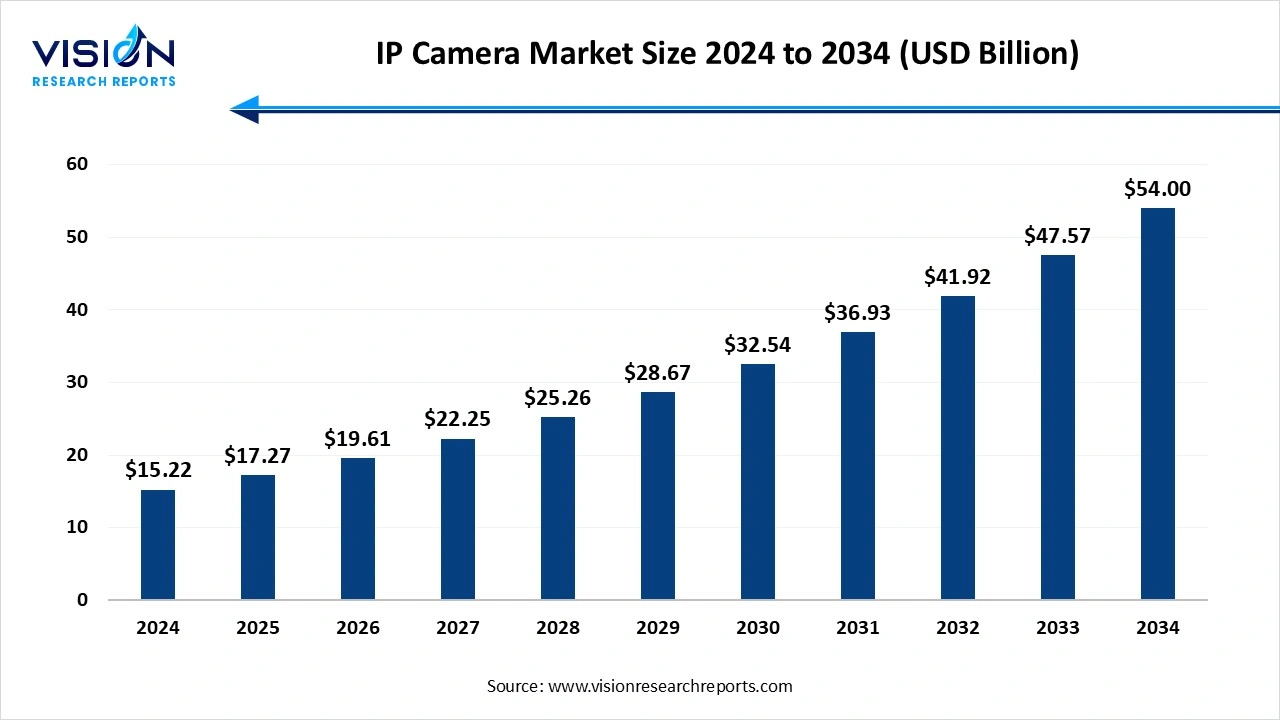

The global IP camera market size was surpassed at USD 15.22 billion in 2024 and is expected to hit around USD 54 billion by 2034, growing at a CAGR of 13.5% from 2025 to 2034.

The global IP camera market has experienced substantial growth, driven by increasing demand for advanced security solutions across residential, commercial, and industrial sectors. IP cameras, known for their ability to transmit video data over networks with high resolution, remote accessibility, and advanced analytics, have become a cornerstone of modern surveillance systems. Factors such as rising concerns about public safety, smart city initiatives, and the integration of AI-powered features like facial recognition and motion detection are further propelling market expansion.

The growth of the global IP camera market is driven by rising security concerns across various sectors. Increasing demand for high-definition video quality, remote monitoring, and integration with smart devices makes IP cameras a preferred choice over traditional systems. The development of smart cities and urbanization has also boosted demand for advanced surveillance solutions in public safety and infrastructure monitoring.

The integration of AI and cloud computing technologies enhances features like facial recognition, motion detection, and real-time alerts, making IP cameras more effective. The affordability, ease of installation, and the growing need for surveillance in sectors like e-commerce and logistics further fuel market growth.

The North American IP camera market led the global market, capturing a substantial 25% share in 2024. The IP camera market is primarily dominated by North America, with the United States leading the charge due to its high demand for advanced security solutions in both residential and commercial sectors. The region benefits from technological advancements and widespread adoption of smart security systems, making it the largest market. Europe follows closely, driven by increasing demand for security solutions in countries like the UK, Germany, and France, coupled with stringent data protection regulations such as GDPR, which further push the need for secure surveillance systems.

