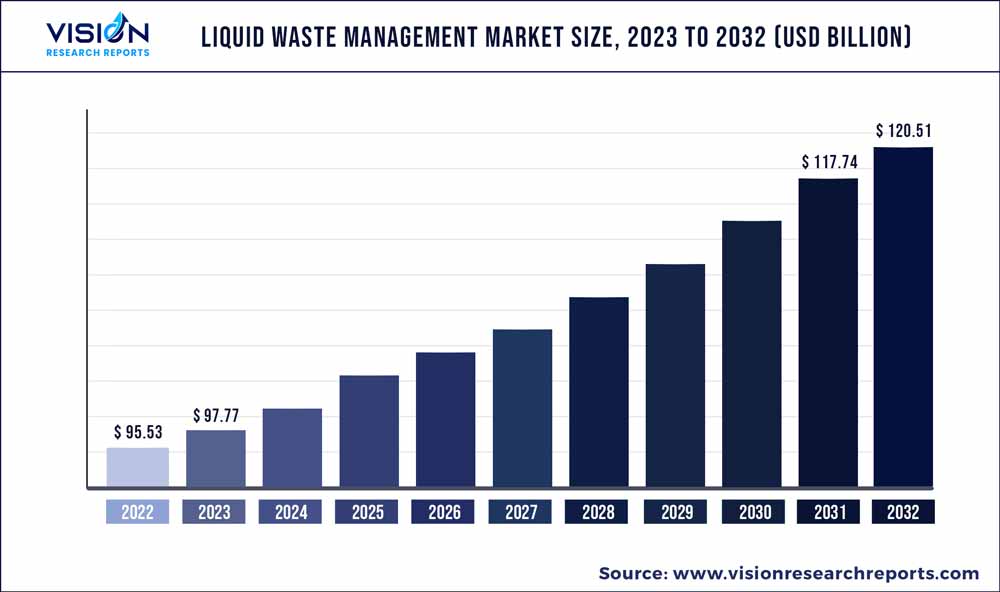

The global liquid waste management market was surpassed at USD 95.53 billion in 2022 and is expected to hit around USD 120.51 billion by 2032, growing at a CAGR of 2.35% from 2023 to 2032. The liquid waste management market in the United States was accounted for USD 25.14 billion in 2022.

Key Pointers

Report Scope of the Liquid Waste Management Market

| Report Coverage | Details |

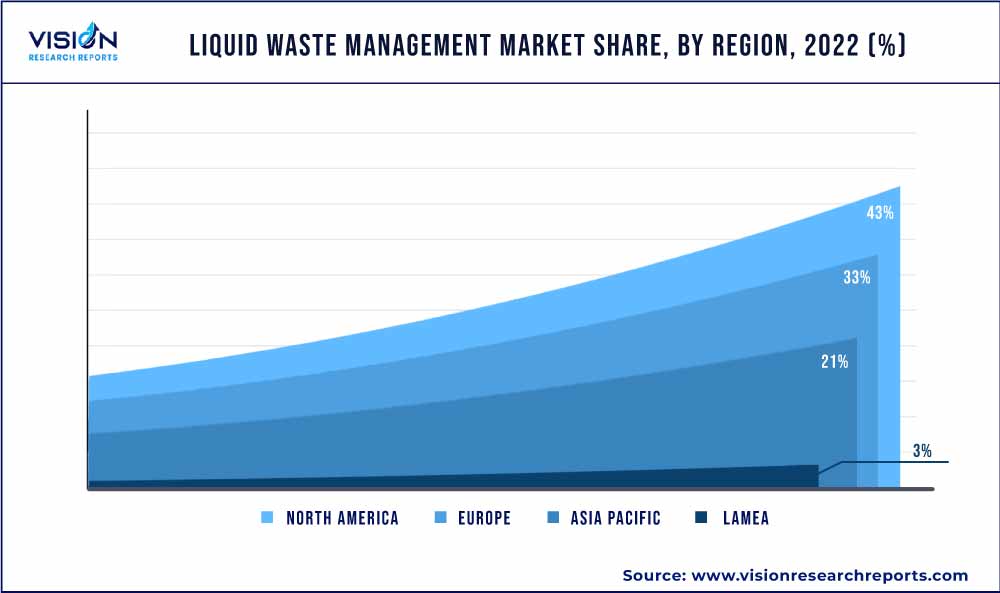

| Revenue Share of North America in 2022 | 43% |

| CAGR of Asia Pacific from 2023 to 2032 | 3.54% |

| Revenue Forecast by 2032 | USD 120.51 billion |

| Growth Rate from 2023 to 2032 | CAGR of 2.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Veolia; Waste Management Solutions; Clean Harbors Inc.; Clean Water Environmental; Liquid Environmental Solutions (LES); DC Water; Covanta Holding Corp.; Stericycle, Inc.; U.S. Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts |

