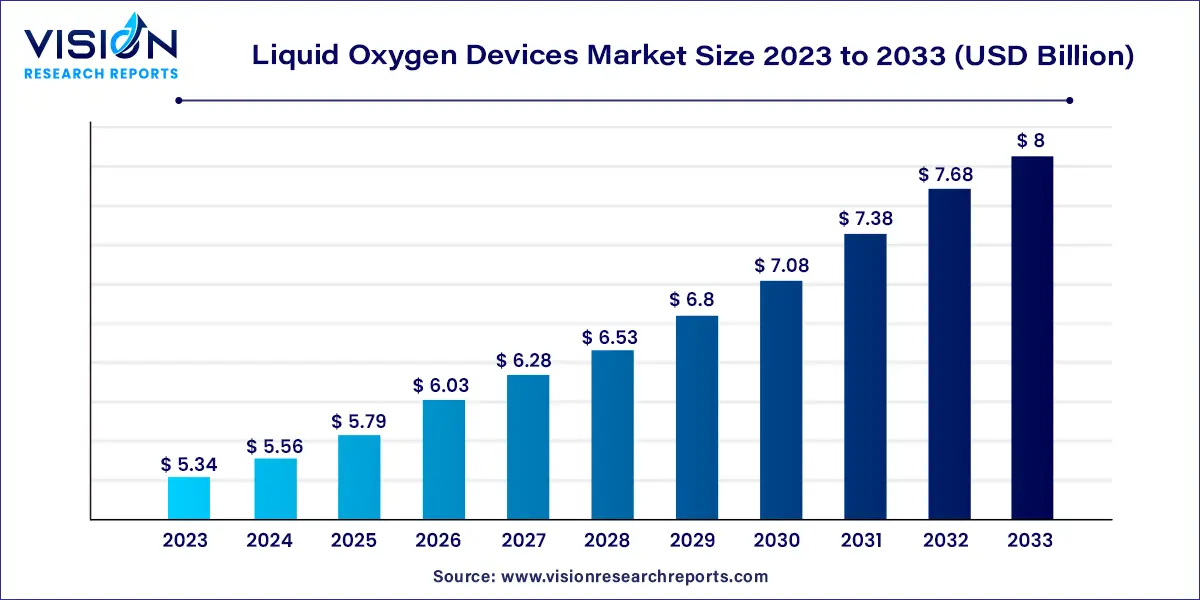

The global liquid oxygen devices market was valued at USD 5.34 billion in 2023 and it is predicted to surpass around USD 8 billion by 2033 with a CAGR of 4.12% from 2024 to 2033.

The global healthcare industry is witnessing a transformative shift with advancements in medical technology. One such area that has gained significant attention is the development and utilization of liquid oxygen devices. These devices play a pivotal role in delivering oxygen therapy to patients, especially those suffering from respiratory disorders. Liquid oxygen devices offer several advantages over traditional oxygen cylinders, including higher storage capacity, convenience in usage, and enhanced mobility.

The global healthcare landscape is undergoing a paradigm shift, especially in the domain of respiratory care. Liquid oxygen devices have emerged as a crucial component in this transformation, offering advanced solutions for oxygen therapy. Unlike conventional oxygen cylinders, liquid oxygen devices store oxygen in a cryogenic state, providing a more efficient and convenient way to deliver oxygen to patients in need.

The growth of the liquid oxygen devices market is attributed to several key factors. Firstly, the increasing prevalence of respiratory disorders worldwide, such as chronic obstructive pulmonary disease (COPD) and asthma, has led to a rising demand for efficient oxygen therapy solutions, driving the market expansion. Secondly, advancements in technology have significantly enhanced the design and functionality of liquid oxygen devices, making them more user-friendly and reliable. Additionally, the growing aging population, coupled with the awareness regarding the benefits of oxygen therapy, has further boosted market growth. Moreover, the portable and convenient nature of liquid oxygen devices has made them a preferred choice among healthcare providers and patients, augmenting the market demand. These factors collectively contribute to the robust growth trajectory of the liquid oxygen devices market, offering substantial opportunities for industry players and ensuring improved respiratory care for patients globally.

