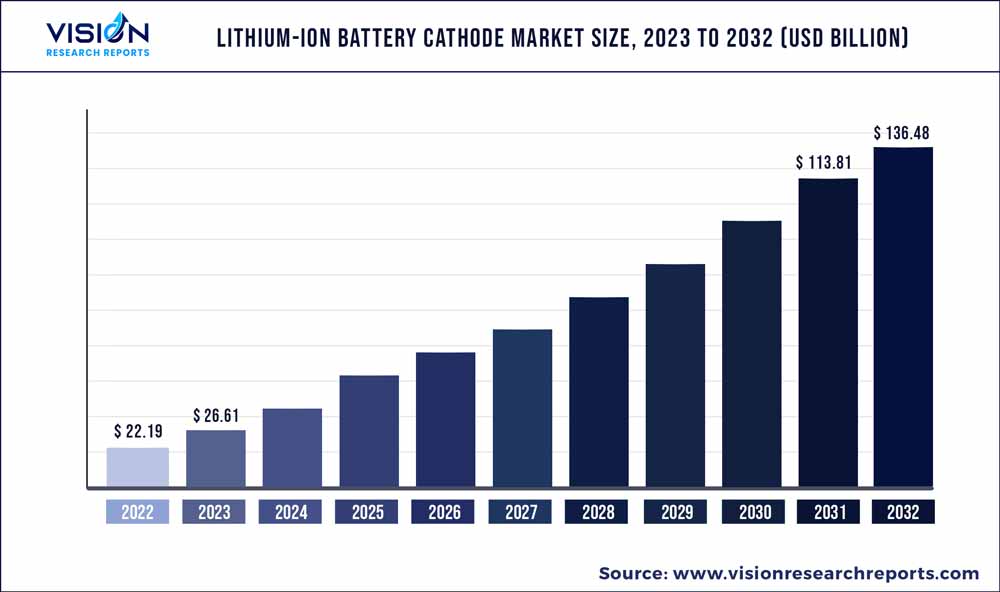

The global lithium-ion battery cathode market was valued at USD 22.19 billion in 2022 and it is predicted to surpass around USD 136.48 billion by 2032 with a CAGR of 19.92% from 2023 to 2032. The lithium-ion battery cathode market in the United States was accounted for USD 4.5 billion in 2022.

Key Pointers

Report Scope of the Lithium-ion Battery Cathode Market

| Report Coverage | Details |

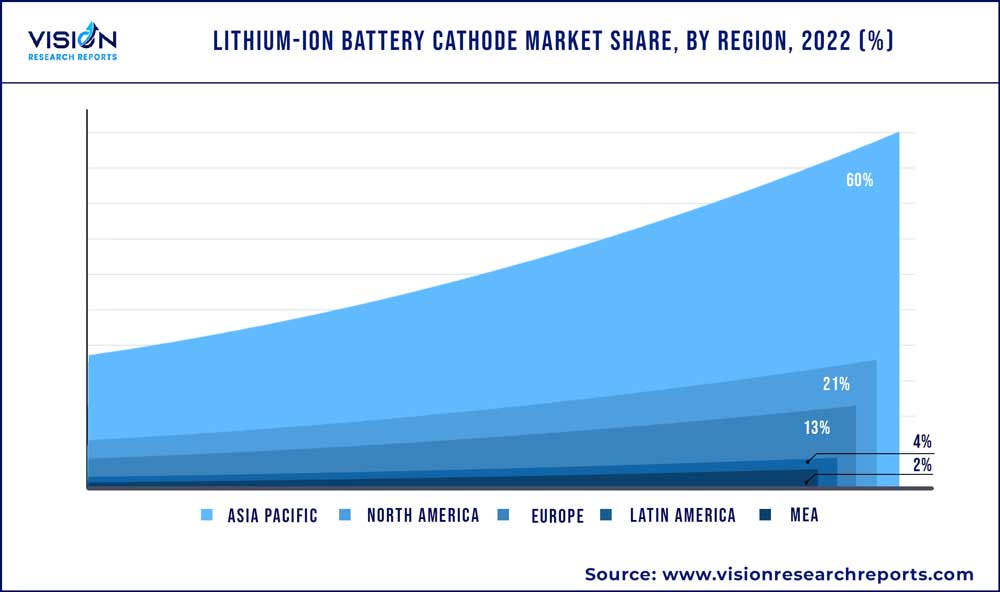

| Revenue Share of Asia Pacific in 2022 | 60% |

| Revenue Forecast by 2032 | USD 136.48 billion |

| Growth Rate from 2023 to 2032 | CAGR of 19.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nichia Chemical, BASF SE, Sumitomo Chemicals, LG Chem, Samsung SDI, Targray Technology international, Inc., NEI Corporation, POSCO Chemicals, Umicore SA, Hitachi |

The market has witnessed a substantial growth of electric vehicle supply equipment (EVSE), which also significantly affects the lithium-ion battery cathode market. Public policies are further encouraging the development of multiple charging stations through direct investments and the formation of public-private partnerships, specifically in urban areas. The demand for renewable energy sources is increasing owing to the depletion of fossil fuels and rising environmental pollution caused by non-renewable sources of energy. Renewable sources such as tidal, wind, & solar energy need to be converted and stored for further applications. Sources such as wind and solar produce variable power that needs to be converted into a storable form. Energy storage systems (ESS) aid in storing the energy produced from renewable sources for further use.

