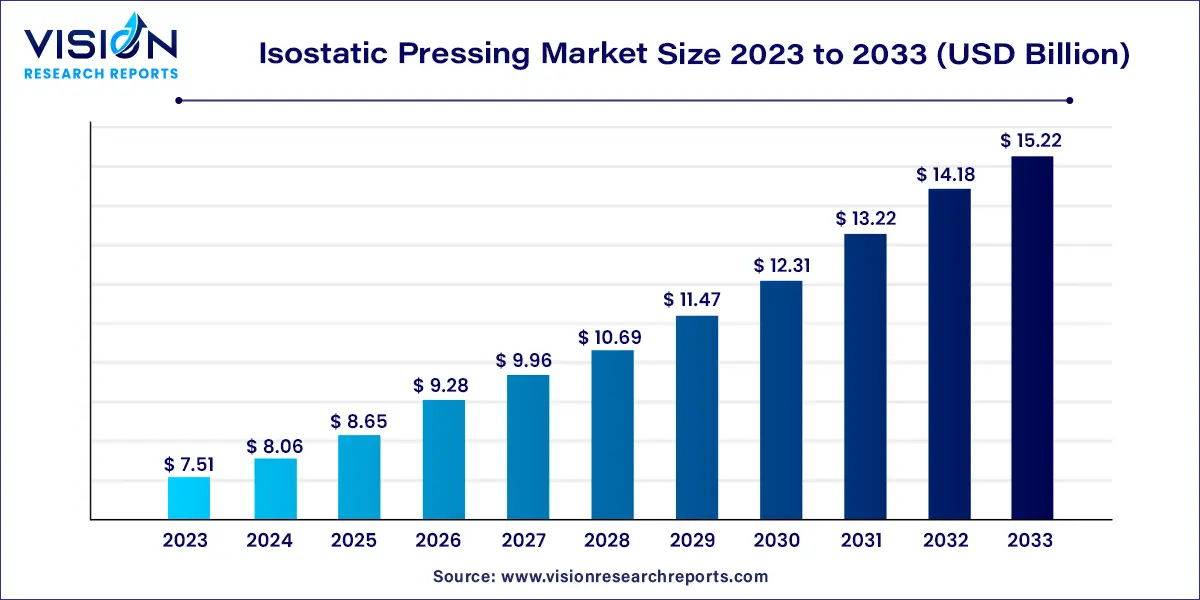

The global isostatic pressing market size was valued at USD 7.51 billion in 2023 and it is predicted to surpass around USD 15.22 billion by 2033 with a CAGR of 7.32% from 2024 to 2033. The isostatic pressing market is driven by technological advancements, increased demand for high-performance materials, and expanding applications across various industries.

The robust growth of the Isostatic Pressing market can be attributed to several key factors propelling its expansion. Technological advancements stand out as a primary driver, with continuous innovations enhancing the efficiency and capabilities of isostatic pressing techniques. The escalating demand for high-performance materials across diverse industries, including aerospace, automotive, and electronics, further fuels market growth. Isostatic pressing's versatility in applications, spanning powder metallurgy, ceramics, and various manufacturing processes, contributes to its widespread adoption. The market's segmentation based on types, end-use industries, and materials processed provides a nuanced understanding of its dynamics. Key players, such as XYZ Technologies, ABC Materials Inc., and DEF Engineering Solutions, play a pivotal role in shaping the industry, with their market share and strategic initiatives influencing overall market trends.

In 2023, the hot isostatic pressing (HIP) segment emerged as the dominant force in the market based on type. This prominence can be attributed to the escalating demand for intricate components in sectors such as aerospace and automotive, prompting the adoption of advanced manufacturing technologies like HIP. The primary objective is to eliminate porosity and enhance material properties. Given the industry's increasing focus on precision, efficiency, and cost-effectiveness, HIP technology aligns seamlessly with these requirements. By simultaneously applying high isostatic pressure and temperature, HIP ensures the production of fully dense components.

On the other hand, the Cold Isostatic Pressing (CIP) market is thriving due to various key factors. The demand for precision components, particularly in industries like electronics, automotive, and aerospace, propels the widespread adoption of CIP. This process enables the production of high-density and intricate parts. The industry's emphasis on cost-effectiveness and efficiency in manufacturing processes further fuels the utilization of CIP. Known for applying uniform pressure to shape powders into desired forms, CIP plays a pivotal role in meeting stringent quality standards, particularly in applications like semiconductor manufacturing, where precise material properties are paramount.

In terms of process type, dry bag isostatic pressing is a manufacturing method that involves compressing a powder or granular material within a flexible, sealed bag or container. Notably, this technique stands out for its characteristic absence of any liquid or slurry during the pressing process. Widely applied in the production of advanced ceramics, powdered metals, and composite materials, dry bag isostatic pressing offers several advantages. These include the capability to produce components with uniform density, precise dimensions, and minimal porosity. Particularly suitable for materials not requiring a liquid medium during pressing, this method finds application in industries like aerospace, electronics, and medical devices, where the creation of intricate and high-performance components is imperative.

