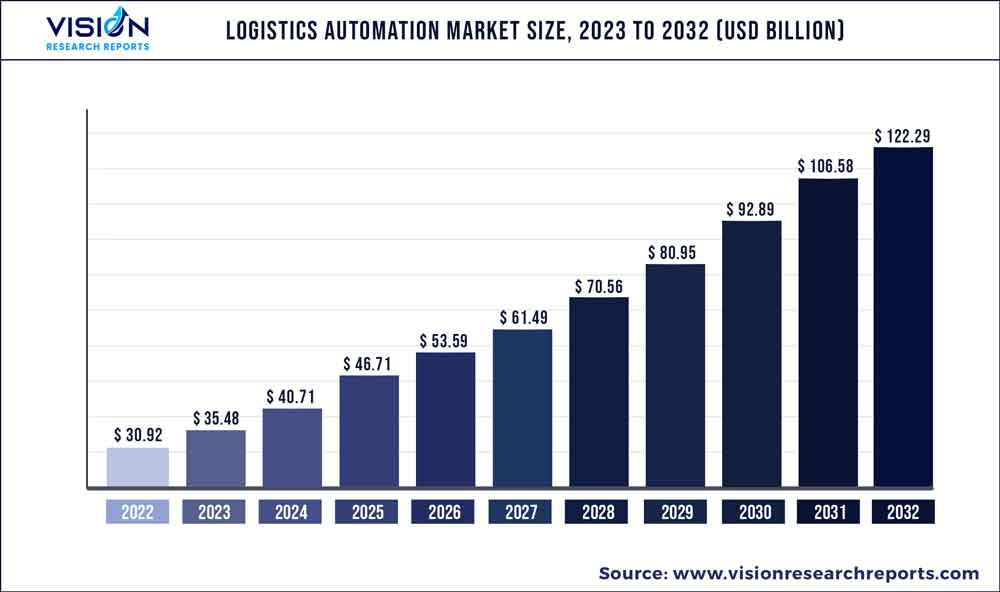

The global logistics automation market was estimated at USD 30.92 billion in 2022 and it is expected to surpass around USD 122.29 billion by 2032, poised to grow at a CAGR of 14.74% from 2023 to 2032. The logistics automation market in the United States was accounted for USD 8.2 Billion in 2022.

Key Pointers

Report Scope of the Logistics Automation Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 33.76% |

| CAGR of Asia Pacific from 2023 to 2032 | 17.24% |

| Revenue Forecast by 2032 | USD 122.29 billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Dematic Corp. (Kion Group AG); Daifuku Co. Limited; Swisslog Holding AG (KUKA AG); Honeywell International Inc.; Jungheinrich AG; Murata Machinery Ltd; Knapp AG; TGW Logistics Group GmbH; Kardex Group; Mecalux SA; Beumer Group GmbH & Co. KG; SSI Schaefer AG; Vanderlande Industries BV; WITRON Logistik; Oracle Corporation; One Network Enterprises Inc.; SAP SE |

Logistics operations are critical factors in the smooth functioning of the supply chain of any business, especially low-margin, high-volume businesses. The logistics sector is witnessing a continuous increase in investments with a significant emphasis on the automation of several logistics functions. Automation enhances efficiency and aids in integrating supply chains; thus, automation is increasingly getting adopted across sectors. The growing tendency of the logistics industry towards adopting automation solutions is one of the significant factors driving the growth of the logistics automation industry.

According to a DHL report published in 2018, 80% of warehouses do not have any automation support and are still operated manually, while 15% of the total warehouses are just mechanized, which means the warehouses use sorters, conveyors, picker solutions, and other machined equipment which are not necessarily automated. The report states that only 5% of total warehouses are automated. The trend displays a remarkable opportunity for the growth of the market in the coming years as companies are increasingly adopting automation in their warehouses, including autonomous robots, automated sorting systems, conveyor systems, etc. Technological development such as communication technologies, sensors, tracking devices, computer vision, artificial intelligence, and machine learning are aiding the growth of the target market.

The e-commerce boom is resulting in increasing adoption of automation solutions owing to the enormous volumes of shipments. The e-commerce shipment volume is growing exponentially by the year, and hence the warehouses require automation solutions to meet the short delivery timelines. The e-commerce fulfillment centers are implementing automated sorting and conveyor systems and highly benefit from inventory management and order management software. Moreover, the major labor challenges faced by the logistics industry across the globe are driving the demand for logistics automation solutions.

