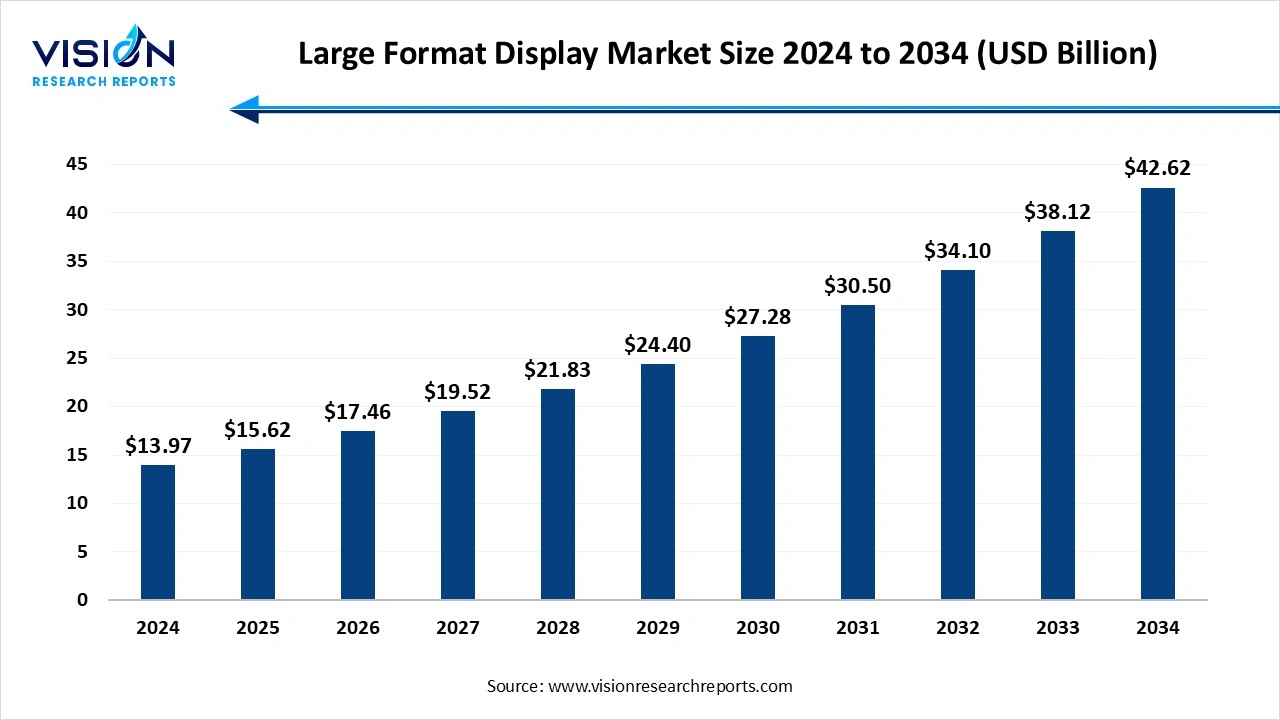

The global large format display market size was reached at around USD 13.97 billion in 2024 and it is projected to hit around USD 42.62 billion by 2034, growing at a CAGR of 11.80% from 2025 to 2034.

The large format display market is experiencing steady growth, driven by rising demand for advanced visual communication in sectors like retail, corporate, education, healthcare, and transportation. These displays, known for their high-resolution, wide viewing angles, and scalability, are widely used for digital signage, video walls, and real-time information broadcasting. As businesses continue to enhance customer engagement through digital transformation strategies, the adoption of large format displays is expanding rapidly.

One of the key growth factors driving the large format display market is the increasing adoption of digital signage across commercial sectors such as retail, hospitality, and transportation. Businesses are investing in large format displays to deliver immersive customer experiences, promote dynamic advertising, and enable real-time content updates. Additionally, the expansion of smart cities and public infrastructure projects has created strong demand for high-visibility display solutions for traffic management, information kiosks, and surveillance systems.

