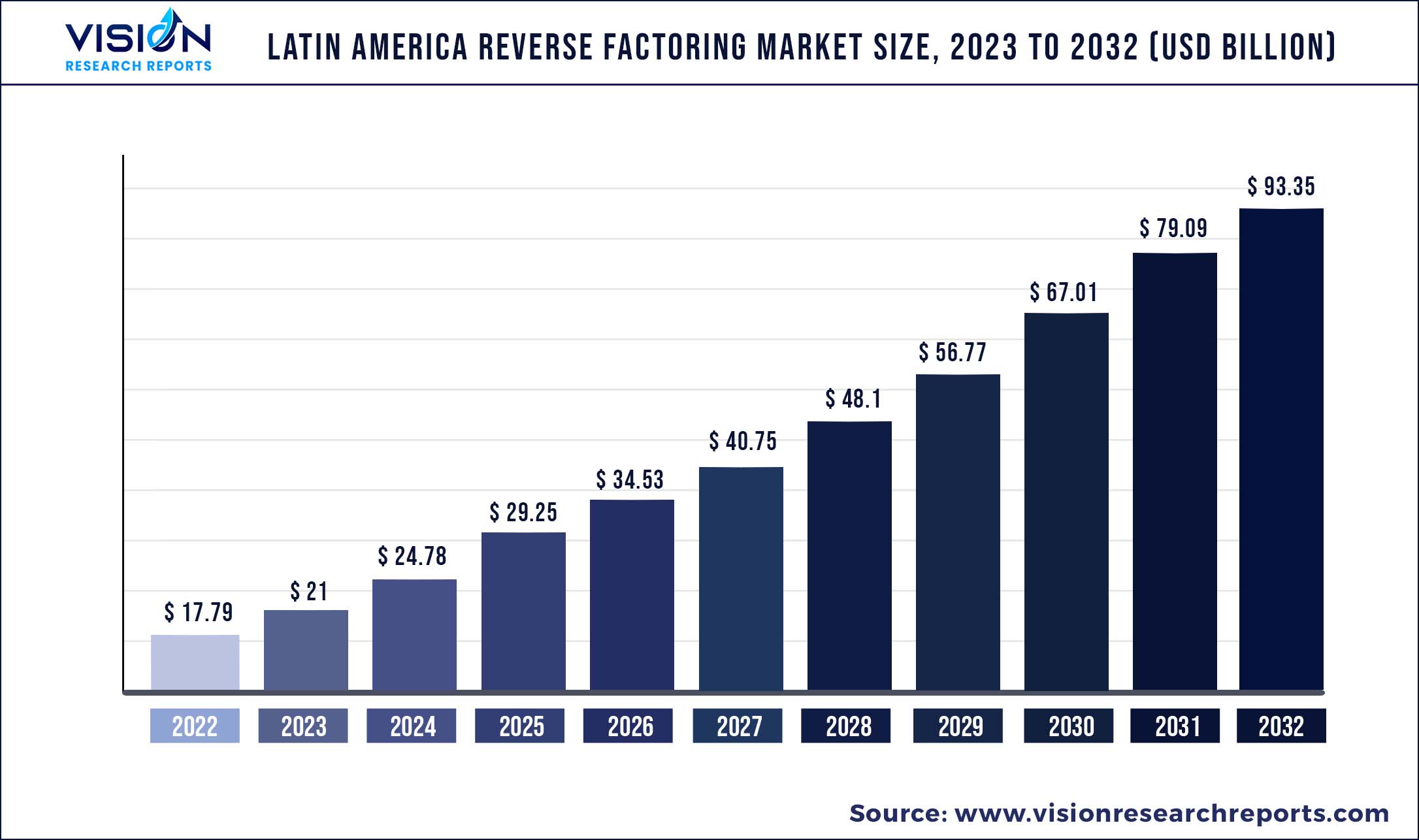

The Latin America reverse factoring market was estimated at USD 17.79 billion in 2022 and it is expected to surpass around USD 93.35 billion by 2032, poised to grow at a CAGR of 18.03% from 2023 to 2032.