The COVID-19 pandemic accelerated the adoption of automation technologies such as robots, conveyors, and automation software, among others, in the logistics sector. The imposed lockdowns and social distancing norms necessitated the deployment of automation tools in warehouses and logistics functions. Although there were shortages and delays in receiving the hardware equipment during the lockdown, the market displayed a positive growth trend from 2020 to 2022.

Component Insights

Based on components, the market is segmented into hardware, software, and services. The hardware segment's market share was 66.87% in 2022 and is expected to grow at a CAGR of 14.43% through the forecast period. Based on the hardware, the market is further segmented into autonomous robots, conveyor systems, automated sorting systems, automated storage and retrieval systems, de-palletizing/palletizing systems, and automatic identification and data collection. Due to the increasing demand for automated transportation, the autonomous robots category holds the largest market share among hardware solutions. Autonomous guided vehicles are expected to draw most of the spend in autonomous robots.

The software segment is further segmented into the following categories: warehouse management system and transportation management system. The warehouse management software automates and optimizes several warehouse processes, such as tracking, storing inventory, receiving, and workload planning, among others, and is expected to be the fastest-growing software solution during the forecast period. The service segment is anticipated to grow at the fastest CAGR of 15.66% throughout the forecast period. The market's continued expansion is primarily due to the increased demand for the deployment and integration of logistics automation.

Function Insights

Based on transportation mode, the market is segmented into inventory & storage management and transportation management. The transportation management segment dominated the market in 2022, with a market share of 62.54%. It is anticipated to grow at a CAGR of 13.93% through the forecast period. Autonomous robots, conveyor systems, and de-palletizing/palletizing systems are used for transportation management. Autonomous robots such as autonomous guided vehicles (AGV) and autonomous mobile robots (AMR) are motorized solutions that transport materials and products throughout the warehouse or manufacturing facility.

The inventory & storage management segment is expected to grow at the fastest CAGR of 15.82% through the forecast period. The inventory & storage management includes automated storage systems and automated retrieval systems. Autonomous storage systems enable automated storage of crates or pallets in racks or shelves, while the retrieval system enables automated retrieval of the products for dispatch from the warehouse. The automation of the inventory and storage process simplifies and expedites the process of tracking and tracing a product in an enormous warehouse.

Logistics Type Insights

Based on logistics type, the market is segmented into sales logistics, production logistics, recovery logistics, and procurement logistics. Among these, the sales logistics segment dominated the market in 2022, with a market share of 35.69%. It is anticipated to grow at a CAGR of 14.85% through the forecast period. Sales logistics is the most critical aspect of the supply chain as it involves moving or delivering the goods to the end consumer. Sales logistics include order management, inventory management, shipping management, and vendor management. Automation solutions such as autonomous robots and automated storage and retrieval systems improve efficiency and reduce delivery turnaround time and hence are being increasingly adopted in sales logistics operations.

The production logistics segment is expected to grow at a considerable CAGR of 15.22% throughout the forecast period. Businesses heavily emphasize optimizing production processes, including time and cost optimization, to improve profitability. Logistics is one of the major expenditures of a business, and automation highly aids in minimizing or at least optimizing the expenditures to a large extent. Production logistics includes inventory management of raw materials, transportation within the manufacturing unit, and distribution.

Organization Size Insights

Based on organization size, the market is segmented into small & medium enterprises (SMEs) and large enterprises. The large enterprises' segment dominated the market in 2022, with a market share of 63.88%. It is anticipated to grow at a CAGR of 14.11% through the forecast period. Large enterprises handle huge volumes of products through the entire supply chain processes, which include raw materials, inventory, and final products. Given the enhanced productivity, large enterprises are increasingly adopting automation solutions such as robots in manufacturing units and inventory warehouses for raw material handling.

The SME segment is expected to grow at a considerable CAGR of 15.62% through the forecast period. Small and medium enterprises focus heavily on cost efficiency and adopt automation solutions to minimize labor costs. Several startups are propping up in the e-commerce fulfillment service industry, and fulfillment centers are increasingly deploying automated sorting systems for fulfillment processes such as kitting and bundling. Automation enables small and medium enterprises to compete with large enterprises.

Software Application Insights

Based on software applications, the market is segmented into inventory management, order management, yard management, shipping management, labor management, vendor management, customer support, and others. Among these, the order management segment dominated the market in 2022, with a market share of 18.47%. It is anticipated to grow at a CAGR of 15.22% through the forecast period. Order management includes management of the entire lifecycle, including order entry, fulfillment of the order, delivery, and post-sale services. The adoption of order management is increasing as it offers visibility to both businesses and customers.