Technological innovations have further accelerated market growth. Advancements such as ultra-HD (4K and 8K) resolution, OLED and micro-LED technology, and interactive touch-enabled displays are enhancing visual quality and user engagement. Moreover, declining display panel prices and improvements in energy efficiency have made LFDs more cost-effective for both indoor and outdoor applications.

The large format display market is witnessing a notable shift toward ultra-high-definition (UHD) displays, including 4K and 8K resolutions, as businesses seek sharper visuals and more impactful presentations. There’s a growing demand for interactive and touch-enabled displays, particularly in the education and corporate sectors where collaboration and engagement are critical. Video walls made up of bezel-less or ultra-thin bezel displays are also gaining popularity for control rooms, broadcast studios, and commercial advertising, enabling a seamless and immersive viewing experience.

Another prominent trend is the rising use of LED-based and energy-efficient display technologies. LED-backlit LFDs are increasingly preferred for their brightness, durability, and lower power consumption. The market is also seeing a surge in outdoor and semi-outdoor applications, driven by smart city initiatives and transportation networks deploying large displays for digital signage, wayfinding, and public information.

One of the major challenges in the large format display market is the high cost associated with acquiring and installing advanced display systems. Technologies such as OLED, micro-LED, and ultra-HD displays offer superior visual quality but come with significant upfront investment, which can be a barrier for small and mid-sized businesses.

Another critical issue is the technical limitations and operational challenges faced in diverse environments. For instance, outdoor large format displays can suffer from visibility issues under direct sunlight and require weather-resistant hardware, which adds to complexity and cost. There is also increased pressure on manufacturers to ensure data security as these systems become more integrated with IoT and cloud networks.

