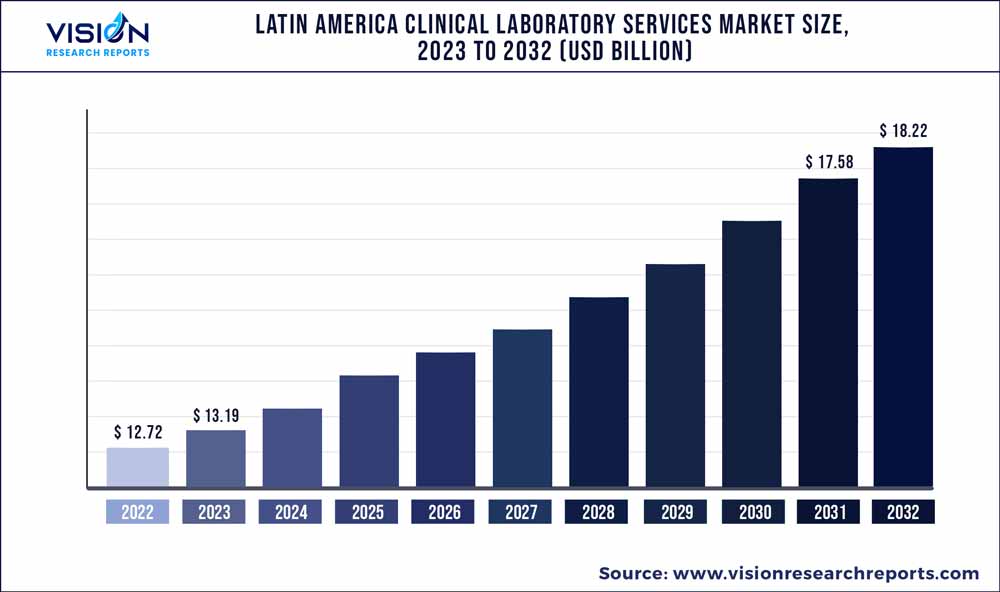

The Latin America clinical laboratory services market was estimated at USD 12.72 billion in 2022 and it is expected to surpass around USD 18.22 billion by 2032, poised to grow at a CAGR of 3.66% from 2023 to 2032.

Key Pointers

Report Scope of the Latin America clinical laboratory services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 12.72 billion |

| Revenue Forecast by 2032 | USD 18.22 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.66% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Abbott; OPKO Health, Inc.; Fresenius Medical Care AG & Co. KgaA; QIAGEN; Quest Diagnostics Incorporated; Siemens Healthcare GmbH; Charles River Laboratories; Laboratory Corporation of America Holdings (LabCorp); DaVita Inc.; Myriad Genetics, Inc.; Genomic Health (Exact Sciences Corporation); DASA; Sysmex Corporation |

The increasing burden of chronic diseases, technological advancements in the field of clinical testing, and growing demand for early diagnostic tests are expected to drive the market. Moreover, rapid advancements in data management, automation, and sample preparation due to growing volumes of testing samples are anticipated to boost market growth during the forecast period.For instance, in February 2020, MGI expanded the availability of its laboratory automation and DNA sequencing products in Latin America with top distributors in Brazil, Peru, Ecuador, Argentina, Mexico, and Colombia.

Advancements in laboratory testing technology through incremental and breakthrough developments are high-impact rendering drivers of the Latin America clinical laboratory services market. Incremental changes are introduced to make the testing processes simpler and enhance their efficiency. The introduction of novel solutions to maximize efficiency and minimize errors is anticipated to further boost the market. For instance, in September 2019, SCIEX received ANVISA approval for a suite of medical devices, including QTRAP 4500MD LC-MS/MS, Topaz and Citrine systems, SCIEX Triple Quad 4500MD LC-MS/MS, which is anticipated to enhance the quality standards of diagnostic testing

Due to the COVID-19 pandemic, there has been an increase in the approval of tests for diagnosis of the novel coronavirus. In February 2020, PAHO took efforts to ensure that countries in Latin America are prepared for COVID-19 laboratory diagnosis. This step was taken to ensure the timely response and identification of the disease in the region. Moreover, during this time, PAHO in collaboration with Fiocruz and the Ministry of Health led training in Brazil for nine countries including Argentina, Chile, Bolivia, Panama, Colombia, Paraguay, Ecuador, Uruguay, and Peru to enhance the preparedness for the COVID-19 diagnosis.

Personalized medicine involves tailoring medical treatments to individual patients based on their genetic information, lifestyle factors, and other personal data. Clinical laboratory services will play a crucial role in providing the genetic testing and analysis necessary for personalized medicine. For instance, genetic testing can help determine the optimal dosage of a medication for a particular patient based on their genetic makeup.

Unclear regulatory frameworks/guidelines for diagnostics in developing economies are anticipated to restrain the Latin America clinical laboratory services market growth. The presence of such discrete and uncertain scenarios in regulations for molecular diagnostic products can create confusion among manufacturers regarding commercialization. However, a number of initiatives are being undertaken in the region to enhance the acceptability and adoption of clinical laboratory tests and solutions with developed regulatory scenario.