The inventory management segment is expected to grow at the fastest CAGR of 15.95% through the forecast period. Inventory management includes keeping track of the inventory levels, managing the inventory of each product, forecasting demand, and accounting for the entire inventory. Efficient inventory management is critical for a successful business as both excess and low inventory can be disastrous in the probability of a company. The demand forecasting of products depending on historical sales is highly beneficial in the maintenance of optimum inventory levels.

Vertical Insights

Based on vertical, the market is segmented into retail & e-commerce, automotive, healthcare, electronics & semiconductors, and others. The retail and e-commerce segment dominated the market in 2022, with a market of 28.99%. The retail & e-commerce sector uses logistics automation solutions in order to meet the increasing volumes of orders and shipments. Logistics automation solutions improve reliability and ensure timely delivery, which aligns with the retail and e-commerce industry's interest.

The healthcare segment is anticipated to register a significant market share over the forecast period. Logistics automation solutions for the healthcare industry provide safe and secure handling, storage, and retrieval of healthcare products such as pharmaceuticals and vaccines. Healthcare sector demands a high level of accuracy and accountability in order to ensure the safety of the products, and automation significantly helps to ensure it. Pharmaceutical products require precise inventory management to avoid shortages and track expiration duration.

Regional Insights

North America led the overall market in 2022, with a market share of 33.76%. The region's growth can be attributed to the presence of several logistics automation solution providers and several logistics giants such as UPS, DHL, and FedEx Corporation, among others, in North America. In addition, the speedy implementation of modern technologies and the existence of modern infrastructure in the region is a supportive factor in the growth of the target market. The U.S. is expected to retain its dominance over the forecast period owing to the rapid boom of the e-commerce sector in the country.

The Asia-Pacific is expected to grow at the fastest CAGR of 17.24% over the forecast period. Asia Pacific is expected to experience rapid economic growth, especially in e-commerce. Moreover, Asia Pacific includes several countries which are hubs of logistical activity, such as Singapore, Indonesia, China, India, etc. Furthermore, the rising technological advancements and rising adoption of Industry 4.0 in countries such as China, India, Japan, and Southeast Asia countries are expected to boost the demand for logistics automation significantly over the forecast period.

Logistics Automation Market Segmentations:

By Component

By Function

By Logistics Type

By Organization Size

By Software Application

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Vertical Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Logistics Automation Market

5.1. COVID-19 Landscape: Logistics Automation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Logistics Automation Market, By Component

8.1. Logistics Automation Market, by Component, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Logistics Automation Market, By Function

9.1. Logistics Automation Market, by Function, 2023-2032

9.1.1. Inventory & Storage Management

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Transportation Management

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Logistics Automation Market, By Logistics Type

10.1. Logistics Automation Market, by Logistics Type, 2023-2032

10.1.1. Sales Logistics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Production Logistics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Recovery Logistics

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Procurement Logistics

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Logistics Automation Market, By Organization Size

11.1. Logistics Automation Market, by Organization Size, 2023-2032

11.1.1. Large Enterprises

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Small & Medium Enterprises

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Logistics Automation Market, By Software Application

12.1. Logistics Automation Market, by Software Application, 2023-2032

12.1.1. Inventory Management

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Order Management

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Yard Management

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Shipping Management

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Labor Management

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Vendor Management

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Customer Support

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Others

12.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Logistics Automation Market, By Vertical

13.1. Logistics Automation Market, by Vertical, 2023-2032

13.1.1. Retail & E-commerce

13.1.1.1. Market Revenue and Forecast (2020-2032)

13.1.2. Healthcare

13.1.2.1. Market Revenue and Forecast (2020-2032)

13.1.3. Automotive

13.1.3.1. Market Revenue and Forecast (2020-2032)

13.1.4. Aerospace & Defense

13.1.4.1. Market Revenue and Forecast (2020-2032)

13.1.5. Electronics & Semiconductors

13.1.5.1. Market Revenue and Forecast (2020-2032)

13.1.6. Others

13.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 14. Global Logistics Automation Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Component (2020-2032)

14.1.2. Market Revenue and Forecast, by Function (2020-2032)

14.1.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.1.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.1.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.1.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Component (2020-2032)