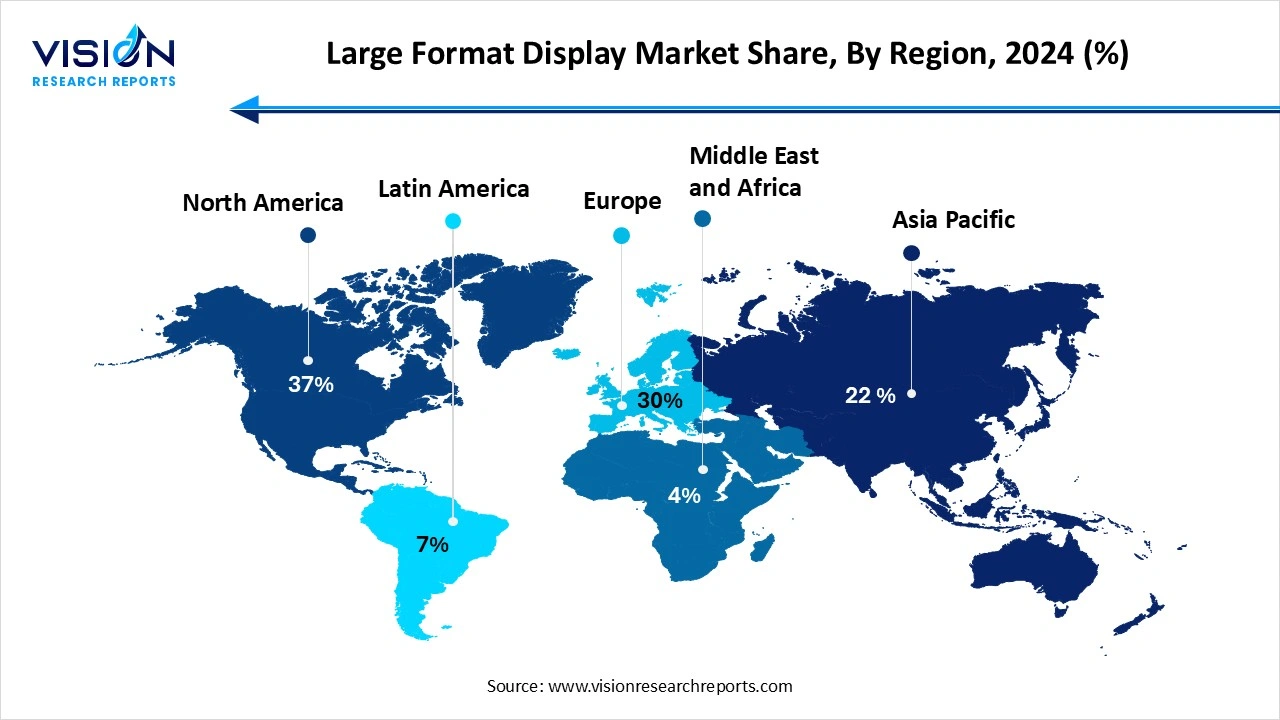

North America led the global large format display market, accounting for more than 37% of the total revenue share in 2024. The presence of major technology providers, a highly digitized business environment, and increasing investments in smart infrastructure contribute to the region’s robust demand. In the United States and Canada, large format displays are extensively used for digital signage, event broadcasting, and public information systems.

The Asia Pacific region is projected to experience the highest compound annual growth rate CAGR in the large format display market during the forecast period. Emerging economies such as China, India, and Southeast Asian countries are seeing a surge in retail digitization, transportation upgrades, and educational modernization all of which require advanced display technologies. China, in particular, stands out due to its strong manufacturing capabilities and domestic demand for large-scale display applications in public and commercial spaces.

The Asia Pacific region is projected to experience the highest compound annual growth rate CAGR in the large format display market during the forecast period. Emerging economies such as China, India, and Southeast Asian countries are seeing a surge in retail digitization, transportation upgrades, and educational modernization all of which require advanced display technologies. China, in particular, stands out due to its strong manufacturing capabilities and domestic demand for large-scale display applications in public and commercial spaces.

The standalone display segment dominated the market, contributing more than 48% to the global revenue in 2024. These displays are widely used across sectors such as retail, education, hospitality, and corporate offices for applications like digital signage, presentations, and information dissemination. Standalone large format displays are available in various sizes and resolutions, making them suitable for both small indoor environments and large public spaces. Their plug-and-play functionality and minimal infrastructure requirements make them a preferred choice for businesses seeking efficient and cost-effective visual communication tools.

The video walls segment is anticipated to register a notable CAGR over the forecast period. Composed of multiple display panels arranged in a seamless grid, video walls are commonly used in control rooms, airports, shopping malls, sports arenas, and broadcast studios. These systems provide a high level of scalability, allowing organizations to customize screen dimensions and layouts based on specific spatial and visual requirements. Technological improvements, such as ultra-narrow bezels, 4K/8K resolution support, and real-time content synchronization, have made video walls more dynamic and engaging.

The LED segment held the largest share of the market revenue in 2024. LED displays are particularly favored in both indoor and outdoor applications where visibility and durability are essential. Their modular design allows for seamless scalability, making them ideal for use in large venues such as stadiums, transportation hubs, and retail environments. The ability of LED displays to maintain clarity even under direct sunlight, combined with advancements in pixel pitch and color accuracy, has significantly improved their visual performance.

The OLED segment is expected to register the fastest CAGR during the forecast period. OLED displays offer deep blacks, high contrast ratios, and wide viewing angles, providing a more immersive visual experience than traditional backlit displays. These characteristics make OLEDs especially appealing in premium indoor environments such as luxury retail stores, corporate lobbies, art galleries, and high-end hospitality spaces where design and aesthetics are as important as functionality.

The 32‚ÄĚ‚Äď65‚ÄĚ segment dominated the market by contributing the highest share of revenue in 2024. These medium-sized displays offer the perfect balance between visibility and space efficiency, making them ideal for retail signage, educational presentations, conference rooms, and transportation hubs. Their manageable dimensions allow for easy installation in confined indoor environments while still providing clear, high-resolution visuals for effective communication.

