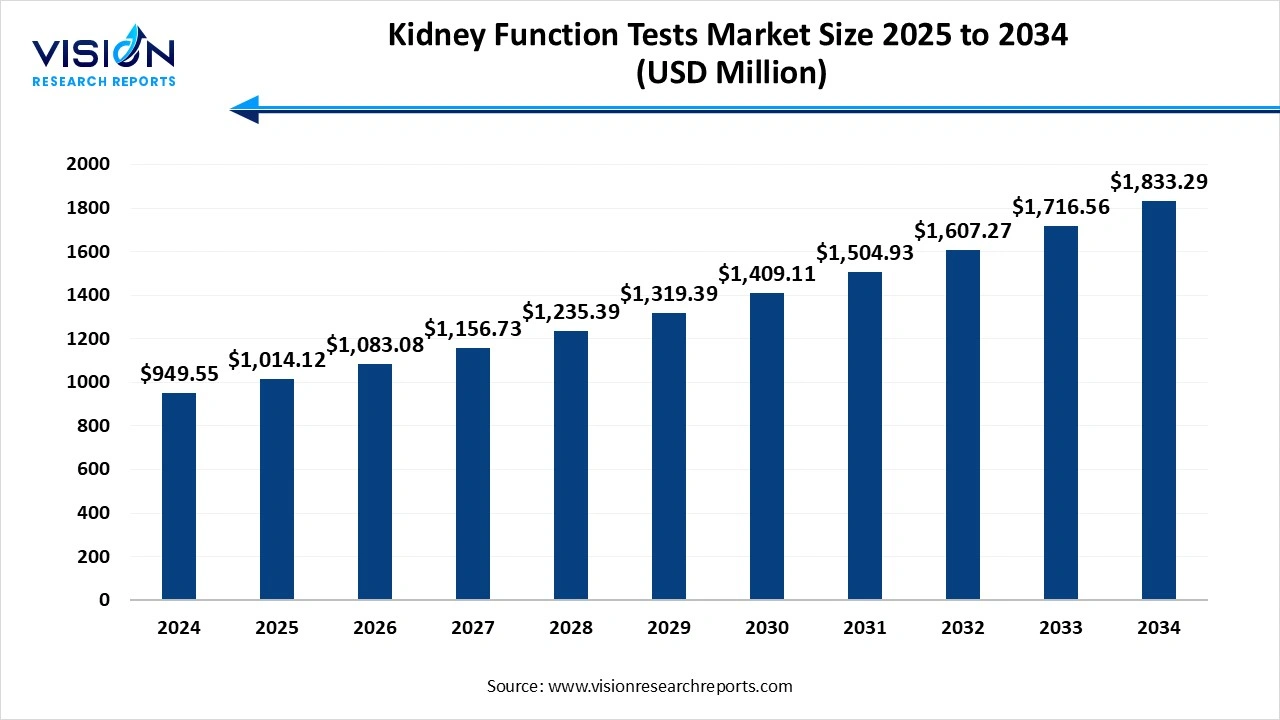

The global kidney function tests market size was reached at USD 949.55 million in 2024 and it is projected to hit around USD 1,833.29 million by 2034, growing at a CAGR of 6.8% from 2025 to 2034. T he market growth is driven by the rising prevalence of chronic kidney diseases, increasing geriatric population, and growing awareness regarding early diagnosis, the Kidney Function Tests Market is experiencing substantial growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 949.55 million |

| Revenue Forecast by 2034 | USD 1,833.29 million |

| Growth rate from 2025 to 2034 | CAGR of 6.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Abbott; Danaher; F. Hoffmann-La Roche Ltd.; Sysmex Corporation; Siemens Healthineers; Randox Laboratories Ltd; Quest Diagnostics; ACON Laboratories, Inc.; Nova Biomedical Corporation; Laboratory Corporation of America Holdings |

The kidney function tests market is experiencing steady growth driven by increasing awareness about kidney health and the rising prevalence of chronic kidney diseases worldwide. These diagnostic tests play a crucial role in the early detection and monitoring of kidney function, helping healthcare providers manage conditions such as acute kidney injury, chronic kidney disease, and other renal disorders effectively. Advancements in technology and the development of more accurate, rapid, and non-invasive testing methods have further fueled market expansion.

