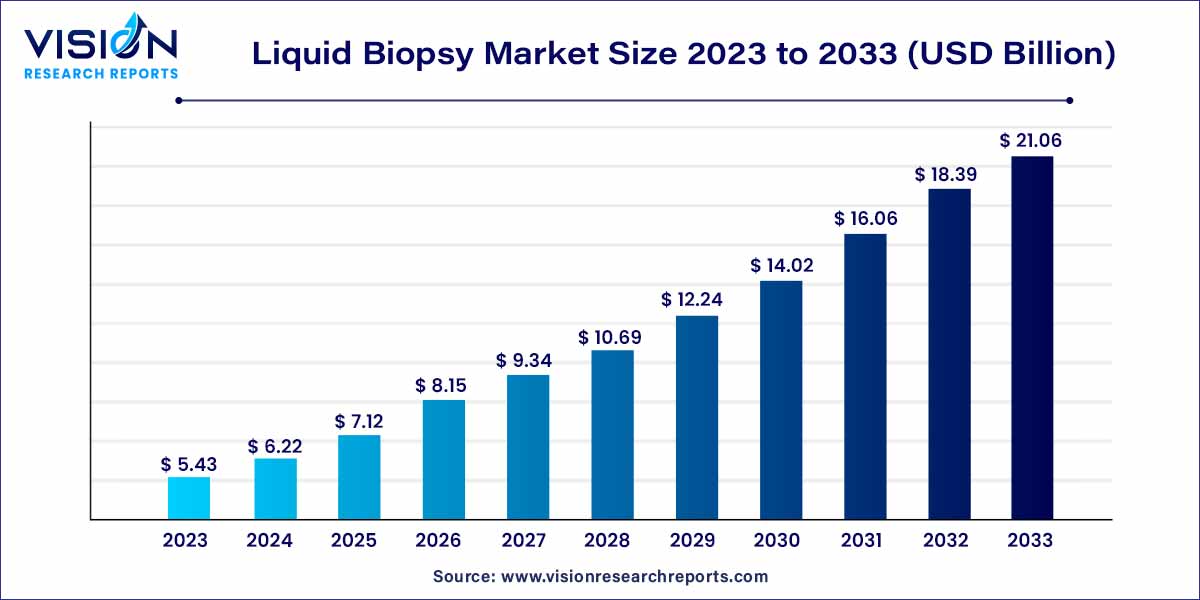

The global liquid biopsy market size was estimated at around USD 5.43 billion in 2023 and it is projected to hit around USD 21.06 billion by 2033, growing at a CAGR of 14.52% from 2024 to 2033. The increasing incidence of cancer, advances in technology for cancer diagnosis, and increased need for less intrusive cancer diagnosis are all driving growth in the liquid biopsy market.

The liquid biopsy market is experiencing significant growth and innovation, revolutionizing cancer detection and monitoring. Unlike traditional tissue biopsies, which involve invasive procedures, liquid biopsies offer a non-invasive alternative by analyzing circulating tumor cells (CTCs), cell-free DNA (cfDNA), and other biomarkers present in bodily fluids such as blood, urine, and cerebrospinal fluid.

"The liquid biopsy market is propelled by several key growth factors. One of the primary drivers is the escalating incidence of cancer globally, prompting the need for non-invasive diagnostic solutions. Technological advancements in sequencing technologies, such as next-generation sequencing and digital PCR, have significantly enhanced the sensitivity and accuracy of liquid biopsy assays, further fueling market growth. Additionally, the clinical utility and adoption of liquid biopsies for real-time monitoring of disease progression, treatment response, and detection of resistance mutations have contributed to increased acceptance by healthcare providers and researchers. Furthermore, the rising demand for personalized medicine and targeted therapies has stimulated the use of liquid biopsies for identifying actionable mutations and guiding treatment decisions. These factors collectively contribute to the robust growth trajectory of the liquid biopsy market."

Growing Adoption of Non-Invasive Diagnostic Solutions:

Advancements in Sequencing Technologies:

Expanding Clinical Applications:

Integration of Artificial Intelligence (AI) and Machine Learning (ML):

Shift towards Companion Diagnostics and Precision Medicine:

The segment of multi-gene-parallel analysis (NGS) dominated the market with a revenue share of 76% in 2023 and is expected to exhibit the highest growth rate throughout the forecast period. NGS technology enables the detection of various mutations responsible for tumor development and the identification of potential resistance mechanisms post-treatment originating from pre-existing clones. Continuous advancements in NGS technology have significantly reduced sequencing costs while maintaining high accuracy levels.