The 66‚ÄĚ‚Äď100‚ÄĚ segment is projected to record the highest CAGR during the forecast period. These large-format displays are particularly favored in settings where audience engagement and impact are paramount, such as in auditoriums, large retail outlets, command centers, and corporate lobbies. Their expansive screen real estate allows for detailed content delivery, data visualization, and dynamic advertising that can be viewed clearly from a distance. With technological advancements making larger displays thinner, lighter, and more energy-efficient, the adoption of 66‚ÄĚ‚Äď100‚ÄĚ models is rising steadily.

The retail segment captured the highest share of market revenue in 2024. By leveraging high-resolution visuals and real-time content updates, brands can attract attention, influence purchase decisions, and create immersive shopping environments. The flexibility of large format displays allows them to be integrated seamlessly into storefronts, checkout areas, and promotional zones, making them valuable assets in both flagship stores and smaller retail outlets.

The transportation segment is projected to experience substantial CAGR growth throughout the forecast period. Airports, train stations, bus terminals, and metro systems utilize these displays for wayfinding, schedule updates, safety notifications, and emergency alerts. Their ability to display dynamic content to large crowds enhances operational efficiency and streamlines passenger flow. With the integration of IoT and smart city infrastructure, transportation authorities are increasingly turning to connected display networks that offer centralized control and remote management.

By Display Type

By Technology

By Display Size

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Large Format Display Market

5.1. COVID-19 Landscape: Large Format Display Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Large Format Display Market, By Display Type

8.1. Large Format Display Market, by Display Type

8.1.1. Video Walls

8.1.1.1. Market Revenue and Forecast

8.1.2. Standalone Displays

8.1.2.1. Market Revenue and Forecast

8.1.3. Interactive Displays

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Large Format Display Market, By Technology

9.1. Large Format Display Market, by Technology

9.1.1. LCD

9.1.1.1. Market Revenue and Forecast

9.1.2. LED

9.1.2.1. Market Revenue and Forecast

9.1.3. OLED

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Large Format Display Market, By Display Size

10.1. Large Format Display Market, by Display Size

10.1.1. 32”-65”

10.1.1.1. Market Revenue and Forecast

10.1.2. 66”-100”

10.1.2.1. Market Revenue and Forecast

10.1.3. 100” above

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Large Format Display Market, By End Use

11.1. Large Format Display Market, by End Use

11.1.1. Retail & Hospitality

11.1.1.1. Market Revenue and Forecast

11.1.2. Hospitality

11.1.2.1. Market Revenue and Forecast

11.1.3. Entertainment

11.1.3.1. Market Revenue and Forecast

11.1.4. Stadiums & Playgrounds

11.1.4.1. Market Revenue and Forecast

11.1.5. Corporate

11.1.5.1. Market Revenue and Forecast

11.1.6. Banking

11.1.6.1. Market Revenue and Forecast

11.1.7. Healthcare

11.1.7.1. Market Revenue and Forecast

11.1.8. Transporation

11.1.8.1. Market Revenue and Forecast

Chapter 12. Global Large Format Display Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Display Type

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Display Size

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Display Type

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Display Size

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Display Type

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Display Size

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Display Type

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Display Size

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Display Type

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Display Size

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Display Type

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Display Size

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Display Type

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Display Size

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Display Type

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Display Size

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Display Type

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Display Size

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Display Type

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Display Size

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Display Type

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Display Size

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Display Type

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Display Size

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Display Type

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Display Size

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Display Type

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Display Size

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Display Type

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Display Size

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Display Type

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Display Size

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Display Type

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Display Size

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Display Type

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Display Size

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Display Type

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Display Size

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Display Type

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Display Size

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Display Type

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Display Size

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Samsung Electronics Co., Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. LG Electronics Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Sharp NEC Display Solutions Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sony Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Panasonic Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Barco NV

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Sharp Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. ViewSonic Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. BenQ Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others