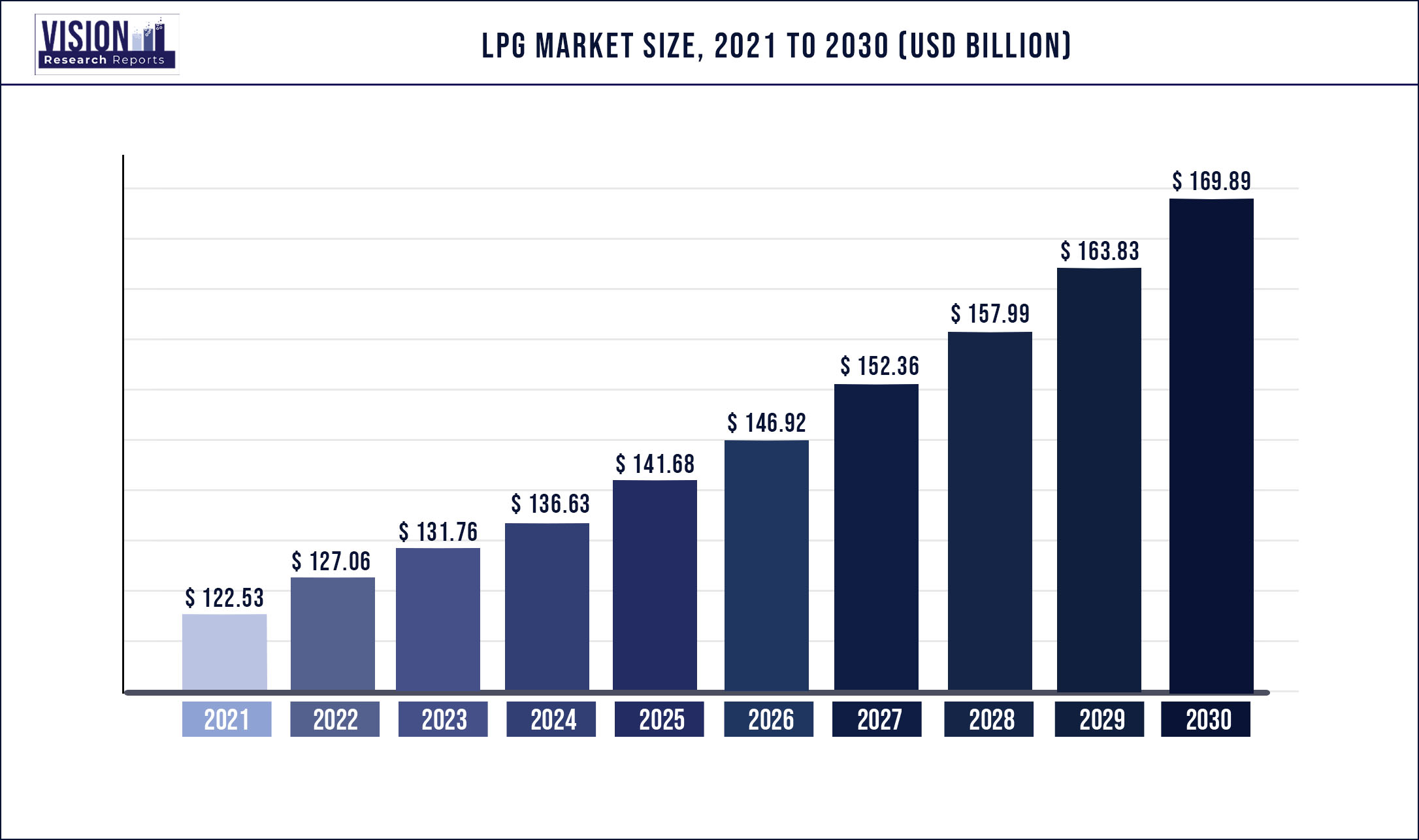

The global liquefied petroleum gas market was estimated at USD 122.53 billion in 2021 and it is expected to surpass around USD 169.89 billion by 2030, poised to grow at a CAGR of 3.7% from 2022 to 2030

Growing demand for liquefied petroleum gas (LPG) from emerging countries is projected to drive the global market during the estimated period. Urbanization and industrialization have increased expressively across the world over the past few years. The flow of investments has changed from developed countries toward emerging countries owing to the low costs of labor and infrastructure.

Increasing prices of fuel and growing environmental concerns have upturned the countries’ attention towards LPG to be used as an alternative fuel, which is the main factor propelling the market growth. Some of the key government mandates such as Federal Emission Standards, and the California Air Resources Board Zero Emission Vehicle Mandate are turning the automotive industry towards more advanced technologies so as to reduce carbon emission and achieve fuel economy, which will directly increase the demand for LPG across the market.

Demand for LPG is anticipated to observe significant growth over the projected period on account of its numerous benefits, such as low cost, low-carbon emissions, and operational benefits. LPG is emerging as a striking option for the commercial sector, combined with low-carbon technologies and renewables to assimilate a reliable year with round the clock power supply with less carbon emissions.

The residential/commercial application segment accounted for a substantial share in 2021 and is estimated to witness significant growth in the next seven years. High demand for LPG as a heating fuel and for cooking purpose in the commercial as well as residential segments has been the major factor increasing its penetration in the sector.