Test Type Insights

The clinical chemistry segment accounted for the largest revenue share of 48% in 2022 owing to the presence of several clinical chemistry tests involved in pathology analysis of body fluids, including analysis of plasma, serum, urine, and other body fluids. In addition, the introduction of new technologies, alternative sampling methods, and the emergence of point-of-care testing methods are likely to further boost the Latin America clinical laboratory services market growth. In February 2020, Ortho Clinical Diagnostics launched a clinical chemistry system to complete its integrated Vitros XT line, designed to cover most typical lab tests.

The human and tumor genetics tests segment is expected to show the fastest growth during the forecast period. This can be attributed to rise in presence of intensive research activities on genetic and proteomic studies, in context of hereditary & gene-mutation-related disorders and rising demand for personalized medicine. Growing need for efficient tests in the early diagnosis of cancer and major infections is expected to drive the segment, primarily due to the precision and accuracy offered by genetic tests. Federal agencies such as the FDA, CMS, and FTC among others regulate these genetic tests.

Service Provider Insights

The hospital-based laboratories segment held the largest revenue share of the Latin America clinical laboratory services market of 54% in 2022. The growing number of outreach programs by hospitals, coupled with the high turnaround of patients suffering from complex and major diseases, is expected to drive the segment. Based on an article published in Forbes Magazine in May 2020, Hospital Israelita Albert Einstein of Brazil announced the development of a highly scalable type of COVID-19 test with the help of Varstation, a startup under the hospital’s incubation program.

The clinic-based laboratories segment is expected to show lucrative growth over the forecast period. One significant trend in the market is the adoption of Point-Of-Care Testing (POCT), which allows medical diagnostic testing to be performed at or near a patient's location. This trend has been driven by the benefits of POCT, such as faster turnaround time, reduced need for sample transportation, and improved patient outcomes. POCT has also been crucial amid the COVID-19 pandemic, with rapid antigen & molecular tests enabling widespread testing and early detection of infected individuals.

Application Insights

The bioanalytical and lab chemistry services segment accounted for the largest revenue share of 53% in 2022 attributed to the increasing number of investigational drugs undergoing clinical trials and the growing number of novel drug candidates being developed for clinical trials. The FDA (U.S.), ANVISA (Brazil), COFEPRIS (Mexico), ANMAT (Argentina), ISP (Chile), and other regulatory bodies provide bioanalytical method development & validation guidelines that help enforce the values required for reliable bioanalytical & lab chemistry methods. The Global Bioanalysis Consortium and other initiatives can help LATAM countries set up their guidelines and move forward more rationally.

The toxicology testing services segment is expected to grow at a significant rate. Toxicology testing is in high demand as most of the startups or smaller laboratories find it financially and clinically feasible. However, the confirmation of toxicity may require the use of advanced testing technologies. Larger laboratories that serve a broader population need to consider the turnaround time when outsourcing. This highlights the need of a cost-benefit analysis for labs considering advanced and confirmatory toxicology services. Moreover, Pharmacogenetic (PGx) testing can be performed to observe adverse drug reactions in individual patients. Therapeutic drug management can help optimize the dose of a therapeutic drug and is complementary to PGx testing

Latin America clinical laboratory services Market Segmentations:

By Test Type

By Service Provider

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Test Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Latin America Clinical Laboratory Services Market

5.1. COVID-19 Landscape: Latin America Clinical Laboratory Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Latin America Clinical Laboratory Services Market, By Test Type

8.1. Latin America Clinical Laboratory Services Market, by Test Type, 2023-2032

8.1.1 Human & Tumor Genetics

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Clinical Chemistry

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Medical Microbiology & Cytology

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Other Esoteric Tests

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Latin America Clinical Laboratory Services Market, By Service Provider

9.1. Latin America Clinical Laboratory Services Market, by Service Provider, 2023-2032

9.1.1. Hospital-Based Laboratories

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Stand-Alone Laboratories

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Clinic-Based Laboratories

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Latin America Clinical Laboratory Services Market, By Application

10.1. Latin America Clinical Laboratory Services Market, by Application, 2023-2032

10.1.1. Bioanalytical & Lab Chemistry Services

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Toxicology Testing Services

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Cell & Gene Therapy Related Services

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Drug Discovery & Development Related Services

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Preclinical & Clinical Trial Related Services

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Other Clinical Laboratory Services

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Latin America Clinical Laboratory Services Market, Regional Estimates and Trend Forecast

11.1. Latin America

11.1.1. Market Revenue and Forecast, by Test Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Service Provider (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Abbott

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. OPKO Health, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Fresenius Medical Care AG & Co. KgaA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. QIAGEN

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Quest Diagnostics Incorporated

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Siemens Healthcare GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Charles River Laboratories.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Laboratory Corporation of America Holdings (LabCorp)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. DaVita Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Myriad Genetics, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others