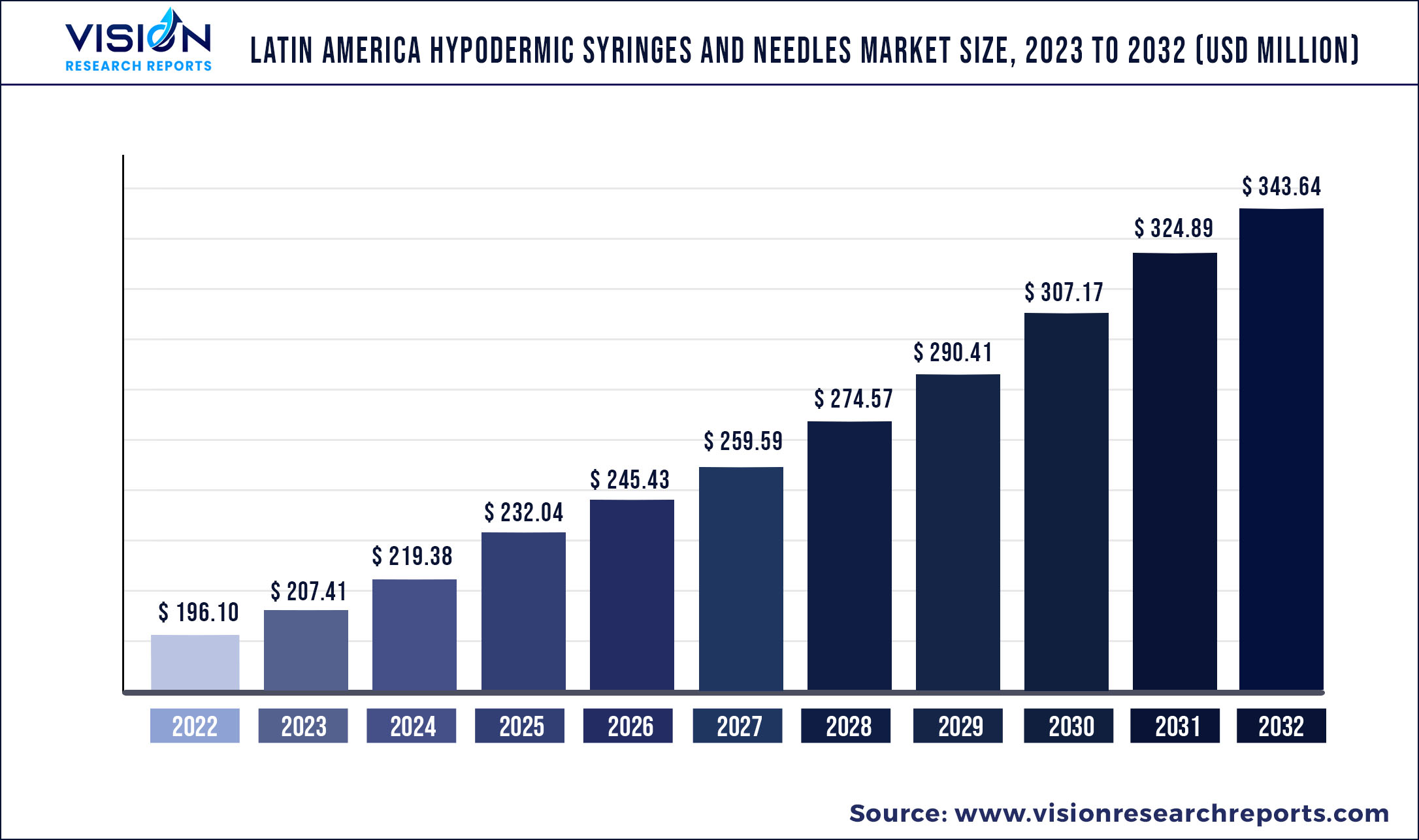

The Latin America hypodermic syringes and needles market was surpassed at USD 196.10 million in 2022 and is expected to hit around USD 343.64 million by 2032, growing at a CAGR of 5.77% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 196.10 million |

| Revenue Forecast by 2032 | USD 343.64 million |

| Growth rate from 2023 to 2032 | CAGR of 5.77% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Companies Covered | Smiths Medical; B. Braun Medical, Inc.; BD; Cardinal Health; Terumo Corporation; Nipro Corporation; Lifelong Meditech Private Limited; EXELINT International, Co.; Vitrex Medical A/S.; Retractable Technologies |

The increasing prevalence of chronic disorders, rising number of surgeries, and increasing demand for syringes for mass vaccination are the primary factors driving the demand for hypodermic syringes and needles.