The increasing demand for wastewater treatment plants coupled with the rising toxicity and safety concerns are expected to drive the demand for liquid waste management over the forecast period. For instance, according to Sales Leads Inc., the construction of wastewater treatment plants stands at 32 units and the expansion of wastewater treatment stands at 8 units. Thus, the growing demand for wastewater treatment in the U.S. is expected to drive the demand for liquid waste management in the coming years. The companies operating in various industries, such as manufacturing, mining, construction, and metallurgical, generate a significant quantity of liquid waste, which is neither recyclable nor consumable.

The operation of big corporations on large scale results in the production of a high amount of liquid waste along with other waste byproducts. This, in turn, has resulted in boosting the importance of proper management of waste by these companies for preventing further degradation of the environment and the planet. Furthermore, these corporations are required to protect the workers from exposure to contaminants. These companies are required to ensure that they adopt an appropriate method to ensure safe and proper waste disposal in an industrial liquid waste management process. Wastewater treatment and removal are critical processes in protecting public health. Wastewater treatment plants and facilities improve the water quality by reducing toxins present in wastewater, which cause harm to the environment and mankind.

According to the American Society of Civil Engineers (ASCE) 2017 Infrastructure Report, it is estimated that around 56 million people will be connected to centralized treatment plants by 2032. These aforementioned factors will propel the market expansion over the forecast period.Moreover, the U.S. EPA reports that between 23,000 and 75,000 sanitary sewers overflow annually in the country. So, upgrading the existing treatment facilities or building new wastewater treatment facilities is anticipated as a result of the increasing number of new users connecting to centralized treatment systems. Furthermore, it is estimated that around 532 new treatment facilities need to be constructed to meet the growing demand for wastewater treatment.

Thus, the growing population, rising number of new housing projects, and an increasing number of users being connected to centralized wastewater treatment systems are expected to drive the demand for secondary wastewater treatment equipment in the coming years. These aforementioned factors are expected to further drive the market demand in the coming years. In addition, a positive government outlook with respect to funding wastewater treatment plants is further anticipated to have a positive impact on the demand for secondary wastewater treatment equipment over the forecast period. For instance, the Clean Water State Revolving Fund (CWSRF) program, which was created through the amendments to the Clean Water Act (CWA) in 1987, is a partnership program between the U.S. EPA and the states.

This program provides funding to communities for various water-related infrastructure projects, such as decentralized wastewater treatment, the construction of publicly owned treatment works, green infrastructure projects, and watershed pilot projects among others. Furthermore, several governments have introduced stringent regulations related to wastewater emissions for industrial sectors, which is expected to drive the market over the forecast period. Major governmental agencies, such as the European Environment Agency (EEA), the United States Environmental Protection Agency (EPA), and the Central Pollution Control Board (CPCB), are playing critical roles in enhancing water quality and preventing water pollution. These aforementioned factors will further drive market expansion.

Source Insights

The residential segment led the market and accounted for approximately 43% of the global revenue share in 2022. Water is used for different applications in the residential sector; therefore, with rapid population growth, demand for water in several applications is increasing, resulting in a significant rise in the amount of per capita wastewater generated. These aforementioned factors are expected to drive the demand for liquid waste management over the forecast period. Rising awareness regarding the proper disposal of waste in the U.S. for maintaining animal and human health has resulted in the emergence of various disposal methods and techniques. The presence of large amounts of dangerous compounds, such as salts & metals, in the waste has made it necessary for waste management companies to dispose of or recycle the waste in a timely manner.

The commercial sector is witnessing significant growth on account of improved medical facilities and high demand in the hospitality industry. The emission of liquid waste, dominantly wastewater, is expected to have a positive impact on the generation of liquid waste over the forecast period. Furthermore, the growing demand for water in different activities in commercial buildings, such as hotels and hospitals, is expected to augment wastewater generation, thereby driving demand for liquid waste management. The optimum utilization of manufacturing facilities is expected to augment the generation of industrial liquid waste. Liquid waste generated through industrial sources includes paper, textile, iron & steel, oil & gas, mining, processing, and other manufacturing industries.