The kidney function tests market is primarily driven by the rising prevalence of chronic kidney diseases (CKD) and related health conditions such as diabetes and hypertension. As these illnesses continue to affect a growing portion of the global population, especially in aging demographics, the demand for regular and accurate kidney function monitoring increases significantly. Early diagnosis through kidney function tests enables timely intervention, reducing the risk of severe complications and improving patient outcomes.

Technological advancements in diagnostic tools and testing methodologies also contribute substantially to the market’s expansion. Innovations such as point-of-care testing, automated analyzers, and non-invasive testing techniques have improved the efficiency, accuracy, and accessibility of kidney function assessments.

One of the primary challenges faced by the kidney function tests market is the high cost associated with advanced diagnostic technologies and equipment. Many cutting-edge testing methods require significant investment, which can limit accessibility, especially in low- and middle-income regions. This cost barrier often restricts widespread adoption, impacting early diagnosis and consistent monitoring of kidney function in underprivileged populations. Additionally, lack of awareness and limited healthcare infrastructure in certain areas further hinder the effective utilization of kidney function tests, delaying timely intervention and treatment.

Another significant challenge is the variability and complexity involved in interpreting test results. Kidney function tests often require specialized knowledge to accurately assess and diagnose conditions, which may not be readily available in all healthcare settings. Moreover, factors such as patient-specific variables and coexisting health conditions can affect test accuracy, leading to potential misdiagnosis or the need for multiple confirmatory tests.

