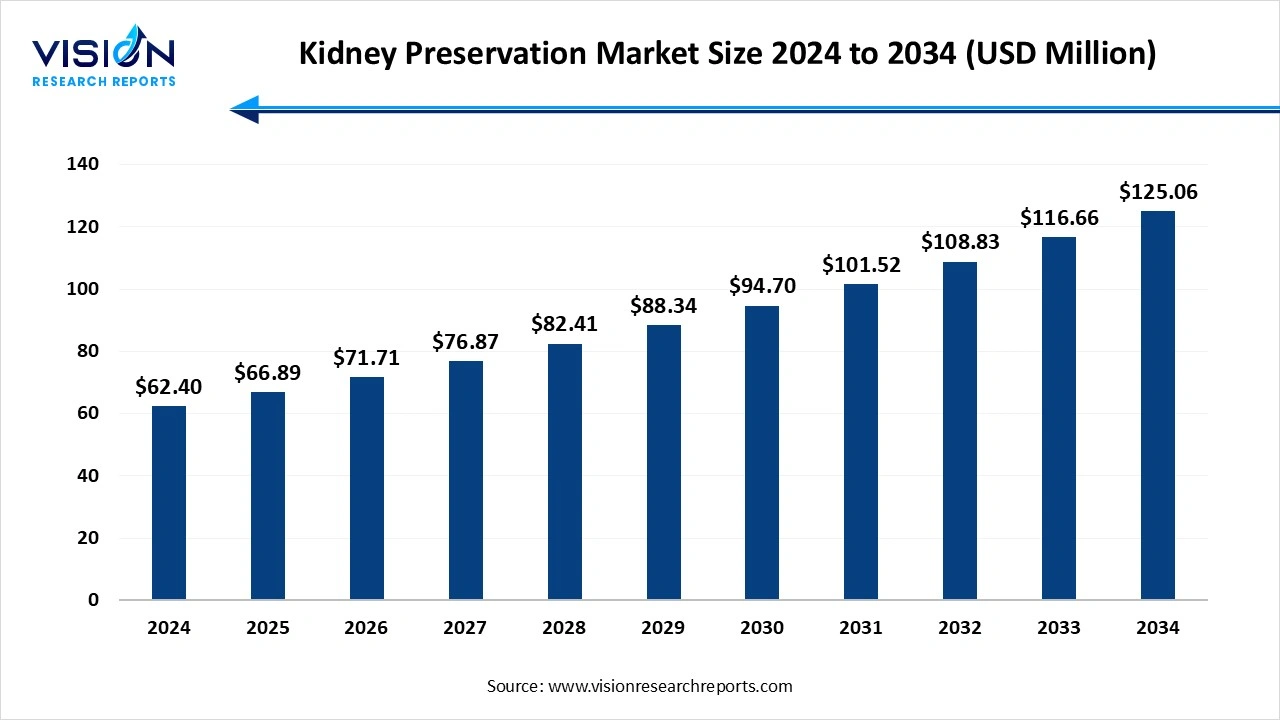

The global kidney preservation market size stood at USD 62.40 million in 2024 and is estimated to reach USD 66.89 million in 2025. It is projected to surge past USD 125.06 million by 2034, registering a robust CAGR of 7.2% from 2025 to 2034. The rising prevalence of kidney diseases, the increasing aging population, and the growing demand for organ donation and transplants.

Kidney preservation is defined as a medical process of maintaining the viability of a kidney after it has been removed from a donor and before it is transplanted into a recipient. The primary goal is to minimize cellular damage caused by ischemia, which is the lack of blood flow and oxygen, during the time the organ is outside the body. Effective preservation is crucial for a successful transplant, as it affects both short-term and long-term graft function and survival. The global kidney preservation market growth is driven by the successful public health campaigns and government initiatives promoting organ donation, which have expanded the potential donor pool, increasing the number of kidneys available for transplantation. Technological innovation, an aging population, and the rising prevalence of kidney diseases drive the market growth.