The COVID-19 pandemic had a significantly positive impact on the hypodermic syringes and needles market. The pandemic drastically increased the demand for medicines, medical disposable products, emergency supplies, and hospital equipment. Hypodermic needles are used in blood sampling. Patients suffering from COVID-19 experiences various challenges and changes that may have elevated the demand for blood sampling. Therefore, the sudden rise in the demand for blood sampling resulted in a substantial increase in sales of hypodermic syringes & needles during the pandemic.

Moreover, the development of COVID-19 vaccines became the top priority to limit the spread of the infection. Most vaccinations, including those currently approved for COVID-19, are administered subcutaneously and intramuscularly using hypodermic needles. Hypodermic syringes and needles are readily available & cheaper, which makes them immediately attractive for delivering vaccines to a large cohort of patients. This made hypodermic needles an ideal choice for delivering COVID-19 vaccines. Thus, the COVID-19 pandemic had a significantly positive impact on the sales of hypodermic syringes and needles.

In addition, with the world moving towards normalcy and increasing funds being allocated towards healthcare, significant advancements are being carried out. These advancements are expected to increase the number of individuals opting for medical procedures leading to a rise in sales of the hypodermic syringes and needles market over the forecast period.

Hypodermic needles are generally used by healthcare professionals. However, patients sometimes use these needles themselves. The usage is most common among diabetic patients who require several insulin shots per day and among patients with asthma or severe allergies. Thus, a rise in the prevalence of diabetes, asthma, and other serious allergies is expected to propel market growth.

Diabetes presents a major health crisis in Latin American countries and is one of the leading causes of death from a chronic non-communicable disease. There is a disproportionate surge of diabetes in Latin America in comparison with other Western countries. It can be due to the genetic, socioeconomic, and environmental predisposition of this regional population for various risk factors of type 2 diabetes mellitus (T2DM), such as insulin resistance, obesity, & other metabolic disorders.

According to the International Diabetes Federation’s 2021 statistics, people with diabetes in the South and Central America region will increase by 48% and is expected to reach 49 million by 2045. This is indicative of the increase in the prevalence of diabetes by 25%, reaching 11.9% by 2045. In 2021, USD 65.3 billion was spent on diabetes in the South and Central America region, which represents 6.7% of the total spent worldwide.

Latin America Hypodermic Syringes And Needles Market Segmentations:

By Type

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Latin America Hypodermic Syringes And Needles Market

5.1. COVID-19 Landscape: Latin America Hypodermic Syringes And Needles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Latin America Hypodermic Syringes And Needles Market, By Type

8.1.Latin America Hypodermic Syringes And Needles Market, by Type Type, 2023-2032

8.1.1. Needles

8.1.1.1.Market Revenue and Forecast (2019-2032)

8.1.2. Syringes

8.1.2.1.Market Revenue and Forecast (2019-2032)

8.1.3. Combination

8.1.3.1.Market Revenue and Forecast (2019-2032)

Chapter 9. Latin America Hypodermic Syringes And Needles Market, Regional Estimates and Trend Forecast

9.1. Latin America

9.1.1. Market Revenue and Forecast, by Type (2019-2032)

9.1.2. Brazil

9.1.2.1. Market Revenue and Forecast, by Type (2019-2032)

9.1.3. Rest of LATAM

9.1.3.1. Market Revenue and Forecast, by Type (2019-2032)

Chapter 10.Company Profiles

10.1. Smiths Medical

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. B. Braun Medical, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. BD

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Cardinal Health

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Terumo Corporation

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Nipro Corporation

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Lifelong Meditech Private Limited

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. EXELINT International, Co.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Vitrex Medical A/S.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Retractable Technologies

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others