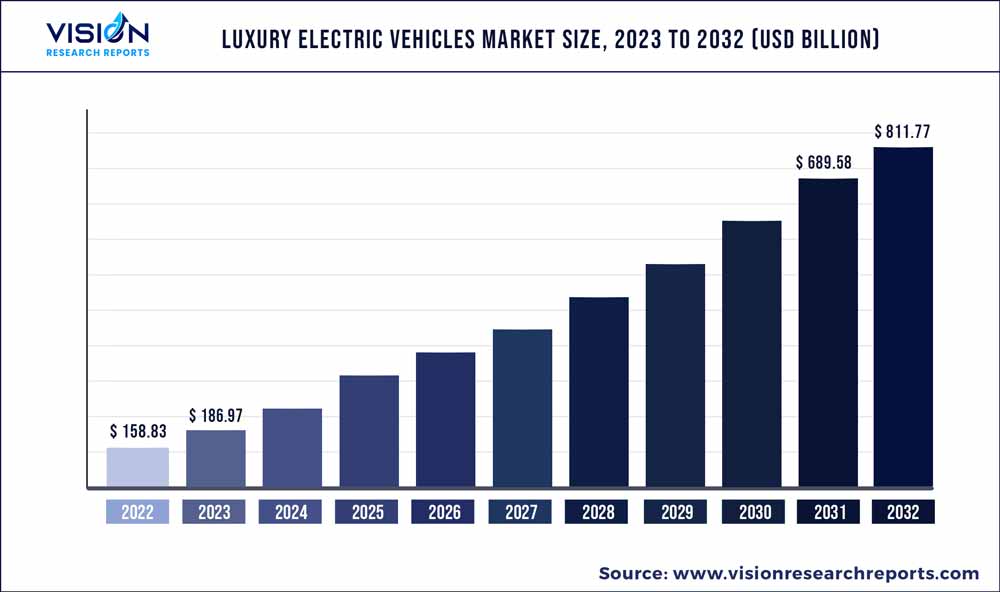

The global luxury electric vehicles market size was estimated at around USD 158.83 billion in 2022 and it is projected to hit around USD 811.77 billion by 2032, growing at a CAGR of 17.72% from 2023 to 2032. The luxury electric vehicles market in the United States was accounted for USD 16.2 billion in 2022.

Key Pointers

Report Scope of the Luxury Electric Vehicles Market

| Report Coverage | Details |

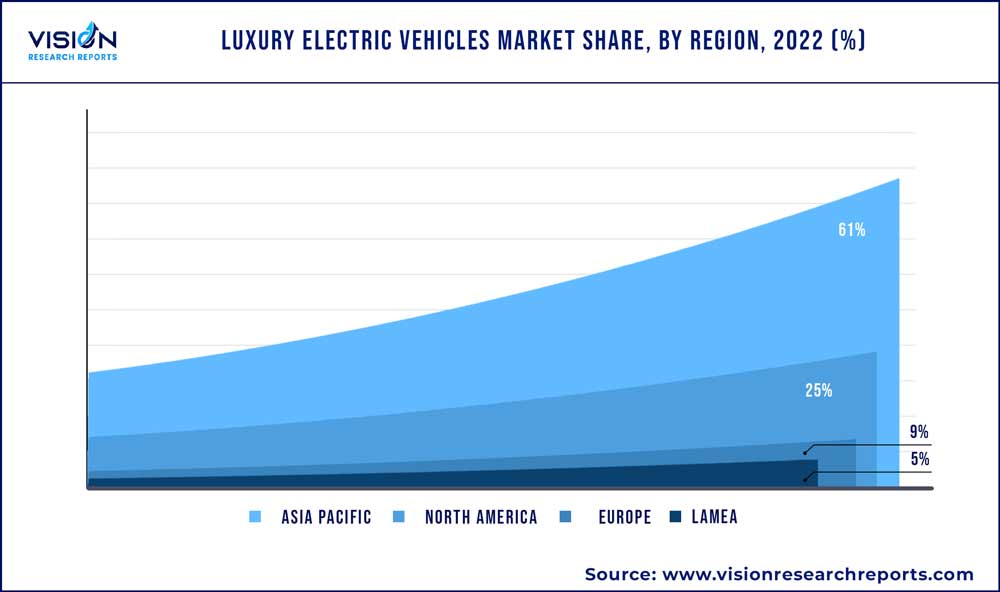

| Revenue Share of Asia Pacific in 2022 | 61% |

| CAGR of North America from 2023 to 2032 | 19.32% |

| Revenue Forecast by 2032 | USD 811.77 billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.72% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Tesla, Inc.; BYD Auto Co., Ltd.; Volkswagen AG; BMW AG; AB Volvo; Ford Motor Company; Hyundai Motor Company; Toyota Motor Corporation; Kia Corporation; Audi AG |