The rising rate of kidney disease and end-stage renal disease is driving the market. Conditions like diabetes and hypertension are major causes of kidney failure and are becoming more common worldwide. For example, the World Health Organization projects a significant rise in the global elderly population, which is more susceptible to organ dysfunction. The growing transplant volume fuels the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 62.40 million |

| Revenue Forecast by 2034 | USD 125.06 million |

| Growth rate from 2025 to 2034 | CAGR of 7.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Organ Recovery Systems, XVIVO Perfusion, Bridge to Life Ltd., Paragonix Technologies, Baxter International Inc., Terumo Corporation, Medtronic plc, Fresenius Medical Care AG & Co. KGaA, CryoLife Inc. |

The pharmaceutical biotechnology companies are investing in clinical trials, regulatory approvals, and production scaling to bring advanced organ preservation technologies to market. The government prioritizes enhancing healthcare infrastructure to deliver more comprehensive medical services. The increasing number of healthcare facilities capable of managing brain-dead patients as viable organ donors.

The organ transplant and the advanced preservation solutions and techniques used can be hindered for some patients and healthcare systems. The kidney transplantation and associated preservation techniques involve substantial costs for advanced preservation technologies, skilled personnel, and post-transplant care. These costs can limit access, particularly in low-resource areas.

The North America kidney preservation market led the global market, capturing 38% share of the revenue in 2024. The region has well-developed healthcare facilities and robust organ transplantation programs; significant burdens of chronic kidney diseases and other chronic conditions drive the demand for organ transplantation. The region is a leader in adopting and innovating advanced preservation technologies, such as machine perfusion. Newer methods like hypothermic and normothermic machine perfusion are gaining traction over the traditional static cold storage (SCS), offering improved outcomes for marginal or extended-criteria donors.

United States Kidney Preservation Market Trends

The increasing prevalence of chronic kidney disease (CKD) and ESRD is fueling demand for transplants and effective preservation methods. More than 1 in 7 American adults has CKD, and approximately 131,000 are newly diagnosed with kidney failure each year, and about 815,000 Americans are living with kidney failure. Innovations in machine perfusion, such as hypothermic (HMP) and normothermic (NMP) perfusion, are extending organ viability, improving outcomes for marginal donors, and expanding the donor pool. The number of kidney transplants in the U.S. continues to increase, with over 25,000 performed in 2022 and more than 27,000 in 2023. This rise directly boosts the demand for preservation solutions and devices. (Source: American Kidney fund)

Asia Pacific expects significant growth in the Kidney Preservation market during the forecast period. The increase in chronic kidney disease and a large aging population. Investments in advanced preservation technologies and expanding healthcare infrastructure are enabling more transplants. Supportive governmental initiatives and rising public awareness of organ donation are also fueling market expansion. Overall, a rising patient pool combined with improving medical and institutional capabilities is driving robust market growth.

Why did the University of Wisconsin (UW) Solution Segment Dominate the Kidney Preservation Market?

The university of wisconsin (UW) solution segment held the dominant market share, representing 76% of the market in 2024. The first preservation fluid to significantly improve transplant outcomes and extend storage time. Its superior, intracellular-mimicking composition offered greater protection against cell damage during cold storage than older solutions like Euro-Collins. The UW solution's success, proven in clinical trials, made it the "gold standard" for abdominal organs and fostered its widespread adoption for decades. This market leadership was solidified by its ability to facilitate broader organ-sharing networks.

The Institute Georges Lopez (IGL-1) solution segment is the fastest-growing in the Kidney Preservation market during the forecast period. According to the National Library of Medicine, the effectiveness of IGL-1 preservation solution in kidney and pancreas transplantation has been found to have insufficient clinical data for definitive conclusions on its long-term efficacy compared to solutions like UW. While limited retrospective studies and case series showed acceptable early outcomes for both kidney and simultaneous kidney-pancreas transplants with IGL-1, larger, well-designed clinical trials are needed to assess its long-term benefits or equivalence, particularly given the potential advantages of IGL-1's composition, such as lower viscosity and different impermeant agents.

How the Normothermic Machine Perfusion (NMP) Segment hold the Largest Share in the Kidney Preservation Market?

