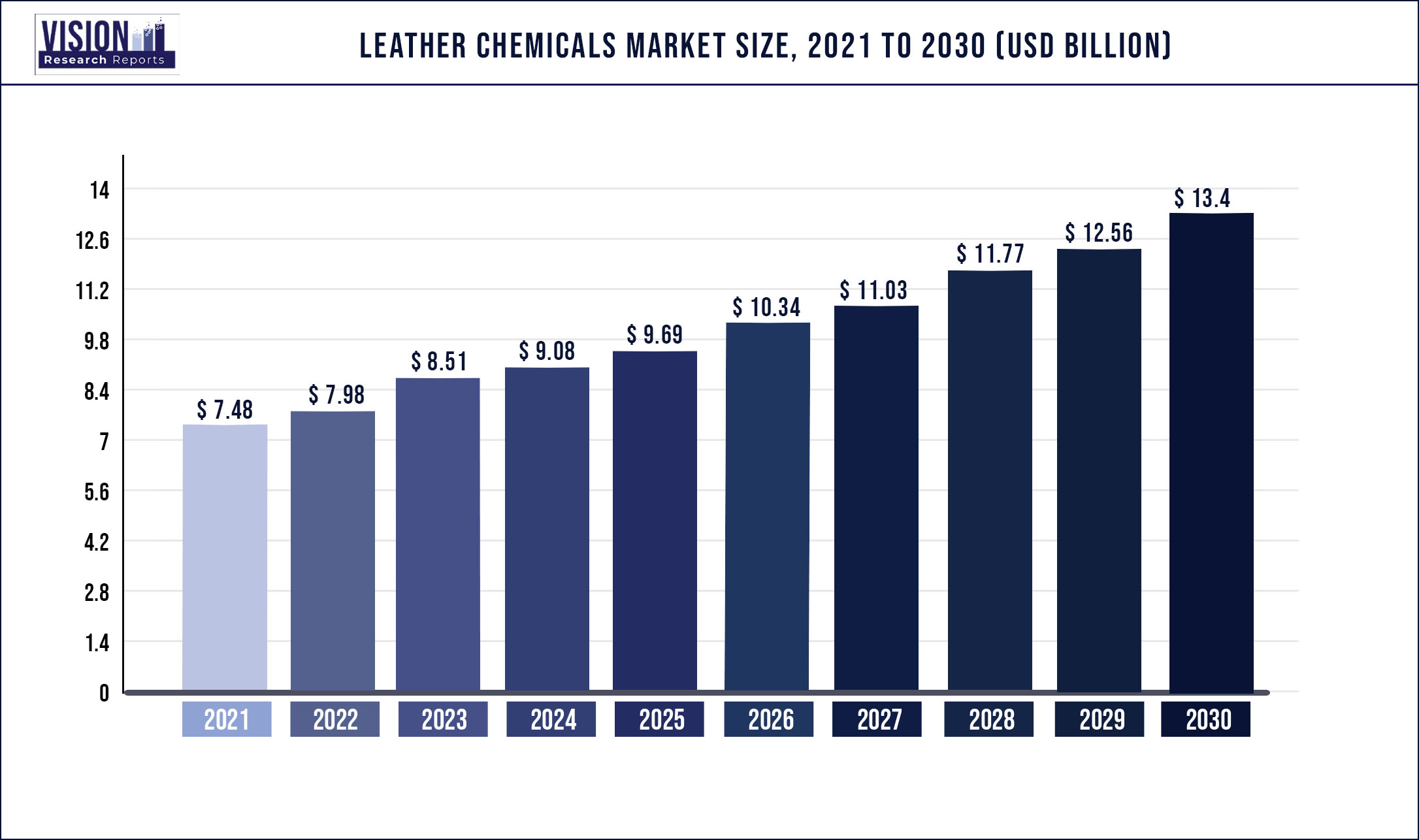

The global leather chemicals market was valued at USD 7.48 billion in 2021 and it is predicted to surpass around USD 13.4 billion by 2030 with a CAGR of 6.69% from 2022 to 2030.

Report Highlights

By product, the U.S. leather chemicals market was valued at USD 326.1 million in 2021 and expected to witness growth at a CAGR of 5.5% from 2022 to 2030.