14.1.7.2. Market Revenue and Forecast, by Function (2020-2032)

14.1.7.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.1.7.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.1.8. Market Revenue and Forecast, by Software Application (2020-2032)

14.1.8.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Component (2020-2032)

14.1.9.2. Market Revenue and Forecast, by Function (2020-2032)

14.1.9.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.1.9.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.1.10. Market Revenue and Forecast, by Software Application (2020-2032)

14.1.11. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Component (2020-2032)

14.2.2. Market Revenue and Forecast, by Function (2020-2032)

14.2.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.2.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.2.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.2.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

14.2.8.2. Market Revenue and Forecast, by Function (2020-2032)

14.2.8.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.2.9. Market Revenue and Forecast, by Organization Size (2020-2032)

14.2.10. Market Revenue and Forecast, by Software Application (2020-2032)

14.2.10.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Component (2020-2032)

14.2.11.2. Market Revenue and Forecast, by Function (2020-2032)

14.2.11.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.2.12. Market Revenue and Forecast, by Organization Size (2020-2032)

14.2.13. Market Revenue and Forecast, by Software Application (2020-2032)

14.2.14. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Component (2020-2032)

14.2.15.2. Market Revenue and Forecast, by Function (2020-2032)

14.2.15.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.2.15.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.2.16. Market Revenue and Forecast, by Software Application (2020-2032)

14.2.16.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Component (2020-2032)

14.2.17.2. Market Revenue and Forecast, by Function (2020-2032)

14.2.17.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.2.17.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.2.18. Market Revenue and Forecast, by Software Application (2020-2032)

14.2.18.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Component (2020-2032)

14.3.2. Market Revenue and Forecast, by Function (2020-2032)

14.3.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.3.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.3.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.3.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

14.3.7.2. Market Revenue and Forecast, by Function (2020-2032)

14.3.7.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.3.7.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.3.8. Market Revenue and Forecast, by Software Application (2020-2032)

14.3.9. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

14.3.10.2. Market Revenue and Forecast, by Function (2020-2032)

14.3.10.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.3.10.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.3.11. Market Revenue and Forecast, by Software Application (2020-2032)

14.3.11.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Component (2020-2032)

14.3.12.2. Market Revenue and Forecast, by Function (2020-2032)

14.3.12.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.3.12.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.3.12.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.3.12.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Component (2020-2032)

14.3.13.2. Market Revenue and Forecast, by Function (2020-2032)

14.3.13.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.3.13.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.3.13.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.3.13.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Component (2020-2032)

14.4.2. Market Revenue and Forecast, by Function (2020-2032)

14.4.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.4.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.4.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.4.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

14.4.7.2. Market Revenue and Forecast, by Function (2020-2032)

14.4.7.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.4.7.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.4.8. Market Revenue and Forecast, by Software Application (2020-2032)

14.4.9. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

14.4.10.2. Market Revenue and Forecast, by Function (2020-2032)

14.4.10.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.4.10.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.4.11. Market Revenue and Forecast, by Software Application (2020-2032)

14.4.12. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Component (2020-2032)

14.4.13.2. Market Revenue and Forecast, by Function (2020-2032)

14.4.13.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.4.13.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.4.13.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.4.13.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Component (2020-2032)

14.4.14.2. Market Revenue and Forecast, by Function (2020-2032)

14.4.14.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.4.14.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.4.14.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.4.14.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Component (2020-2032)

14.5.2. Market Revenue and Forecast, by Function (2020-2032)

14.5.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.5.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.5.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.5.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Component (2020-2032)

14.5.7.2. Market Revenue and Forecast, by Function (2020-2032)

14.5.7.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.5.7.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.5.8. Market Revenue and Forecast, by Software Application (2020-2032)

14.5.8.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Component (2020-2032)

14.5.9.2. Market Revenue and Forecast, by Function (2020-2032)

14.5.9.3. Market Revenue and Forecast, by Logistics Type (2020-2032)

14.5.9.4. Market Revenue and Forecast, by Organization Size (2020-2032)

14.5.9.5. Market Revenue and Forecast, by Software Application (2020-2032)

14.5.9.6. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 15. Company Profiles

15.1. Dematic Corp. (Kion Group AG)

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Daifuku Co. Limited

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Swisslog Holding AG (KUKA AG)

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Honeywell International Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Jungheinrich AG

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Murata Machinery Ltd

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Knapp AG

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. TGW Logistics Group GmbH

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Kardex Group

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Mecalux SA

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others