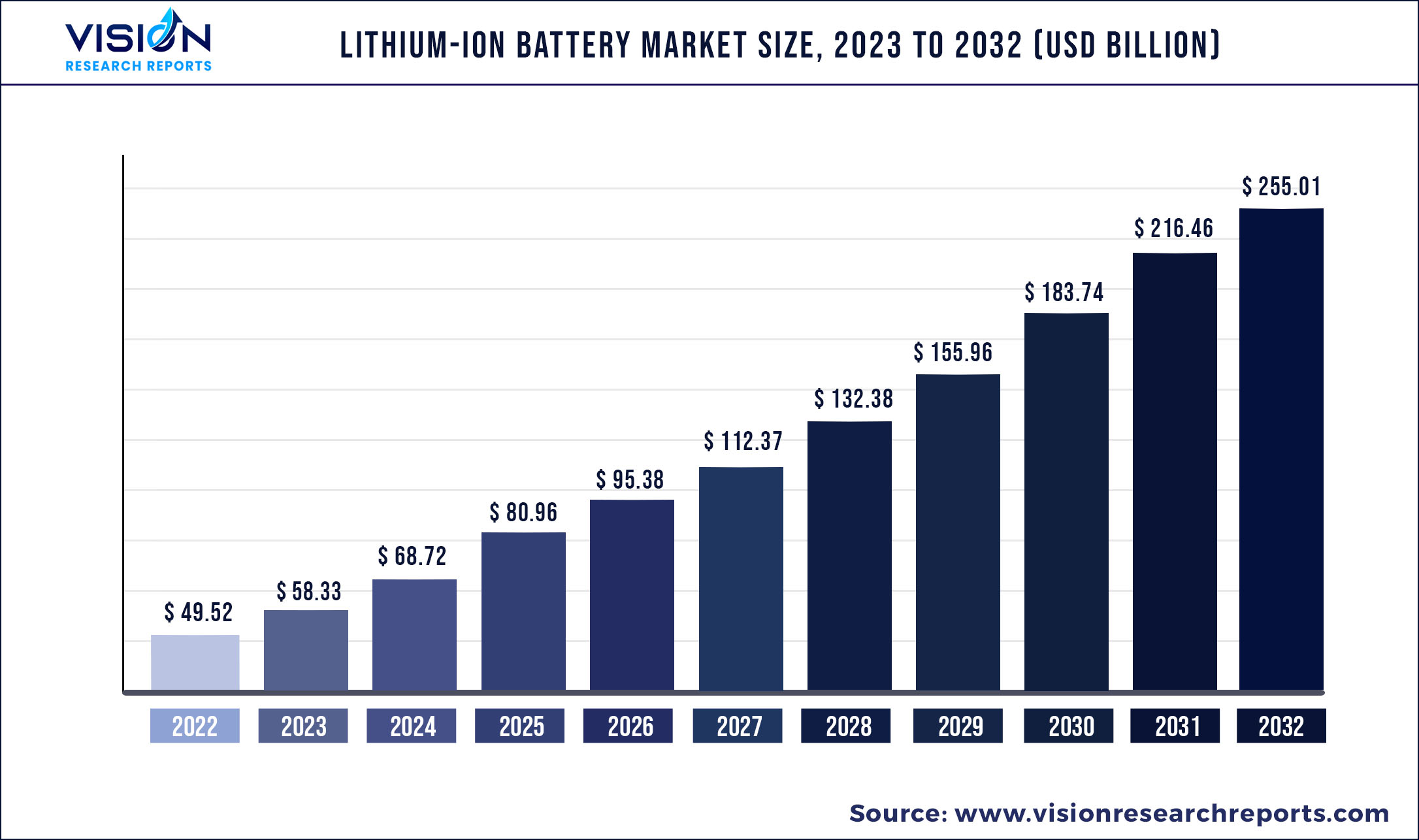

The global lithium-ion battery market was surpassed at USD 49.52 billion in 2022 and is expected to hit around USD 255.01 billion by 2032, growing at a CAGR of 17.81% from 2023 to 2032.