The demand is attributed to the increase in demand for premium products and increasing consumption of the product from end-use industries such as automotive, apparel, and footwear. Demand for the product is predicted to rise in a wide range of applications, including jackets, wallets, upholstery, shoes, and belts, due to changing consumer lifestyles and increased disposable income. Leather is used in Personal Protection Equipment (PPE), such as shoes and gloves, and plays an important part in the construction industry.

Increasing disposable income in developing economies, combined with expanding population, is predicted to enhance demand for consumer goods, fueling the product market. Because of the rising use of finishing chemicals in Europe, the industry is expected to develop. Product manufacturers have integrated their manufacturing and distribution channels to improve market accessibility. The major factor driving the demand for leather in the past as well as in the coming years is the rapidly growing upholstery industry, which finds application in airplanes, furniture, and automobiles. It is liberally used in high-quality furniture and in high-end automobiles. upholstery is easy to clean, durable, and has a luxurious appeal. Premium brands are already offering upholstery to a number of small vehicle models. Another developing area for upholstery is airplane interiors in which high-performance leather makes it a suitable choice for engineers, designers as well as cost controllers.

The demand for footwear is increasing on account of expanding population and rising consumer spending capacity in the developing regions of the world. The dynamics of the footwear industry have changed with individuals preferring multiple as well as different types of footwear. The product is used to provide dimensional strength as well as tolerance to high temperatures and mechanical action to footwear, thus making it more durable. Thus, the thriving footwear industry is also expected to boost productivity growth over the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.48 billion |

| Revenue Forecast by 2030 | USD 13.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.69% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, process, application, region |

| Companies Covered | Stahl International B.V; Lanxess AG; Bayer AG; Elementis plc; Texapel; Chemtan Company Inc.; Lawrence Industries Limited |

Product Insights

The polyurethane resins product segment dominated the market for leather chemicals and accounted for revenue share of 22.97% in 2021. The higher share is attributed to increase in consumption of polyurethane in leather processing. They're also utilized to make organic solvent-free finish formulations, as well as binders, basecoats, and topcoats. Hybrid acrylic polyurethane polymers have made significant contributions to solvent-free finish formulations. Because of their high tensile strength, outstanding elasticity, and abrasion and solvent resistance, PU resins are used to make PU-based synthetic products in addition to their application in other formulations and processing. The need for PU resins in the manufacturing industry is expected to rise, as PU-based leather is considered more environmentally friendly than vinyl-based leather. However, because of the lengthy manufacturing process involved, it is the more expensive of the two.

The surfactants segment is expected to witness a CAGR of 7.1% over the forecast period. The demand is attributed to increase in its utilization as surface-active agents in the leather-making process. They are not only used as emulsifiers or main reaction agents but also as anti-electrostatic, water repellent, and abrasion reduction agents. Moreover, such agents can be used to ease the dispersion of oils in water. Which in turn is expected to drive the growth of the market for leather chemicals.

The Chromium Sulfate segment was valued at USD 818.17 million in terms of revenue in 2021. The demand is attributed to its commonly utilization as tanning agent in leather industry, which is anticipated to drive the demand for the product. It is also used to manufacture chrome-based dyes, which are applied in the dying process. Chromium salts are used to tan a large amount of the leather produced, ranging from 80% to 90%. The major purpose of tanning chemicals like these is to stabilize leather by crosslinking collagen fibres. In tanning and retention operations, trivalent chromium agents are often used. However, the oxidation of trivalent chromium to hexavalent chromium is predicted to remain a critical challenge for leather manufacturers in certain scenarios.

Process Insights

The tanning and dyeing process segment accounted for a revenue share of more than 48.08% in 2021. It is anticipated to witness a CAGR of 6.77% over the forecast period owing to its various operations such as pickling, degreasing, tanning, swimming, shaving, retanning, dyeing, fatliquoring, and drying among others. Additional processes such as neutralization and bleaching depend on the condition of tanned hides and are implemented accordingly.

The beamhouse segment is anticipated to witness the second-largest CAGR of 6.66% over the forecast period. The growth is anticipated to be driven by its application ranging from preparation of hides and skins to preservation. It includes operations such as wetting & soaking, liming and unhairing, and deliming and bating. The chemicals used in such a process vary according to the hides and skins of different animals. The product used in such processes include enzymes, degreasers, sodium sulfide, lime, sulfuric acid, and formic acid.