Liquid waste obtained from facilities of these industries is mostly solid; however, the water used for cleaning equipment or other industrial purposes is expected to boost the production of liquid waste in these sectors. The liquid waste generated through oil & gas, iron & steel, and other manufacturing industries accounts for a majority of the market share in industrial waste generation. The oil spillage in the country coupled with liquid waste generated through refineries and metal manufacturing facilities is expected to drive the production of liquid waste from industrial sources in the U.S. For instance, according to The International Tanker Owners Pollution Federation Limited, in 2022, the volume of oil lost to the environment due to tanker spills was roughly 15,000 tons. The three major occurrences are responsible for almost 14,000 tons of this.

Industry Insights

Liquid waste generated from the iron & steel industry contains a significant quantity of acid, dust, oil, and metal particles other than iron & steel. This effluent water or sludge poses a significant threat to the environment as it contains sulphur compounds and cyanide among other hazardous elements. Rising social awareness related to the limited availability of natural resources, increasing sustainability, and conservation measures coupled with regulations aiding enhanced waste management techniques are expected to nurture new technologies in the industry. Iron & steel makers are also being compelled to comply with reuse & recycle ideologies.

This, in turn, is expected to boost enhanced wastewater and liquid waste recovery practices. Rising awareness regarding automotive fluid collection & recycling is expected to boost liquid waste management demand since a vast amount of chemicals, oils, and wastewater from this sector contain potentially useful & reusable materials. The detrimental effect of these effluents on the environment has also attracted several regulations from the U.S. EPA, and CARB, among others to drive the market demand.

The oil & gas refining & processing sector emits large quantities of liquid waste owing to high levels of water consumption in these processes. Liquid waste management plays a crucial role in the industry on account of the high levels of immiscible hydrocarbons in liquid waste & water emitted from oil & gas operations. Pollutants are released inevitably into the environment owing to pump leakage, corrosion, failures, or industrial accidents, while regular activities also leak specific amounts of liquid waste into the atmosphere.

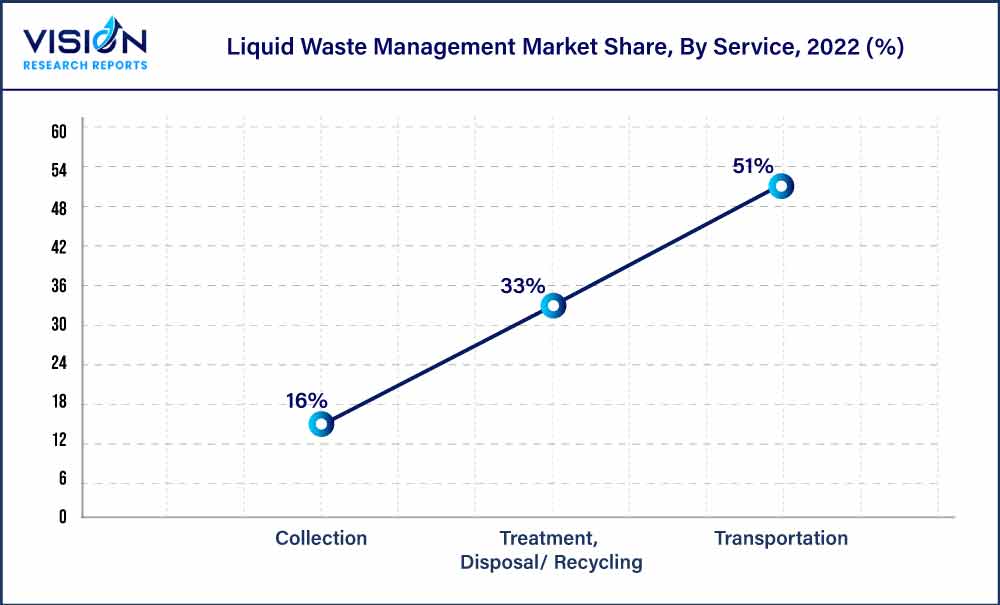

Service Insights

The transportation segment let the market and accounted for around 51% of the global revenue share in 2022. Liquid waste contains certain hazardous materials and specific actions are to be taken while handling and collecting the waste. The hazardous waste cannot be disposed of in a landfill. Liquid waste collection services include segregation of waste, loading & unloading of waste, selecting a suitable area, setting up that area for storage of liquid waste at a minimum distance from where the waste is generated, and maintenance of the waste. Liquid waste transportation service includes the movement of liquid waste from storage areas to the place of recycling and processing. Waste transported by vehicle must be transported under proper observation to avoid waste spilling and leaking.

