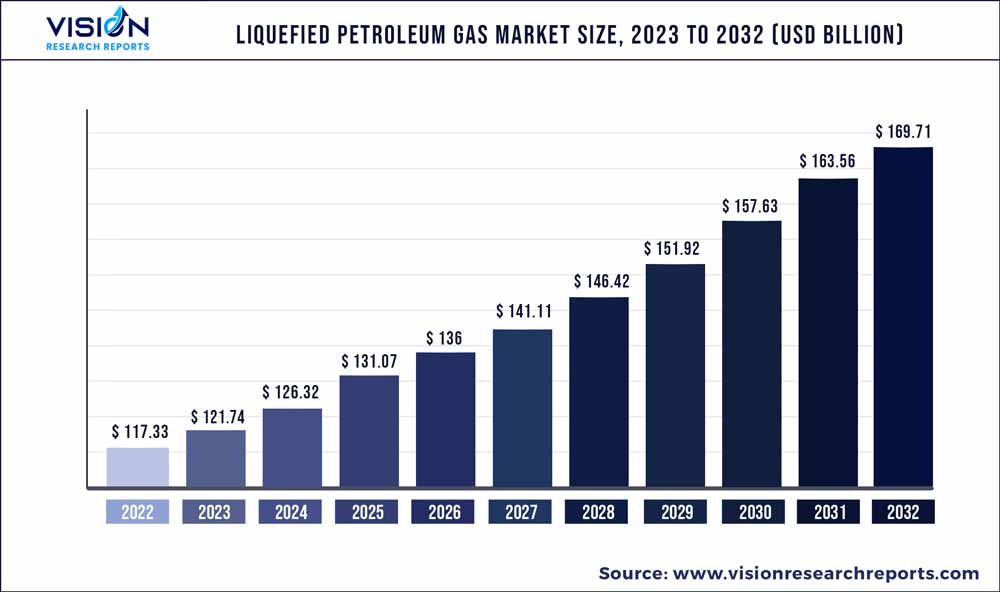

The global liquefied petroleum gas market was estimated at USD 117.33 billion in 2022 and it is expected to surpass around USD 169.71 billion by 2032, poised to grow at a CAGR of 3.76% from 2023 to 2032.

Key Pointers

Report Scope of the Liquefied Petroleum Gas Market

| Report Coverage | Details |

| Market Size in 2022 | USD 117.33 billion |

| Revenue Forecast by 2032 | USD 169.71 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.76% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Repsol; China Gas Holdings Ltd.; Saudi Arabian Oil Co.; FLAGA GmbH; Kleenheat; Bharat Petroleum Corporation Limited; JGC HOLDINGS CORPORATION; Phillips 66 Company; Chevron Corporation; Reliance Industries Limited; Exxon Mobil Corporation; Total; Royal Dutch Shell; Petroliam Nasional Berhad (PETRONAS); PetroChina Company Limited; Petredec Pte Limited; Qatargas Operating Company Limited; Petrofac Limited; Vitol; China Petroleum & Chemical Corporation; BP Plc. |

Growing demand for liquefied petroleum gas (LPG) from emerging countries is projected to drive the global market during the estimated period. Urbanization and industrialization have increased expressively across the world over the past few years. The flow of investments has changed from developed countries toward emerging countries owing to the low costs of labor and infrastructure.

Increasing prices of fuel and growing environmental concerns have upturned the countries’ attention towards LPG to be used as an alternative fuel, which is the main factor propelling the market growth. Some of the key government mandates such as Federal Emission Standards, and the California Air Resources Board Zero Emission Vehicle Mandate are turning the automotive industry towards more advanced technologies so as to reduce carbon emission and achieve fuel economy, which will directly increase the demand for LPG across the market.

Demand for LPG is anticipated to observe significant growth over the projected period on account of its numerous benefits, such as low cost, low-carbon emissions, and operational benefits. LPG is emerging as a striking option for the commercial sector, combined with low-carbon technologies and renewables to assimilate a reliable year with round the clock power supply with less carbon emissions.

The residential/commercial application segment accounted for a substantial share in 2019 and is estimated to witness significant growth in the next seven years. High demand for LPG as a heating fuel and for cooking purpose in the commercial as well as residential segments has been the major factor increasing its penetration in the sector.

The liquefied petroleum gas (LPG) market in the Asia Pacific conquered the global consumption and accounted for over 28.0% share of the total volume in 2019. The Asia Pacific is anticipated to witness significant growth during the forecast period. Increasing consumption of liquefied petroleum gas for domestic usage purposes, such as cooking fuel, coupled with initiatives taken by the government, mainly in India, China, and Indonesia, is projected to propel LPG demand across the region.

