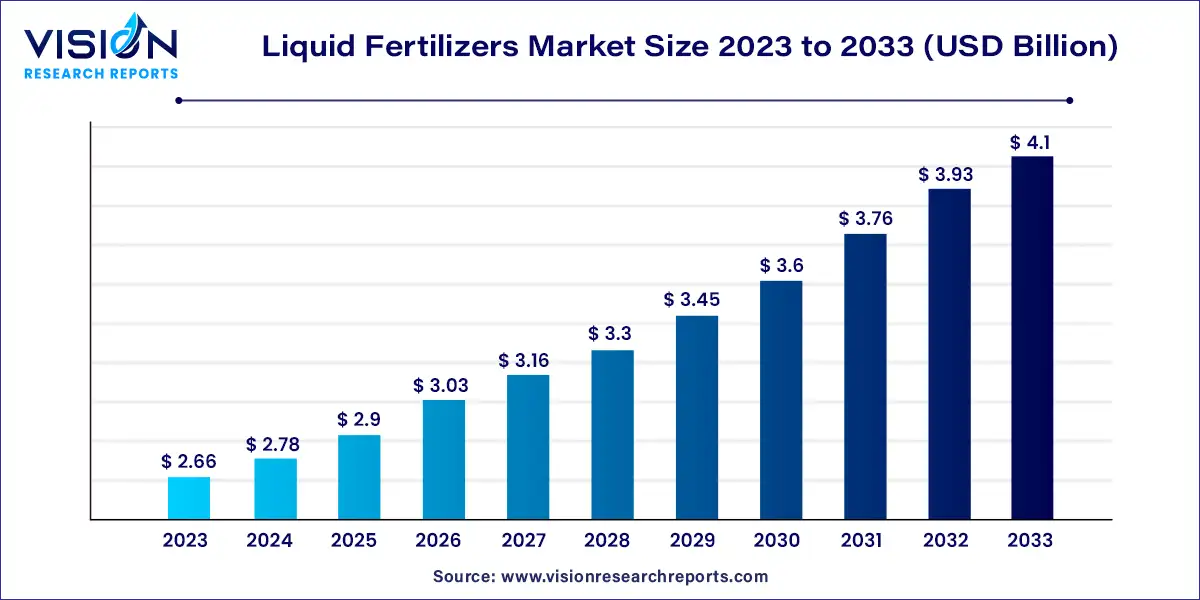

The global liquid fertilizers market size was valued at USD 2.66 billion in 2023 and is anticipated to reach around USD 4.1 billion by 2033, growing at a CAGR of 4.43% from 2024 to 2033. The global liquid fertilizers market is a dynamic and rapidly evolving segment of the agricultural industry. Liquid fertilizers, distinguished by their nutrient-rich, fluid form, are gaining popularity for their efficiency and ease of application compared to traditional granular fertilizers.

The expansion of the liquid fertilizers market is propelled by an increasing global agricultural productivity demands efficient nutrient delivery systems, and liquid fertilizers offer a significant advantage by providing rapid and precise nutrient uptake for crops. Technological advancements in fertilizer formulations and application methods further boost market growth, as they enhance nutrient absorption and reduce wastage. Additionally, the rising focus on sustainable farming practices drives the adoption of liquid fertilizers, which often feature environmentally friendly compositions and more controlled application techniques. Regional agricultural intensification, particularly in developing economies, coupled with growing awareness of the benefits of liquid fertilizers, supports further market expansion. Together, these elements underscore the dynamic growth trajectory of the liquid fertilizers industry.

