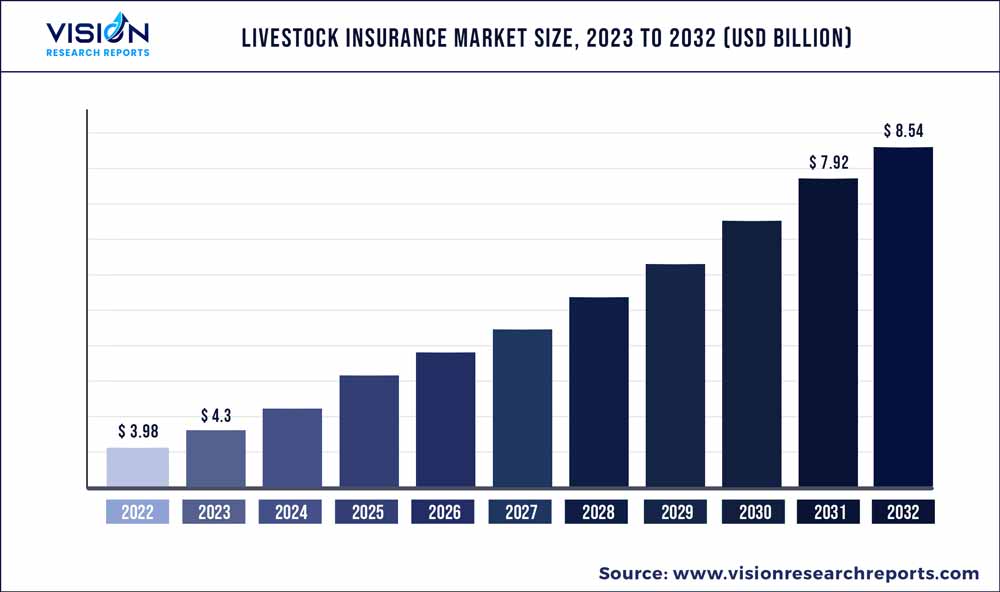

The global livestock insurance market was estimated at USD 3.98 billion in 2022 and it is expected to surpass around USD 8.54 billion by 2032, poised to grow at a CAGR of 7.94% from 2023 to 2032. The livestock insurance market in the United States was accounted for USD 1.6 billion in 2022.

Key Pointers

Report Scope of the Livestock Insurance Market

| Report Coverage | Details |

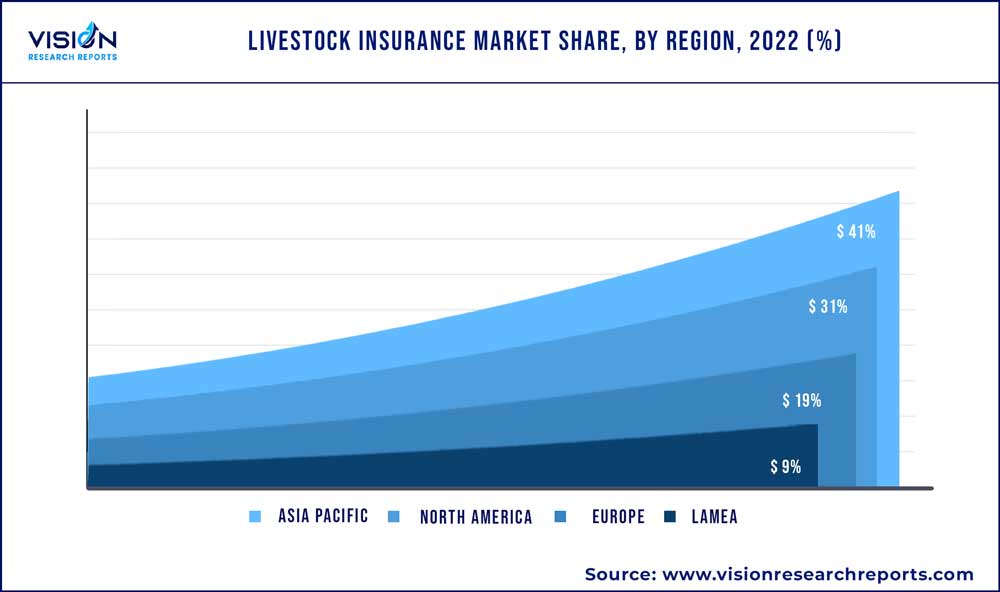

| Revenue Share of Asia Pacific in 2022 | 41% |

| Revenue Forecast by 2032 | USD 8.54 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.94 |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nationwide Mutual Insurance Company; AXA SA; FBL Financial Group, Inc; HDFC ERGO General Insurance Company Limited; ICICI Lombard General Insurance Company Limited; ProAg (Tokio Marine HCC group of companies); The Hartford; Reliance General Insurance Company Limited (part of Reliance Capital); Sunderland Marine (NorthStandard Limited); Royal Sundaram General Insurance Co.Limited |

Key factors contributing to this growth include increasing demand for meat, milk, and dairy products, need for risk management, supportive government initiatives, and prevalence of diseases, among others. In January 2022, FAARMS an agri-tech start-up partnered with Reliance General Insurance Companyto provide cattle insurance to livestock farmers in India via its mobile application.