The cost of lithium-ion batteries is estimated to decrease over the next seven years owing to the increasing number of manufacturing facilities of companies such as BYD, Tesla, Samsung, BAK Battery, Shandong Wina Battery, and Zhejiang Tianneng. The low weight of lithium, along with its excellent energy-to-weight performance, is predicted to fuel demand lithium-ion battery cathode over the forecast period.

Major technological advancements in lithium-ion batteries, including the electrolytes, changes in the anode material of the silicon drastically increasing the voltage capacity, and the Li-S & Li-air technologies exhibiting high-energy-density, are projected to boost the demand for the lithium-ion battery cathode chemical composition in the near future.

Favorable government policies for domestic infrastructure developments through the National Infrastructural Plan of the U.S. are anticipated to support the growth of the lithium-ion battery cathode market in the country over forecast period.

GDP growth of the country and increase in its industrial output are expected to lead to flourishing medical, electronics, industrial controls, furniture, and appliances sectors in the U.S. The abovementioned trend is projected to promote the usage of lithium-ion batteries in the country in the coming years.

Some states of the U.S., including California, Colorado, Connecticut, Indiana, Massachusetts, Washington, Virginia and Kentuckyhave started considering the deployment of energy storage systems in their utilities as a part of their integrated resource plans.

Chemical Composition Insights

Based on chemical composition, the lithium-ion battery cathode market has been segmented into cobalt, manganese, phosphate, nickel cobalt manganese, lithium iron phosphate, and others. In terms of revenue, due to high energy density and high safety, lithium cobalt oxide batteries are in great demand for mobile phones, tablets, laptops, and cameras, so cobalt will account for the largest market share in 2022, reaching a level of 33%, and is expected to be Increasing market growth over the forecast period. Growing demand for lithium manganese oxide in various applications including power tools, others, energy storage, and electric drivetrain due to high power, long life, and safety is expected to drive its demand over the forecast period. However, factors such as high discharge rate and low capacity and energy density may hamper the segment growth during the forecast period.

Cell Type Insights

Based on Cell type, the lithium-ion battery cathode market has been segmented into polymer, cylindrical and prismatic. Cylindrical segment accounted for largest share of 44% in 2022 and expected to maintain its dominance in coming years owing to the applications in electric vehicles and energy storage systems.

Polymer emerged as second largest segment in 2022 due to its application in mobile devices, electric vehicles and toys. Cylindrical segment in expected to grow at a stagnant growth over forecast period.

End-Use Insights

Based on end-use, the lithium-ion battery cathode market has been segmented into consumer electronics, automotive, energy storage systems, industrial, and medical equipment. Consumer electronics is the largest market segment with a market share of 40% in 2022 owing to the widespread use of Ni-MH and Li-ion as portable batteries. Electric and hybrid electric vehicles are expected to be the major consumers of lithium-ion batteries in the coming years. Rising awareness among the general public about the benefits of battery-powered vehicles and rising fossil fuel prices, especially in Asia Pacific, Europe, and North America, are expected to aid the growth of the lithium-ion battery cathode market for automotive application forecast period.

Regional Insights

The Asia-Pacific region accounted for 60% of the global lithium-ion battery cathode market share in 2022. The booming electric vehicle market in Asia-Pacific countries, including India and China, is one of the key factors positively impacting the demand for lithium-ion batteries. Lithium-ion batteries in the area. The rise of the Asia-Pacific region as a global manufacturing hub has led to the increasing adoption of tools powered by lithium-ion batteries. Furthermore, the region has the largest population in the world. This has led to high sales of consumer electronics such as mobile phones and laptops that operate on lithium-ion batteries in Asia Pacific.

North America held the second largest share in the lithium-ion battery cathode market due to increasing demand for lithium-ion batteries for smartphones due to increased shelf life and improved efficiency. Rising demand for electric vehicles owing to increasing consumer awareness to reduce global carbon emissions is expected to drive market growth.

In addition, due to EPA regulations on lead pollution and resulting environmental hazards, as well as regulations on storage, disposal and recycling of lead-acid batteries, the demand for lead-acid batteries has decreased leading to an increase in demand for lithium-ion batteries in automobiles.

Lithium-ion Battery Cathode Market Segmentations:

By Chemical Composition

By Cell Type

By End-Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Chemical Composition Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lithium-ion Battery Cathode Market

5.1. COVID-19 Landscape: Lithium-ion Battery Cathode Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lithium-ion Battery Cathode Market, By Chemical Composition

8.1. Lithium-ion Battery Cathode Market, by Chemical Composition, 2023-2032

8.1.1 Cobalt

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Manganese

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Phosphate

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Nickel Cobalt Manganese

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Lithium Iron Phosphate

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Lithium-ion Battery Cathode Market, By Cell Type

9.1. Lithium-ion Battery Cathode Market, by Cell Type, 2023-2032

9.1.1. Polymer

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cylindrical

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Prismatic

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Lithium-ion Battery Cathode Market, By End-Use

10.1. Lithium-ion Battery Cathode Market, by End-Use, 2023-2032

10.1.1. Consumer Electronics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Medical Devices

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Energy Storage

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Automotive

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Industrial

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Lithium-ion Battery Cathode Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.1.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.1.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.2.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.2.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.3.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.3.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Chemical Composition (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Cell Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 12. Company Profiles

12.1. Nichia Chemical

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BASF SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sumitomo Chemicals.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. LG Chem.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Samsung SDI

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Targray Technology international, Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. NEI Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. POSCO Chemicals

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Umicore SA

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hitachi

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others