On the other hand, wet bag isostatic pressing represents a distinct variant of the isostatic pressing process, marked by the incorporation of a liquid medium alongside the powder material. Commonly utilized in producing components with specific material requirements, such as certain ceramics and metal alloys, wet bag isostatic pressing allows for precise control of pressing conditions. This method is particularly beneficial for materials that exhibit higher compressibility in the presence of a fluid. Industries where achieving a specific microstructure or material property is crucial, such as in the manufacturing of advanced ceramics for electronic applications or specialized metal components, favor this process.

In terms of end-use, the medical segment is poised to experience a significant CAGR from 2024 to 2033. This growth is attributed to the increasing demand for the fabrication of precise, durable, and biocompatible components essential for various medical applications, including implants, prosthetics, and medical instruments. Isostatic pressing plays a vital role in the dental industry, where it is widely employed for producing ceramic components used in dental restorations such as crowns, bridges, and dental implants. This method ensures that dental prosthetics exhibit the necessary strength, durability, and biocompatibility required for successful and long-lasting dental treatments.

Isostatic pressing also finds extensive application in the manufacturing of sputtering targets, which are essential components for coating flat panel displays, semiconductors, data storage devices, architectural glass, and solar panels. Achieving both a fine microstructure and full density in targets is crucial in the sputtering process. Hot Isostatic Pressing (HIP) technology facilitates the densification of powders to complete density while preserving a fine microstructure, ensuring the production of high-quality sputtering targets.

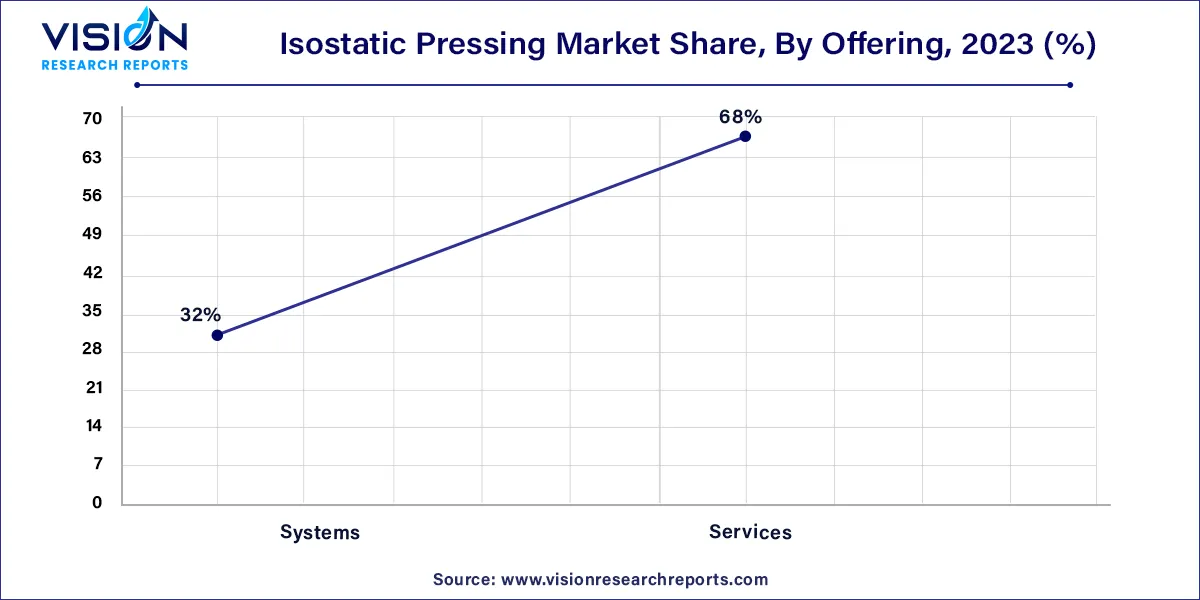

In terms of offering, the services segment took the lead in the market, commanding the largest revenue share at 68% in 2023. Isostatic pressing plays a pivotal role in ensuring the precise and uniform compaction of powdered or granular materials, resulting in components with consistent density and minimal variation in dimensions. This makes it the preferred choice for applications where precision is of utmost importance. Additionally, isostatic pressing proves instrumental in optimizing material properties, such as strength and hardness, by eliminating voids and achieving higher density. This capability is particularly valuable in industries where the mechanical performance of components is a critical factor, including medical, aerospace, and automotive sectors.

Driven by the demand for precision in component fabrication, isostatic pressing systems enable the production of intricate and complex parts with consistent density. Their versatility, allowing them to work with various materials such as ceramics, metals, and composites, positions these systems as go-to solutions across diverse industries. The ability to achieve full density while maintaining fine microstructures is crucial in applications like aerospace, medical, and electronics. Isostatic pressing systems contribute significantly to material homogeneity, eliminating porosity and ensuring uniform material properties