The COVID-19 pandemic has brought attention to the importance of risk management and the need for insurance coverage in the livestock industry. Livestock farmers have become more aware of the potential financial risks associated with disease outbreaks, supply chain disruptions, and market volatility. Lockdowns, restrictions on gatherings, and reduced consumer demand affected livestock prices and market dynamics. Livestock insurance helps farmers manage price risk and market volatility by providing coverage for fluctuations in beef and milk prices, ensuring a level of income stability. This increased awareness has led to a higher demand for livestock insurance as farmers seek to protect their livelihoods.

The increasing need for minimizing production risks is a key market driver. Livestock farming is inherently exposed to various risks, such as diseases, adverse weather conditions, theft, and accidents. Farmers and livestock owners are becoming increasingly aware of the potential financial losses associated with these risks. As a result, there is a growing recognition of the importance of risk management and the need for insurance coverage. In addition, climate change has led to an increase in extreme weather events, such as droughts, floods, and storms, which can have a significant impact on livestock farming. These events pose risks to livestock health, infrastructure, and feed availability. Livestock insurance helps farmers mitigate financial losses resulting from such events, making it an essential risk management tool in the face of climate change.

Supportive government initiative is another major factor fueling the market growth. Governments in many countries recognize the significance of livestock farming for the economy and food security. To support the industry, governments often implement policies and regulations that encourage or require livestock insurance coverage. In May 2022, the USDA updated its 3 key livestock insurance options-the Livestock Gross Margin (LGM), Dairy Revenue Protection (DRP), and Livestock Risk Protection (LRP). The options were revised to offer greater flexibility for protecting swine, dairy, and cattle operations, reach more producers, and better meet the needs of the livestock producers. Such supportive initiatives contribute to the growth of the livestock insurance industry.

Coverage Insights

By coverage, the mortality segment accounted for the largest revenue share of over 41% of the market in 2022. Large number and type of insurance companies offering mortality insurance for livestock is expected to fuel the segment growth in the coming years.Established insurance companies, for instance,leverage their experience, financial strength, and underwriting expertise to attract and retain customers. While the agricultural insurance providers, including crop insurers, offer livestock insurance as part of their product portfolio. These insurers leverage their existing infrastructure, distribution channels, and expertise in agricultural risk management to enter the market.

The others segment is projected to grow at the fastest rate of over 9.02% during the forecast period. The others segment comprises coverage for infertility, disability, transportation, liability, theft etc. Livestock farming plays a vital role in international trade, with countries exporting livestock and livestock products worldwide. Insuring livestock during transportation and ensuring biosecurity measures are in place becomes crucial in this context. The livestock insurance industry benefits from the need to safeguard these trade operations and protect against potential financial losses.

Animal Type Insights

By animal type, the bovine segment comprising cattle and buffaloes held the largest share of about 36% of the market in 2022. This is owing to growing awareness and uptake of bovine insurance policies to minimize production risks. Bovine insurance provides coverage for livestock losses caused by adverse weather conditions, including death, injury, or production loss due to feed scarcity or infrastructure damage. It also offers protection against market volatility and price risk, ensuring a level of income stability for beef and dairy producers. Bovine insurance plays a crucial role in mitigating financial losses caused by disease outbreaks by covering livestock mortality, treatment expenses, and biosecurity measures. These benefits are expected to contribute to the segment growth.

Other animals segment is anticipated to expand at the highest CAGR of about 9.06% during 2023 to 2032. The segment includes insurance for aquaculture, deer, alpacas, llamas, camels etc. The increasing types of animal species covered by insurance companies combined rising penetration of insurance in these livestock sectors are expected to propel the segment growth in the near future.AXA SA for instance, offers insurance policies for deer, alpacas, zoo animals, llamas among others.Reliance General Insurance Company Limited on other hand, provides livestock insurance for camel, donkey, and yak among others.