The liquefied petroleum gas (LPG) market in the Asia Pacific conquered the global consumption and accounted for over 28.08% share of the total volume in 2021. The Asia Pacific is anticipated to witness significant growth during the forecast period. Increasing consumption of liquefied petroleum gas for domestic usage purposes, such as cooking fuel, coupled with initiatives taken by the government, mainly in India, China, and Indonesia, is projected to propel LPG demand across the region.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 122.53 billion |

| Revenue Forecast by 2030 | USD 169.89 billion |

| Growth rate from 2022 to 2030 | CAGR of 3.7% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Sources, application, region |

| Companies Covered | Repsol; China Gas Holdings Ltd.; Saudi Arabian Oil Co.; FLAGA Gmbh; Kleenheat; Bharat Petroleum Corporation Limited; JGC HOLDINGS CORPORATION; Phillips 66 Company; Chevron Corporation; Reliance Industries Limited; Exxon Mobil Corporation; Total; Royal Dutch Shell; Petroliam Nasional Berhad (PETRONAS); PetroChina Company Limited; Petredec Pte Limited; Qatargas Operating Company Limited; Petrofac Limited; Vitol; China Petroleum & Chemical Corporation; BP Plc. |

Source Insights

Based on the source, the non-associated gas source segment accounted for 53.98% share in terms of revenue in 2021. The source segment is segregated into the refinery, associated gas, and non-associated gas. The sources of the fuel differ from area to area, for example, in North America, the majority of the gas production is basically from natural gas processing units. However, Asia Pacific is reliant on its refineries for production. On a global scale, refineries are one of the primary sources of production of numerous gases. Escalating refining capacity, specifically in Saudi Arabia, Brazil, India, and China, is projected to surge product supply over the upcoming years.

In Asia Pacific, liquefied petroleum gas demand from associated gas was 18.92 million tons in 2021. Non-associated sources accounted for a noteworthy revenue share and are projected to witness significant growth over the projected period. The United States shale gas boom has occurred as a major drift, resulting in excess in the global industry. The market has also witnessed substantial field developments in oil and gas wells, coupled with growing on-site processing facilities, mainly in Russia, China, the U.S., and Canada.

Application Insights

Based on the application, the others segment accounted for the largest share of 49.95% in terms of volume in 2021. The application segment is sub-divided into residential/commercial, chemical, industrial, autogas, refinery, and others. The chemical application segment is expected to witness the fastest growth in terms of revenue over the forecast period. Extensive dependency on liquefied petroleum gas as a cooking fuel can be witnessed among the urban and rural residents across the regions, such as the Asia Pacific and Central and South America.

The commercial and residential application segment accounted for a substantial share in the LPG market in 2021. Promising government subsidies and initiatives to endorse the product as the major substitute for conventional fuels, such as wood and coal, have been the key factors contributing to the segment growth. Liquefied petroleum gas is also replacing chlorofluorocarbon and hydrofluorocarbon as a refrigerant owing to a nominal contribution towards depletion in the ozone layer. This has led to amplified application opportunities in the commercial/residential segment in ventilating and heating applications in addition to the cooking uses. The sector is likely to witness significant growth over the upcoming years to influence a net global industry worth exceeding USD 6.81 million by 2030.

Autogas is projected to witness substantial growth in the near future owing to increasing alternative fuel demand in the transportation sector to minimize environmental concerns, such as carbon emission levels and pollution levels. In addition, it is one of the cheapest energy sources, which is making it suitable for diesel and gasoline in the global transportation industry. The segment is anticipated to expand at a CAGR of 4.7% from 2022 to 2030 in terms of revenue in Germany.

Regional Insights

Europe held the largest volume share of 78.6% in 2021. In Europe, LPG demand in residential/commercial applications is expected to witness significant growth from 2022 to 2030. Numerous summit meetings such as COP21 are taken into consideration by many countries to decrease carbon emissions in the atmosphere. For instance, India is taking up initiatives to use other cooking fuels for cooking purposes.

Mature economies of Europe and North America are anticipated to witness significant growth in the years to come owing to growing awareness regarding the reduction of carbon emission. In Europe, Germany is expected to expand at a CAGR of 4.33% in terms of revenue.

The Asia Pacific accounted for a significant share in 2021. Population growth, ample resource availability, and high energy necessities, coupled with easy affordability, owing to the existence of government subsidies on LPG cylinders have been the key factors fueling the regional market growth. This is further maintained by the increasing petrochemical capacities across India, China, India, Thailand, and South Korea.

India emerged as a prominent importer of liquefied petroleum gas in 2021, taking consignments at a steady rate from the United States and Middle East regions to fund domestic fuel usage. Prime Minister Narendra Modi announced that India had met its target to provide 80 million free cooking gas connections to the residents of India and 2022 demand will fulcrum on the capability of the government to sustain the market at low marketing prices. To that end, an entry of investment in liquefied petroleum gas receiving distribution pipelines (over 14 million mt/year) and terminals (over 12 million mt/year) will support LPG usage in India.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on LPG Market

5.1. COVID-19 Landscape: LPG Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global LPG Market, By Source

8.1. LPG Market, by Source, 2022-2030

8.1.1. Refinery

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Associated Gas

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Non-associated Gas

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global LPG Market, By Application

9.1. LPG Market, by Application, 2022-2030

9.1.1. Residential/Commercial

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Chemical

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Autogas

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Refinery

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global LPG Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Repsol

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. China Gas Holdings Ltd

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Saudi Arabian Oil Co.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. FLAGA Gmbh

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kleenheat

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bharat Petroleum Corporation Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. JGC HOLDINGS CORPORATION

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Phillips 66 Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Chevron Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Reliance Industries Limited

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others