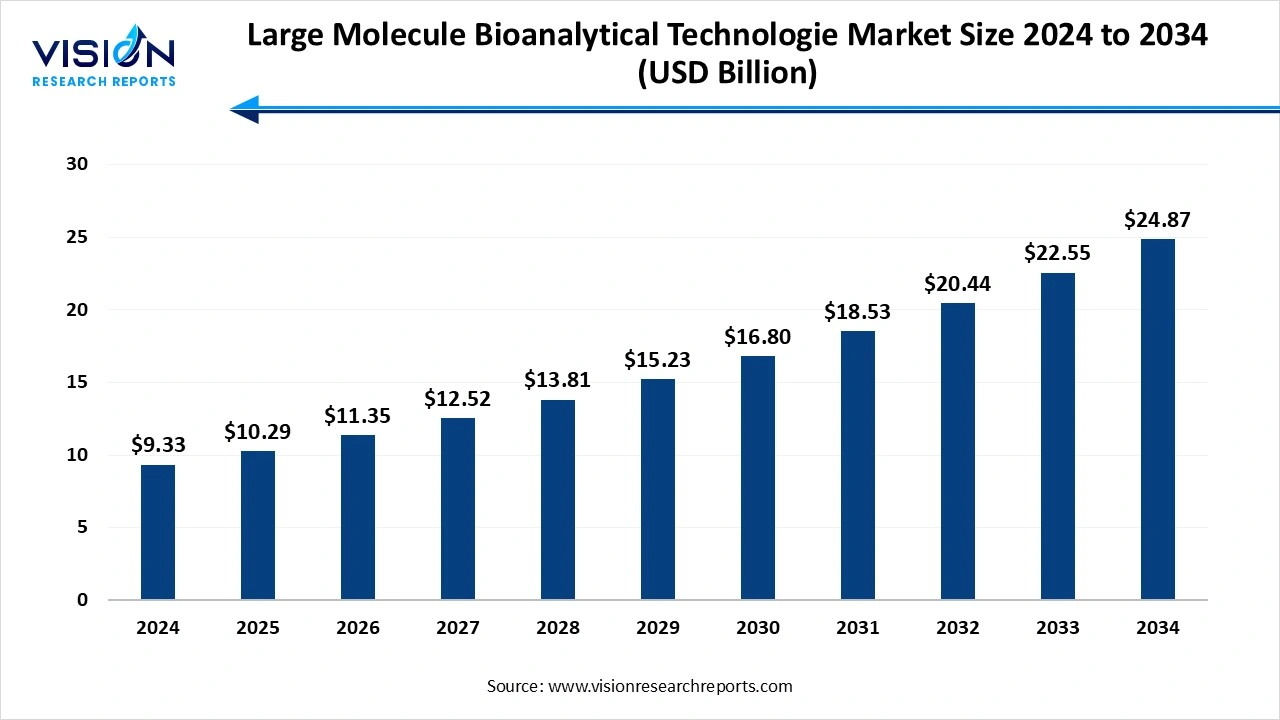

The global large molecule bioanalytical technologies market size was reached at around USD 9.33 billion in 2024 and it is projected to hit around USD 24.87 billion by 2034, growing at a CAGR of 10.30% from 2025 to 2034.

The large molecule bioanalytical technologies market is a critical segment within the pharmaceutical and biotechnology industries, supporting the development and validation of biologics, including monoclonal antibodies, vaccines, and recombinant proteins. These technologies are essential for assessing the pharmacokinetics, pharmacodynamics, and immunogenicity of biologic drugs throughout preclinical and clinical stages. As biologics continue to dominate drug pipelines due to their targeted efficacy and therapeutic potential, the demand for precise, sensitive, and robust analytical solutions has surged.

Advancements in analytical platforms such as mass spectrometry, ligand-binding assays, and hybrid LC-MS/MS techniques are shaping the market's evolution, enabling researchers to analyze complex biomolecules with greater accuracy and throughput. Additionally, regulatory authorities are placing increasing emphasis on bioanalytical method validation and standardization, driving the adoption of high-quality technologies and automation across labs.

The growth of the large molecule bioanalytical technologies market is primarily driven by the increasing demand for biologics and biosimilars across various therapeutic areas such as oncology, autoimmune diseases, and infectious diseases. As biologic drugs are more complex than small molecules, they require specialized analytical methods to ensure accuracy in measuring efficacy, safety, and immunogenicity. This complexity has led to the widespread adoption of advanced technologies such as ligand-binding assays, mass spectrometry, and chromatography.]