Source Insights

The non-associated gas source type accounted for more than USD 62.02 billion in 2022. The sources of the fuel differ from area to area, for example, in North America the majority of the gas is procured from natural gas processing units. However, Asia Pacific relies on its refineries for production. On a global scale, refineries are one of the primary sources of gas production. Escalating refining capacity, specifically in Saudi Arabia, Brazil, India, and China is projected to surge product supply over the upcoming years.

The demand for liquefied petroleum gas from associated gas in the Asia Pacific region was more than 17.0 million tons in 2022. It is likely to reach more than 23.0 million tons by 2032, increasing at an assessed CAGR of over 3.0% from 2023 to 2032. Non-associated sources accounted for a noteworthy revenue share and are projected to observe the fastest growth over the projected period.

The United States shale boom has occurred as a major drift resulting in excess in the global LPG market. The market has also witnessed substantial field developments in oil and gas wells coupled with growing on-site processing facilities mainly in Russia, China, the U.S., and Canada.

Application Insights

The chemical application type accounted for more than USD 19.03 billion in 2022. Commercial and residential application accounted for a substantial share in the LPG market. Extensive dependency on liquefied petroleum gas as a cooking fuel can be witnessed among the urban and rural residents across the regions such as Asia-Pacific and Central and South America.

Promising government subsidies and initiatives to endorse the product as the major substitute fuel to conventional fuels such as wood and coal that has been the key factors contributing towards market penetration. Liquefied petroleum gas is also replacing chlorofluorocarbon and hydrofluorocarbon as a refrigerant owed to nominal contribution toward the depletion of the ozone layer. This has led to amplified application opportunities in the commercial/residential segments in ventilating & heating applications in addition to cooking purposes.

Autogas is also projected to witness substantial growth in the near future owing to increasing alternate fuel demand in the transportation sector to minimize environmental concerns such as carbon emission levels and pollution levels. In addition, it is one of the cheapest energy sources, which is making it suitable for diesel and gasoline in the global transportation industry.

Regional Insights

Asia Pacific led to a surge in the global market with a net demand of more than 83.06 million tons in 2022. Population growth, ample resource availability, and high energy necessities coupled with easy affordability owed to the existence of government subsidies on LPG cylinders have been the key factors accountable for high market penetration. This is further maintained by the increasing petrochemical capacities across India, China, India, Thailand, and South Korea.

India is a prominent importer of liquefied petroleum gas demand in 2022, taking consignments at a steady rate from the United States and Middle East regions to fund domestic fuel usage. Prime Minister Narendra Modi announced that India had met its target to provide 80 million free cooking gas connections to the residents of the country, and 2020 demand will fulcrum on the capability of the government to sustain the market at low marketing prices. To that end, an entry of investment in liquefied petroleum gas receiving distribution pipelines (over 14 million mt/year) and terminals (over 12 million mt/year) will support LPG usage in India.

The LPG demand in Europe was more than USD 33.04 billion in 2022 and is expected to reach over USD 43.08 billion, growing at an estimated CAGR of over 3.01% from 2023 to 2032. Numerous summit meetings such as COP21 are taken into deliberation by many countries to decrease carbon emissions into the atmosphere. For instance, India is taking the initiative to use other cooking fuels for cooking purposes.

Mature economies of Europe and North America are anticipated to witness significant growth owing to growing awareness reduce carbon emissions. In Europe, Russia is forecasted to grow at the fastest CAGR of 4.9% in terms of revenue over the forecast period.

Liquefied Petroleum Gas Market Segmentations:

By Source

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liquefied Petroleum Gas Market

5.1. COVID-19 Landscape: Liquefied Petroleum Gas Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Liquefied Petroleum Gas Market, By Source

8.1. Liquefied Petroleum Gas Market, by Source, 2023-2032

8.1.1. Refinery

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Associated Gas

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Non-Associated Gas

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Liquefied Petroleum Gas Market, By Application

9.1. Liquefied Petroleum Gas Market, by Application, 2023-2032

9.1.1. Residential/Commercial

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Chemical

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Autogas

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Refinery

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Liquefied Petroleum Gas Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Repsol

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. China Gas Holdings Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Saudi Arabian Oil Co.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. FLAGA GmbH

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kleenheat

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bharat Petroleum Corporation Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. JGC HOLDINGS CORPORATION

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Phillips 66 Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Chevron Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Reliance Industries Limited

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others