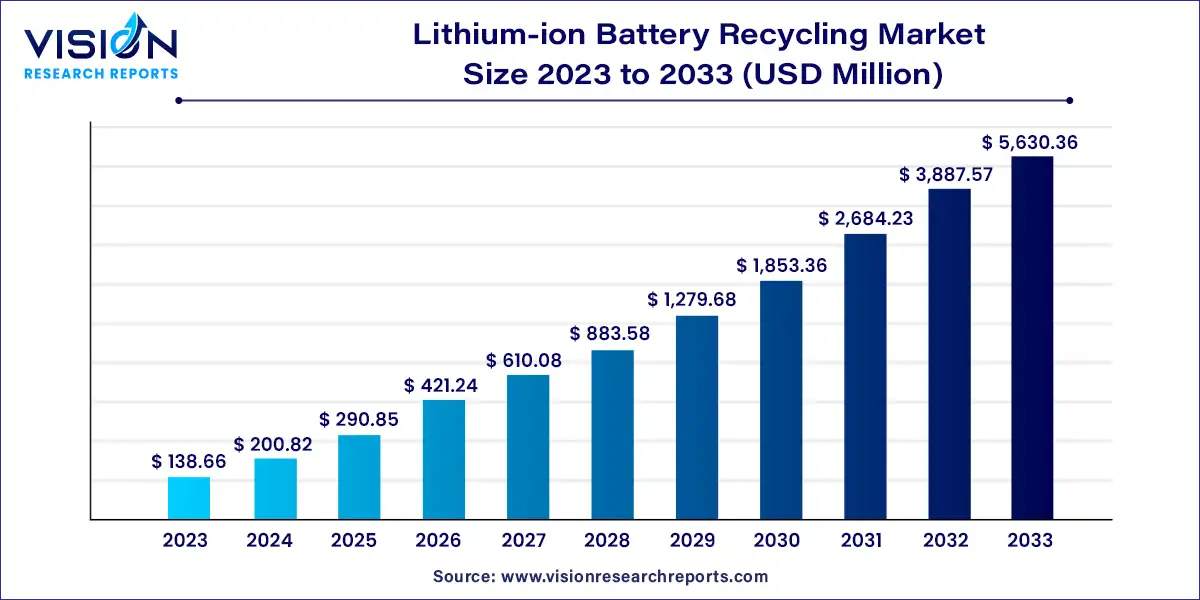

The global lithium-ion battery recycling market size was valued at USD 138.66 million in 2023 and it is predicted to surpass around USD 5,630.36 million by 2033 with a CAGR of 44.83% from 2024 to 2033.

The lithium-ion battery recycling market has gained significant traction in recent years due to the growing demand for electric vehicles (EVs), portable electronics, and renewable energy storage systems. Lithium-ion batteries are integral to these technologies, offering high energy density and long lifespan. However, their disposal at end-of-life poses environmental challenges and the loss of valuable resources.

The growth of the lithium-ion battery recycling market is driven by an increasing adoption of electric vehicles (EVs) and the proliferation of portable electronics have heightened the demand for lithium-ion batteries, necessitating efficient recycling solutions to manage end-of-life batteries responsibly. Secondly, stringent environmental regulations and government policies promoting sustainable practices have spurred investments in recycling infrastructure. Thirdly, the recycling of lithium-ion batteries enables the recovery of valuable metals such as lithium, cobalt, nickel, and manganese, reducing reliance on primary sources and ensuring a stable supply chain for these critical materials.

The transportation sector led the market, capturing a substantial revenue share of 69 in 2023. Lithium-ion batteries are favored in transportation due to their advantages such as high discharge tolerance, improved energy density, long cycle life, rapid recharge capability, and minimal memory effect. Recycled batteries find application in stationary energy storage systems within the automotive industry, offering a sustainable solution for grid stabilization and integration of renewable energy sources. Similarly, the electronics sector reuses these batteries to manufacture new products like wearables, computers, and smartphones, reducing dependence on virgin resources.