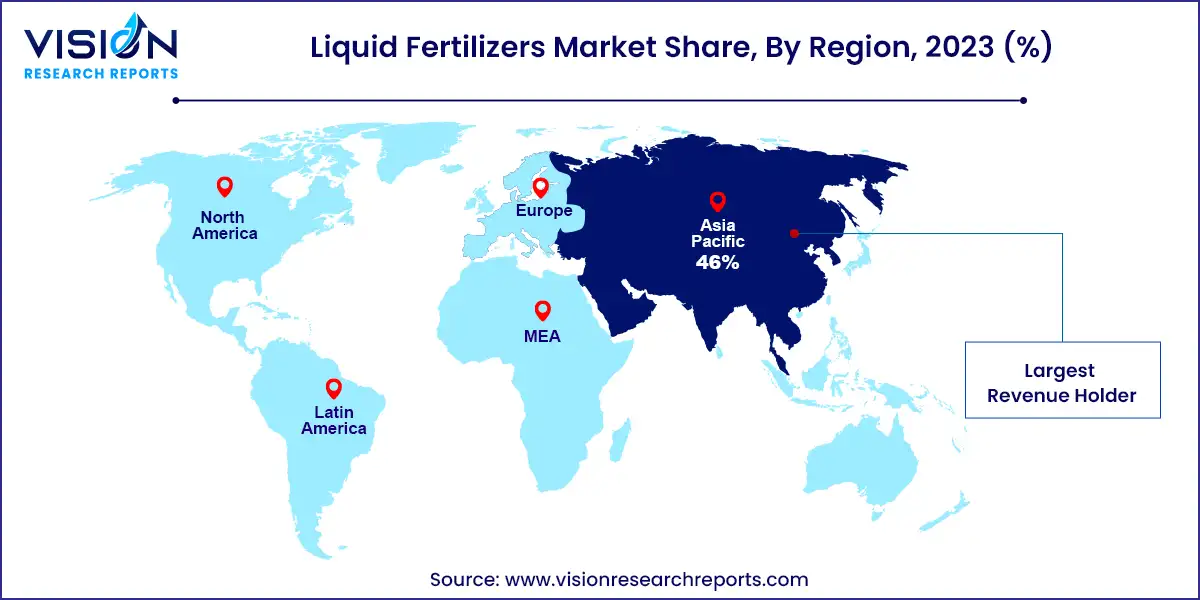

The Asia Pacific region led the market, with a revenue share of over 46% in 2023. The region's large population creates a high demand for agricultural products, necessitating enhanced crop productivity and yield. As a major player in global agriculture, the diversity of crops grown in the Asia Pacific, ranging from staple foods like rice and wheat to cash crops like fruits and vegetables, fuels the demand for fertilizers in this region.

Additionally, the prevalence of smallholder farming and labor-intensive agricultural practices increases the need for efficient and easy-to-apply fertilization methods. Liquid fertilizers are well-suited for small-scale farmers due to their versatility in application techniques, making them an attractive option. The growing awareness of sustainable farming practices and environmental concerns further drives the adoption of liquid fertilizers, as they can be applied in ways that reduce runoff and minimize environmental pollution, aligning with the push towards more responsible agriculture in the region.

In 2023, foliar application dominated the market with a revenue share of 69%. Foliar spraying involves directly applying nutrients to plant leaves, allowing for the efficient absorption of essential elements. This method has gained popularity, particularly in the horticulture industry, due to its effectiveness in quickly correcting micronutrient deficiencies, especially during early growth stages. While foliar applications provide a rapid remedy, they are considered a temporary solution rather than a long-term replacement for soil fertilizers. For example, during summer, fruit trees can be treated for spider mite infestations by applying pesticides to their leaves. The rise in small-scale farming and a focus on sustainable agricultural practices have made horticulture increasingly lucrative compared to traditional farming methods.

Fertigation, another method of application, saw significant growth, holding a 32% market share during the forecast period. Fertigation combines irrigation and fertilization, enabling precise nutrient and water delivery directly to the plant's root zone. This technique helps increase crop yields while minimizing environmental pollution and ensures uniform nutrient application across entire fields. Fertigation is becoming more popular due to the global shift towards efficient irrigation systems and the adoption of precision agriculture. By integrating fertigation with digital technologies, farmers can optimize nutrient delivery based on real-time data, such as soil moisture and crop needs, promoting sustainable farming practices.

Grains and cereals held the largest market share in 2023, accounting for 39% of total revenue. These crops are vital components of the global food supply and are a staple for billions of people worldwide. With a growing global population, the demand for grains and cereals remains high, emphasizing the importance of effective nutrient management to achieve optimal yields.

These crops are cultivated on a large scale across various agro-climatic zones, leading to substantial demand for fertilizers, including liquid options, to maintain productivity and consistency. The versatility of these fertilizers allows them to be applied using both traditional and modern precision agriculture techniques, catering to the specific needs of different grain and cereal varieties. This flexibility in nutrient application provides numerous advantages for farmers.

Nitrogen fertilizers dominated the market, capturing a 53% revenue share in 2023. Nitrogen is essential for healthy plant growth, playing a crucial role in forming amino acids, proteins, and chlorophyll, all vital for plant development and photosynthesis. Consistent nitrogen supply is critical throughout the growth stages of crops. Liquid nitrogen fertilizers offer flexibility in their application, such as through foliar spraying and fertigation, making them a popular choice among farmers.

This adaptability allows farmers to fine-tune nutrient delivery based on the specific needs and growth conditions of crops. The increasing global demand for higher crop yields further drives the use of nitrogen-based fertilizers, given their rapid availability and significant impact on agricultural productivity.

By Product

By Application

By Method of Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liquid Fertilizers Market

5.1. COVID-19 Landscape: Liquid Fertilizers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Liquid Fertilizers Market, By Type

8.1. Liquid Fertilizers Market, by Type, 2023-2032

8.1.1 Nitrogen

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Micronutrients

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Potassium

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Phosphate

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Liquid Fertilizers Market, By Mode of Application

9.1. Liquid Fertilizers Market, by Mode of Application, 2023-2032

9.1.1. Soil

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Fertigation

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Foliar

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Liquid Fertilizers Market, By Production Process

10.1. Liquid Fertilizers Market, by Production Process, 2023-2032

10.1.1. Organic

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Inorganic

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Liquid Fertilizers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Production Process (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Mode of Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Production Process (2020-2032)

Chapter 12. Company Profiles

12.1. AgroLiquid

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. COMPO Expert GmbH (Grupa Azoty S.A.)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Haifa Group

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ICL Group Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. K+S Aktiengesellschaft

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Kugler Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nutrien Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Nutri-Tech Solutions Pty Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Plant Food Company Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tessenderlo Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others