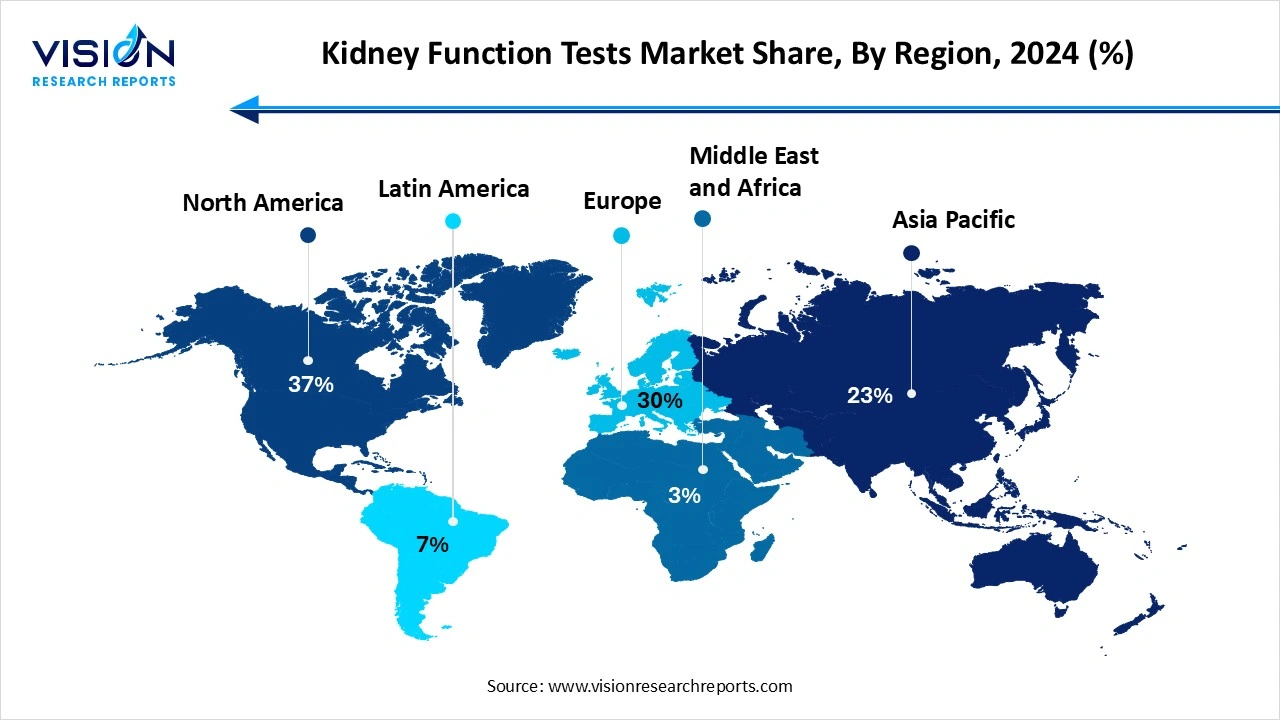

The North American kidney function tests industry led the market, capturing a 37% share in 2024. North America remains a dominant player in the market, supported by advanced healthcare systems, high awareness of kidney health, and substantial investments in diagnostic technologies. The presence of well-established hospitals and diagnostic laboratories further bolsters the adoption of kidney function tests, alongside significant government initiatives aimed at managing chronic kidney diseases.

The kidney function tests market in the Asia Pacific region is projected to register the fastest growth, with a CAGR of 7.7% over the forecast period. The Asia-Pacific region is witnessing rapid market expansion due to rising incidences of diabetes and hypertension, which are major risk factors for kidney diseases. Improving healthcare infrastructure, growing middle-class populations, and increased accessibility to diagnostic facilities are key factors propelling market growth in countries such as China, India, and Japan.

The clearance tests segment held the largest revenue share, representing 29% of the market in 2024. These tests, including creatinine clearance and inulin clearance, provide critical insights into the glomerular filtration rate (GFR), a key indicator of kidney function. By quantifying how effectively the kidneys remove substances from the bloodstream, clearance tests help in early diagnosis and monitoring of kidney diseases, allowing for timely intervention and treatment adjustments.

The urine tests segment is expected to grow at the fastest rate of 8.1% in the upcoming years. These tests include urine protein, albumin, and microalbumin measurements, which can reveal the presence of kidney damage even before significant changes in blood markers appear. Urinalysis also helps identify infections, hematuria, and other urinary tract conditions that may affect kidney performance.

The hospitals segment secured the largest revenue share, accounting for 41% in 2024. The critical nature of kidney-related conditions often necessitates immediate and accurate testing, which hospitals are well-positioned to provide. Additionally, the increasing number of chronic kidney disease cases and the growing emphasis on early diagnosis and treatment within hospital settings are driving the demand for kidney function tests in this segment.

The diagnostic laboratories segment is projected to expand rapidly, registering a CAGR of 7.8% during the forecast period. These laboratories often cater to patients referred by healthcare providers, providing timely results that assist in diagnosis, treatment planning, and disease monitoring. The expansion of diagnostic laboratory networks, coupled with advancements in laboratory automation and testing technologies, has enhanced the accessibility and affordability of kidney function tests.

By Product

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Kidney Function Tests Market

5.1. COVID-19 Landscape: Kidney Function Tests r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Kidney Function Tests Market, By Product

8.1. Kidney Function Tests Market, by Product, 2024-2033

8.1.1. Clearance Tests

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Urine Tests

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Blood Tests

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Dilution And Concentration Tests

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other Tests

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Kidney Function Tests Market, By End-use

9.1. Kidney Function Tests Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Laboratories

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Research Laboratories And Institutes

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Roche Diagnostics

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens Healthineers

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Thermo Fisher Scientific

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Beckman Coulter (a Danaher company)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Bio-Rad Laboratories

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Sysmex Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Ortho Clinical Diagnostics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Quest Diagnostics

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BioMérieux

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others