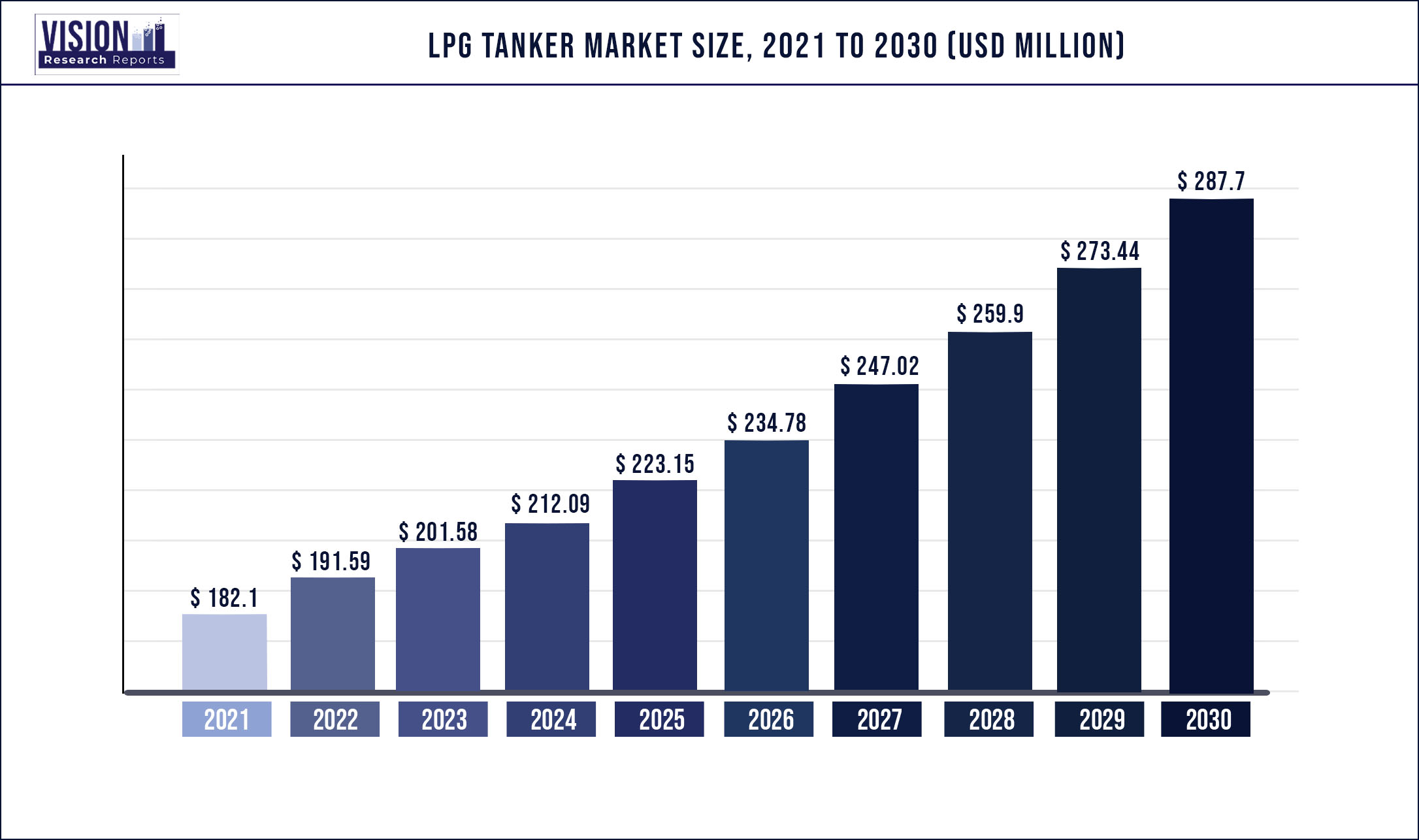

The global LPG tanker market was surpassed at USD 182.1 million in 2021 and is expected to hit around USD 287.7 million by 2030, growing at a CAGR of 5.21% from 2022 to 2030

Report Highlights

Strong growth in shale gas production is likely to propel the market growth over the coming years. The volatility of crude oil prices coupled with developments in hydraulic fracturing and horizontal drilling methods resulted in major companies shifting their attention towards the production of oil and gas from shale rock. Change in focus towards the production of shale gas is further projected to enhance market growth over the estimated period. The Very Large Gas Carriers (VLGC) segment led the market in 2021.