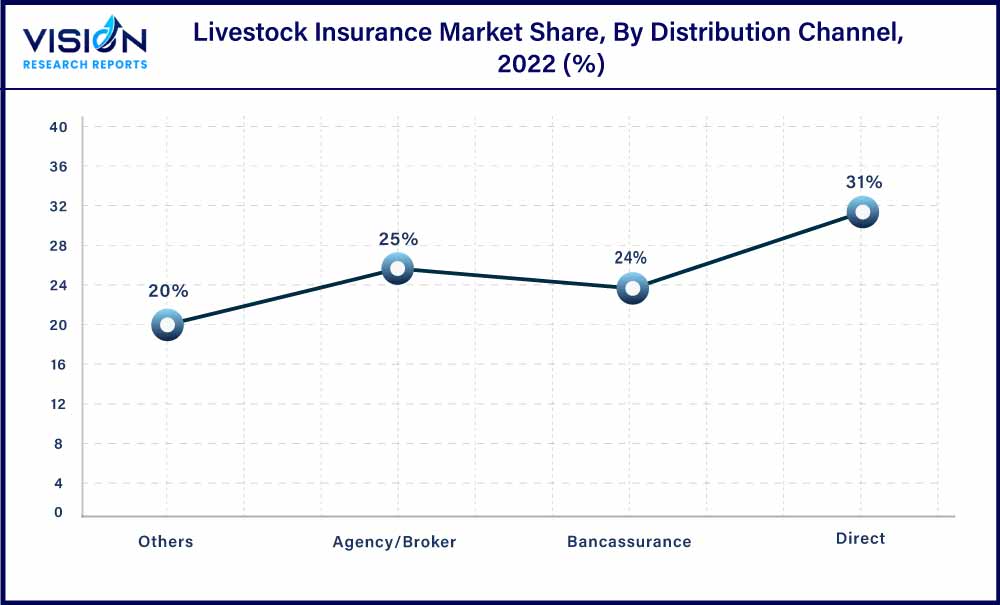

Distribution Channel Insights

The direct sales segment attributed to over 31% share of the market by distribution channel in 2022. This is owing to companies adopting omnichannel marketing strategies such as direct company sales agents, online renewals, among others.ICICI Lombard General Insurance Company Limited for instance, allows its customers to purchase and renew policies online. Other channels of distribution such as dairy co-operatives and microfinance institutions are expected to grow at the fastest rate of more than 8% over the coming years.

Key factors driving the growth include ground-level connectivity of these institutions and growing awareness among livestock producers regarding insurance policies for livestock animals. In April 2023, the Kerala Cooperative Milk Marketing Federation (Milma) in India partnered with the Agricultural Insurance Company of India Ltd (AIC) to launch bovine insurance scheme to offset loss of income owing to a fall in milk yield during summers.Farmers would be eligible to register for the scheme through dairy cooperative societiesunder the Malabar Regional Cooperative Milk Producers Union.

Regional Insights

Asia Pacific dominated the market with revenue share of over 41% in 2022. This is owing to the presence of a sizeable livestock population, increasing disposable income, and the growing awareness among livestock farmers to mitigate production risks by adopting livestock insurance. As per FAO and internal GVR estimates, China accounts for about half of the global pig population. In 2022, the country’s pig population was estimated to be 410 million. The Latin American region, on the other hand, is projected to grow at the fastest rate of about 9.04%.

Insurance companies are introducing innovative products tailored to the specific needs of livestock farmers. These products may include coverage for livestock mortality, disease outbreaks, production loss, and even parametric insurance solutions based on weather indices. The development of specialized livestock insurance products enhances the market's attractiveness and addresses the unique risks faced by farmers. Furthermore, government-sponsored or subsidized insurance programs for livestock in some countries such as India is expected to contribute to regional growth in the coming years.

Livestock Insurance Market Segmentations:

By Coverage

By Animal Type

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Coverage Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Livestock Insurance Market

5.1. COVID-19 Landscape: Livestock Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Livestock Insurance Market, By Coverage

8.1. Livestock Insurance Market, by Coverage, 2023-2032

8.1.1 Mortality

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Revenue

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Other Coverage

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Livestock Insurance Market, By Animal Type

9.1. Livestock Insurance Market, by Animal Type, 2023-2032

9.1.1. Bovine

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Swine

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Sheep & Goats

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Poultry

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Other Animals

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Livestock Insurance Market, By Distribution Channel

10.1. Livestock Insurance Market, by Distribution Channel, 2023-2032

10.1.1. Direct

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Agency/Broker

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Bancassurance

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Livestock Insurance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.1.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.2.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.3.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Animal Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. AftNationwide Mutual Insurance Companyerpay

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. AXA SA.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. FBL Financial Group, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. HDFC ERGO General Insurance Company Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ICICI Lombard General Insurance Company Limited

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ProAg (Tokio Marine HCC group of companies)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. The Hartford.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Reliance General Insurance Company Limited (part of Reliance Capital)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Reliance General Insurance Company Limited (part of Reliance Capital).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Royal Sundaram General Insurance Co.Limited

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others