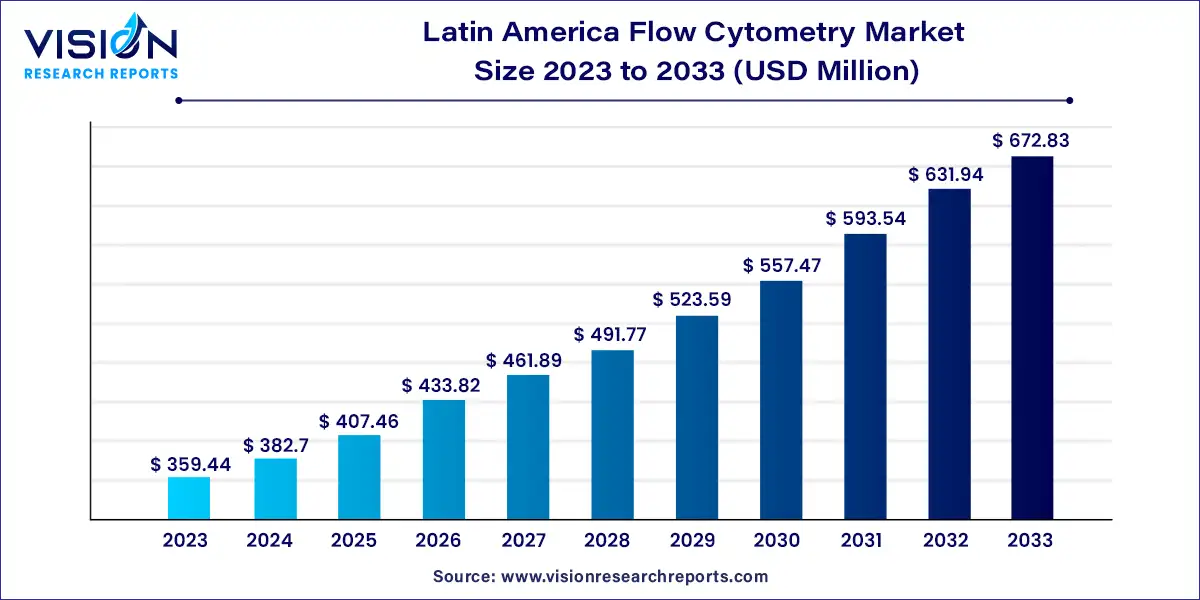

The Latin America flow cytometry market size was estimated at around USD 359.44 million in 2023 and it is projected to hit around USD 672.83 million by 2033, growing at a CAGR of 6.47% from 2024 to 2033.

The Latin America flow cytometry market presents a dynamic landscape marked by significant advancements and a burgeoning demand for cutting-edge technologies in life sciences research and clinical diagnostics. Flow cytometry, a technique enabling the analysis of cellular characteristics at the single-cell level, has gained prominence across the region for its versatility and applicability in diverse fields.

The growth of the Latin America flow cytometry market is driven by the expanding pharmaceutical and biotechnology sectors in the region serve as primary drivers, fostering a heightened demand for advanced analytical tools like flow cytometry. As research activities in life sciences gain momentum, the need for precise cellular analysis becomes increasingly apparent. The rising prevalence of chronic diseases in Latin America further amplifies the market's growth, prompting a surge in demand for sophisticated diagnostic solutions. Countries such as Brazil, Mexico, Argentina, and Colombia are emerging as pivotal contributors, boasting vibrant research ecosystems marked by collaborations between academic institutions and industry players. This collaborative approach not only fuels innovation but also enhances the adoption of flow cytometry across diverse applications.

| Report Coverage | Details |

| Market Size in 2023 | USD 359.44 million |

| Revenue Forecast by 2033 | USD 672.83 million |

| Growth rate from 2024 to 2033 | CAGR of 6.47% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The instrument segment held the largest market share of 37% in 2023. The segment’s dominance is attributed to the rising adoption of flow cytometers and an increasing focus on technological advancements. The rising research in the field of diagnostics to provide accurate diagnostics is propelling the growth of the overall market. In January 2023, BD (Becton, Dickinson and Company) introduced an innovative high-speed sorting technology that helps unlock advancements in the diagnosis of oncology, immunology, cell therapies, and other fields. The development of novel products provides enhanced accuracy, cost-effectiveness, and portability, enabling growth opportunities in the market.

