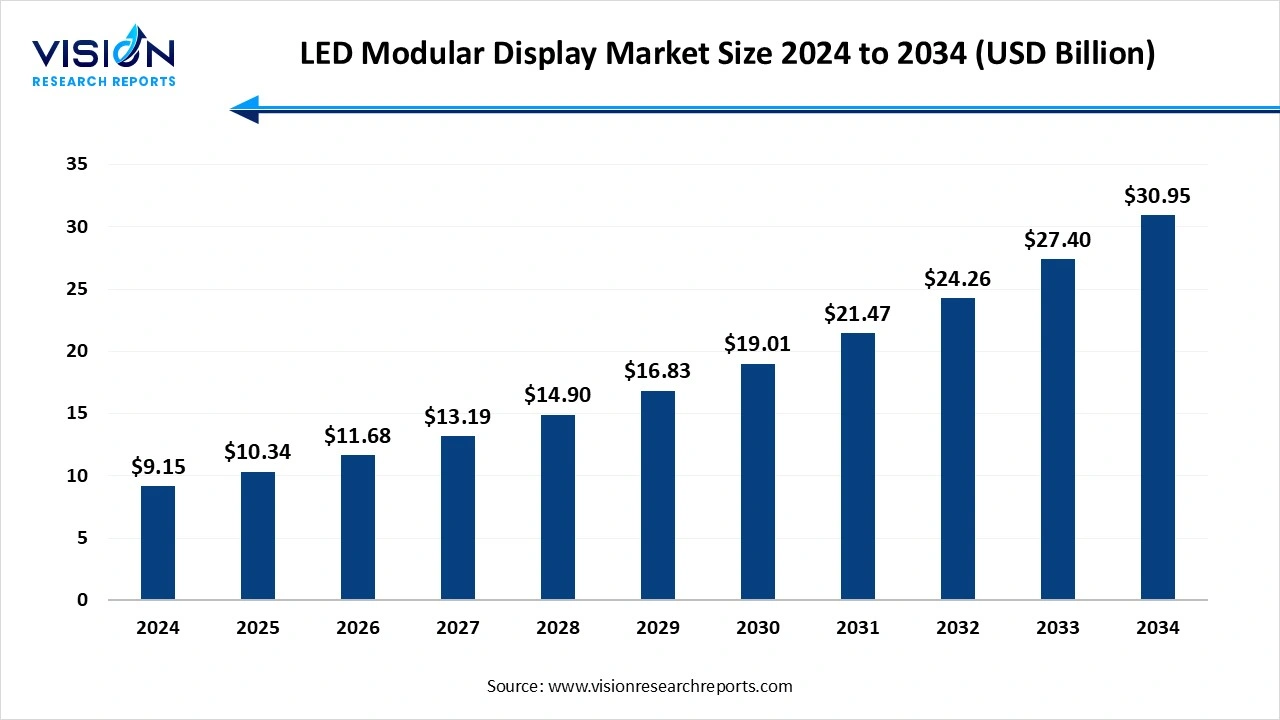

The global LED modular display market size was exhibited at USD 9.15 billion in 2024 and is expected to grow from USD 10.34 billion in 2025, to reach around USD 30.95 billion by 2034, expanding at a CAGR of 12.96% over the forecast period.

The growth of the LED modular display market is primarily fueled by an advancement in LED technology have significantly improved display quality, enabling higher resolution and better color accuracy, which attracts businesses seeking to enhance visual communication. Additionally, the rising demand for digital signage across various sectors, including retail, transportation, and entertainment, has propelled the adoption of LED modular displays, as they effectively capture consumer attention and convey dynamic content. Moreover, the versatility and customization options of LED modular displays allow for tailored solutions that fit diverse application needs, further driving their popularity. Finally, the ongoing shift towards more energy-efficient solutions has made LED technology an appealing choice, as these displays consume less power while delivering exceptional performance, aligning with sustainability goals for many organizations.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.15 Billion |

| Revenue Forecast by 2034 | USD $30.95 Billion |

| Growth rate from 2025 to 2034 | CAGR of 12.96% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