However, the Large Gas Carrier (LGC) is anticipated to take over the forecast period by a small margin. Very large gas carriers are widely used for the transportation of liquified petroleum gas (LPG) for longer distances across various countries. Growing liquefied petroleum gas trade relationships between various regions, such as the Middle East and Asian countries, Western Africa and Europe, and the United States, is the major factor projected to boost the VLGC segment growth. The full-pressurized segment led the market in 2021 and will maintain its lead throughout the forecast period. The market is anticipated to have a steady growth in all segments as the amount of LPG transported increases.

The supply chain of the LPG and ancillary industries was affected due to the shutdown of production facilities, especially in Asia Pacific, as it was the epicenter of the COVID-19. The manufacturing and energy & power sectors globally experienced a considerable slowdown due to the COVID-19. In addition, local and international travel restrictions, quarantine requirements, and lockdowns further delayed shipments of LPG that were in process of being delivered. The market growth is determined by improved LPG trading around the globe. Shale gas extraction is likely to rise at a rapid pace, which will drive growth over the forecast years. Factors including capacity expansion of shale gas from untapped stocks enhanced global gas trade, and ongoing usage of liquefied petroleum gas as a cooking fuel is contributing to the development of the market for liquefied petroleum gas tankers.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 182.1 million |

| Revenue Forecast by 2030 | USD 287.7 million |

| Growth rate from 2022 to 2030 | CAGR of 5.21% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Vessel size, refrigeration & pressurization, region |

| Companies Covered | StealthGas Inc.; Dorian LPG Ltd.; BW Group; Hyundai Heavy Industries Co., Ltd.; Kawasaki Heavy Industries, Ltd; Mitsubishi Heavy Industries, Ltd.; EXMAR, PT Pertamina (Persero); The Great Eastern Shipping Co. Ltd.; Namura Shipbuilding Co., Ltd.; Kuwait Oil Tanker Co. S.A.K.; DAE SUN Shipbuilding and Engineering Co. Ltd.; STX Corp.; Teekay Corp. |

Vessel Size Insights

On the basis of vessel sizes, the global liquified petroleum gas tanker market has been further divided into Very Large Gas Carriers (VLGC), Large Gas Carriers (LGC), Medium Gas Carriers (MGC), and Small Gas Carriers (SGC). The VLGC segment led the market and accounted for 29.2% of the global revenue share in 2021. Very large gas carriers are widely used for the transportation of LPG gas for longer distances across various countries. Growing liquefied petroleum gas trade relationships between countries, such as the Middle East and Asian countries, Western Africa and Europe, and the United States, is the major factor boosting the segment growth. However, the LGC is anticipated to take over the forecast period by a small margin. Large gas carriers also have a significant share in the global market.

Some of the key trends observed in the market include innovation in LGC development, which is expected to boost market growth. For instance, in June 2021, Belgium-based shipping group, Exmar, delivered its newly-built largest dual-fuel LPG carrier Flanders Innovation with an 88,000 cbm capacity. The LPG carrier has a deadweight tonnage of 55,100 tons with a length of 230 m and a width of 36.6 m. The vessel dual-fuel technology is expected to reduce CO2 emissions by about 38% compared to the IMO reference lines. Growing extraction and production of shale gas with exporting domestic liquefied petroleum gas is the main factor expected to propel the growth of the LGC and MGC segments. The demand for SGC is projected to observe considerable growth over the coming years owing to the growing LPG demand from residential segments.