| Report Coverage | Details |

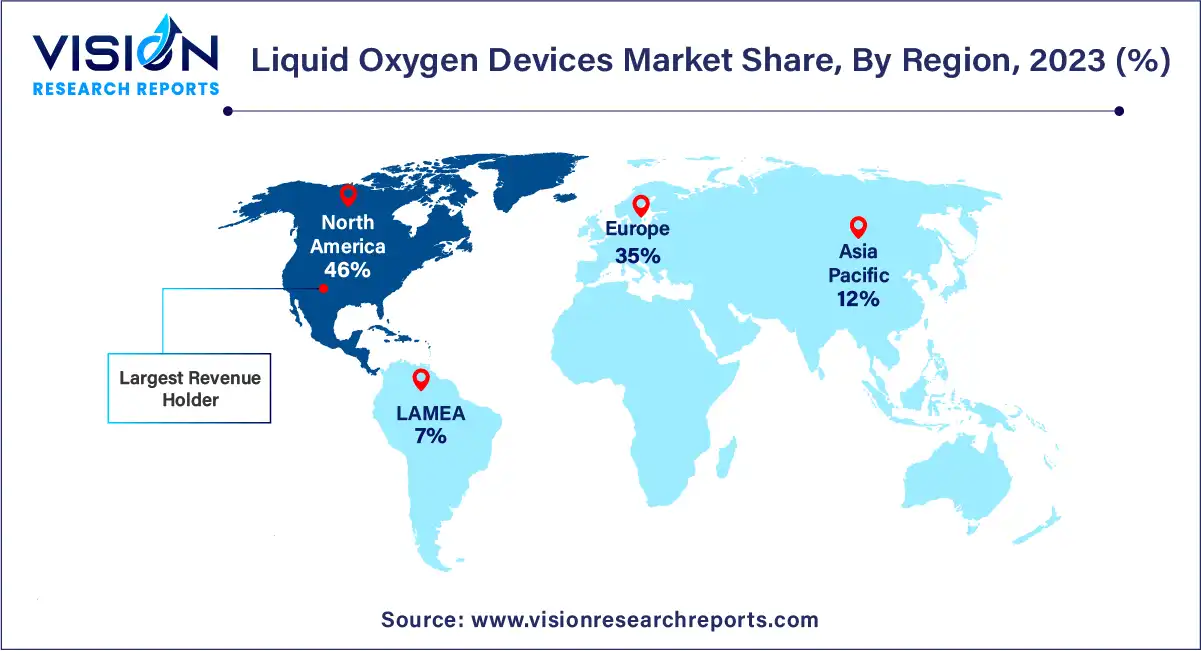

| Revenue Share of North America in 2023 | 46% |

| Revenue Forecast by 2033 | USD 8 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.12% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The homecare segment accounted for the biggest revenue share of 48% in 2023. In the domain of home care, liquid oxygen devices have emerged as a cornerstone in providing efficient and convenient oxygen therapy solutions to patients. The ease of use, portability, and continuous oxygen supply make these devices ideal for individuals seeking oxygen therapy in the comfort of their homes. Patients with chronic respiratory disorders, such as COPD and asthma, benefit immensely from the uninterrupted oxygen flow facilitated by liquid oxygen devices, allowing them to maintain a better quality of life without the constraints of traditional oxygen cylinders.

The outpatient facilities segment is expected to grow at the fastest CAGR during the predicated period. Outpatient facilities have embraced liquid oxygen devices as an essential component of their medical offerings. These facilities cater to a diverse range of patients requiring oxygen therapy on an outpatient basis. Liquid oxygen devices provide healthcare professionals with a reliable and portable solution to ensure that patients receive the necessary oxygen levels while receiving treatment or undergoing diagnostic procedures. The mobility of these devices proves especially valuable in outpatient facilities where patients often move within the premises for various medical interventions.

North America led the market with the highest market share of 46% in 2023. North America stands as a significant contributor to the market, owing to a well-established healthcare infrastructure and a high prevalence of respiratory disorders. The region's commitment to technological advancements and patient-centric care has fostered the adoption of liquid oxygen devices, particularly in the United States and Canada.

Asia Pacific region is anticipated to grow significantly throughout the forecast period. Asia-Pacific is a region poised for robust market expansion, given its large population and a rising incidence of respiratory ailments. Countries like China and India are key growth drivers, with improving healthcare infrastructure and a growing demand for advanced oxygen therapy solutions.

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liquid Oxygen Devices Market

5.1. COVID-19 Landscape: Liquid Oxygen Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Liquid Oxygen Devices Market, By End-use

8.1.Liquid Oxygen Devices Market, by End-use Type, 2024-2033

8.1.1. Hospitals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Outpatient Facilities

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Home Care

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Liquid Oxygen Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by End-use (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by End-use (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by End-use (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by End-use (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by End-use (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by End-use (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by End-use (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by End-use (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by End-use (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by End-use (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by End-use (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by End-use (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by End-use (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by End-use (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by End-use (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 10. Company Profiles

10.1. CAIRE

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. CRYOFAB

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Philips

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Airliquide

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Inogen

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others