Another key factor contributing to market growth is the evolving regulatory landscape that emphasizes stringent validation and standardization of bioanalytical methods. Regulatory agencies like the FDA and EMA have introduced specific guidance for bioanalytical method development, encouraging pharmaceutical and biotech companies to invest in sophisticated, compliant technologies.

One of the most prominent trends in the large molecule bioanalytical technologies market is the increasing integration of hybrid analytical techniques. Technologies such as ligand-binding assays combined with mass spectrometry (LBA-MS) are gaining popularity for their enhanced sensitivity, specificity, and ability to handle complex biological matrices. These hybrid platforms offer improved detection capabilities for large molecules like therapeutic proteins and antibodies, which are often challenging to analyze using traditional methods alone.

Another emerging trend is the rise of automation and digitalization in bioanalytical laboratories. High-throughput systems, robotic sample handling, and data analytics tools are streamlining workflows and reducing turnaround times, making it possible to manage large volumes of clinical samples more efficiently. Additionally, artificial intelligence and machine learning are being explored to enhance data interpretation, method development, and predictive modeling in complex biologic assays.

One of the major challenges faced by the large molecule bioanalytical technologies market is the inherent complexity of biologic drugs. Unlike small molecules, large molecules such as monoclonal antibodies, fusion proteins, and vaccines exhibit high molecular weight, structural variability, and complex pharmacokinetics. These properties demand sophisticated analytical methods and highly trained personnel to ensure accurate quantification and characterization.

Another significant challenge lies in the evolving regulatory expectations and the need for strict compliance with bioanalytical guidelines. Regulatory bodies such as the FDA and EMA mandate rigorous validation protocols and documentation, which can be difficult to maintain consistently, especially when working with novel therapeutic formats or in early development phases. Additionally, standardizing analytical methods across global facilities and maintaining reproducibility in outsourced CRO partnerships can further complicate the process.