These waste materials are required to be covered and must be leak-proof during transportation. The transportation of some liquid waste presents a high risk to the environment. Hazardous liquid waste from industrial and commercial premises is transported through transport vehicles, whereas non-hazardous liquid waste is transported to the recycling facility or a permitted sewage system inlet. Transportation of liquid waste also includes the movement of hazardous substances, and the transporter is subject to several regulations under the Resource Conservation and Recovery Act (RCRA). The players involved in providing transportation services invest heavily in vehicles and transport systems.

The transporter of liquid waste is required to hold waste during transportation. Liquid waste is disposed of or recycled in sewage treatment plants or in liquid waste treatment facilities, which are privately owned and operated. Disposal of liquid waste is done either through direct landfill injection via a bioreactor process, solidification, and then landfilling or through a chemical wastewater treatment process. With the increase in liquid waste, the market for disposal and recycling wastewater is growing at a significantpace. Furthermore, disposal of hazardous waste is associated with high risk and the treatment facility must include advanced technology and skilled personnel to avoid accidents in such places.

Regional Insights

North America led the market and accounted for 43% of the global revenue share in 2022. This is owing to penetration in commercial, residential, and industrial end-users, driven by stringent environmental and disposal regulations. Moreover, according to U.S. EPA, the wastewater treatment plants in the U.S. process approximately 34 billion gallons of wastewater every day. For instance, in January 2020, Veolia signed an agreement with Alcoa USA Corporation to take over the hazardous waste treatment site located in Arkansas, U.S. This acquisition is expected to strengthen the geographical presence of the company in the country. The market in Europe is expected to grow at a CAGR of 2.33% during the forecast period.

The region generates large volumes of municipal waste owing to high per capita water consumption, coupled with an established industrial manufacturing base. Moreover, there is an increase in population, which is connected to secondary wastewater treatment, which shows rising demand for liquid waste management. For instance, according to Eurostat, 2023 report, 530 kg per capita municipal waste was generated in 2021 in the EU. This would escalate the demand for waste management in the region. Asia Pacific will emergeas the fastest-growing regional market registering a CAGR of 3.54% over the projected period. Increased government focus on curbing high levels of environmental pollution, due to accelerated economic growth, rapid industrialization, and high population, will favor industry expansion.

Moreover, the increase in demand for clean drinking water is anticipated to further drive the demand for liquid waste management solutions. The growing awareness about the importance of preserving water quality and natural water resources is driving the market in Central & South America. In addition, rising investments in various development plans in Brazil, Mexico, and Argentina are boosting the demand further. For instance, the Brazilian government has devised strategies to accomplish ambitious environmental goals and has taken suitable actions to bring the country's wastewater treatment closer to that of wealthy countries.

Liquid Waste Management Market Segmentations:

By Source

By Industry

By Service

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liquid Waste Management Market

5.1. COVID-19 Landscape: Liquid Waste Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Liquid Waste Management Market, By Source

8.1. Liquid Waste Management Market, by Source, 2023-2032

8.1.1 Residential

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Commercial

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Industrial

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Liquid Waste Management Market, By Industry

9.1. Liquid Waste Management Market, by Industry, 2023-2032

9.1.1. Textile

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Paper

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Iron & Steel

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Automotive

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Pharmaceutical

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Oil & Gas

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Liquid Waste Management Market, By Service

10.1. Liquid Waste Management Market, by Service, 2023-2032

10.1.1. Transportation

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Collection

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Treatment, Disposal/ Recycling

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Liquid Waste Management Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.2. Market Revenue and Forecast, by Industry (2020-2032)

11.1.3. Market Revenue and Forecast, by Service (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Service (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.2. Market Revenue and Forecast, by Industry (2020-2032)

11.2.3. Market Revenue and Forecast, by Service (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Service (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Industry (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Service (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Industry (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Service (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.2. Market Revenue and Forecast, by Industry (2020-2032)

11.3.3. Market Revenue and Forecast, by Service (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Service (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Industry (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Service (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Industry (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Service (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Service (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Industry (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Service (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Industry (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Service (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.5.3. Market Revenue and Forecast, by Service (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Industry (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Service (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Industry (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Service (2020-2032)

Chapter 12. Company Profiles

12.1. Veolia

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Waste Management Solutions.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Clean Harbors Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Clean Water Environmental.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Liquid Environmental Solutions (LES)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DC Water

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Covanta Holding Corp.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Stericycle, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. U.S. Ecology, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Republic Services, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others