The software segment is expected to show fastest growth rate over the forecast period. Flow cytometry software controls and captures data generated by cytometers, analyzes the information, and gives a statistical analysis of the results. The software is used in research for cell capture, data processing, and clinical diagnostics for disease diagnosis by analyzing patient samples. The growing prevalence of various target diseases and the primary focus of major players in the development of novel software is further propelling the market growth. In February 2023, Agilent Technologies Inc. announced the launch of NovoExpress software that enables integrated compliance tools for NovoCyte flow cytometer systems

The cell-based segment accounted for the largest revenue share of 79% in 2023 due to increasing awareness of the advantages and benefits of cell-based assays and a growing demand for early diagnosis of various diseases. Furthermore, developments in cell-based assay technology, such as innovation in software, equipment, algorithms, affinity reagents, and labels, are projected to promote usage in the future. In January 2023, BD collaborated with the European Molecular Biology Laboratory (EMBL) and published profiles of the company’s innovation in flow cytometry that has the potential to transform cell biology, immunology, and genomics research and enable the discovery of cell-based therapeutics.

The bead-based segment is expected to show the fastest growth rate over the projected period.The assay using beads assesses intracellular soluble proteins such as growth factors, chemokines, cytokines, and phosphorylated cell signaling proteins. The high-throughput flow cytometry technique is observed as one of the most advanced instruments for performing multiplex bead-based experiments. The multiplex bead-based approach offers an unprecedented growth opportunity in the domain of infectious disease diagnosis, research, and treatment. The demand for bead-based products is anticipated to increase over the forecast period due to developments in molecular engineering, and monoclonal antibody production as well as the associated benefits such as cost-efficiency, quick turnaround time, and micro-sampling capabilities.

The clinical segment held the largest revenue share of 47% in 2023. The segment growth is attributed to the increased cancer and infectious disease research and development initiatives, particularly COVID-19. Flow cytometry is routinely used to diagnose both benign and malignant hematologic diseases. It can help with diagnosis, therapy regimens, and monitoring residual or relapsed disease in various clinical settings. Moreover, increased R&D investments in biotechnology and pharmaceutical industries are projected to fuel market growth. Furthermore, ongoing expansion efforts by leading market players and the introduction of novel technologies for clinical applications are expected to propel market growth considerably.

The industrial segment is expected to show the fastest growth rate over the forecast period. This is due to the growing use of the technique in cell culture. The technique is used in the pharmaceutical business for applications including target discovery, drug properties and compound screening, non-clinical safety & toxicity evaluation, and clinical research. Flow cytometry provides high throughput and speed for large-scale drug development and testing by detecting several factors on the cell surface and generating complicated and adequate data by avoiding false positives results in single-parameter tests. The benefits of utilizing flow cytometry in bioprocessing activities at larger-scale for drug discovery is likely to drive market growth.

Academic institutes segment led the market with the largest revenue share of 32% in 2023 and is expected to maintain a dominant share throughout the forecast period. In cell biology and molecular diagnostic research, flow cytometry is utilized to detect cell parameters such as physical features of cells, recognition of biomarkers via particular antibodies, cell type, cell lineage, and maturation stage. This technique can be used in various educational settings, including molecular biology, pathology, immunology, plant biology, and marine biology. With increased R&D initiatives, the segment is expected to rise significantly over the forecast period.

Clinical testing labs are estimated to show the fastest growth over the forecast period. The growth of the market is due to the rising need for the diagnosis of target diseases, including cancer, infectious diseases, and immunological disorders, efficiently and cost-effectively. Flow cytometry is a widely adopted tool for diagnosing various diseases, and an increasing prevalence of target diseases in the region is propelling the demand for innovative products in the market. Furthermore, the rising demand for early diagnosis fuels the need for innovative products, further driving segment growth.

By Product

By Technology

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Latin America Flow Cytometry Market

5.1. COVID-19 Landscape: Latin America Flow Cytometry Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Latin America Flow Cytometry Market, By Product

8.1. Latin America Flow Cytometry Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents & Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Accessories

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Services

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Latin America Flow Cytometry Market, By Technology

9.1. Latin America Flow Cytometry Market, by Technology, 2024-2033

9.1.1. Cell-based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bead-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Latin America Flow Cytometry Market, By Application

10.1. Latin America Flow Cytometry Market, by Application, 2024-2033

10.1.1. Research

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Clinical

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Latin America Flow Cytometry Market, By End-use

11.1. Latin America Flow Cytometry Market, by End-use, 2024-2033

11.1.1. Commercial Organizations

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospitals

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Clinical Testing Labs

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Latin America Flow Cytometry Market, Regional Estimates and Trend Forecast

12.1. Latin America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Cytiva

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sartorius AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. BD (Becton, Dickinson and Company)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Agilent Technologies, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Sysmex Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Apogee Flow Systems Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Thermo Fisher Scientific Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Bio-Rad Laboratories, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. DiaSorin S.p.A.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Miltenyi Biotec

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others