Finishing process refers to stages after the drying process. It includes mechanical finishing operations and coatings. Leather can be finished in various ways through buffing, spray-coated, treatment with pigment, resins, dyes, or lacquered with urethane. Finishing coats include the base, intermediate, and topcoats. Main components and additives used in this process include surfactants and polyurethane resins. Increasing demand for premium products along with growing inclination of manufacturers toward aesthetic parameters is likely to drive the demand for leather chemicals over the forecast period.

Application Insights

The footwear application segment accounted for revenue share of more than 49.99% in 2021. The demand is attributed to increase in demand for leather used for manufacturing footwear, which, in turn, is driving demand for the product in footwear industry. Basic components of footwear include leather, rubber, plastic, textile, and metal among others. It is used in various application such as leather finishing, tanning, and dyeing among others. These chemicals are also used for strengthening the crust and filling.

The upholstery segment is expected to register the second-highest CAGR of 6.7% in the market for leather chemicals over the forecast period. The growth is anticipated to extensive coating applications. One of the major factors contributing to the growth of upholstery is increased use of soft leather in automotive and furniture industry. Upholstery includes leather for automotive and furniture sectors. Aniline, semi-aniline, and pigmented/protected leathers are extensively used in automotive and furniture upholstery, owing to which leather chemicals required for tanning, beam housing, retanning, waterproofing, and fatliquoring of such leathers are consumed on a large scale.

Wallets, belts, and other accessories are examples of leather items. In comparison to other end-use segments, the amount of leather required for such products is quite low. As a result, the leather goods segment's demand for the product is predicted to expand at a moderate rate. Tanning and dyeing chemicals, followed by finishing chemicals, are used extensively in the manufacturing of goods. Over the forecast period, rising consumer inclination toward product aesthetics, combined with rising demand for luxury leather products, is expected to increase demand for the product in leather goods.

Regional Insights

Asia Pacific dominated the market for leather chemicals and accounted for revenue share of more than 50.1% in 2021. The demand is attributed to the abundant availability of raw materials and the high concentration of product manufacturers. One of the primary elements propelling market growth in Asia Pacific is the low-cost labor. Because of the country's substantial imports of footwear and luxury consumer goods, the product's penetration in the country's product industry is limited. However, Japan's vehicle industry is well-established, and the country consumes a considerable amount of the product. Rising demand for products from the automobile industry is expected to be a major driving force in the country's product market.

In Europe, the leather chemicals market is anticipated to witness the second-largest CAGR of 6.94% over the forecast period. The growth is anticipated as it drives the consumer appliances, automobile, and footwear, industry. The tanning business in Europe is heavily reliant on raw resources and export. The market for leather chemicals is likely to increase in the next years due to rising demand for the product in manufacturing for footwear, furniture, automobile interiors, and apparel, among other applications. The luxury market is predicted to drive the country's market expansion, therefore the product market in Italy is highly focused and robust. Vegetable tanning is becoming more popular in the region, and it is likely to mimic some of the benefits of chromium, which is expected to add to the increase of chemicals used in synthetic leather manufacturing.

In Central and South America, the market for leather chemicals is expected to be driven by the growing industry in Brazil. The Brazilian product industry is characterized by extensive production of footwear & goods, especially travel accessories, and a strong connection with the U.S. market. The aforementioned characteristics have resulted in lucrative growth opportunities in the market for leather chemicals in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Leather Chemicals Market

5.1. COVID-19 Landscape: Leather Chemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Leather Chemicals Market, By Product

8.1. Leather Chemicals Market, by Product, 2022-2030

8.1.1 Biocides

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Surfactants

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Chromium Sulfate

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polyurethane Resins

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Sodium Bicarbonate

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Leather Chemicals Market, By Process

9.1. Leather Chemicals Market, by Process, 2022-2030

9.1.1. Tanning & Dyeing

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Beamhouse

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Finishing Chemicals

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Leather Chemicals Market, By Application

10.1. Leather Chemicals Market, by Application, 2022-2030

10.1.1. Footwear

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Upholstery

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Leather Goods

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Garments

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Leather Chemicals Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Process (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Process (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Process (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Process (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Process (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Process (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Process (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Process (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Process (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Process (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Process (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. Stahl International B.V

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lanxess AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bayer AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Elementis plc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Texapel

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Chemtan Company Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Lawrence Industries Limited

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others