Key Pointers

Report Scope of the Latin America Reverse Factoring Market

| Report Coverage | Details |

| Market Size in 2022 | USD 17.79 billion |

| Revenue Forecast by 2032 | USD 93.35 billion |

| Growth rate from 2023 to 2032 | CAGR of 18.03% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Companies Covered | Credit Suisse Group AG; eFactor Network; Drip Capital Inc.; JP Morgan Chase & Co.; Monkey; Banco Bilbao Vizcaya Argentaria; Kyriba; Barclays Plc; Deutsche Factoring Bank; Accion International; TRADEWIND GMBH; HSBC Group; Societe Generale; Mitsubishi UFJ Financial Group, Inc. |

The market growth can be attributed to the shifting focus of micro, small, and medium-sized enterprises (MSMEs) toward supply chain financing and the rising adoption of new technologies in the market. The stringent lockdown measures during the COVID-19 pandemic disrupted the whole supply chain process in Latin America resulting in a massive slowdown in the manufacturing industry, reduced import export operations, and affected the financial performance of industries. However, with the ease in lockdowns in early 2021, most of the MSMEs preferred reverse factoring services to optimize their supply chain and increase their working capital to accelerate their business growth, thereby driving the market growth during the forecast period.

Supply Chain Financing (SCF) or reverse factoring is emerging as a prominent alternative for accessing short-term credits in Latin America. Supply Chain Management (SCM) helps suppliers monetize their bill receivables without any financial liability, which is inevitable in the case of a loan. By monetizing suppliers’ receivables and offering immediate liquidity, reverse factoring also reduces the Cash Conversion Cycle (CCC) and Days of Sales Outstanding (DSO). In addition, SCF enables the buyer to initiate faster payments to the supplier, which helps improve corporate liaisons with suppliers and significantly reduces the operational risk throughout the supply chain. Thus, the following factors aimed to drive the market during the forecast period.

The rising support by governments across the region for creating smooth working capital solutions is driving Latin America reverse factoring market growth. The governments of various countries in the region, including Paraguay, Chile, Mexico, and Argentina, are announcing supportive initiatives for the promotion and development of reverse factoring. For instance, in 2018, the Government of Peru mandated e-invoice issuing for all companies from all end-use sectors. E-invoicing is assisting Peru-based MSMEs in obtaining instant cash payments from buyers through reverse factoring. Thus

Advancements in digital technologies such as big data analytics, Artificial Intelligence (AI), Natural Language Processing (NLP), Machine Learning (ML), Blockchain, the Internet of Things (IoT), and cloud computing are creating new opportunities for the market. Further the AI solution providers are investing significant time and efforts in R&D activities to offer improved AI tools for reverse factoring solutions. For instance, in September 2022, FactorFox Software launched FactorFox Mobile Optical Character Recognition (OCR), an AI application, for various factoring services. This OCR application optimizes an organization's ability to automate documentation and speed up operations for faster funding.

Market players are focusing on mergers, partnerships, and acquisitions to enhance their service offerings and brand value, creating a favorable environment for the reverse factoring services market. For instance, in May 2022, Galgo Capital’s subsidiary, Ancon SpA, a special purpose vehicle company, acquired a 40% stake in the factoring and account collection company Crece Capital for an undisclosed amount in Peru.

Latin America Reverse Factoring Market Segmentations:

| By Category | By Financial Institution | By End-use |

|

Domestic International |

Banks Non-banking Financial Institutions |

Manufacturing Transport & Logistics Information Technology Healthcare Construction Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Category Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Latin America Reverse Factoring Market

5.1. COVID-19 Landscape: Latin America Reverse Factoring Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Latin America Reverse Factoring Market, By Category

8.1. Latin America Reverse Factoring Market, by Category, 2023-2032

8.1.1 Domestic

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. International

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Latin America Reverse Factoring Market, By Financial Institution

9.1. Latin America Reverse Factoring Market, by Financial Institution, 2023-2032

9.1.1. Banks

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-banking Financial Institutions

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Latin America Reverse Factoring Market, By End-use

10.1. Latin America Reverse Factoring Market, by End-use, 2023-2032

10.1.1. Manufacturing

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transport & Logistics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Information Technology

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Construction

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Latin America Reverse Factoring Market, Regional Estimates and Trend Forecast

11.1. Latin America

11.1.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.2. Market Revenue and Forecast, by Financial Institution (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. Brazil

11.1.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Financial Institution (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.1. Rest of LATAM

11.1.1.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.1.2. Market Revenue and Forecast, by Financial Institution (2020-2032)

11.1.1.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Credit Suisse Group AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. eFactor Network

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Drip Capital Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. JP Morgan Chase & Co.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Monkey

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Banco Bilbao Vizcaya Argentaria

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Kyriba

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Barclays Plc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Deutsche Factoring Bank

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Accion International

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others