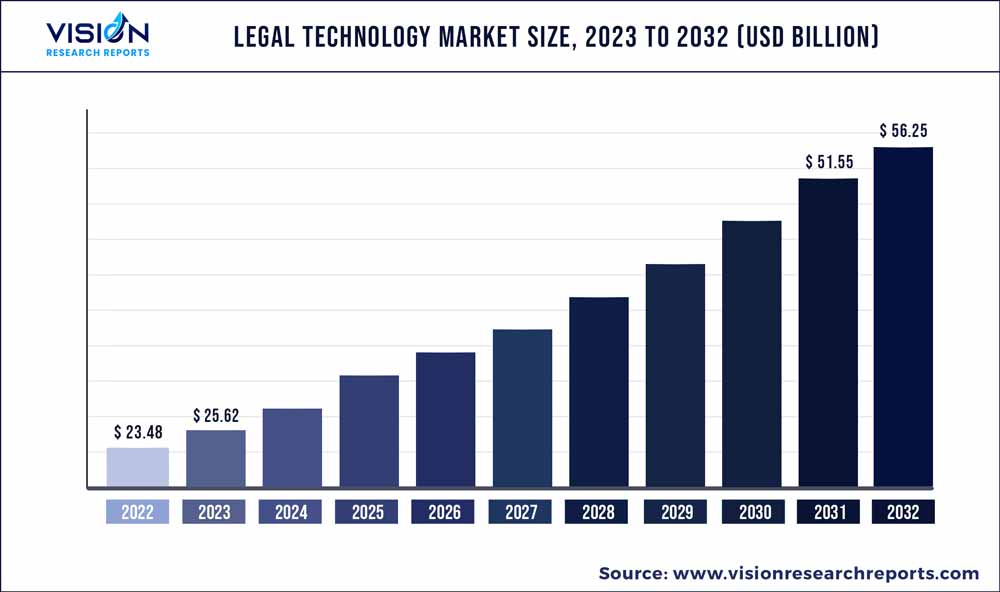

The global legal technology market size was estimated at around USD 23.48 billion in 2022 and it is projected to hit around USD 56.25 billion by 2032, growing at a CAGR of 9.13% from 2023 to 2032. The legal technology market in the United States was accounted for USD 10.7 billion in 2022.

Key Pointers

Report Scope of the Legal Technology Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 50% |

| Revenue Forecast by 2032 | USD 56.25 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Icertis, Inc.; Filevine Inc.; DocuSign, Inc.; Casetext Inc.; ProfitSolv, LLC; Knovos, LLC; Mystacks, Inc.; Practice Insight Pty Ltd (WiseTime); TimeSolv Corporation; Themis Solutions Inc. (Clio); Everlaw, Inc.; LexisNexis Legal & Professional Company |

The rising investment in technologies to automate and optimize legal procedures to improve the productivity and profitability of law firms and streamline operations is projected to fuel the growth of the market over the forecasted period. The legal technology industry is witnessing significant developments in artificial intelligence (AI) and blockchain technologies. The key stakeholders in the global market, including judiciaries, law societies, private law firms, corporate legal departments (public and private sectors), legal aid service providers, developers of legal products, and the overall legal systems, are heavily investing in advanced legal technologies to offer effective legal services to their clients. The emerging trend of smart contracts and blockchain technology has enabled law firms and legal departments to record data securely.

The adoption of cloud-based platforms is accelerating the development of the global legal technology industry. There was a slower implementation of cloud-based technologies among legal firms and corporate legal departments; however, the recent COVID-19 pandemic and the following shift towards hybrid work created a rapid demand to prioritize digital technologies and enable cloud access.

For instance, in December 2021, NetDocuments Software, Inc., a cloud-based content products and services platform, collaborated with the Executive Office for United States Attorneys. The company provided various solutions, including email and document management, to more than 5,000 agency users.

Solution Insights

The services segment is expected to witness the highest CAGR of over 10.52% over the forecast period. The segment is divided into consulting services, support services, and others. The demand for consulting services is rising owing to their ability to guide the implementation of new technologies by assessing the current solutions and workflows.

The support services offer technical assistance during updates and maintenance of platforms and solutions. Furthermore, increasing demand for training services to ensure staff education after implementing technology is projected to provide significant growth opportunities to the services segment.

The software segment accounted for the highest market share of about 76% in 2022 and is expected to maintain its dominance throughout the forecast period. The growth is attributed to the increasing adoption of legal software from legal departments and law firms to reduce costs, streamline workflows and improve efficiency.

The segment is further divided into cloud-based and on-premises software. Incorporating the latest technologies, such as machine learning, artificial intelligence, and blockchain technology, is projected to offer lucrative growth opportunities for the market. For instance, in April 2023, Filevine Inc. launched Demands.ai which enables a simplified and faster way to assemble demand letters by using the. vine platform and artificial intelligence.

Type Insights

The analytics segment is anticipated to witness a CAGR growth of over 11.05% from 2023 to 2032. The rising demand for incorporating data analytics and artificial intelligence to help lawyers and legal professionals make better decisions and streamline their workflow. Analytics software can help lawyers and legal professionals better manage and analyze significant data.

This can include everything from case documents and contracts to financial records and client data. By using analytics tools, legal professionals can quickly identify patterns and trends in this data, which can help them to make more informed decisions. For instance, in March 2023, Icertis, Inc. and KPMG LLP collaborated to deliver Icertis Contract Intelligence through the contracting practices of KPMG to help customers to reduce costs, increase revenue, ensure compliance, and manage risks.