Key Pointers

Report Scope of the Lithium-ion Battery Market

| Report Coverage | Details |

| Market Size in 2022 | USD 49.52 billion |

| Revenue Forecast by 2032 | USD 255.01 billion |

| Growth rate from 2023 to 2032 | CAGR of 17.81% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | GS Yuasa International Ltd.; BYD Company Ltd.; A123 Systems LLC; Hitachi, Ltd.; Johnson Controls; NEC Corporation; Panasonic Corporation; Duracell Inc.; Electrochemist; SK Innovation Co., Ltd; Energizer; CBAK Energy Technology; Tesla; Renault Group; Samsung SDI Co., Ltd.; Toshiba Corporation; LG Chem; Saft; Contemporary Ampere Technology Co., Limited |

The automobile sector is expected to witness significant growth owing to the rising adoption of electric vehicles. The worldwide registration of electric vehicles is anticipated to increase significantly over the forecast period. The U.S. emerged as the largest market in North America with a revenue share of over 75.0% in 2021. Increasing sales of electric vehicles in the U.S. owing to supportive federal policies, coupled with the presence of market players in the country, are expected to drive the demand for lithium-ion batteries in the U.S. over the forecast period.

The federal policies include the American Recovery and Reinvestment Act of 2009, which offer tax credits to consumers for purchasing electric vehicles. The new Corporate Average Fuel Economy standards (CAFE) mandate the fuel economy of passenger cars and light commercial vehicles plying on roads in the U.S., resulting in the surged adoption of electric vehicles in the country. Increasing demand for lithium-ion batteries in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive the market. In addition, increasing demand for electric vehicles owing to growing consumer awareness regarding reducing global carbon emissions is expected to fuel market growth.

In addition, the decline in demand for lead-acid batteries owing to EPA regulations on lead contamination and resulting environmental hazards, coupled with the regulations on lead-acid battery storage, disposal, and recycling, has led to an increase in the demand for lithium-ion batteries in automobiles. Mexico has been the primary focus of the global automobile industry as companies worldwide are eyeing to invest in the country. It is the fourth-largest exporter in the automobile industry, after Germany, Japan, and South Korea. Growing automobile production in the country is anticipated to drive the demand for lithium-ion batteries.

COVID-19 has been a major restraint to the market growth owing to several factors including reducing operational costs by end-users, coupled with disruption in the availability of spare parts due to sluggish manufacturing activities and logistics issues. Battery providers have taken subsequent steps to ensure their services to end-users who have signed long-term contracts with them. Vendors are opting for digital tools and are following prescribed preventative measures including social distancing norms and the use of protective kits in case of on-site inspection and repair services required by end-users on a case-to-case basis.

Key Companies & Market Share Insights

The market is extremely competitive with key participants involved in R&D and constant product innovation. Several companies are engaged in new product development to improve their global market share. For instance, BYD and Panasonic hold a strong position on account of their increased manufacturing capacities and large distribution network. Some prominent players in the global lithium-ion battery market include:

Lithium-ion Battery Market Segmentations:

| By Product | By Application |

|

Lithium cobalt oxide (LCO) Lithium iron phosphate (LFP) Lithium Nickel Cobalt Aluminum Oxide (NCA) Lithium Manganese Oxide (LMO) Lithium Titanate (LTO) Lithium Nickel Manganese Cobalt (LMC) |

Automobile Consumer Electronics Industrial Energy Storage Systems Medical Devices |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lithium-ion Battery Market

5.1. COVID-19 Landscape: Lithium-ion Battery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lithium-ion Battery Market, By Product

8.1. Lithium-ion Battery Market, by Product, 2023-2032

8.1.1. Lithium cobalt oxide (LCO)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Lithium iron phosphate (LFP)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Lithium Nickel Cobalt Aluminum Oxide (NCA)

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Lithium Manganese Oxide (LMO)

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Lithium Titanate (LTO)

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Lithium Nickel Manganese Cobalt (LMC)

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Lithium-ion Battery Market, By Application

9.1. Lithium-ion Battery Market, by Application, 2023-2032

9.1.1. Automobile

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Consumer Electronics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Energy Storage Systems

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Medical Devices

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Lithium-ion Battery Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. BYD Company Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Duracell Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Hitachi, Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Johnson Controls

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. LG Chem

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Panasonic Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Renault Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Samsung SDI Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tesla

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. TOSHIBA CORPORATION

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others