Refrigeration & Pressurization Insights

The full pressurized segment led the market and accounted for the largest revenue share of more than 32.7% in 2021. The full pressurized segment will maintain its lead throughout the forecast period. The market is anticipated to have a steady growth in all segments as the amount of LPG transported increases. Fully-refrigerated types are VLGCs that are capable of transporting 15,000 m3 to 85,000 m3 of gas and are suitable for long distances. Vessels used in such ships are proficient in bearing a minimum working temperature of –50ooC and a maximum working pressure of around 0.28 kg/cm2. Carriers for ethylene are observed as a discrete segment in the industry since they need extra refrigeration for safe transportation across the world.

The semi refrigerated segment is expected to grow at a steady CAGR over the forecast period. These vessels are similar to full-pressure vessels as they have a Type C tank. In this case, the pressure vessel is usually rated for a maximum working pressure of 57 bars. The size of the ship is up to 7,500 m3 and is mainly used for transporting liquid gas. Decompression can reduce the thickness of the tank compared to a fully pressurized container, but at the expense of additional freezing systems and tank insulation. The tanks of these ships are made of steel that can withstand temperatures of up to 10 °C and can be cylindrical, conical, or spherical. A small ship carrier is generally the full-pressure type. The semi-refrigerated techniques are used for the shipment spaces around 7,500m3.

Regional Insights

Europe dominated the global liquified petroleum gas tanker market in 2021 and accounted for the largest revenue share of over 29.44%. Russia led the Europe regional market in 2021, in terms of revenue. The market in Europe is primarily driven by a rise in the demand for LPG due to government initiatives and low domestic production for LPG, which leads to higher demand for LPG tankers to facilitate import. North America, the Middle East, and Western Africa are the key regional markets for LPG tankers on account of the growing exports of liquefied petroleum gas to regions, such as Europe and the Asia Pacific. North America is one of the top exporters of LPG in the world after Qatar and Australia. The presence of abundant proven reserves of shale gas in the region drives the market.

According to the Observatory of Economic Complexity (OEC), North America accounted for a share of 15.3% of the global LPG exports valued at USD 45 billion in 2021. Moreover, the demand for LPG in the U.S., Canada, and Mexico is expected to increase owing to its application as cooking fuel. LPG is also used in these countries in heating applications in residential buildings during winters. In terms of revenue, Asia Pacific accounted for the second-largest share in 2021. The market in this region is led by China, Japan, and India. More than 70% of the LPG tankers in the world are manufactured in the Asia Pacific region, specifically in South Korea and Japan. The countries in the Asia Pacific region are largely developing countries that are undergoing rapid industrialization.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on LPG Tanker Market

5.1. COVID-19 Landscape: LPG Tanker Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global LPG Tanker Market, By Vessel Size

8.1. LPG Tanker Market, by Vessel Size, 2022-2030

8.1.1. Very Large Gas Carriers (VLGC)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Large Gas Carriers (LGC)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Medium Gas Carriers (MGC)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Small Gas Carriers (SGC)

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global LPG Tanker Market, By Refrigeration & Pressurization

9.1. LPG Tanker Market, by Refrigeration & Pressurization, 2022-2030

9.1.1. Ethylene

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Full Refrigerated

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Semi Refrigerated

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Full Pressurized

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global LPG Tanker Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.1.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.2.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.5.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Vessel Size (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Refrigeration & Pressurization (2017-2030)

Chapter 11. Company Profiles

11.1. BW Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dorian LPG Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. EXMAR

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hyundai Heavy Industries Co., Ltd

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kawasaki Heavy Industries, Ltd

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mitsubishi Heavy Industries, Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Namura Shipbuilding Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. PT Pertamina (Persero)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. StealthGas Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. The Great Eastern Shipping Co. Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others