The normothermic machine perfusion (NMP) segment held the largest revenue share in the kidney preservation market in 2024. The ability to actively resuscitate donor kidneys, unlike passive cold storage. It allows for a real-time assessment of organ viability before transplantation, improving outcomes and reducing organ discard rates. NMP is particularly effective for marginal donor organs from older or high-risk donors, expanding the overall donor pool. By mimicking physiological conditions, NMP provides a platform for both reconditioning damaged organs and delivering novel therapeutic agents.

The static cold storage segment is experiencing the fastest growth in the market during the forecast period. According to naturemedicine, the traditional and most widely used method for kidney preservation involves flushing with a cold solution like the University of Wisconsin (UW) solution and storing on ice to slow metabolic processes. SCS is favored for its simplicity and cost-effectiveness, offering proven reliability for preserving high-quality kidneys over short durations despite limitations in longer preservation times compared to modern techniques.

How the Living Donors Segment hold the Largest Share in the Kidney Preservation Market?

The living donors segment held the largest revenue share in the kidney preservation market in 2024. The significantly better recipient outcomes, including longer graft survival and lower rejection rates. Living donor kidneys are also of higher quality, having less damage than deceased donor organs, and can be transplanted immediately through a planned procedure. This contrasts with deceased donor organs, which have longer and less predictable preservation and waiting times. As awareness and surgical techniques improve, living donation is increasingly seen as the optimal treatment option for end-stage renal disease.

The donation after circulatory death segment is experiencing the fastest growth in the market during the forecast period. The increase in the supply of transplantable kidneys, advances in organ preservation technology, especially the rise of techniques like normothermic machine perfusion (NMP) and hypothermic machine perfusion, have significantly improved the viability of DCD kidneys. Growing awareness about DCD within the medical community and among potential donor families, coupled with improved guidelines and protocols for DCD donation, is leading to a higher acceptance and utilization rate of DCD kidneys. Expanding the scope to extended criteria donors and comparable long-term outcomes fuels the market growth.

How the Transplantation Centers and Hospitals Segment hold the Largest Share in the Kidney Preservation Market?

The transplant centers and hospitals segment held the largest revenue share at 44% in 2024. These facilities are the ultimate destination for donor kidneys and the location where transplantation surgeries take place. They possess the necessary infrastructure, including specialized surgical teams, advanced equipment, and post-operative care units for successful kidney transplants. They are integrating innovative hypothermic and normothermic perfusion systems, along with novel preservation solutions with optimized chemical compositions to enhance organ viability and extend preservation times.

The organ procurement organization (OPOs) segment is experiencing the fastest growth in the market during the forecast period. The growing awareness and rising rate of organ donation registration directly contribute to a larger volume of kidneys available for transplantation, which expands the operational intensity of OPOs. Rising adoption of new preservation technologies to improve the viability of donated kidneys and decrease cold ischemia. Advancements in preservation have made DCD kidneys more viable, improving their post-transplant outcomes despite the initial warm ischemia time.

By Preservation Solution

By Technique

By Donor Type

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Kidney Preservation Market

5.1. COVID-19 Landscape: Kidney Preservation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Kidney Preservation Market, By Preservation Solution

8.1. Kidney Preservation Market, by Preservation Solution

8.1.1. University of Wisconsin (UW)

8.1.1.1. Market Revenue and Forecast

8.1.2. Histidin-Tryptophan-Ketoglutarate (HTK) Solution

8.1.2.1. Market Revenue and Forecast

8.1.3. Celsior Solution

8.1.3.1. Market Revenue and Forecast

8.1.4. Hypertonic Citrate Adenine (HC-A) Solution

8.1.4.1. Market Revenue and Forecast

8.1.5. Institute Georges Lopez (IGL-1) Solution

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Kidney Preservation Market, By Technique

9.1. Kidney Preservation Market, by Technique

9.1.1. Static Cold Storage

9.1.1.1. Market Revenue and Forecast

9.1.2. Hypothermic Machine Perfusion

9.1.2.1. Market Revenue and Forecast

9.1.3. Normothermic Machine Perfusion

9.1.3.1. Market Revenue and Forecast

9.1.4. Other

9.1.4.1. Market Revenue and Forecast

9.1.5. Opthalmology

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Kidney Preservation Market, By Donor Type