The transportation segment is projected to exhibit the highest compound annual growth rate (CAGR) during the forecast period. Factors driving this growth include increasing awareness of environmental sustainability, rising demand for electric vehicles, and other related factors. Additionally, the industrial segment is expected to experience significant growth in battery manufacturing and recycling, driven by demand from sectors such as consumer electronics, renewable energy storage, aerospace, and medical devices. Industries value lithium-ion batteries for their high energy density, longevity, and rechargeable properties.

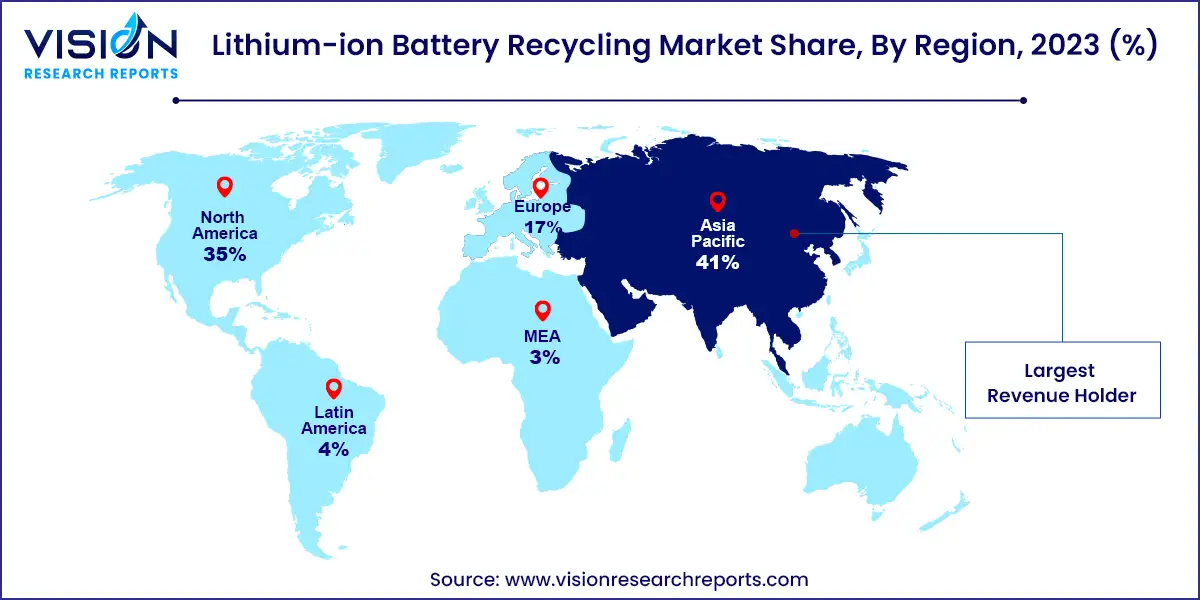

North America is poised to grow at a substantial CAGR throughout the forecast period, fueled by increasing demand for cleaner energy sources.

The United States leads the market with significant investments in recycling facilities and the development of new infrastructure. For instance, in July 2023, Stellantis and Samsung SDI announced plans to establish a second Star Plus Energy Gigafactory in the U.S., slated to begin production in early 2027.

In 2023, the Asia Pacific region dominated the global market. Growth drivers include cost-effective battery solutions, rapid adoption of electric vehicles due to heightened awareness of sustainable mobility, and robust sales of consumer electronics. Population growth in countries like China and India further bolsters market expansion.

The lithium-ion battery recycling market in China is experiencing robust demand growth, driven by environmental concerns, technological advancements, and government support. Efforts focus on developing innovative processes to recover valuable materials from spent batteries and enhance recycling efficiency.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lithium-ion Battery Recycling Market

5.1. COVID-19 Landscape: Lithium-ion Battery Recycling Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lithium-ion Battery Recycling Market, By Application

8.1. Lithium-ion Battery Recycling Market, by Application Type, 2024-2033

8.1.1. Transportation

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electronics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Industrial

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Lithium-ion Battery Recycling Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Contemporary Amperex Technology Co., Limited

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. LG Energy Solution

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Panasonic Corporation

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. SAMSUNG SDI CO., LTD.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. BYD

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. SVOLT Energy

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Tesla

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Shenzhen Manly Battery Co.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. TOSHIBA CORPORATION

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. SK on Co., Ltd

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others