The Asia-Pacific region is projected to experience substantial growth, with an expected compound annual growth rate (CAGR) exceeding 15% in from 2025 to 2034. The region's rapid urbanization and increasing infrastructure development have contributed to a surge in demand for IP cameras. India, Japan, and South Korea are also emerging as key markets, driven by the growing need for security solutions in residential, commercial, and industrial sectors.The region’s rapid urbanization is a significant factor in this surge, with an increasing urban population fueling the rising demand for security in both commercial and residential properties. As more people move to cities, the need for robust surveillance systems has intensified, making security a top priority.

The hardware segment captured the largest market share, exceeding 77% in 2024. This segment primarily includes camera bodies, lenses, sensors, encoders, and network connectivity components. Advanced IP cameras are now equipped with high-resolution image sensors, ranging from HD to 4K and even 8K, ensuring superior image clarity. Lenses with adjustable focal lengths allow for flexible viewing angles, making them suitable for various applications, including wide-area monitoring and close-up surveillance.

The service segment is projected to experience the highest CAGR, exceeding 15% from 2025 to 2034. This segment encompasses a wide range of services, including installation, system integration, maintenance, and technical support. Installation services are crucial for proper camera placement, network configuration, and connectivity setup, ensuring optimal performance. System integration services help organizations seamlessly incorporate IP cameras into their existing security infrastructure, including video management systems (VMS) and cloud storage solutions.

The infrared (IR) IP camera segment has gained significant traction in the global IP camera market due to its superior performance in low-light and nighttime conditions. Infrared IP cameras are equipped with IR LEDs that emit infrared light, making them capable of capturing clear video footage even in complete darkness. This feature is particularly valuable for applications where continuous surveillance is required, such as perimeter security, critical infrastructure monitoring, and remote area surveillance. Technological advancements have led to the development of smart IR cameras, which automatically adjust IR intensity based on the distance of objects, preventing overexposure and maintaining image clarity.

The pan-tilt-zoom (PTZ) segment is projected to experience the highest CAGR from 2025 to 2034. These cameras are equipped with motorized mechanisms that allow them to pan (move horizontally), tilt (move vertically), and zoom in or out, providing comprehensive coverage with a single device. PTZ cameras are particularly popular in large spaces such as shopping malls, stadiums, airports, and city surveillance systems, where operators can dynamically adjust the camera’s field of view to track specific activities or individuals.

The consolidated segment held the largest share of the market in 2024. This traditional approach allows for easier management and monitoring, as all data and video feeds from the cameras are routed to a single location. Consolidated systems are widely used in commercial applications such as large retail stores, office buildings, and public facilities, where centralized control is crucial for maintaining oversight and security.

The distributed segment is projected to experience the fastest CAGR from 2025 to 2034. In distributed systems, each camera operates independently, with its own network connectivity and often its own storage capabilities. Unlike consolidated systems, distributed IP cameras can be located across large areas or multiple sites, providing greater flexibility in monitoring vast spaces.

The commercial segment held the largest share of the market in 2024. Commercial establishments, including retail stores, shopping malls, hotels, offices, banks, and educational institutions, rely heavily on IP camera systems to ensure the safety of employees, customers, and assets. These cameras offer high-definition video surveillance, remote monitoring capabilities, and advanced features such as facial recognition, automatic number plate recognition (ANPR), and real-time alerts, making them indispensable for commercial security.

The residential sector is projected to experience the highest compound annual growth rate (CAGR) from 2025 to 2034. Homeowners are increasingly opting for IP cameras as a cost-effective and reliable solution for monitoring their properties, deterring potential intruders, and ensuring the safety of family members. Modern residential IP cameras offer features such as high-definition video quality, night vision, two-way audio communication, motion detection, and instant notifications, making them ideal for indoor and outdoor monitoring.

By Component

By Product Type

By Connection Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on IP Camera Market

5.1. COVID-19 Landscape: IP Camera Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global IP Camera Market, By Component

8.1. IP Camera Market, by Component

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global IP Camera Market, By Product Type

9.1. IP Camera Market, by Product Type

9.1.1. Fixed

9.1.1.1. Market Revenue and Forecast

9.1.2. Pan-Tilt-Zoom (PTZ)

9.1.2.1. Market Revenue and Forecast

9.1.3. Infrared

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global IP Camera Market, By Connection Type

10.1. IP Camera Market, by Connection Type

10.1.1. Consolidated

10.1.1.1. Market Revenue and Forecast

10.1.2. Distributed

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global IP Camera Market, By Application