Rising demand for emission-free, air combating fuel efficient, and technologically advanced vehicles is driving the growth of the luxury electric vehicle in the market. In addition, the increasing consumer inclination towards entertainment, safety and comfort features has positively impacted the market growth. Besides, the growing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) in the emerging economies of the Asia Pacific region has propelled the demand for luxury electric vehicles.

The prominent players in the luxury electric vehicle industry are majorly investing in building lightweight, cost-effective, and high-density batteries. For instance, General Motors Company is working on testing the different combinations of propulsion chemistries to slash the existing cost of electric batteries. General Motors is experimenting with the combination of silicon-rich and lithium metal anode to produce its next-generation Ultium batteries to reduce the propulsion cell price to $100/kwh by the year 2025. In addition, the company has plans to enhance battery life for high-speed electric vehicles with a driving range of 805 to 965km.

Government initiatives to increase electric vehicle penetration across developing nations is catalyzing the growth of luxury electric vehicle in the market. Several governments are providing tax subsidies on the purchase of luxury and economy electric vehicles, which is encouraging consumers to switch towards electric models over gasoline-powered vehicles. In addition, the fluctuating crude oil prices due to a pandemic, geopolitical events, harsh climatic conditions, and up-surge in the existing fluctuation influence consumers automobile purchase decisions. Since the rise in fuel price increases the overall cost of owning the vehicles during the overall lifespan of the vehicle; thus, consumers are shifting towards technologically advanced, secured, and luxury electric vehicles.

Moreover, the sales of luxury electric vehicles are hindered due to the limited number of charging stations, charging points, and it’s supporting charging infrastructure across the globe. For instance, the developing nations of the world, such as Mexico, have around 1,069 propulsion charging stations by the year 2021, of which 1002 are public charging stations, and 67 are fast charging stations. Thus, the lack of availability of fast charging stations in Mexico limits the sales of luxury electric vehicles in the country.

Propulsion Type Insights

Based on the propulsion type, the luxury electric vehicles industry has been segmented into the Battery Electric Vehicle (BEV), Plug-in-Hybrid Electric Vehicle (PHEV), and Fuel cell Electric Vehicle (FCEV). The battery electric vehicle segment accounted for over 66% of the market share in the global market. Rising environmental concerns, and government policies to increase the electric vehicle penetration globally is driving the battery electric vehicle segment growth in the global market. In addition, the rising inclination of vehicle manufacturers towards producing a wide range of electric vehicles with advanced features pertaining to artificial intelligence and the Internet of Things (IoT) is contributing to the growth of the segment. For instance, one of the prominent players of the electric vehicle market Audi AG plans to launch the 2023 Audi e-tron® GT in the year 2023, the model has Matrix-design LED headlights, X-frame trim and laser lights. Besides, the 2023 Audi e-tron® GT is high performance, has fast charging batteries, and offers batteries with more than 250 KW. Thus, on similar lines, the segment is expected to offer numerous opportunities to the stakeholders in the market.

The fuel cell luxury electric vehicle segment is estimated to grow at a CAGR of 21.82% from 2023 to 2032. The exponential growth of the fuel cell luxury electric vehicle segment is attributed to the shift in trend towards clean energy fuels and rising investments in the development of fuel cell technology for vehicles. Additionally, the increasing inclination towards producing the essential materials used for building and operation of the hydrogen refueling fuel cell infrastructure, and battery charging infrastructure is expected to propel the growth of hydrogen-powered fuel cell luxury electric vehicles in the market.