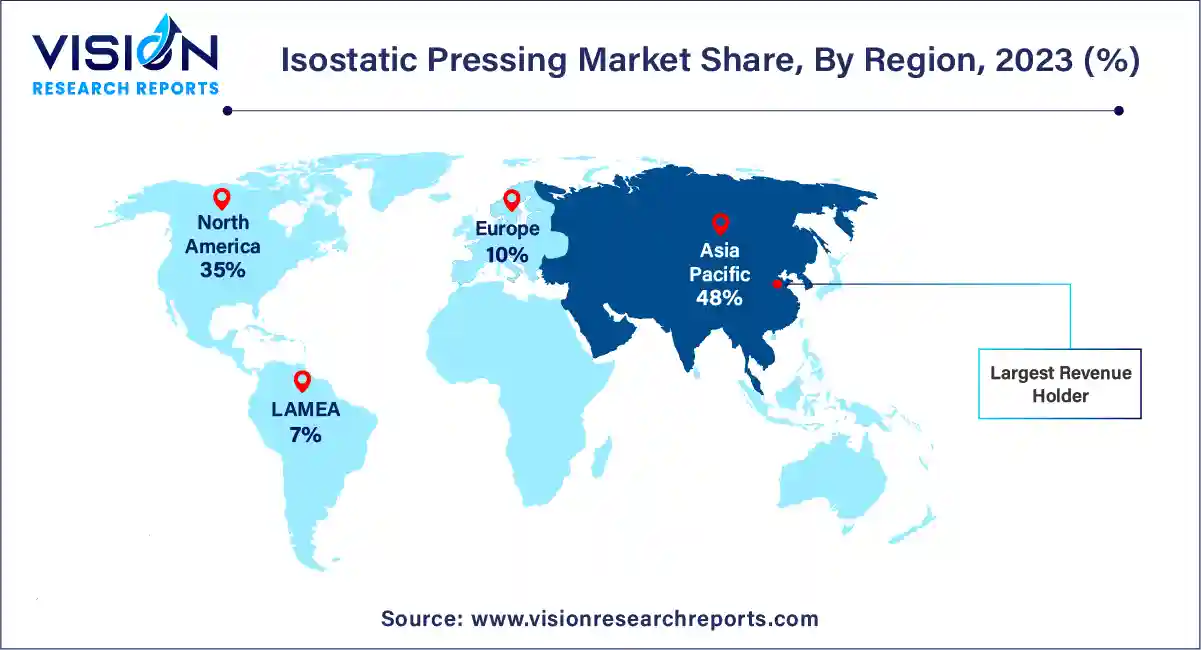

The North American isostatic pressing market is propelled by a surge in investment focused on technological innovations within the region's automotive industry. The extensive use of titanium alloy in lightweight vehicles has prompted market players to invest in the production of titanium alloy through hot isostatic pressing. This strategic move aims to reduce the manufacturing cost of titanium parts for vehicles, contributing to the overall growth of the isostatic pressing market.

In 2023, Asia Pacific emerged as the dominant force in the market, boasting a significant revenue share of 48%. The region has evolved into a prominent hub for medical tourism, with several countries heavily investing in their medical industry to attract global patients. The growing middle class in countries like China and India has spurred an increased demand for medical services and products. As industries expand, there is a heightened requirement for precision components, driving the adoption of isostatic pressing technologies. Furthermore, the expansion of the medical industry in the Asia Pacific region significantly contributes to the demand for isostatic pressing in the manufacturing of medical implants, dental restorations, and other precision components.

By Offering

By Type

By Capacity

By Process Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Isostatic Pressing Market

5.1. COVID-19 Landscape: Isostatic Pressing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Isostatic Pressing Market, By Offering

8.1. Isostatic Pressing Market, by Offering, 2024-2033

8.1.1. Systems

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Isostatic Pressing Market, By Type

9.1. Isostatic Pressing Market, by Type, 2024-2033

9.1.1. Hot Isostatic Pressing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cold Isostatic Pressing

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Isostatic Pressing Market, By Capacity

10.1. Isostatic Pressing Market, by Capacity, 2024-2033

10.1.1. Small-sized HIP

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medium-sized HIP

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Large-sized HIP

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Isostatic Pressing Market, By Process Type

11.1. Isostatic Pressing Market, by Process Type, 2024-2033

11.1.1. Dry Bag Pressing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Wet Bag Pressing

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Isostatic Pressing Market, By End-use

12.1. Isostatic Pressing Market, by End-use, 2024-2033

12.1.1. Manufacturing

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Automotive

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Electronics & Semiconductor

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Medical

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Aerospace & Defense

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Energy & Power

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Oil & Gas

12.1.7.1. Market Revenue and Forecast (2021-2033)

12.1.8. Others

12.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Isostatic Pressing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.2. Market Revenue and Forecast, by Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.1.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.2. Market Revenue and Forecast, by Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.2.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.2.7. Market Revenue and Forecast, by Process Type (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.2.10. Market Revenue and Forecast, by Process Type (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.2. Market Revenue and Forecast, by Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.3.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.2. Market Revenue and Forecast, by Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.4.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.2. Market Revenue and Forecast, by Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.5.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Process Type (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. KOBE STEEL, LTD.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Bodycote

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Isostatic Pressing Services

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Nikkiso Co., Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Kennametal Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. DORST Technologies GmbH & Co. KG

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. American Isostatic Presses Inc

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. EPSI

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Shanxi Golden Kaiyuan Co., Ltd.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Fluitron

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others