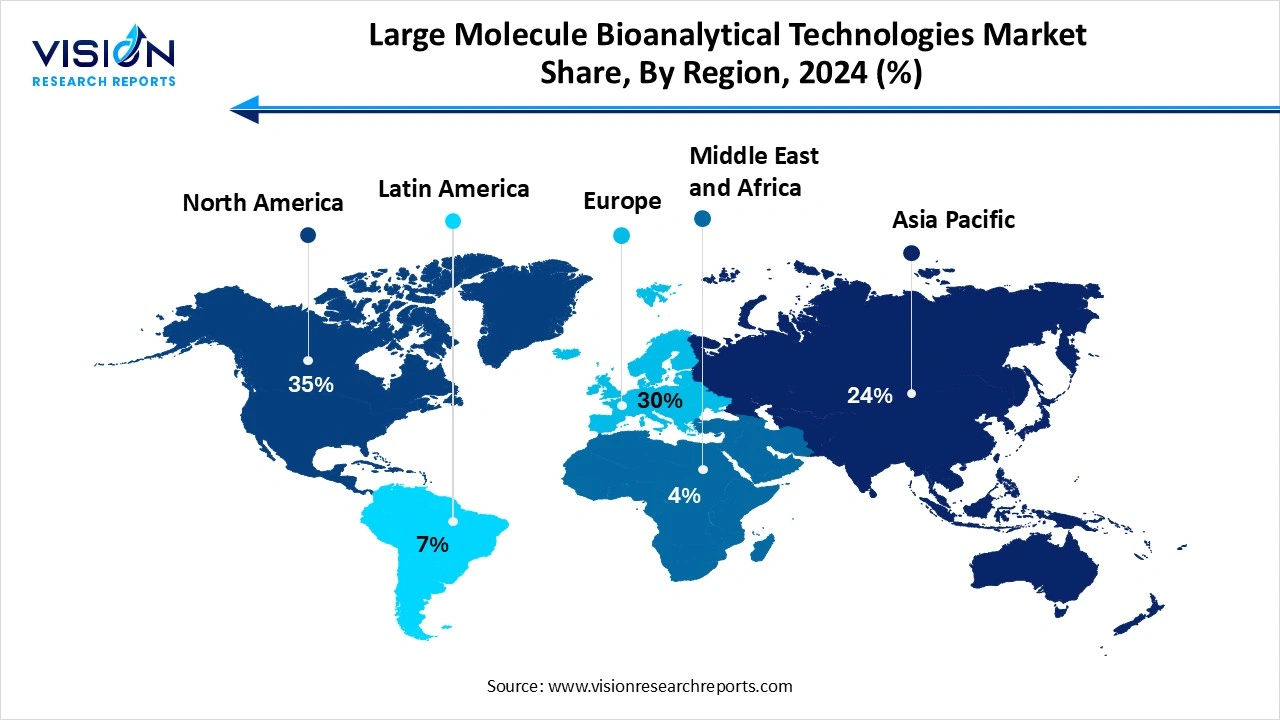

North America accounted for the largest revenue share of 35% in 2024, the large molecule bioanalytical technologies market. This dominance is largely driven by the presence of leading pharmaceutical and biotechnology companies, advanced research infrastructure, and a strong regulatory framework that supports innovation in biologics development. The U.S., in particular, is a hub for clinical trials and biopharmaceutical R&D, which fuels the demand for sophisticated bioanalytical platforms and services. Additionally, strategic collaborations between academia and industry, coupled with government funding for biologics and biosimilar research, contribute to the continued growth of the market in this region.

The Asia-Pacific large molecule bioanalytical technologies market is projected to witness the fastest growth, expanding at a CAGR of 11.8% from 2025 to 2034. Asia-Pacific region is witnessing the fastest growth rate, propelled by increasing clinical research activities, expanding pharmaceutical manufacturing capacity, and a rising demand for cost-effective biologics. Countries like China, India, and South Korea are investing heavily in healthcare infrastructure and biotechnological advancements, positioning themselves as emerging leaders in the global bioanalytical space.

The Asia-Pacific large molecule bioanalytical technologies market is projected to witness the fastest growth, expanding at a CAGR of 11.8% from 2025 to 2034. Asia-Pacific region is witnessing the fastest growth rate, propelled by increasing clinical research activities, expanding pharmaceutical manufacturing capacity, and a rising demand for cost-effective biologics. Countries like China, India, and South Korea are investing heavily in healthcare infrastructure and biotechnological advancements, positioning themselves as emerging leaders in the global bioanalytical space.

The product segment led the market, capturing the highest revenue share of 72% in 2024. Instruments such as liquid chromatography systems, mass spectrometers, and immunoassay analyzers are central to laboratories conducting bioanalysis of large molecules. Alongside these, the availability of high-quality reagents and consumables such as antibodies, detection substrates, and assay buffers enhances the precision and reproducibility of analytical procedures.

The services segment is expected to be the fastest-growing segment, recording a CAGR of 10.9% from 2025 to 2034. These services encompass method development, validation, sample analysis, and data interpretation tailored to support various phases of drug development. With increasing complexity in biologics and growing regulatory scrutiny, service providers are investing in advanced analytical platforms and skilled personnel to meet the rising expectations of clients.

The biologics segment captured the highest revenue share in 2024. Biologics, including monoclonal antibodies, therapeutic proteins, and vaccines, require precise and sensitive analytical tools to assess their pharmacokinetics, immunogenicity, and bioavailability. As pharmaceutical companies focus heavily on the development of biologic drugs, there is a parallel rise in the need for robust bioanalytical methods to support regulatory submissions and ensure product efficacy and safety.

The cell and gene therapy segment is projected to register the fastest CAGR over the forecast period. These therapies involve highly complex biological materials that demand advanced analytical approaches to monitor vector performance, transgene expression, and immune responses. The bioanalytical assessment of cell and gene therapies requires integration of novel tools such as qPCR, digital PCR, and next-generation sequencing alongside traditional bioanalytical platforms.

By Products & Services

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Large Molecule Bioanalytical Technologies Market

5.1. COVID-19 Landscape: Large Molecule Bioanalytical Technologies r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Large Molecule Bioanalytical Technologies Market, By Products & Services

8.1. Large Molecule Bioanalytical Technologies Market, by Products & Services, 2024-2033

8.1.1. Product

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables & Accessories

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Instruments

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Reagents & Kits

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Service

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Large Molecule Bioanalytical Technologies Market, By Application

9.1. Large Molecule Bioanalytical Technologies Market, by Application, 2024-2033

9.1.1. Biologics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oligonucleotide Derived Drugs & Molecules

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Viral Vector

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cell & Gene Therapy

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Nanoparticles & Polymers

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Products & Services (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Agilent Technologies, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bio-Rad Laboratories, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Charles River Laboratories International, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Laboratory Corporation of America Holdings (Labcorp)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. SGS SA

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ICON plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Syneos Health, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. WuXi AppTec

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Eurofins Scientific SE

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others