The Single Gene Analysis (PCR Microarrays) segment is projected to witness substantial growth during the forecast period, driven by technological advancements in PCR techniques. The introduction of Droplet Digital PCR (ddPCR) represents a notable advancement, enabling precise quantification of nucleic acids with heightened sensitivity and accuracy. This PCR technology serves as a rapid and precise tool for detecting and monitoring various cancer types.

In 2023, the Circulating Nucleic Acids biomarker segment held the largest market share, accounting for 36%, mainly due to the extensive applications of circulating tumor DNA (ctDNA) in liquid biopsies. Translational cancer researchers are increasingly identifying ctDNA from tumors using liquid biopsy techniques. The discovery of ctDNA presents promising prospects for future cancer diagnosis applications by serving as a potential biomarker. It has been proposed as an alternative source for molecular profiling of tumor DNA in cancer patients, offering a less invasive approach compared to traditional methods.

The Exosomes/Microvesicles segment is expected to witness the fastest compound annual growth rate (CAGR) over the forecast period. Exosomes offer significant advantages in liquid biopsy applications. They are found in various body fluids, including plasma, cerebrospinal fluid, and urine, and exhibit high stability due to their encapsulation by lipid bilayers. Exosomes play a crucial role as mediators between cells during cancer progression and metastasis, forming a complex signaling pathway network between cancer cells and the tumor microenvironment. This interaction is a key factor in cancer progression across all stages.

In 2023, the Cancer application segment dominated the overall market, capturing a revenue share of 87%. This dominance can be attributed to the increasing adoption of liquid biopsy for cancer detection, driven by the growing global prevalence of cancer. Liquid biopsy technology has emerged as one of the most rapidly evolving diagnostic technologies, experiencing significant growth in clinical applications in recent years. It serves as a promising precision oncology tool, enabling longitudinal monitoring and less invasive molecular diagnostics for therapeutic purposes.

The Reproductive health segment is projected to experience the fastest compound annual growth rate (CAGR) of 12.85% over the forecast period, fueled by promising research and development (R&D) efforts in liquid biopsy for the treatment and maintenance of reproductive health. This segment is expected to witness profitable growth throughout the projection period, further supported by alliances and partnerships among industry players in reproductive health. For example, in September 2021, Bionano Genomics and NuProbe collaborated on reproductive health and oncology liquid biopsy testing, offering the opportunity to identify variations that traditional next-generation sequencing (NGS) methods may not detect.

In 2023, the hospitals and laboratories end-use segment emerged as the dominant force in the market, accounting for a revenue share of 43%. Hospitals are preferred healthcare facilities due to the availability of comprehensive services under one roof. The advantage of hospitals in conducting cancer diagnosis lies in their ability to deliver test results promptly, even in emergency situations. Liquid biopsy has revolutionized cancer diagnosis by providing doctors with highly precise results in a shorter turnaround time, thereby reducing treatment delays. Cancer patients undergoing treatment in hospitals benefit from routine monitoring to assess resistance to treatment.

The specialty clinics segment is poised to exhibit the fastest compound annual growth rate (CAGR) of 12.25% over the forecast period. This growth can be attributed to increased awareness of personalized medicine, advancements in technology, and a rising demand for cost-effective healthcare services. Government initiatives aimed at providing various facilities, including reimbursement for diagnostic tests, are expected to further drive market growth. Additionally, healthcare institutions are collaborating with laboratories to offer a diverse range of clinical tests, such as microbiology testing, thereby expanding the scope of services provided by specialty clinics.

In 2023, North America emerged as the dominant region in the market, commanding a revenue share of 51%. This dominance is attributed to several factors including the high prevalence of cancer, rapid technological advancements, and growing government initiatives in the region. The United States, in particular, leads the market due to substantial investments and the presence of numerous biotechnology companies focused on developing advanced diagnostic tests. Organizations such as the American Society of Clinical Oncology (ASCO) are actively supporting the adoption of liquid biopsy techniques, which is expected to further drive revenue growth in this market.

The Asia Pacific region is poised to witness the fastest compound annual growth rate (CAGR) of 13.12% over the forecast period, driven by various factors including improving healthcare reforms. Other contributors to market growth in the region include a growing population, advancements in healthcare infrastructure, and the entry of new market players. Asia Pacific has a significant population and experiences a high prevalence of cancer, with an estimated 10.5 million new cases reported in the region in 2022 according to Global Cancer Statistics.

By Sample Type

By Biomarker

By Application

By End-use

By Clinical Application

By Product

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others