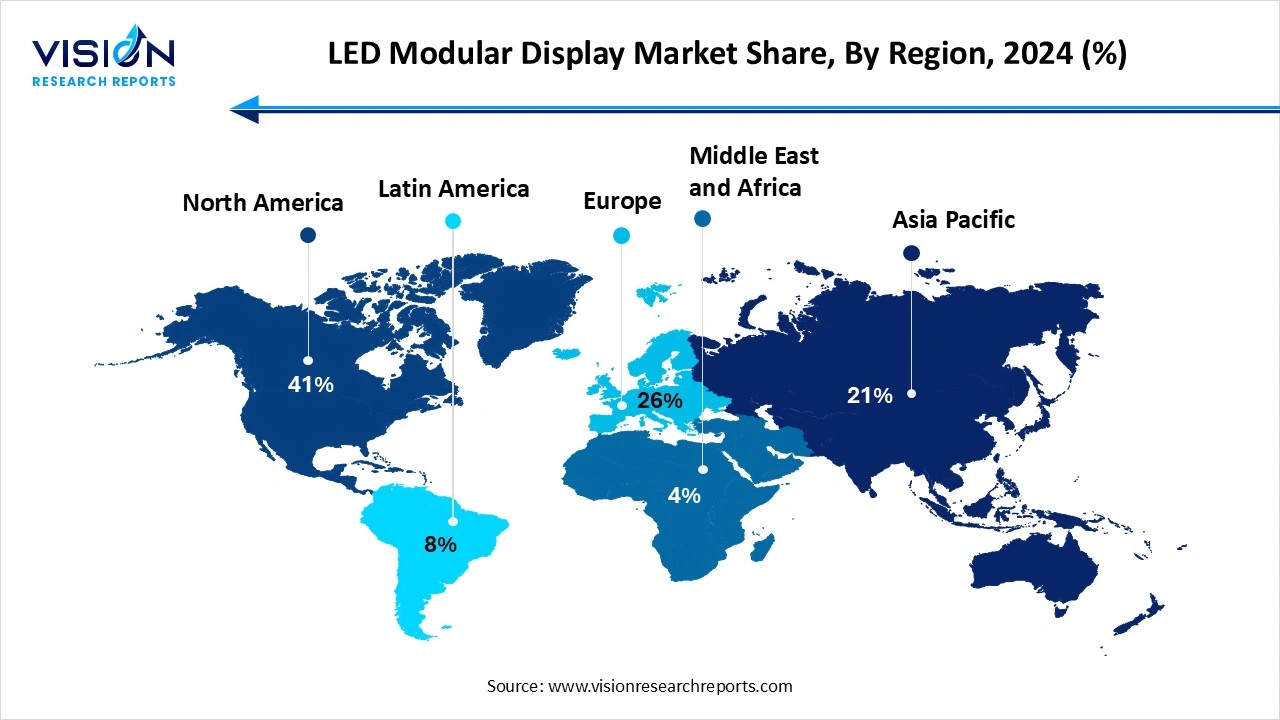

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Barco, Daktronics, Mitsubishi Electric Corporation, NEC Display Solutions (Sharp Corporation), Panasonic Corporation, PixelFLEX, Planar (Leyard), Prismaflex (Baxter), Pro Display, Samsung, Shenzhen Absen Optoelectronic Co., Ltd., Sony Corporation, Unilumin, and Yaham. |