11.1. IP Camera Market, by Application

11.1.1. Residential

11.1.1.1. Market Revenue and Forecast

11.1.2. Commercial

11.1.2.1. Market Revenue and Forecast

11.1.3. Government

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global IP Camera Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component

12.1.2. Market Revenue and Forecast, by Product Type

12.1.3. Market Revenue and Forecast, by Connection Type

12.1.4. Market Revenue and Forecast, by Application

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component

12.1.5.2. Market Revenue and Forecast, by Product Type

12.1.5.3. Market Revenue and Forecast, by Connection Type

12.1.5.4. Market Revenue and Forecast, by Application

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component

12.1.6.2. Market Revenue and Forecast, by Product Type

12.1.6.3. Market Revenue and Forecast, by Connection Type

12.1.6.4. Market Revenue and Forecast, by Application

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component

12.2.2. Market Revenue and Forecast, by Product Type

12.2.3. Market Revenue and Forecast, by Connection Type

12.2.4. Market Revenue and Forecast, by Application

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component

12.2.5.2. Market Revenue and Forecast, by Product Type

12.2.5.3. Market Revenue and Forecast, by Connection Type

12.2.5.4. Market Revenue and Forecast, by Application

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component

12.2.6.2. Market Revenue and Forecast, by Product Type

12.2.6.3. Market Revenue and Forecast, by Connection Type

12.2.6.4. Market Revenue and Forecast, by Application

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component

12.2.7.2. Market Revenue and Forecast, by Product Type

12.2.7.3. Market Revenue and Forecast, by Connection Type

12.2.7.4. Market Revenue and Forecast, by Application

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component

12.2.8.2. Market Revenue and Forecast, by Product Type

12.2.8.3. Market Revenue and Forecast, by Connection Type

12.2.8.4. Market Revenue and Forecast, by Application

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component

12.3.2. Market Revenue and Forecast, by Product Type

12.3.3. Market Revenue and Forecast, by Connection Type

12.3.4. Market Revenue and Forecast, by Application

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component

12.3.5.2. Market Revenue and Forecast, by Product Type

12.3.5.3. Market Revenue and Forecast, by Connection Type

12.3.5.4. Market Revenue and Forecast, by Application

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component

12.3.6.2. Market Revenue and Forecast, by Product Type

12.3.6.3. Market Revenue and Forecast, by Connection Type

12.3.6.4. Market Revenue and Forecast, by Application

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component

12.3.7.2. Market Revenue and Forecast, by Product Type

12.3.7.3. Market Revenue and Forecast, by Connection Type

12.3.7.4. Market Revenue and Forecast, by Application

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component

12.3.8.2. Market Revenue and Forecast, by Product Type

12.3.8.3. Market Revenue and Forecast, by Connection Type

12.3.8.4. Market Revenue and Forecast, by Application

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component

12.4.2. Market Revenue and Forecast, by Product Type

12.4.3. Market Revenue and Forecast, by Connection Type

12.4.4. Market Revenue and Forecast, by Application

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component

12.4.5.2. Market Revenue and Forecast, by Product Type

12.4.5.3. Market Revenue and Forecast, by Connection Type

12.4.5.4. Market Revenue and Forecast, by Application

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component

12.4.6.2. Market Revenue and Forecast, by Product Type

12.4.6.3. Market Revenue and Forecast, by Connection Type

12.4.6.4. Market Revenue and Forecast, by Application

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component

12.4.7.2. Market Revenue and Forecast, by Product Type

12.4.7.3. Market Revenue and Forecast, by Connection Type

12.4.7.4. Market Revenue and Forecast, by Application

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component

12.4.8.2. Market Revenue and Forecast, by Product Type

12.4.8.3. Market Revenue and Forecast, by Connection Type

12.4.8.4. Market Revenue and Forecast, by Application

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component

12.5.2. Market Revenue and Forecast, by Product Type

12.5.3. Market Revenue and Forecast, by Connection Type

12.5.4. Market Revenue and Forecast, by Application

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component

12.5.5.2. Market Revenue and Forecast, by Product Type

12.5.5.3. Market Revenue and Forecast, by Connection Type

12.5.5.4. Market Revenue and Forecast, by Application

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component

12.5.6.2. Market Revenue and Forecast, by Product Type

12.5.6.3. Market Revenue and Forecast, by Connection Type

12.5.6.4. Market Revenue and Forecast, by Application

Chapter 13. Company Profiles

13.1. Hikvision

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Dahua Technology

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Axis Communications

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bosch Security Systems

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Honeywell

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Hanwha Techwin (Samsung Techwin)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Panasonic

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Vivotek

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Ubiquiti Networks

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Logitech (Circle View)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others