Contract lifecycle management accounted for the highest market share of over 26% in 2022. Contract lifecycle management software involves the management of contracts from the initial drafting stage through execution, ongoing management, and eventual expiration or renewal. The growth of contract lifecycle management software in the legal technology market is attributed to the increasing need for businesses to manage contracts more efficiently and effectively. With the growing complexity and rising number of contracts that businesses need to manage and the need for greater compliance and risk management, contract lifecycle management software is becoming an essential tool for businesses of all sizes.

End-user Insights

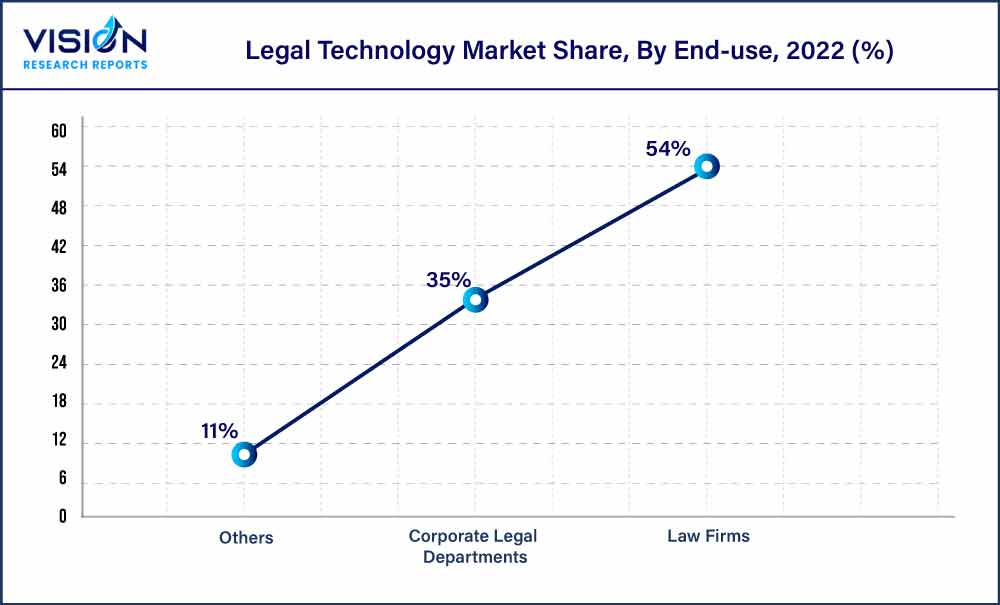

The others segment is expected to grow at a CAGR of approximately 10.03% during the forecast period. The others segment include individuals/lawyers and government agencies. The individual/lawyer uses legal technology software to research, review contracts, draft documents, and manage cases. Government agencies use legal technology solutions to manage legal operations, compliance obligations, legal contracts, and e-billing software to track invoices, manage payments, and streamline operations.

The law firms segment accounted for the highest market share of about 56% in 2022 and is expected to continue its dominance throughout the forecast period. The rising adoption of legal technology in legal firms is attributed to the benefits of collaborating with colleagues and clients more efficiently and accessing documents or data from anywhere.

Legal technology solutions allow law firms to perform tasks like due diligence and document review by accessing large amounts of data accurately and quickly. Furthermore, the features such as electronic billing are resulting in rising adoption as it allows lawyers to time-tracking and helps to manage invoices, saving time and reducing errors.

Regional Insights

The legal technology market in the Asia Pacific region is projected to grow significantly in the coming years. The growth is attributed to the rising adoption of machine learning and artificial intelligence technologies in the legal industry. Companies in the Asia Pacific region are increasingly adopting the latest technologies to perform legal research, document management, contract analysis and review, and much more.

For instance, in January 2023, Themis Solutions Inc. (Clio) expanded its operation to Australia to expand and support partnerships, sales, and product development in the Australian legal market. Furthermore, the growing incorporation of blockchain technology positively impacts the market as it enables law professionals to perform tasks, including dispute resolution and contract management, and provides an immutable and secure transaction record.

North America accounted for the highest market share of around 50% in 2022. The region is projected to witness substantial growth owing to the increasing automation by using machine learning and artificial intelligence coupled with the increasing adoption of cloud-based solutions as they offer scalability, cost-effectiveness, and flexibility, offering various growth opportunities for the market. Furthermore, incorporating blockchain technology to offer transparency and more secure legal transactions is projected to fuel the growth of legal technology in North America.

Legal Technology Market Segmentations:

By Solution

By Type

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Solution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Legal Technology Market

5.1. COVID-19 Landscape: Legal Technology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Legal Technology Market, By Solution

8.1. Legal Technology Market, by Solution, 2023-2032

8.1.1 Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Legal Technology Market, By Type

9.1. Legal Technology Market, by Type, 2023-2032

9.1.1. E-discovery

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Legal Research

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Practice Management

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Analytics

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Compliance

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Document Management

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Contract Lifecycle Management

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Time-Tracking & Billing

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Legal Technology Market, By End-user

10.1. Legal Technology Market, by End-user, 2023-2032

10.1.1. Law Firms

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Corporate Legal Departments

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Legal Technology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2020-2032)

11.1.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.3. Market Revenue and Forecast, by End-user (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2020-2032)

11.2.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2020-2032)

11.3.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 12. Company Profiles

12.1. Icertis, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Filevine Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DocuSign, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Casetext Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ProfitSolv, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Knovos, LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Mystacks, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Practice Insight Pty Ltd (WiseTime)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. TimeSolv Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Themis Solutions Inc. (Clio)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others