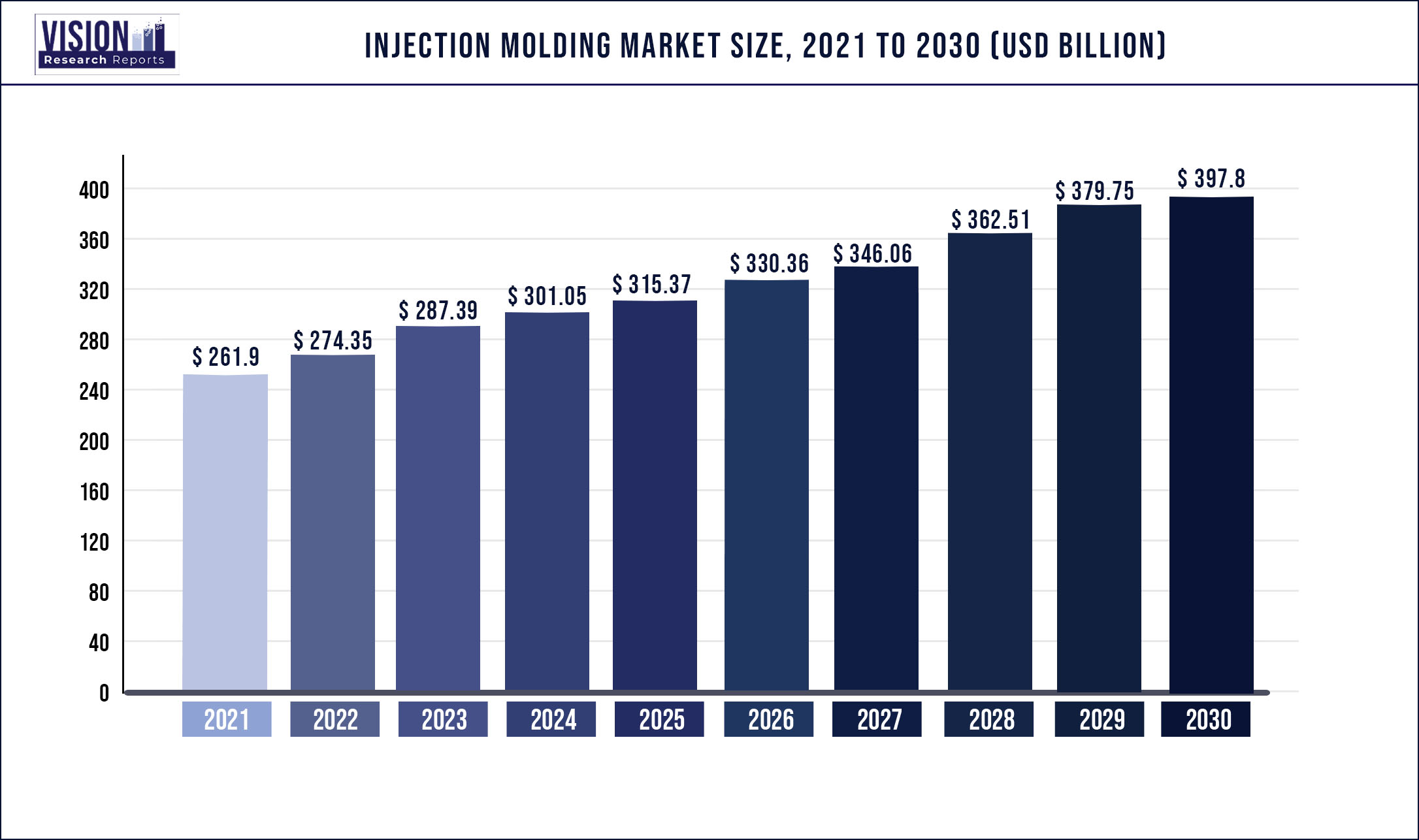

The global injection molding market was surpassed at USD 261.9 billion in 2021 and is expected to hit around USD 397.8 billion by 2030, growing at a CAGR of 4.75% from 2022 to 2030.

The market is driven by the rising demand for injection-molded components from various end-user industries since it offers cost-effective and efficient methods for manufacturing high-volume production of parts and products. The market has witnessed growth especially from the medical industry, with the emergence of the COVID-19 pandemic, as this product can offer accuracy, a high range of operation, repeatability, and cleanliness. Furthermore, packaging manufacturers leverage injection molding with robotics to run faster production rates with cost-effectiveness.

The market has witnessed surged adoption in recent years on account of the manufacturing technology employed for producing complex products. Players incorporate industry 4.0 in their process, thereby optimizing the requirement of raw materials, lowering costs, increasing automation, flexibility among other things. COVID-19 pandemic had caused supply chain disruptions in 2020 resulting in losses for the service providers as demand from various end-user industries was halted. However, with the infusion of economic stimulus packages, manufacturers have adopted automation to shorten production cycle time, thereby increasing productivity and profits.