North America LED Modular Display Market Trends

The North American LED modular display market emerged as a lucrative region in 2024, bolstered by a strong culture of research and development that drives innovation in LED technology. The well-developed manufacturing infrastructure and robust supply chains facilitate a steady flow of components and raw materials, supporting the production of high-quality LED modular displays. With a strong economy and rising disposable incomes, demand for LED modular displays across various applications is increasing. Furthermore, businesses in North America are increasingly investing in advanced technologies, such as LED displays, to enhance their operations. The U.S. LED modular display market led the region, driven by diverse applications, including entertainment, advertising, and corporate communications. Continuous advancements in LED technology featuring lower power consumption, higher brightness, and improved color accuracy make these displays increasingly appealing across various sectors. The growing trend of digital signage in entertainment, retail, and corporate environments is fueling demand for LED modular displays, which provide versatile and impactful visual solutions. Additionally, large-scale events and concerts rely heavily on LED modular displays to deliver immersive visual experiences, contributing significantly to market growth.

The European LED modular display market is poised for significant growth during the forecast period. The region holds a considerable share due to strong demand stemming from digital out-of-home (DOOH) advertising initiatives and the increasing adoption of technologies in countries such as the U.K., Germany, Italy, and Belgium. The rising prevalence of corporate trade shows, sporting events, and live performances is also expected to drive the demand for LED modular displays in Europe. For example, Panasonic Connect Co., Ltd. partnered with the Olympic Broadcasting Services (OBS), the Paris Organizing Committee for the Olympic Games, and the International Olympic Committee (IOC) to deliver state-of-the-art audiovisual solutions for event operations. This collaboration involves broadcast production equipment, professional displays, and projection systems for the Paris 2024 Olympic and Paralympic Games.

In 2023, the U.K. LED modular display market held a significant share, driven by government initiatives aimed at promoting smart cities and digital transformation. These efforts are expected to create opportunities for LED displays in transportation, public spaces, and infrastructure. Continuous innovation and technology adoption are likely to attract new LED display products and applications, driving market growth during the forecast period. Additionally, the expanding retail sector in the U.K. is anticipated to encourage widespread adoption of LED modular displays in retail environments to enhance the customer experience.

The indoor modular screens segment led the global market, capturing a revenue share in 2024. This growth is primarily driven by the increasing demand for LED video walls to present departure and arrival information for flights, buses, and trains at airports and transit stations. Recognized for their reliability and efficiency, LED video walls are gaining popularity due to their capacity to deliver seamless, high-quality images. Consequently, these indoor modular screens are widely utilized in retail environments and shopping centers, further propelling market expansion.

Conversely, the outdoor modular screens segment is projected to experience a notable compound annual growth rate (CAGR) throughout the forecast period. Outdoor LED screens are specifically designed to convey information attractively, even in challenging weather conditions like dust, heat, and rain. The segment’s growth is fueled by a rising demand for outdoor LED displays in various applications, including stadium screens, advertising boards, scoreboards, and video walls. Additionally, the surge in outdoor activities, such as concerts, sporting events, brand promotions, product launches, and political gatherings, is anticipated to stimulate market growth.

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on LED Modular Display Market

5.1. COVID-19 Landscape: LED Modular Display Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global LED Modular Display Market, By Type

8.1.LED Modular Display Market, by Type

8.1.1. Indoor Modular Screens

8.1.1.1. Market Revenue and Forecast

8.1.2. Outdoor Modular Screens

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global LED Modular Display Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Type

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Type

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Type

9.2. Europe

9.2.1. Market Revenue and Forecast, by Type

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Type

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Type

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Type

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Type

9.3. APAC

9.3.1. Market Revenue and Forecast, by Type

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Type

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Type

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Type

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Type

9.4. MEA

9.4.1. Market Revenue and Forecast, by Type

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Type

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Type

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Type

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Type

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Type

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Type

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Type

Chapter 10. Company Profiles

10.1. Barco

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Daktronics

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Mitsubishi Electric Corporation

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. NEC Display Solutions (SHARP CORPORATION)

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Panasonic Corporation

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. PixelFLEX

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Planar (LEYARD)

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Prismaflex (Baxter)

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Pro Display

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. SAMSUNG

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others