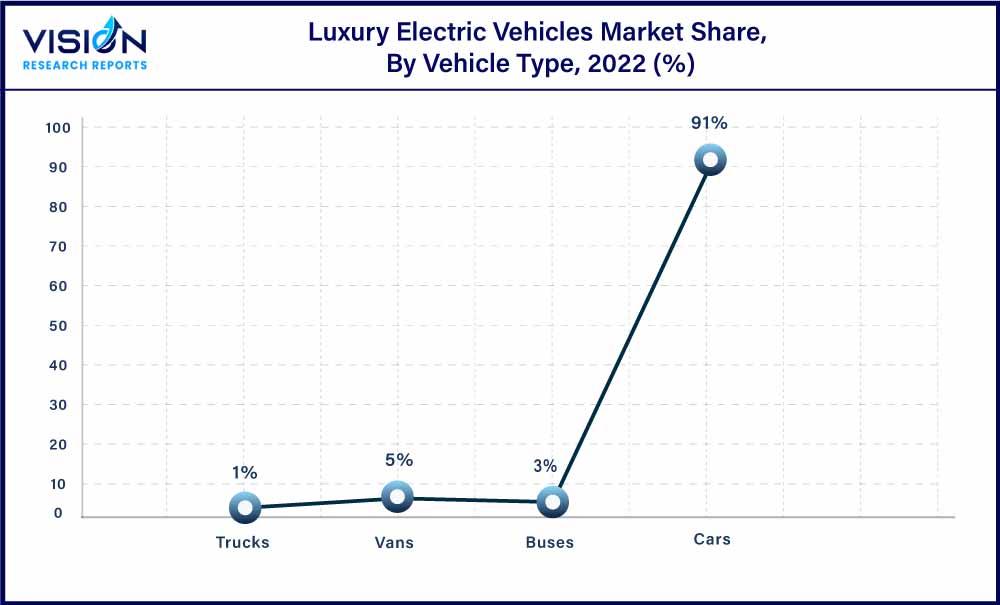

Vehicle Type Insights

Based on vehicle type, the market has been segmented into cars, buses, vans, and trucks. The car segment dominated the overall market in 2022 and accounted for over 91% of the global market share in the year. The share of the segment is attributed to the higher integration of advanced technologies such as e-torque vectoring plus technology and systems such as; virtual cockpit plus, advanced driver assistance, infotainment system, advanced lighting system, and others in the upcoming luxury electric vehicle.

The vans segment is estimated to grow at a CAGR of 21.74 % from 2023 to 2032. The growth of the luxury vans segment is attributed to the rising consumer traction towards luxury pickup trucks for traveling and sightseeing purposes. Furthermore, electric vehicle manufacturers are producing luxury pick-up variants to fulfill the rising demand. For instance, in April 2022, Ford Motor Company started the production of an electric F-150 Lightning pickup truck in Michigan. The electric pick-up truck is one of the fastest accelerating luxury electric pickup trucks/vans with a low price range the pickup- truck is available for customers based in America.

Regional Insights

The Asia Pacific region dominated the luxury electric vehicles industry and accounted for over 61% of the market share in the year 2022. The region is expected to continue its dominance during the forecast period due to increasing government focus towards building battery charging infrastructure and hydrogen fueling stations in developing nations such as China and India. For instance, the growing focus of the Chinese government on replacing existing fleets with hydrogen fuel cell vehicles. The goal is to have one million fuel-cell electric vehicles on the road and install 1,000 hydrogen fueling stations by 2032. Therefore, government initiatives are expected to increase the penetration of battery electric and fuel cell electric luxury variants in the market.

North America is anticipated to witness a significant CAGR of 19.32% from 2023 to 2032. The high growth pace is attributed to high paying capacities of the consumers based in the region. The consumers in the region started spending more on comfort, entertainment and luxury, thus there is increase in sales of luxury electric vehicle variants over the economy vehicles. In addition, the government tax rebate on electric vehicle purchases encourages consumers to opt the luxury electric vehicle and over petrol and diesel vehicle in the market.

Luxury Electric Vehicles Market Segmentations:

By Propulsion Type

By Vehicle Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Luxury Electric Vehicles Market

5.1. COVID-19 Landscape: Luxury Electric Vehicles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Luxury Electric Vehicles Market, By Propulsion Type

8.1. Luxury Electric Vehicles Market, by Propulsion Type, 2023-2032

8.1.1. BEV

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. PHEV

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. FCEV

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Luxury Electric Vehicles Market, By Vehicle Type

9.1. Luxury Electric Vehicles Market, by Vehicle Type, 2023-2032

9.1.1. Cars

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Buses

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Vans

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Trucks

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Luxury Electric Vehicles Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Propulsion Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Vehicle Type (2020-2032)

Chapter 11. Company Profiles

11.1. Tesla, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BYD Auto Co., Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Volkswagen AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BMW AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. AB Volvo

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ford Motor Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hyundai Motor Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Toyota Motor Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Kia Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Audi AG.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others