10.1. Kidney Preservation Market, by Donor Type

10.1.1. Standard Criteria Donor (SCD)

10.1.1.1. Market Revenue and Forecast

10.1.2. Expanded Criteria Donor (ECD)

10.1.2.1. Market Revenue and Forecast

10.1.3. Donation after Brain Death (DBD)

10.1.3.1. Market Revenue and Forecast

10.1.4. Donation after Circulatory Death (DCD)

10.1.4.1. Market Revenue and Forecast

10.1.5. Living Donor

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Kidney Preservation Market, By End Use

11.1. Kidney Preservation Market, by End Use

11.1.1. Transplant Centers / Hospitals

11.1.1.1. Market Revenue and Forecast

11.1.2. Organ Procurement Organizations (OPOs)

11.1.2.1. Market Revenue and Forecast

11.1.3. Others

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Kidney Preservation Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Preservation Solution

12.1.2. Market Revenue and Forecast, by Technique

12.1.3. Market Revenue and Forecast, by Donor Type

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Preservation Solution

12.1.5.2. Market Revenue and Forecast, by Technique

12.1.5.3. Market Revenue and Forecast, by Donor Type

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Preservation Solution

12.1.6.2. Market Revenue and Forecast, by Technique

12.1.6.3. Market Revenue and Forecast, by Donor Type

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Preservation Solution

12.2.2. Market Revenue and Forecast, by Technique

12.2.3. Market Revenue and Forecast, by Donor Type

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Preservation Solution

12.2.5.2. Market Revenue and Forecast, by Technique

12.2.5.3. Market Revenue and Forecast, by Donor Type

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Preservation Solution

12.2.6.2. Market Revenue and Forecast, by Technique

12.2.6.3. Market Revenue and Forecast, by Donor Type

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Preservation Solution

12.2.7.2. Market Revenue and Forecast, by Technique

12.2.7.3. Market Revenue and Forecast, by Donor Type

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Preservation Solution

12.2.8.2. Market Revenue and Forecast, by Technique

12.2.8.3. Market Revenue and Forecast, by Donor Type

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Preservation Solution

12.3.2. Market Revenue and Forecast, by Technique

12.3.3. Market Revenue and Forecast, by Donor Type

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Preservation Solution

12.3.5.2. Market Revenue and Forecast, by Technique

12.3.5.3. Market Revenue and Forecast, by Donor Type

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Preservation Solution

12.3.6.2. Market Revenue and Forecast, by Technique

12.3.6.3. Market Revenue and Forecast, by Donor Type

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Preservation Solution

12.3.7.2. Market Revenue and Forecast, by Technique

12.3.7.3. Market Revenue and Forecast, by Donor Type

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Preservation Solution

12.3.8.2. Market Revenue and Forecast, by Technique

12.3.8.3. Market Revenue and Forecast, by Donor Type

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Preservation Solution

12.4.2. Market Revenue and Forecast, by Technique

12.4.3. Market Revenue and Forecast, by Donor Type

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Preservation Solution

12.4.5.2. Market Revenue and Forecast, by Technique

12.4.5.3. Market Revenue and Forecast, by Donor Type

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Preservation Solution

12.4.6.2. Market Revenue and Forecast, by Technique

12.4.6.3. Market Revenue and Forecast, by Donor Type

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Preservation Solution

12.4.7.2. Market Revenue and Forecast, by Technique

12.4.7.3. Market Revenue and Forecast, by Donor Type

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Preservation Solution

12.4.8.2. Market Revenue and Forecast, by Technique

12.4.8.3. Market Revenue and Forecast, by Donor Type

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Preservation Solution

12.5.2. Market Revenue and Forecast, by Technique

12.5.3. Market Revenue and Forecast, by Donor Type

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Preservation Solution

12.5.5.2. Market Revenue and Forecast, by Technique

12.5.5.3. Market Revenue and Forecast, by Donor Type

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Preservation Solution

12.5.6.2. Market Revenue and Forecast, by Technique

12.5.6.3. Market Revenue and Forecast, by Donor Type

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Organ Recovery Systems

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. XVIVO Perfusion

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Bridge to Life Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Paragonix Technologies

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Baxter International Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Terumo Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Medtronic plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Fresenius Medical Care AG & Co. KGaA

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. CryoLife Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others