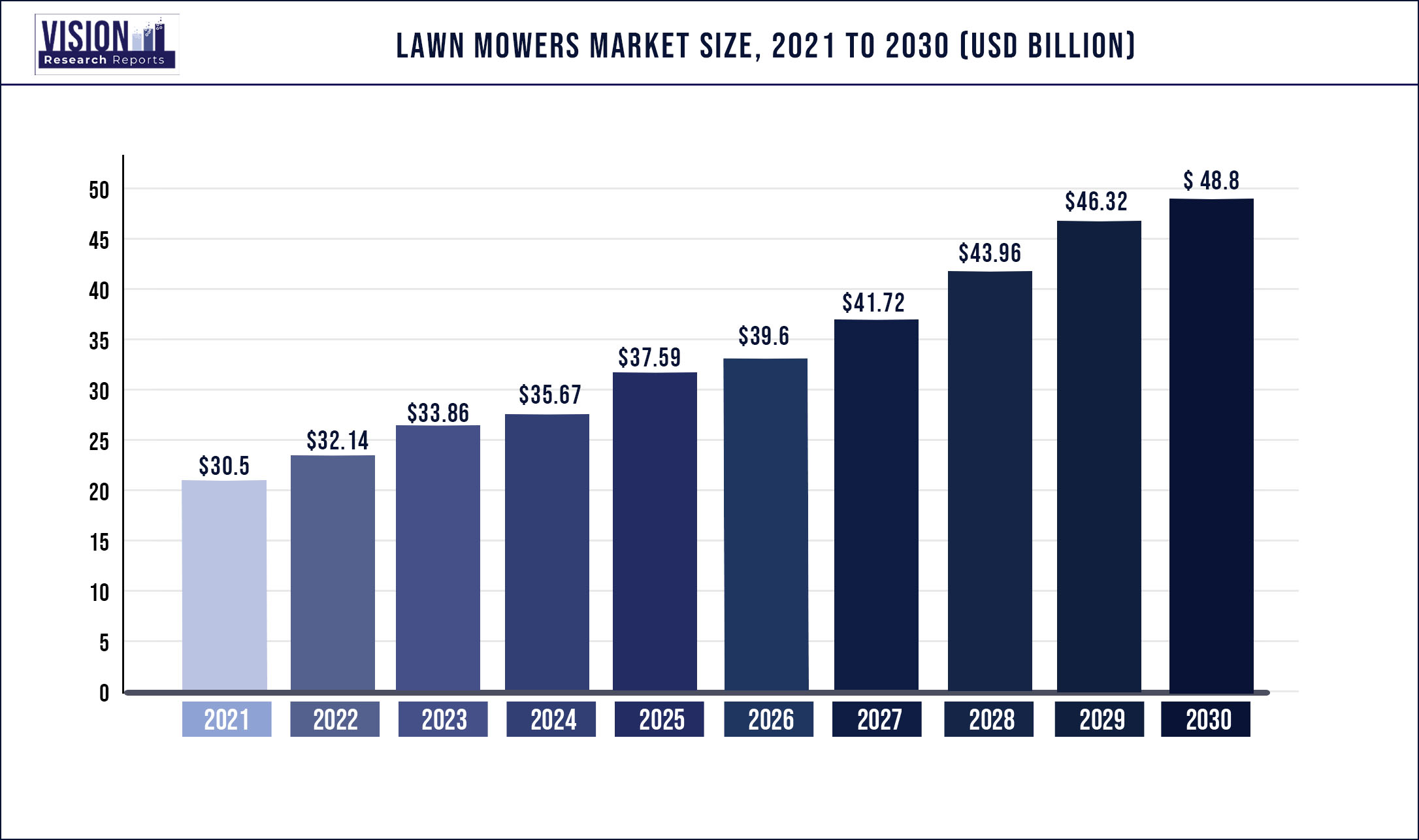

The global lawn mowers market was valued at USD 30.5 billion in 2021 and it is predicted to surpass around USD 48.8 billion by 2030 with a CAGR of 5.36% from 2022 to 2030.

The industry growth witnessed a mild hiccup with supply disruptions from the impact of COVID-19 in 2020; however, the growth declined by not more than one percent. The newly minted work-from-home model paved the way for several consumers with more time to involve in gardening and lawn mowing activities. With households diverting funds from traveling to home landscape projects, the market reached pre-COVID levels in 2021. However, factors such as ongoing semiconductor shortage, rising labor costs, and materials associated with upgraded customer comforts, more robust frames, and high-quality mowers are influencing the lawn mower's prices, thereby limiting the market growth over the forecast period.