The demand for plastic injection molding is witnessing significant growth due to high tensile strength and high-temperature endurance that have led to the surged usage of engineering-grade plastic resins for molded products. Moreover, plastic resins enable a reduction in manufacturing waste, product weight, and overall manufacturing costs. Companies providing molding services are engaged in acquiring the latest technologies to meet the changing demands from the medical industries and increase manufacturing capacity. For instance, in August 2021, HTI Plastics installed a new 420-ton injection molding press with an integrated Engel Viper 20 robot to advance its machinery capabilities.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 261.9 billion |

| Revenue Forecast by 2030 | USD 397.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.75% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Material, application, region |

| Companies Covered | C&J INDUSTRIES; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Proto Labs, Inc.; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR PLAST GROUP; D&M Plastics, LLCMaterial Insights |

Material Insights

The injection molding in plastics led the market and accounted for the largest revenue share of 98.3% in 2021 owing to low-cost technology suitable for high-volume production runs and applications that require consistency in design and strict tolerances that plastic offers. Recent innovations to minimize the rate of faulty production have encouraged mass production of complicated plastic shapes, especially in packaging, consumer goods, and construction augmenting the industry growth. The demand for plastic resins in injection molding is witnessing increased adoption due to factors such as high tensile strength, increased metal tolerance, and high-temperature endurance. Moreover, these resins enable a reduction in manufacturing waste, product weight, and overall manufacturing costs, thereby augmenting industry growth.

The metal material segment is likely to witness a CAGR of 7.3% over the forecast period. Factors such as resistance to corrosion, superior surface finish, and ability to manufacture parts with complex geometries have resulted in demand for metal molded components. Furthermore, increasing demand for minimally invasive surgeries has led to the surged demand for metal medical injection molded components. The rising costs of recyclability of plastics have led manufacturers to switch towards bioplastics that have similar properties to plastics and are environmentally friendly. Furthermore, the rising demand for rubber and ceramics products in medical, automotive, and electronics end-use industries is anticipated to have a positive impact on industrial growth.

Application Insights

The packaging applications segment led the industry and accounted for the largest revenue share of 32.4%. The increased demand for injection molding in packaging is attributed to the changing consumer trends, sustainability, and e-commerce penetration. Furthermore, increasing investments in food processing, pharmaceutical, and personal care industries are boosting the service demand for packaging products. The growth in smartphone, artificial intelligence, and voice recognition technologies coupled with the presence of technology-driven companies is expected to play a key role in the injection molding market growth. Rising demand for connectors, plug connectors, and sensors, as well as electronic components and other electronics, is expected to drive the growth.

The medical application segment is likely to witness a CAGR of 5.7% over the forecast period. In the wake of the COVID-19 pandemic, the demand for medical devices and components increased considerably. Ongoing advancements in the field of surgery in the form of standardization of methods and technological progressions are anticipated to drive the expansion of the medical sector and fuel the demand for injection molded medical components. The advent of electric vehicles globally has provided an opportunity for injection molding service providers in automobile applications. Brakes, clutching system, and drive trains, consists of components such as gears, seals, and magnets, manufactured using injection molding. Moreover, the growing demand for replacing metal components with plastic in automobiles is expected to drive during the forecast period.

Regional Insights

Asia Pacific led the market and accounted for the largest revenue share of 40.4% in 2021. A favorable environment for industrial growth, abundant raw materials, low-cost labor coupled with increasing investments in the packaging, medical, and electronics applications are expected to boost the demand for these products over the forecast period. In North America, rising healthcare expenditure and the increasing elderly population are anticipated to have a positive impact on the growth of the medical sector. The ongoing spread of the omicron variant of COVID-19 in North America has increased hospitalization, thereby fueling the demand for medical injection molding services. Furthermore, rapid innovation in the packaging and automobile sector is anticipated to boost the market growth.

In Central and South America, the market is likely to witness a CAGR of 5.1% over the forecast period owing to growing investments in disruptive technologies, such as robotics, artificial intelligence, IoT, and cloud technologies required molded components. These factors coupled with increased private consumption and the growth in the healthcare industry are expected to drive the market in the region. Europe accounted for a significant share of global revenue in 2021, owing to innovation, growing investment stimulus, and technology promotion in various end-use sectors such as packaging, automobile, and medical. Growing demand for sustainable, recyclable, smart packaging from various end-users is expected to impact the growth positively.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Injection Molding Market

5.1. COVID-19 Landscape: Injection Molding Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Injection Molding Market, By Material

8.1. Injection Molding Market, by Material, 2022-2030

8.1.1. Plastics

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Metals

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Injection Molding Market, By Application

9.1. Injection Molding Market, by Application, 2022-2030

9.1.1. Packaging

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Consumables & Electronics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Automotive & Transportation

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Building & Construction

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Medical

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Injection Molding Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Material (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Material (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. C&J INDUSTRIES

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. All-Plastics

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Biomerics

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. HTI Plastics

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. The Rodon Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. EVCO Plastics

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Majors Plastics, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Proto Labs, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tessy Plastics

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Currier Plastics, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. Formplast GmbH

11. 11.1. Company Overview

11. 11.2. Product Offerings

11. 11.3. Financial Performance

11. 11.4. Recent Initiatives

11.12. H&K Müller GmbH & Co. KG

11. 12.1. Company Overview

11. 12.2. Product Offerings

11. 12.3. Financial Performance

11. 12.4. Recent Initiatives

11.13. Hehnke GmbH & Co KG

11. 13.1. Company Overview

11. 13.2. Product Offerings

11. 13.3. Financial Performance

11. 13.4. Recent Initiatives

11.14. TR PLAST GROUP

11. 14.1. Company Overview

11. 14.2. Product Offerings

11. 14.3. Financial Performance

11. 14.4. Recent Initiatives

11.15. D&M Plastics, LLC

11.15.1. Company Overview

11. 15.2. Product Offerings

11. 15.3. Financial Performance

11. 15.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others