inc.; Master Molded Products Corporation; HTI Plastics Inc.; Rutland Plastics; AptarGroup, Inc.; LACKS ENTERPRISES, INC.; The Rodon Group; Heppner Molds |

Growing demand from key applications including automotive, packaging, and construction in Brazil, Russia, India, China, and South Africa (BRICS) nations, is likely to drive the growth. The high-growth regions such as the Middle East and Asia Pacific have witnessed a surge in capacity addition over the last few years.

The increasing presence of plastic injection molding companies in China on account of low manufacturing costs and ample availability of skilled labor is anticipated to benefit the regional market. Major foreign companies are increasing their production capabilities in the region, owing to the growing demand for plastic products. Government support in the form of tax benefits and financial incentives in China and India to increase the FDI flow has helped develop the market for plastics in these countries.

In packaging application, high-density polyethylene (HDPE) is extensively used in thin-wall injection molding. Growing packaging demand from food, bin liners, and thing gauge bags is anticipated to drive its growth over the forecast period. The rising penetration of injection molded HDPE in shipping containers, industrial pails, and houseware application is anticipated to further drive its demand over the forecast period.

The recent outbreak of the COVID-19 pandemic has affected the revenue generation of the companies operating in the injection molded plastics industry owing to the halt or slowdown in the production facilities. Thus, the companies are focusing on stepping up their resources and production capabilities to help in the fight against the pandemic. For instance, G&C Products, a U.S.-based plastic injection mold-making company that produces plastic products for fishing and the medical industry, started the production of personal protective equipment such as face shields and face masks.

Raw Material Insights

In terms of revenue, polypropylene held the largest market share of more than 34.54% of the overall demand in 2022, owing to its increasing consumption in automotive components, household goods, and packaging applications. Growing polypropylene finished products penetration in protective caps in electrical contacts and battery housings, food packaging is anticipated to further drive its demand over the forecast period.

Polypropylene components are widely used in food packaging and electrical contacts due to corrosion resistance and electrical insulation properties respectively. On account of the aforementioned factors, the segment is expected to witness the highest growth over the forecast period.

However, the halt in manufacturing activities to contain the spread of coronavirus has led to a decline in the consumption of polypropylene and negatively impacted its demand in various applications. Manufacturers are experiencing difficulties in running their production units owing to logistic restrictions and limitations on the movement of people, which are further cascading the negative impact on product demand.

Acrylonitrile butadiene styrene (ABS) emerged as the second major raw material for injection molded plastics in terms of the overall revenue share in 2022. Rising acrylonitrile butadiene styrene component demand in medical devices, automotive components, electronic housings, and consumer appliance manufacturing is expected to drive its growth over the forecast period.

Application Insights

The packaging segment wielded the majority of the pie and accounted for more than 30.51% of the overall market share in 2022. The finished products used in packaging undergo various development phases to meet regulatory guidelines and end-user requirements. A few requirements plastics need to meet for packaging application are increased shelf life of food products, better performance toward wear, and tear, and durability.

Injection molded plastics hold immense potential in the medical and automotive industries. The industry is expected to witness the highest growth in the medical devices & components sector. Optical clarity, biocompatibility, and cost-effective method of production are expected to drive the demand in the medical industry.

The stringent regulatory scenario regarding medical grade polymers use in healthcare sectors is anticipated to positively impact growth in the sector over the forecast period. Rising preference towards bio-degradable polymers among medical device manufacturers is also anticipated to create profitable opportunities in the medical industry over the forecast period.

A strong shift in the trend toward replacing steel with plastics in the automotive industry is expected to spur the growth in demand for injection molded plastics over the forecast period. Recently, government regulations have forced automotive manufacturers to use plastics instead of other materials such as iron and steel.

Automobile manufacturers have been focusing on reducing the overall weight of vehicles to improve fuel efficiency. Increasing use of plastics to replace metals and alloys in automotive components is expected to drive product demand from the automobile segment, thereby providing an immense opportunity for growth in the near future.

Regional Insights

Asia Pacific led the global demand with a market share of more than 39.42% in terms of revenue in 2022. Increasing infrastructure spending coupled with growing automobile demand in countries such as China, India, Indonesia, and Malaysia is expected to drive market penetration in the region.

Major end-use industries such as electronics and automobiles are shifting their manufacturing bases to Asia Pacific countries such as India, China, Indonesia, and Thailand owing to low labor costs. Government incentives in the form of tax benefits are offered to manufacturers in these regions. This factor increases the requirement for manufacturing various automotive and electrical parts which in turn is expected to drive product demand over the forecast period.

Europe was one of the prominent markets for injection molded plastics with a total demand estimated to reach USD 103.54 billion by 2032. Europe’s non-food and beverage packaging applications include cosmetics and toiletries, pharmaceuticals, and household chemicals. Increasing demand for electronic appliances such as laptops and cellular phones in U.K., Germany, and France is expected to drive demand from consumables and electronics application. Growth of the automobile industry in Europe is expected to further drive regional demand over the forecast period.

Injection Molded Plastic Market Segmentations:

By Raw Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Injection Molded Plastic Market

5.1. COVID-19 Landscape: Injection Molded Plastic Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Injection Molded Plastic Market, By Raw Material

8.1. Injection Molded Plastic Market, by Raw Material, 2023-2032

8.1.1. Polypropylene (PP)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Acrylonitrile Butadiene Styrene (ABS)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. High-Density Polyethylene (HDPE)

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Polystyrene (PS)

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Injection Molded Plastic Market, By Application

9.1. Injection Molded Plastic Market, by Application, 2023-2032

9.1.1. Packaging

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Consumables & Electronics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Automotive & Transportation

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Building & Construction

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Medical

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Injection Molded Plastic Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. ExxonMobil Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BASF SE

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. DuPont de Nemours, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Dow, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Huntsman International LLC.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Eastman Chemical Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. INEOS Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. LyondellBasell Industries Holdings B.V.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. SABIC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Magna International, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others