The rising popularity of autonomous or robotic lawn mowers is expected to drive the market over the forecast period. Consumers are becoming tech-savvy and shunning traditional manual or fuel-powered mowers and shifting towards electric and robotic mowers. Overall, the lawn mower industry has been relatively stagnant for the last few years; however, the advent of products including electric or battery-powered mowers came as a respite in recent times. The trend for advanced products will continue to witness modest growth over the forecast period. Consumers are keen to embrace newer technologies that make their life easier. Therefore, the robotic mowers segment will register a healthy compound annual growth rate over the forecast period.

Further, the consumer trends mentioned above, introducing products with sensors, Bluetooth, and Wi-Fi capabilities will bode well for lawn mower market growth over the forecast period. These technologies enable consumers to control the device remotely using a smartphone, allowing convenience. The Husqvarna Group, Positec Germany GmbH, and Robomow are some companies that offer app-based robotic lawn mowers.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 30.5 billion |

| Revenue Forecast by 2030 | USD 48.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.36% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, end use, region |

| Companies Covered | American Honda Motor Co., Inc.; Ariens Company; Briggs Stratton; Deere & Company; Deere & Company; Falcon Garden Tools; Fiskars; Husqvarna Group; MTD Products; Robert Bosch GmbH; Robomow Friendly House; The Toro Company |

Product Insights

The electric-powered lawn mowers segment dominated the market and accounted for the largest revenue share of 29.7% in 2021. This growth is ascribed to ease of use and high torque to weight ratio, enabling these lawnmowers to cut tall grass. The segment captured a sizeable share in 2021 and is anticipated to register a steady CAGR exceeding 5.0% from 2022 to 2030. Furthermore, advancements in battery-powered engines have increased the durability and efficiency of these mowers, making them one of the popular choices among users.

The robotic mowers segment is projected to surpass 15.0 billion by 2030, almost 2.5 times the market size in 2021. The massive segment growth is ascribed to consumer inclination towards tech-savvy products that offer convenience and environment-friendly options. Furthermore, the price for robotic products has reached affordable price points increasing their adoption in developed markets over the last few years. Consumers prefer to integrate these mowers with their existing smart home ecosystem, allowing them to control the device remotely using a smartphone-based app.

End-use Insights

The residential segment dominated the market and accounted for the largest revenue share of around 60.0% in 2021. Lawnmowers are primarily used in a residential setting for gardening applications, whereas in commercial spaces, for large-scale landscaping applications and lawn maintenance. The demand for lawn mowers in the residential market witnessed an uptick post-2020 and exceeded USD 18 billion in 2021. This healthy demand is ascribed to the proliferation of remote working models worldwide, giving consumers time to engage in leisure activities such as gardening or DIY gardening from their homes. As consumers began to spend more time at home, the demand for products associated with gardening gained traction, a trend that is expected to go on for at least the next two years.

On the other hand, commercial gardening or landscaping witnessed a minor impediment with projects and associated spending taking a halt due to worldwide lockdown restrictions. Due to supply disruptions, economic uncertainty, and smaller budgets, orders were stalled for the said period. However, as the trade channels, notably e-commerce channels, opened in the second half of 2020 and with infrastructure projects back on track, the market is projected to witness a relatively milder demand over the next few years. The segment is expected to register a CAGR of 4.9% from 2022 to 2030.

Regional Insights

North America dominated the lawn mowers market and accounted for the largest revenue share of 34.9% in 2021. Developed markets such as North America and Europe have traditionally been at the forefront of high market demand. In 2021, these regional markets held their leading positions in terms of market share, collectively surpassing 60%. Over the last couple of years, urbanization in Western Europe has made living spaces smaller, declining garden size. This trend will pose a severe threat to the demand for lawn mowers in the region. However, the development and maintenance of lawns in commercial spaces will provide some respite to the otherwise challenged industry growth.

In the U.S., over 30% of households are known to have kitchen gardens, suggesting that gardening still prevails in most parts of the U.S. This trend is projected to come as a respite for lawnmower OEMs to drive sales. In addition to this, more than 70% of the households in the U.S. have a backyard lawn, resulting in the usage of lawn mowers to maintain the grass and creating opportunities for OEMs that offer lawn trimming products. North America is anticipated to register a CAGR of approximately 6% over the forecast period, primarily due to an increase in lawn maintenance activities amid the pandemic and an increase in construction activities in 2021.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lawn Mowers Market

5.1. COVID-19 Landscape: Lawn Mowers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lawn Mowers Market, By Product

8.1. Lawn Mowers Market, by Product, 2022-2030

8.1.1. Manual

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Electric

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Petrol

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Robotic

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Lawn Mowers Market, By End-use

9.1. Lawn Mowers Market, by End-use, 2022-2030

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Commercial/Government

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Lawn Mowers Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. American Honda Motor Co., Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Ariens Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Briggs Stratton

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Deere & Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Falcon Garden Tools

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Fiskars

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Husqvarna Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. MTD Products

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Robert Bosch GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Robomow Friendly House

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. The Toro Company

11. 11.1. Company Overview

11. 11.2. Product Offerings

11. 11.3. Financial Performance

11. 11.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others